Is gold part of your investment portfolio? Let me tell you that Gold has always been a favourite asset class among Indian investors, and for good reason. Gold has yielded phenomenal returns in the last decade and acts as a hedge against inflation.

An Exchange-Traded Fund (ETF) is a relatively new asset class in India, and a vast majority of Indians are still unaware of it.

But Gold ETFs are becoming very popular, as they allow investors to purchase and hold gold electronically.

Investing in ETF is amongst the best and smartest ways to invest in gold for a number of reasons.

When you buy Gold ETF, you do not need to worry about its purity, safety, buying in small denominations and other problems associated with physical gold.

Table of Contents

What is an ETF?

Exchange-traded funds (ETFs) are passively managed instruments that directly track an asset or an index. The returns are generated based on the underlying asset or index.

What is a Gold ETF?

Gold ETFs are passively managed investment fund which invest in gold bullion and tracks the prices of gold. It’s a simple investment product which combines the simplicity of gold investment and flexibility of stock investment.

It is traded on major stock exchanges, including Mumbai, London, New York, Zurich, etc. These ETFs trade on the National Stock Exchange’s cash market just like any other stock, and they can be bought and sold at market prices.

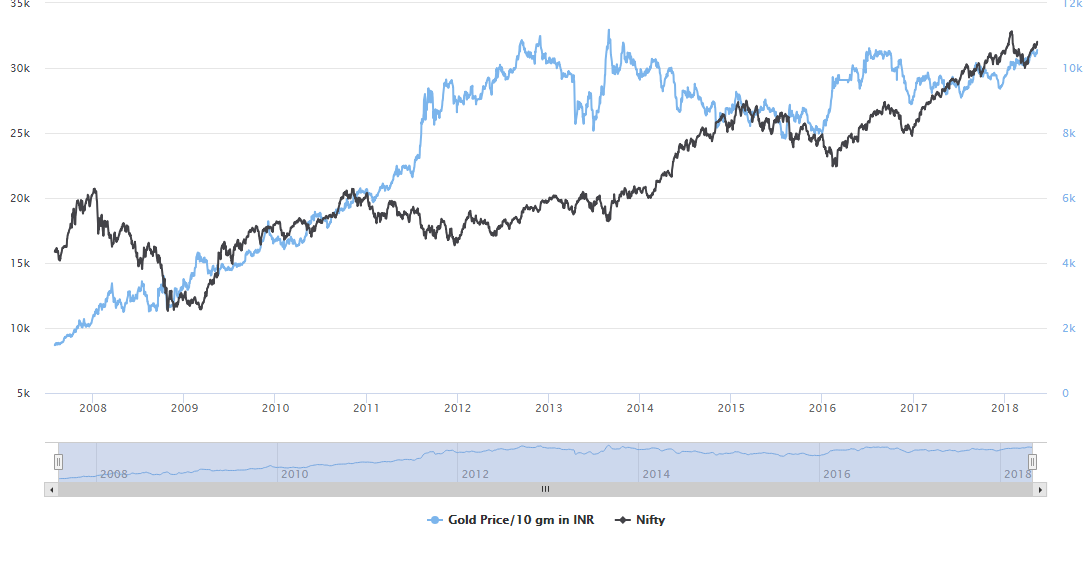

You can invest in Gold BeEs, an open-ended passively managed Exchange Traded Fund (ETF), that closely correspond to the returns provided by the domestic price of gold. This is how Nifty BeEs has performed in the last decade.

Why invest in gold ETF?

Gold ETFs are mutual fund schemes that provide an efficient platform for small investors to invest in gold.

Some of the key benefits to investing in ETF are stated below-

1. Lower expense

Due to its unique creation mechanism, they have a lower expense as compared to physical gold.

Moreover, owning gold ETF is also cheaper than owning physical gold because it has no cost of carrying (i.e. cost of storing physical gold)

2.Hedge against inflation

The inclusion of gold in your portfolio provides a cushion against inflation.

3. Safe haven

During any financial distress, it acts as a safe haven.

When the US market collapsed in 2008, people shifted their investments to gold, and let me tell you, it has kept people’s trust.

4. Diversification benefit

Investment in gold serves as an alternative asset that is not directly correlated with traditional assets, thus providing a diversification benefit.

5. Purchase cost

A very low commission is charged for trading in gold ETF, which is around 0.4-0.5% (almost equivalent to a brokerage charge), along with a very nominal annual storage fee.

However, in the case of physical gold, the markup can be as high as 10-20%.

Moreover, investment in ETF is cheaper since it has no carry cost (i.e., the cost of storing physical gold).

6. Safety

Safety is of utmost importance which is often associated with physical gold.

These ETFs are a perfect investment since the storage problem is also taken care of since ETFs are stored electronically in a demat form.

7. Small denominations

Gold ETFs are very suitable, especially for small investors, as you can purchase as little as one gram, which we generally do not do when buying physical gold.

Comparative analysis

Gold shares have a very low correlation with equity, so whenever the economy is in trouble, gold prices spike.

In other words, it shares an inverse relation with equity.

In the last decade, it had rallied from Rs 8000 to Rs 31000 per 10 gm giving a CAGR of 14.51%.

The yellow metal witnessed a steep rally since the stock market crash in 2008 and since then it never looked back.

After the crash, the US Federal Reserve pumped in $100 billion in the economy in just 18 months in its bond-buying programme or “Quantitative Easing”.

This created very high liquidity in the yellow metal market, which boosted its price drastically.

Moreover, falling interest rates and the depreciation of the US dollar helped push its price to a record high between 2010 and 2013.

A message to every parent

I would suggest every parent invest in gold ETF systematically every month as soon as their child is born.

The reason is that by the time their kids are eligible for marriage, they don’t feel the pinch of buying gold ornaments, as is customary in Indian weddings.

You do not need to worry about timing the market.

Moreover, it is very light on your pocket and also provides the benefit of rupee cost averaging.

How much gold should be there in your portfolio?

I believe that If you are a conservative investor or an investor seeking a moderate risk, you can include 10% of gold in your overall portfolio.

However, for high-risk-seeking investors, a 5% investment in gold would be an appropriate choice.

How to trade in Gold ETF?

It’s very easy to trade in gold ETF, where you just need to have an online trading account to buy or sell at any time.

There are a number of Gold ETFs in India, and complete lists can be viewed on various financial sites.

Bottomline

Investment in gold has been prevalent in India since the days of our forefathers and holds importance even today.

I believe adding gold in your portfolio systematically over the years would be a right choice since it not only helps to fight inflation but also acts a safe haven during any market collapse.

However, due to advancements in technology and finance, the mode and vehicle of investment have undergone rapid change these days.

Hence just reading the blog would not help but go forward to start investing in gold in a disciplined way.

In order to get the latest updates on Financial Markets visit Stockedge

Gold is a favourite asset class amongst Indians and I highly recommend all parents to invest in gold in the name of their kids.

Moreover, Gold ETF is a great way to invest in gold which offers a number of benefits.

Thanks Ankit for the lovely writeup.

Today’s news calendar for the US trading session is relatively quiet, but we do have some events this week that could spur on some market movement and you will want to make note of those on your own financial calendars throughout the entire week, going all the way into Friday with US non-farm payrolls.

All right, let’s get started here with the US Dollar versus the Swiss Franc [USDCHF]. We’re looking at the daily timeframe. In the live, daily Trade Room, we’ve been discussing this downward-facing channel here. The two red trend lines that you see here on my chart. Downward-facing channel. Throughout the past couple of weeks, we’ve been studying the rising within that pattern.

Previously, along the blue trend lines, we saw it find a low along the bottom and rise all the way to the top. In a recent pattern, we saw it find a low, but not making it all the way – quite all the way – to the top of the pattern, and now falling back down towards the mid-0.9500s. Of course that doesn’t mean we have turned all the way back down and we’re going to see it go all the way back down to the bottom, but definitely something to take note of is the fact that we have not completed the pattern this time so far and moved all the way to the top of the range.

If it starts to go bullish again, we would of course look to target back to the top of the range, but currently, last week, the market was clearly bearish here for the USDCHF. Of course like I said, we have news events all this week that could change everything that we’re looking at here on this currency, but definitely, at least at this current point, we have a bearish momentum built into the market.

Let’s go ahead and zoom in a little bit here on the daily timeframe. Five days in a row it’s been going down. Doesn’t mean it has to continue down, but definitely something that you would take note of. If you’re looking to sell in this direction, there’s two reasons to sell it. I think, first off, you would look for it to come back up here into this pink zone, close to the 0.9600-level, if you’re looking to go short. I don’t think at the current moment it’s a good idea to go short because we’re clearly into the support level, into the mid to upper-0.9500s, the green-shaded area.

So, currently the green-shaded area is our support. If you’re looking to go short again, it either needs to go up to the pink zone or break through this green-shaded area, and then we could look for it to tackle the next support, which is down here at the purple-shaded area. If we start to see some evidence of reversal, maybe a break above the pink zone, we might look for the bullish action to return, but currently bearish, and I think that’s probably the direction at least for the first part of this week that we’ll continue to focus our efforts on.

Down here to the four-hour timeframe. You could see it’s kind of stuck right now between the pink and the green-shaded area. So, what I would expect that we’re looking for is a breakout of this congestion that we’re in right now. Above it, may start to signal the upside again for the USDCHF. Below it, as it is right now, and getting below the green-shaded area, further movement down towards the 0.9500-level would likely be expected. So, watching for a breakout of this congestion will probably be your key to direction for the USDCHF this week.

Nice article it’s helpful