Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

- You can pick four or five ace investors and pick the best of their ideas with some of your criteria put in and also skip the businesses which you don’t understand.

- It is also important that if you are cloning, clone the best.

- Retail investors must watch their risk appetite before doing any investments because different people have different risk taking abilities.

- Do your own research before investing in any ace investors stock or in a cloned portfolio.

- Keep track viciously on entry and exit of ace investors.

The Indian stock markets have witnessed a strong bull rally over the four-five years.

Many stocks have gone up multi-fold.

| Table of Contents |

|---|

| Why you should not follow Ace Investors Blindly? |

| Cloning Strategy – the other way |

| Analysis on cloning |

So retail investors who have been late to the party could be anxiously looking for money-multiplying opportunities.

Many retail investors mimic the stock investments of big names in the stock markets. We wouldn’t say it is wrong to mimic successful investors.

But what you imitate is worth considering.

To imitate someone’s investing philosophy and approach is one thing.

And to blindly copy the stock portfolio of a successful investor is a different ball game altogether. If you find yourself doing the latter, then we have a warning for you.

Why you should not follow Ace Investors Blindly?

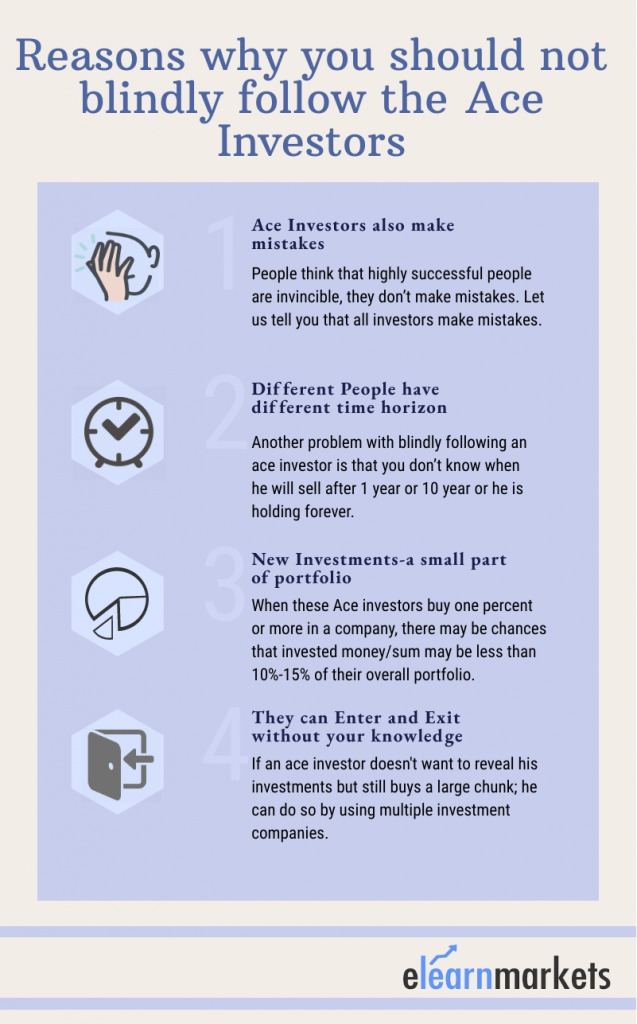

Here are some key reasons why you should not follow Ace Investors Blindly –

1. Ace investors also make mistakes:

People think that highly successful people are invincible, they don’t make mistakes. Let us tell you that all investors make mistakes.

Even the legendary Warren Buffett makes mistakes. He admitted that his investment in major retailer Tesco had been a huge mistake.

Just because an ace investor has invested in a particular stock, there is no guarantee that it will perform well.

2. Different Ace Investorshave a different Time horizon:

Another problem with blindly following an ace investor is that you don’t know when he will sell after 1 year or 10 years or he is holding forever.

Many retail investors often have personal reasons to sell in a time frame that is shorter than Ace investors holding period.

In short, you would not know the investment time frame. So, it increases the risk for retail investors.

3. New Investments – a small part of the portfolio:

When these Ace investors buy one percent or more in a company, there may be chances that invested money/sum may be less than 10%-15% of their overall portfolio.

Learn to invest with Stock Investing Made Easy course by Market Experts

By copying and without knowing anything, retail investors invest a large portion of their portfolio in that particular stock.

If it goes wrong, the ace investor, being better informed, will exit in time. His stake is anyway a small part of his portfolio. But the retail investor who doesn’t have the same access to information and is overweight could lose a large chunk of his money.

4. Ace Investors can enter and exit without your knowledge:

If an ace investor doesn’t want to reveal his investments but still buys a large chunk; he can do so by using multiple investment companies.

If each company holds less than one percent stake, others will not get to know the correct percentage of holding the investor has in a company.

These ace investors are also more vocal when they enter a stock. Their entry is publicized. But when they exit, they don’t usually talk about it.

It is good to track what other big ace investors are doing, but blindly following someone and buying stocks without understanding the merits and risks is not good.

Cloning Strategy – the other way:

A clone is simply a new portfolio of stocks created based on the stock ideas of ace investors.

All people in the stock market are cloning but doing it in a structured manner is a different thing.

Cloning Strategy, a term coined by Mohnish Pabrai.

He clones portfolios of renowned investors in US market like Warren Buffett and had a very good track record by beating the S&P 500 by 10%+ annualized since 2000.

Learn in 2 hours – Cloning your way to Stock Market success

Analysis on cloning:

There were some professors in the U.S. who looked at every stock Warren Buffett bought from 1975 to 2005, and did an analysis.

If you bought what Buffett bought after it became publicly known, on the last day of the month at a higher price and held it until Buffett started selling and sold it after it was known publicly that Buffett had sold, then you got the price which was the lowest price on the last day of the month, and if you did this for every stock he bought and sold for 30 years, then you would beat the index by 11.5% in a year.

There are around 5500 companies in the stock market. It is not possible for retail investor to analyze all companies or all industries.

So, Cloning can be used as an idea generation strategy because ace investors, mutual fund managers have good knowledge and good resources to choose good stocks.

You can use this process to create watch list and after that you can study the promoter, company and industry using StockEdge App. It is one of the best trading app for all your needs.

It acts as a scanner before you take action.

Happy Learning!