| Table of Contents |

|---|

| Impact of Corporate Tax Cut |

| Global Standing |

| Future Outlook of Corporate Tax Cut |

| Economic Affect |

| Companies benefiting |

The FM recently introduced the reduction in corporate tax cut boosting investor sentiment in the midst of a severe slowdown.

The reduced corporate tax rate of 22 per cent would apply on domestic entities that don’t avail any other exemption and tax incentives.

Also, these companies will not be required to pay any MAT.

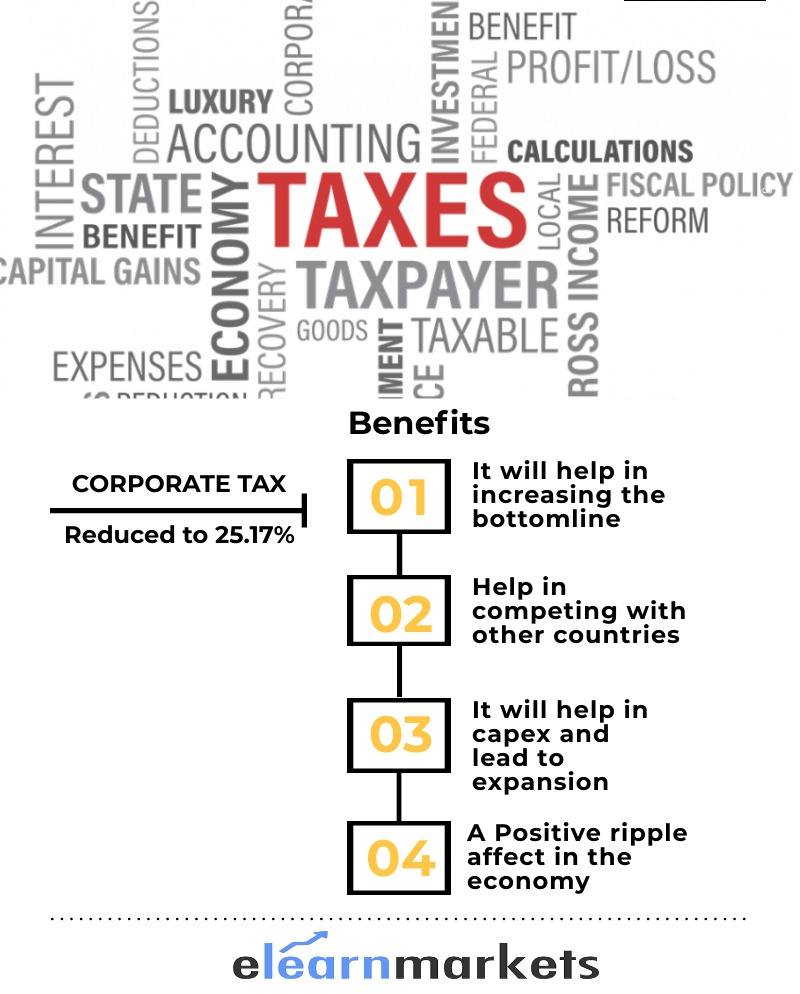

The effective tax rate, in this case, would be 25.17 per cent, including cess and surcharge.

Reduction in corporate tax cut was a long-pending demand of Indian firms.

Impact of Corporate Tax Cut

For those starting new manufacturing investments between 1st October 2019 and 31st March 2023, tax will be 15% with effective tax at 17.01%.

The immediate impact will be an increase in cash flows of Corporate India that will be either channelized into debt reduction or incremental investments in increasing capacity expansion.

The ₹1.45 lakh crore tax giveaway is unlikely to widen fiscal deficit much. The shortfall will be met through increased tax collections due to higher growth which the massive tax cuts are expected to achieve.

Government revenues foregone after this tax cut is of INR 1.45 trillion which amounts to about 0.7% of GDP.

But more importantly, lower tax outflow could increase the share of profit-making companies in India.

Global Standing

This is a reform which is in line to make the country a superpower and a 5 trillion economy.

The tax rates in India after the tax cut is more competitive compared to rest of Asia. The tax rate is now below the average tax rates in Asia.

The Asian countries which have lesser tax rates than India are Hong Kong, Singapore, Thailand and Vietnam.

But countries like Malaysia, Indonesia, China, Japan and South Korea have tax rates more than India.

This latest tax cut has placed India in a better position in competition with the rest of the countries.

Learn about corporate tax with Insurance & Taxation Made Easy by Market Experts

This provides ample opportunity in terms of fresh investments and growth of the country.

You will be excited to know about which countries have no taxes in this article.

Future Outlook of Corporate Tax Cut

The future outlook of the country has been broadened with ample opportunities by this step.

It will help in attracting foreign investments and will also help the domestic companies to invite more for joint venture operations.

India is likely to attract investors and companies looking to move out of China.

The domestic companies who were in the higher tax brackets will be benefited due to the tax cut.

This will improve their bottom line and help them to think of capex and expansion.

The reduction in corporate tax will allow more cash in the hands of the corporate India.

Economic Affect

It is expected that additional cash in the hands of the companies will allow for a slew of opportunities to be tapped into by the corporate sector.

Also, the excess liquidity available will allow Indian companies to start competing better on a global level through capital expenditure in areas they deem necessary.

Most importantly, the fiscal boost will benefit the industry supply chain as the excess cash will boost corporate and their suppliers, thereby having a positive ripple effect.

In an economy where companies have faced issues with excessive debt, this is an opportunity for the cash to be utilized to pare back debt and repay lenders thus improving corporate balance sheets and pumping credit back into the system.

Whichever way one looks at the tax changes, the excess money will help whether corporates decide to invest the money, pay back loans, buyback debt, pay shareholders, or boost salaries.

Explore the future of corporate tax cuts and their economic impact. Dive and learn futures and options with us to navigate global changes effectively!

Companies benefiting:

SBI– The largest PSU under very high tax net

Bajaj Finance– A well managed company which belongs to a conglomerate group

Britannia- An MNC company favourite of the investors under high tax bracket

HDFC Bank-One of the largest private banks in the country under high tax net.

Kotak Mahindra Bank– A major private bank under high tax net.

ONGC-A PSU under high tax bracket

ITC- A conglomerate company under high tax bracket

BPCL– A PSU under high tax net

Ultratech Cement– One of the biggest players in the cement industry under high tax net

M&M- A conglomerate Group Company under high tax net.