Mutual funds have a feature called Systematic Withdrawal Plans (SWP) that enables investors to take out a set amount of money from their investments on a monthly basis. Investors who want to maintain the integrity of their mutual fund investments while simultaneously seeking a consistent income stream are the main ones who employ SWPs. The following is a guide to comprehending and making use of mutual fund SWPs:

Table of Contents

What is a Systematic Withdrawal Plan?

A Systematic Withdrawal Plan is a method of completely or partially withdrawing stock market investments in a periodical manner.

Just like investors build their investments regularly with an SIP, they can redeem investments regularly with an SWP.

Investments can be redeemed on a monthly, quarterly, half-yearly, or yearly basis. These withdrawals are made on the basis of an amount specified by the investor.

Once an amount is set, the fund will sell the required number of units, as per NAV, to give back the specified amount to the investor.

Why should an investor use a SWP?

Using an SWP allows an investor to reap the benefits of investment over a prolonged period rather than all at once. SWPs can be an essential element of financial security and retirement planning, as they can help create a stream of regular income.

Also, many investors look for investments that can create a regular income for them. Instead of opting for dividend-paying investments compulsorily, they can simply invest in any mutual fund of their choice, then set up an SWP.

Now, let us understand the advantages and disadvantages of using systematic withdrawal plans.

How does a Systematic Withdrawal Plan work?

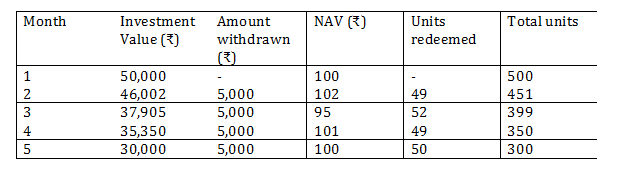

Let us understand the systematic withdrawal plan with the help of a practical example.

Suppose an investor has a lump-sum investment of ₹50,000 in a mutual fund, purchased at a Net asset value(NAV) of ₹100.

Now, they have decided to use a SWP to redeem it.

Suppose they choose to withdraw ₹5,000 monthly for the next four months. Here is what their investment will look like at the end of the five months –

As the NAV fluctuated, a suitable number of units were sold to give the investor ₹5,000 monthly. Therefore, by redeeming the investment through an SWP, they now have 300 units remaining at an investment value of ₹30,000.

₹20,000 have also been successfully withdrawn over the last four months, irrespective of any changes in the value of the units. Now, with this table in mind, let us discuss the pros and cons of using Systematic Withdrawal Plans.

What are the Advantages of Systematic Withdrawal Plans?

- SWPs provide the benefit of rupee-cost averaging. Investors can sell more units when the NAV is low, and less when the NAV is high.

- Investments are less affected by market volatility, thus assisting wealth creation on a long-term basis.

- A Systematic Withdrawal Plan helps set up a regular stream of income from mutual fund investments.

- As mentioned before, withdrawals will not depend on the NAV; rather they will be made as per the amount mentioned by the investor.

- Setting up an SWP stops investors from making impulsive selling decisions out of fear in the market, thus teaching financial discipline and patience.

What are the Disadvantages of Systematic Withdrawal Plans?

- SWPs are more suitable for people approaching retirement, as they need to focus more on regular income than long-term investing.

- SWPs can erode our overall capital in a bearish market. When the NAV is low, more units of the fund will be sold, leaving an investor with less capital after the SWP is stopped.

Systematic Withdrawal Plans are a great way to build a regular stream of income.

What’s more, an investor can simultaneously set up an SIP on one mutual fund and an SWP on another.

This can be done to keep building the capital while creating a stream of periodical income.

Before an SWP is set up, any informed investor must carry out proper market research and understand how the SWP will help them achieve their objectives.

Doing so can ensure that setting up a SWP can give any investor maximum benefits.

Conclusion

A systematic withdrawal plan (SWP) can be used to make regular withdrawals from a mutual fund investment. SWPs provide investors with a regular stream of fixed income, irrespective of a fluctuating NAV. Their many benefits make them suitable tools for goal-based investing.

Frequently Asked Questions

What is a Systematic Withdrawal Plan (SWP)?

Mutual funds have a feature called a Systematic Withdrawal Plan (SWP) that enables investors to take out a set amount of money from their investments on a monthly basis.

How does SWP work?

Investors establish an SWP with a mutual fund scheme of their choice and define the frequency, duration, and amount of withdrawals. The investor’s bank account is credited with the designated withdrawal amount after the mutual fund automatically sells units from the investor’s holdings.

Thanks , for simple and lucid explanation of SWP.

Hi,

Thank you for reading our blog!!

Keep Reading!