Equity Linked Saving Scheme (ELSS Funds)

Introduction to Section 80C

Income tax is a direct tax that every Indian who falls in the taxable bracket has to pay to the Government of India every year. Irrespective of whether you are a salaried individual, businessman, professional, etc. you need to plan your taxes well. Unless you pay close attention to how you are spending and investing your money, you can end up paying heavy taxes which can significantly reduce the amount of money you will have left in your hand.

Thankfully, there are several legal and widely accepted ways in which you can save tax without circumventing the rules of the country. If you have been paying taxes for some time, you must have surely heard about Section 80C of the Income Tax Act 1961, the governing law for income tax in India. This section aims at promoting the habit of saving and investing among taxpayers. Investment under 80C can provide you with significant tax deductions if you do it wisely.

By investing in the tax-deductible instruments specified under this section, you can save a significant amount of money by having to pay lower taxes.

So let us take a closer look at section 80C and how it can help you to save taxes in the next unit of this module.

What is Section 80C of the Income Tax Act?

Section 80C of the Income Tax Act 1961 simply says that if you invest in one of the several approved investment products/instruments listed in it, you can claim a lump sum deduction from your total taxable income. Thus the amount of your income that will be subject to tax will be lower, resulting in lower tax payable.

As of now, the maximum amount of deduction that can be claimed stands at ₹1,50,000 (as of Financial Year 2021 - 22). But that is under the old tax regime; there are no such deductions if you are opting for the new tax regime.

The deduction of tax for investment under 80C is however only applicable for individuals and Hindu Undivided Families (HUF) and not for the other assessees.

Thus, by investing in the following tax-deductible instruments specified under Section 80C, you can save a significant amount of money as you will have to pay lower taxes:

- Equity Linked Savings Scheme (ELSS)

- Public Provident Fund (PPF)

- Employee Provident Fund (EPF)

- Tax-Saving Fixed Deposits (FD)

- National Pension System (NPS)

- National Savings Certificates (NSC)

- Unit Linked Insurance Plans (ULIP)

- Sukanya Samriddhi Yojana (SSY)

- Senior Citizens Savings Scheme (SCSS)

These investments are very different from each other in terms of structure, investment horizon, and risk profile. Similarly, the returns that you can get can also vary significantly.

It is important that you choose your investment options carefully under Section 80C and try to get the best returns from them as per the amount of risk that you are willing to take.

Hence, 80C investment not only helps you save on taxes but also you get the advantage to earn good returns, making it a smart financial choice.

What is Equity Linked Saving Scheme (ELSS)?

As we saw earlier, there are various financial instruments that are eligible for deductions under section 80C of the Income Tax Act, 1961. Among all of them, Equity Linked Savings Scheme (ELSS) funds are by far the most popular among the investors looking to get high returns from equity apart from tax savings. As of March 2022, the total current investments (AUM) of ELSS funds were ₹1,51,594 crores.

Please note AUM related data for each category of mutual funds are freely available on the website of AMFI. You can visit https://www.amfiindia.com/ for more such information.

So what is an Equity Linked Savings Scheme anyway?

ELSS is a special category of equity mutual funds which offer the dual benefits of tax saving and capital gains to the investors. They carry a lock-in period of 3 years, which is mandated under section 80C. Once you invest in an ELSS mutual fund, you will not be able to withdraw the amount before the expiry of 3 years.

Now you must be thinking that the lock-in period of 3 years is too long and your money will get blocked till then. This is, in fact, a good thing for the following reasons:

Firstly, in a regular open-ended equity mutual fund, the fund manager always needs to keep some part of the corpus idle to pay the investors who redeem the mutual fund on a daily basis. Since redemption can happen on any day, generally anywhere between 5 to 10% of the total corpus of the fund is kept idle. This means that this portion of the corpus does not earn any returns and is similar to a non-productive asset for the investors.

The lock-in period of 3 years in an ELSS mutual fund means that the fund manager is not obligated to meet any redemption requests, at least in the first 3 years of the existence of the fund. He can, therefore, invest a larger proportion of the fund, thereby earning higher returns for the investors

Secondly, ELSS funds promote long-term saving habits. Since the investment is subject to a compulsory lock-in, even if you have the urge of redeeming the investment when it starts yielding short-term gains, you cannot take the money out for at least 3 years. Thus purchasing the units of an ELSS tax saving mutual fund is a great way to invest for the long term. It can certainly give you good capital gains when the markets do well.

Some of the important features of an ELSS are:

- An ELSS is a type of mutual fund.

- It is an equity mutual fund, so most of its corpus is invested in shares. All ELSS funds carry a compulsory lock-in period of 3 years. You can

not withdraw your investment before the expiry of this period. - You can get a tax benefit of up to ₹150,000 by investing in an ELSS. Though the tax benefits are kept at the levels already mentioned, there

is no limit to how much you can invest in ELSS. - You can get a tax benefit of up to ₹150,000 by investing in an ELSS. Though the tax benefits are kept at the levels already mentioned, there

is no limit to how much you can invest in ELSS. - ELSS is a long-term investment. So, you can gain a high rate of return provided the markets do well in this period.

- There are both dividend and growth options available. You can choose the option that suits you the most at the time of investment.

- In India, any investment in an equity fund made for more than 1 year is considered to be a long-term investment, which is not subjected to tax. Hence, the amount that you will receive when you redeem the investment after 3 years will be tax-free in your hands.

One point that you always have to keep in mind is that just like in the case of equity shares, ELSS funds are also subject to market volatility. When the markets do well, ELSS will give you good returns since the prices of the stocks in which it has invested will increase, and vice-versa.

How To Invest In ELSS - SIP Or Lump Sum?

Now that we have a fair idea about what ELSS is? In this unit, let's see how we invest in it?

ELSS gives you the option to either make lump-sum investments or to invest through a Systematic Investment Plan (SIP). Let us now understand the advantages and disadvantages of each of these modes of investment.

Lump sum investment:

Many investors go for investing in ELSS in a lump sum. Since these funds can get them good tax savings, they try to quickly invest in ELSS in the last 3 months of the financial year, especially if they have not done the section 80C investments in the first 9 months of the year. This can often be dangerous, especially if the markets are very high when the investment is made.

Since the investment is generally made in a single transaction, the entire purchase happens at a high rate. If the markets come down after this, the investment starts yielding losses. Mutual funds experts say that lump sum investment in ELSS is ideal only for those who are investing for a really long term like 10 years.

Systematic investment plan:

Investing in an ELSS through a SIP is the ideal option for most investors, especially the small ones. These are beneficial for many reasons:

Since the investments are staggered over the entire year, the purchases of the ELSS units happen at different prices (NAV). In this way, the cost of investment gets averaged out and you do not end up getting stuck at a very high rate.

Systematic Investment Plans, as the name suggests, require you to invest systematically on predefined dates. This promotes the habit of disciplined investing, which is much better than investing sporadically and haphazardly.

Because of these obvious benefits, it is highly recommended to go for a SIP in ELSS instead of investing in a lump sum.

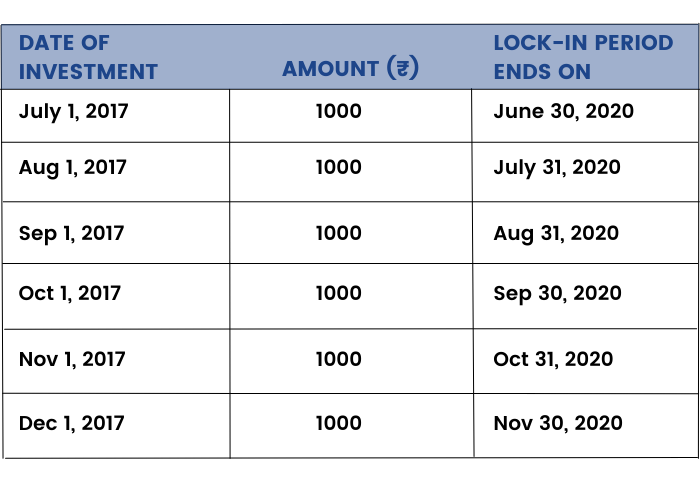

One thing you need to remember here: In case of a SIP, every investment will be subject to a three-year lock-in. That means that the three years will be calculated from the actual date of each installment, and not from the date on which the first installment was paid.

For example, if you invest rupees 1000 every month in an ELSS for six months, the lock-in will be calculated as follows:

Fund Options - Growth and Dividend

Like all other equity mutual funds, ELSS funds also offer the growth options and dividend options to the investors. You can choose either of the following at the time of investing in an ELSS mutual fund.

Growth option

When you choose the growth option, you allow the mutual fund house to further invest the returns that you earn to generate more returns. In other words, you allow the fund house to reinvest your returns for generating compounded returns. When you redeem the amount at the end of the lock-in period or sometime later, your entire investment along with the returns is paid out to you.

Dividend option

If you need the returns to be paid out to you periodically in the form of dividends, then you must select the dividend option. In this case, your returns are not reinvested but paid out to you whenever a dividend is declared by the fund house.

One thing to remember is that unlike in other equity mutual funds, the dividend reinvestment option is not available in case of an ELSS mutual fund. There were some procedural problems because of which the Association of Mutual Funds in India (AMFI) discontinued this option in 2015.

Which one to choose?

If you are looking for periodic payouts from the ELSS fund, then you must choose the dividend option. It is ideal when you either need the dividends to meet your spending obligations or want to invest the returns in some other fund and not the same ELSS fund again.

The growth option is ideal for those who are looking to build their wealth. This option offers the benefit of compounded returns. Hence, if the markets perform well during your holding period, then the amount that you can get upon redemption can be substantial. Go for this option if you are not in the need of regular payouts of the returns that you earn.

Advantages & Disadvantages Of Using Dividend Option

As already mentioned earlier, the main advantage of the dividend option is that you can get regular periods if the ELSS fund performs well. You can use this amount in any way that you want.

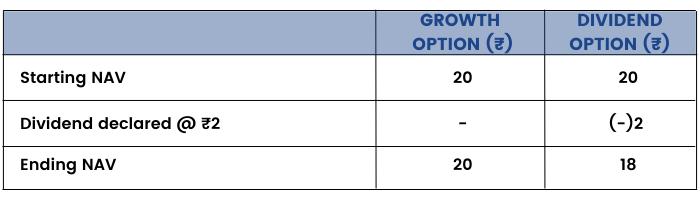

On the flip side, you will not get the advantage of compounding your investments if you use the dividend option. The fund house will deduct the value of the dividend payout from the NAV whenever the dividend is actually paid out to you. This deduction doesn't happen in case of the growth option since no dividend is paid out.

Hence, when you check the NAVs, you will find that the NAV of the dividend option of an ELSS mutual fund is less than that of the growth option. Let us take an example to understand why this happens:

Suppose there is an ELSS fund which is declaring dividends for the first time. Before declaration, the NAV of both options will be the same. However, once the dividend is paid out, the NAVs will become different.

Hence, choose the growth option if you are really interested in building wealth and have no problems in keeping the entire amount (initial investment + returns) in the fund throughout your holding period.

Comparison Of ELSS With Various Other Options U/S 80C

Let us now take a brief look at a comparison of the investment options approved under section 80C.

Please note that the instruments which have a fixed rate of interest may vary when you are reading this module as the rates are changed by the government on a yearly or a quarterly basis.

As you can see, the Equity Linked Saving Schemes (ELSS) have traditionally given the highest returns among all the tax saving instruments that are included in section 80C. No wonder that these are very popular among the taxpayers. Every year crores of rupees are invested in ELSS mutual funds by them, especially during the tax saving seasons of December to March.

Ready to simplify your share market journey? Enroll now for the 'Share Market Made Easy' course!

ELSS Vs ULIP

As we saw earlier, there are numerous financial instruments that are eligible for deductions under section 80C, such as ELSS, NPS, PPF, ULIPs and more. A word of caution here: Many investors sometimes get confused between an Equity Linked Saving Scheme (ELSS) and Unit Linked Insurance Plan (ULIP). While both of them offer tax deductions under section 80C, they are completely different from each other in terms of their product features and risk-return profiles.

Here are certain differences which will help you to distinguish between the two:

- ULIP is an insurance product offered by insurance companies while ELSS is a mutual fund.

- ULIP is a hybrid product, offering features of both insurance and investment. ELSS is a pure investment product which does not provide any insurance coverage.

- ULIPs generally deduct a hefty amount from the amount invested as various charges like fund management expenses, life insurance charges and various administrative fees. Whatever amount remains after this deduction is invested in the equity markets. However, in the case of ELSS, the entire amount gets invested in the equity markets without any deductions.

- Though ULIPs can offer an expected return of 8 to 10%, the time taken to generate the returns is much longer than that of ELSS. This is because the investor starts getting returns only after the initial charges that are deducted by the insurance company get recovered.

- While the performance of ELSS funds is quite easily understandable, it is often notoriously difficult to understand how the ULIPs behave. In the past, countless investors have complained about not getting satisfactory returns from a ULIP even when the markets have performed well.

Many investment advisers may try to sell you ULIPs disguising them as equity investment products. We recommend you to choose an ELSS mutual fund if you only want to invest in the equity markets and do not need any insurance cover. Do not invest in a ULIP just for saving tax u/s 80C.

How To Choose An ELSS Scheme?

Considering the fact that we have learned previously that; how ELSS funds are better tax-saving instruments than others. Let us now discuss how to choose an ELSS mutual fund for yourself or what are the different criteria you should look at while choosing an ELSS mutual fund for investing and also for the purpose of saving tax.

So, selecting the right ELSS fund is extremely important since investing in the wrong one can be quite dangerous. Here are some of the factors that you must check before deciding on the best ELSS funds in which you can invest.

Remember, that spending some time and effort in doing careful research before investing can help you to choose the winning funds that are also expected to perform well in the future.

Caution:

All investment in equity shares and equity Mutual Funds, including ELSS investments are subject to market risk. No matter how well you research, there is always a possibility that the fund you choose may not perform as per your expectation if the stock markets do not do well. Keeping this factor aside, by doing careful research, we can, however, evaluate the health of a fund and try to pick the best performers in which we can invest.

Doing solid research is very important, but it can never guarantee profits.

1. Asset Under Management

The thumb rule is that you should invest in an ELSS scheme which has a large Asset Under Management (AUM). When a fund manager has a large corpus to invest, then he or she can make robust decisions and draw up better strategies to generate returns. A fund with a low AUM will not give this flexibility to the fund manager and he or she will have to work under severe constraints.

Another big risk of investing into an ELSS scheme with low AUM is that in case a big investor exits from the fund, then the stability of the ELSS fund will be at stake. The AUM will become even smaller in that case. Since you are locked in for 3 years, you will not be able to exit from it, resulting in unnecessary losses for you.

2. Performance ranking

Most investors only look at the returns generated by the ELSS fund in the short and the long terms while purchasing an ELSS scheme. While that is important, it is also very important to look at how the ELSS funds are compared to its peers in terms of performance. This is where performance ranking comes in.

Every ELSS fund is assigned a Quartile ranking depending on their relative performance vis a vis all the other funds. They are classified into four Quartiles numbered 1 to 4. The top performers are classified in Quartile 1 and the worst performers are classified as Quartile 4.

Needless to say, always try to invest in the funds belonging to the top Quartiles, i.e. 1 and 2. Avoid choosing the low performers classified in Quartiles 3 and 4.

3. Ratio analysis

Evaluating the Fund Ratios will help you to find out how an ELSS scheme is performing based on certain preset parameters. While investing in an ELSS scheme it is very important to look at these ratios to understand whether the fund is worth investing in or not.

Some of the common ratios that will help you to understand the risk and return potential of all the funds better are Standard Deviation, Sharpe Ratio, Treynor Ratio, etc.

You can easily find the current ratios from the websites of the respective Mutual Fund companies and of many other research sites like Mutualfundindia.com, Moneycontrol.com and Valueresearchonline.com.

We will discuss these ratios in detail in the next unit.

4. Total expense ratio

The total expense ratio is one of the most important ratios for any investor. It will tell you what percentage of the profits from the ELSS mutual fund are being used to meet the management, administrative and distribution expenses of the fund. It is calculated as:

Total expense ratio = (Total Expenses Of The Fund) / (Total Assets Of The Fund)

The higher the Total Expense Ratio, the lower will be the return that you earn. Hence it is important that you choose a fund which has a relatively lower total expense ratio.

5. Fund manager’s performance

The fund manager is the captain of the ELSS ship, and it is he who takes most of the decisions regarding the investments that the fund makes. Hence it is very important that the fund manager is strong and well experienced.

Before investing in an ELSS, do some research regarding the fund manager. Try to know his/her qualification, experience, track record, etc. Try to evaluate the performance of the other funds that he/she might be handling, and look out for any signs of an outstanding performance by any of those funds.

The fund manager’s performance can also be found out by looking at a fund ratio called Alpha. This will tell you the extra returns that the fund manager has been able to generate over and above the average industry returns. A fund manager who has been able to generate a high alpha is considered to be better than another one who has just generated the industry average returns.

Fund Ratios, Performance Consistency And Fund Rating

Previously we have learned how ratio analysis can be helpful in choosing the best ELSS funds. Ratios like Sharpe Ratio can help you to understand the risk and return potential of all the funds. So, in this unit, we will learn to evaluate a fund based on ratios, performance consistency and its rating.

A. Fund Ratios

1. Standard deviation

Standard deviation is a widely accepted measure of risk. It will tell you how risky the fund is, i.e. What is the chance that the fund will not be able to generate the expected returns in the future.

How to evaluate?

It is always better to choose an ELSS fund with low standard deviation.

2. Beta:

Beta is widely accepted as a measure of the volatility of the funds. It will give you an idea of how much volatility in the ELSS fund returns you can expect when the markets move up or down.

Funds with a Beta of 1 are expected to move exactly in the same way as the market moves. Those with the Beta of more than 1 will witness higher volatility than the market. Those with a Beta of less than 1 have a lower volatility than the market.

For example, if the market moves up or down by 100 points, then the stocks with different Beta will move as follows

How to evaluate?

- If you are a conservative investor then choose a volatility less than 1.

- If you want the ELSS to generate returns in line with the market returns, then choose a fund with Beta of 1

- However, if you have the appetite for higher risk and want high returns, then you should choose an aggressive ELSS which has a Beta greater than 1.

3. Sharpe Ratio

Sharpe ratio measures the risk-adjusted returns generated by a fund. A higher Sharpe ratio means that you are getting better returns vis-a-vis the risk that you are taking.

Sharpe ratio is calculated as:

Sharpe ratio = (Average Returns Generated By The Fund – Risk-Free Rate) / Standard Deviation Of The Returns Of The Fund.

How to evaluate?

You should look for funds with higher Sharpe ratio as they will give you better returns compared to the risk that you would be taking by investing in them Treynor ratio.

4. Treynor Ratio

Treynor ratio is another risk-adjusted measure of the returns generated by an ELSS mutual fund. While Sharpe ratio uses standard deviation as a measure of the risk, Treynor ratio uses Beta.

Treynor ratio is calculated as:

Treynor Ratio = (Average Fund Return – Risk-Free Rate) / Beta Of The Fund

How to evaluate?

You should look for funds with a higher Sharpe ratio as they will give you better returns compared to the risk that you would be taking by investing in them.

B. Performance Consistency Of ELSS

All investors should look at the track record of the ELSS mutual fund to determine how consistent their returns are. It is always important that you choose an ELSS fund which has generated consistent returns year on year. The funds whose returns are not very consistent are the ones who earn huge returns in one year when the markets are favorable and struggle to generate any returns when the markets are bad. It is very risky to invest in an ELSS fund whose returns are highly volatile.

Hence you need to look at the past performance of the ELSS to understand their track record. Now one common mistake that most investors make is that they look at the returns of the past 1 or 2 years to determine whether the fund is good or not. This is the wrong way of checking the performance consistency of ELSS.

Since ELSS investment is a long-term one, always try to check the 3-year and 5-year returns. If the fund has been in existence for many years then you can also check the returns generated by the fund since its inception. This will give you a better idea of its performance consistency and will give you an idea about what to expect in the future, provided the market does not crash. It is a great way to choose the best fund from the plethora of ELSS that are available in the market today.

C. Fund Rating

Many independent agencies compare the performance of the funds and assign ratings to them. While investing in an ELSS you should look at these fund ratings to identify the top performers. Since fund rating is done by third party agencies like Value Research and CRISIL, these are considered to be authentic and reliable by the investors.

The ratings that are given by Value Research range from 5 stars to 1 star. They do separate ratings based on the 3-year returns and 5-year returns of the funds and then arrive at a composite rating for each fund. If any fund has been in existence for less than 3 years or has an AUM of less than 5 crores, then it is not rated.

CRISIL on the other hand does mutual fund ranking. They consider portfolio and NAV based parameters of the funds for deciding on the rankings. They also consider asset quality, risk-adjusted returns, liquidity, etc. of each fund.

Before investing in the ELSS Fund you need to compare the funds based on their ratings and rankings. This will help you to avoid choosing the wrong ELSS funds which can prove to be a costly mistake.

Examples of ELSS Schemes

In the previous units, we discussed how to understand the risk-adjusted returns and performance of the ELSS funds. Let us now look at some of the top performing ELSS funds and the ratings that have been assigned to them by Value Research. This will make it easier for you to understand how the data is presented.

Please note that these examples are for illustration only, and we are in no way recommending you to invest in these funds.

A. Tata India Tax Savings Fund

1. Returns

2. Ratios

B. Aditya Birla Sun Life Tax Relief 96

1. Returns

2. Ratios

C. DSP BlackRock Tax Saver Fund

1. Returns

2. Risk Ratios

Conclusion

Equity Linked Saving Schemes have been popular tax saving investments for many years now, and its popularity continues to grow every year. The solid advantages that it offers, including tax saving and opportunity to gain high returns, are the reasons for this popularity.

An ELSS mutual fund can be purchased very easily like any other mutual fund, either online through the website of the mutual fund or the distributors, or in the traditional offline way by filling up a form and issuing a cheque. This hassle-free way of investing and redeeming will enable you to invest and redeem the ELSS fund quickly once the lock-in period is over. This is another reason why people love ELSS funds.

So, go ahead and choose the best tax saving mutual fund (ELSS) for yourself, and get the opportunity to build wealth by staying invested in the ELSS fund for the long term.