Financial Literacy

Basic Financial Literacy

This module introduces you to the concept of financial literacy & financial education and its hues.

In this module, you'll discover the transformative power of finance education in enhancing your financial well-being. We'll delve into the significance of establishing clear financial objectives and illustrate how gaining financial knowledge can pave the way to attaining them.

What is finance?

In simple words, Finance is money management.

It is the process of acquiring money and effectively using it over a period of time. The term finance has its own definition at various levels:

At a personal level, it is called personal finance.

At the corporate level, it is business financing.

At the government level, it is public financing.

In this module, we will discuss the Personal Finance level.

What is financial literacy?

Financial Literacy is the skill and knowledge required to manage one’s financial resources. Apart from making prudent decisions, financial literacy also guides you to achieve your financial goals.

How old should one be to be financially literate?

Financial literacy does not require adulthood. It is a topic of common sense and you should be more interactive with this lesson, especially with your younger ones. Once you have laid a strong base and inculcated in them the entire ideology of managing money, say pocket money, your job is done.

As rightly said by Robert Kiyosaki, author of Rich Dad, Poor Dad (a popular book on Personal Finance):

“We were not taught financial literacy in school. It takes a lot of work and time to change your thinking and to become financially literate.”

Habits may take time to develop, but once done, they become a lifestyle.

Are Financial Literacy and Financial Education the same?

Financial literacy means knowing and understanding different money topics like budgeting, saving, investing, and handling debt. It's about having the smarts to make good money choices and understanding financial stuff like products and services.

Financial education is a broader term that includes all the stuff that helps people learn about money better and make smarter money decisions. This could include classes at school, workshops, talks, or information from workplaces or banks.

When we talk about financial education, is any certification required?

Apart from major degrees like CA and CFA, you can take the NISM-Series-XVIII: Financial Education Certification Examination, which will enhance your basics in the field of Finance, stock markets, banking and insurance and more.

Next, we will understand the importance of financial literacy.

What Is The Importance Of Financial Literacy?

The importance of financial literacy and how to manage money is clear when you look at the facts. More than 70% of working people in India barely have enough money to cover their expenses until the next payday.

This means they can only save money for unexpected events. Sadly, many end up borrowing money at high-interest rates when they face money problems, which makes their situation even worse.

People who understand money matters are better at making wise financial decisions. This helps them avoid tough financial problems and be ready for unexpected expenses.

Why is financial literacy important?

Feeling Financially Strong

Knowing how money works helps people feel strong and in control of their lives. It allows them to make smart choices about money and taxes, which helps them save more.

Being aware of Scams

People who know about money are less likely to be tricked by scams or get into financial trouble. They're also better at keeping their money safe, even when times are tough, such as during a crisis.

Living Standard

Understanding money reduces stress and helps people plan for the things they want in life, like buying a house, sending kids to college, or retiring comfortably.

Avoiding Debt

If you understand money, you're less likely to get into debt trouble. You know how to borrow responsibly and avoid owing too much.

Making Wealth

Knowing about money helps you make smart choices with your money, like investing for the future or saving for big things like a house or college.

Planning Retirement

As people live longer, it's important to plan for retirement. Knowing about money helps you save enough for a comfy retirement and handle any surprises along the way.

How To Determine A Financial Goal?

A financial goal is an objective that you work for by deciding what to do with your money.

As mentioned in the last unit, these financial goals can be short-term (like a vacation) or long-term (like buying a house).

How to do it?

Fix your goals: First, figure out what you want to achieve in life, like buying a house, saving for your child's education, going on a dream vacation, or building a retirement fund.

Set a timeline: Next, decide when you want to achieve each goal. Make sure your deadlines are realistic, practical and specific.

Estimate Costs and Budget: Think about how much money you'll need for each goal. Consider factors like inflation that might increase the cost over time and your income.

Prioritize practically: Decide which goals are most important to you. Consider your personal, family, and work-related priorities.

Why should you set a financial goal?

Setting an objective before starting the work will boost your confidence and put you on the right track to achieving it.

And once you have that clarity, you will know exactly how to achieve that goal of financial management.

What Are Savings?

Savings refer to the excess of income over expenses. This excess is what you have left with you after you’ve incurred all your necessary expenses (bills, groceries, etc.)

Different mode of Saving

Senior Citizen Savings Scheme

National Savings Certificate

Fixed deposits

Savings Bank account

Recurring deposits

Kisan Vikas Patra

Why is Savings Important?

Savings are important because they help you meet future goals, such as buying a house, or even short-term goals, like a short vacation.

Long-Term Security: Saving money is like building a safety net for your future. It helps you handle unexpected expenses and gives you peace of mind.

Financial Independence: Saving money makes you more independent. You can spend on what you like and live comfortably.

Taking Risks: With savings, you can take risks like starting a business or changing careers without worrying too much about money.

Reducing Stress: Having savings means less stress about the future, like retirement or medical expenses.

Compound Interest: Saving allows your money to grow over time with compound interest, helping you beat inflation.

Usually, people utilize their savings in the following way-

-They put it away in a savings account or

-They invest it.

We will discuss both ways of utilizing your savings, one by one.

How do you calculate your Savings?

Your savings rate should be the amount of money you save compared to how much you make.

If we consider the 50/30/20 rule of thumb, almost 20% of what you earn should go into your savings.

However, it is further dependent on various factors like your age, risk appetite, goals, and more.

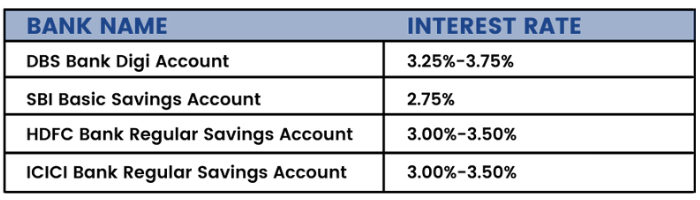

The following interest rates are applicable on the popular savings accounts of India as of November 2021 –

What Are Investments?

Investments refer to spending your time or energy on something while anticipating -

Income generation, or Value addition

For example, a farmer ploughs his field on a daily basis under the expectation that he may reap some returns in the form of grains after a specified period of time. This means that he gives his time and energy to anticipate future benefits within a certain time frame.

Types of Investments

Stocks: When you buy a company's stock, you become a small owner of that company. People who own a company's stock are called shareholders. They can make money if the stock price goes up or if the company pays dividends, which are a portion of its profits.

Bonds: Bonds are like loans you give to governments or companies. When you buy a bond, you're lending them money. In return, they promise to pay you back the money with interest over time.

Funds: Funds are like big pots of money managed by experts. They let you invest in different things like stocks, bonds, or commodities. Mutual funds are valued at the end of the day, while ETFs are like stocks and change in value throughout the day.

Investment Trusts: Trusts pool money from investors to invest in things like real estate. Real Estate Investment Trusts (REITs) invest in properties and pay investors for the rent they collect. REITs trade on stock exchanges, so you can easily buy or sell them.

Alternative Investments: These are investments other than stocks and bonds. Hedge funds and private equity are examples. Hedge funds can bet on different things in the market, while private equity helps companies get money without going public. Some alternative investments are now available to regular investors.

Options and Other Derivatives: These are financial contracts based on the value of something else, like a stock. Options give you the choice to buy or sell a stock at a certain price by a certain time. They can be risky because they use borrowed money to potentially make bigger gains or losses.

Commodities: Commodities are things like gold, oil, or crops. You can buy them directly or through agreements to buy or sell them in the future at a set price. This helps manage risk or make speculative bets.

What is the difference between Savings and Investments?

Savings store your money, investments make it grow. How?

When you invest, you also take up some risk of losing the money. Returns are usually not guaranteed. Then why invest?

The more risk you take, the more profit you can earn. Therefore, while putting your money in a bank account will earn you some interest, investing in different products can help you build your wealth faster.

Another important difference between the two is their purpose. Savings are usually made for short-term emergencies, whereas investments are done to build your wealth.

What is the right age to begin investing?

The 100 minus age rule helps decide how much of your investment portfolio should be in stocks and how much in bonds. It suggests subtracting your age from 100. The result tells you what percentage of your portfolio should be in stocks. The rest can be in bonds.

This rule assumes that as you get older, you should have less in stocks and more in bonds.

For example, if you're 35 and just starting to invest, the rule would say:

Stocks: 100 - 35 = 65%

Bonds: 35%

How to plan your investments?

You can build savings by simply storing away the money or by putting it in interest-earning accounts, but investment is not that easy.

Since there are many products and schemes available for us to choose, you cannot simply invest before deciding on -

Why you are investing?

Which product is the best for achieving your goals?

For example, if you plan to earn some extra money for a vacation you want to go on next year, you cannot put your money in a mutual fund that generally has a lock-in period of one to three years. This is where investment planning comes in.

Investment planning is the process of identifying financial goals and converting them through building a plan.We will discuss more on investment planning in the next unit.

Importance of Investment

Investing today in whatever suited instruments of immense importance for Individuals.

Helps you beat inflation- Inflation is a universal fact that will erode your money with time. It reduces the purchasing power of money. To beat this, your money needs to grow and the best way for this is to Invest.

Financial Independence- The passive income that comes out of investments that we do makes your money earn passive income for you. This gives financial stability and enables you to follow your passion and take bigger risks.

Retirement Planning- You also become independent of any need during your retirement when you have a retirement corpus through investments.

Tax Benefits- Your investments could also help you save on taxes. PPF, ELSS, Tax-Saving Bonds, and long-term fixed deposits can give you tax benefits under section 80C of the Income Tax Act 1961.

Steps In The Investment Planning Process

The investment planning steps are as follows:-

Find when and how much you are saving

The first step in making your investment plan is to determine how much you can save after all your fixed expenses. Generally, 20% of income is considered a thumb rule, but you need to self-analyse. This will include creating an emergency fund that will help you like a secret weapon.

Set your financial goals

The next step is to have clear short-term and long-term financial goals. Once you understand your future needs, making a plan will be much more feasible.

Analyze your risk-taking ability

Making any investment plan first requires ticking a few boxes about the investor's risk-taking capacity. Various factors like Age, Income, Dependents, and area of work define how much risk you should take at a given point. Based on this, your investment tools can be decided.

Create a savings portfolio

Jotted down the above points. Now comes the need to create a balanced savings portfolio for yourself. According to budget, expenses and goals, create a portfolio that gives decent returns with minimal risk as per your profile

Learn about all investment options and Calculate your asset allocation

There are different investment options available for an individual investor, which can be differentiated based on -

Time duration

The risk appetite of the investor

As per the data below, the following products are the most popular investment options in India -

Use our platform Elearnmarkets to learn about various investment options like Equity, Debt, Mutual Funds and more.

Why Should You Diversify Your Investments?

In the previous sections, we saw the steps to create a balanced portfolio and the various products available for investment. We need to split the funds into different products instead of putting all our money in one place. As Warren Buffett said, “ Do not put all your eggs in one basket.”

This process of splitting our funds is known as diversification.

Diversification means spreading your investments across different types of assets, like stocks, bonds, and real estate, as well as different industries and places around the world. This helps lower the risk because if one investment doesn't do well, others might do better, balancing things out. The goal is to have a mix of investments that aren't too similar to each other.

Harry Markowitz, an American Economist and Nobel Laureate, explains the importance of diversification: “Diversifying sufficiently among uncorrelated risks can reduce portfolio risk toward zero.”

How does this work?

Suppose you have ₹1000 in savings, which you decide to invest in the shares of a company. Two months later, the company goes bankrupt, and it cannot afford to pay you back anymore, so you lose all ₹1000. Now, if you had put some of this money into a different investment, the burden of your loss would have been lesser. This is how diversification reduces risk.

Diversification can be around-

Sectors and Industries

Companies

Asset Classes

Time Frames

Benefits of Diversification

Protecting Wealth: Diversification helps older investors and retirees safeguard their money, especially when they rely on their investments for income.

Boosting Returns: Diversification aims to increase returns while managing risks. It's like getting more bang for your buck, considering the risks involved.

Creating Opportunities: Diversification opens doors to new possibilities. For instance, if you invest in different sectors, you might benefit from unexpected successes, like a streaming company making a big content partnership.

Adding Fun to Investing: Diversifying can make investing more exciting. Instead of focusing on just one area, it encourages exploring various industries and companies, which can be both stimulating and rewarding.

There are a few disadvantages as well

Not everyone is knowledgeable enough to make a diversified portfolio. It might reduce the risk but, at the same time, will have the possibility to reduce the expected returns. Diversification helps in reducing some losses, but we cannot define diversification as a shield for all kinds of losses.

Budgeting

In Unit 2 of this module, we were briefly introduced to the concept of budgeting & why it is necessary for personal finance. Let us now elaborate on this topic & discuss its benefits.

What is Budgeting?

A budget is a financial plan which you can use to allocate your income towards -

- Expenses

- Debt payments

- Investments

The process of preparing this budget is called budgeting.

Importance of Budgeting

Budgeting is crucial for reaching financial goals effectively. Here's why:

It boosts awareness of your financial situation.

It helps you save more money.

It prepares you for emergencies.

It reduces debt.

It aids in making smarter financial choices.

It prevents overspending by managing expenses.

What are the Benefits of Budgeting?

Budgeting has many benefits.

- It can improve your lifestyle. You can stop living ‘paycheck to paycheck’ and save efficiently if you plan a good budget.

- Budgeting is the first step in moving towards your financial goals. Suppose your goal is to be able to save enough to deposit funds into a mutual fund every month.

- If you provide for it in your budget, you will understand what expenses you might have to cut down to save enough for your investment.

- When you save money by budgeting, you save it for your future. Therefore, a good budget can assist you in retirement planning as well.

- Making a budget can help you in creating a fund of additional money. You can use this fund in case of emergencies instead of borrowing unnecessarily.

What Are The Steps In The Budgeting Process?

Now that we have understood budgeting & its benefits let us discuss the steps to prepare a budget.

The steps to prepare a budget can be categorized as follows -

1. Set up a plan of action.

The first step in this budgeting process is to decide in advance what estimated proportion of your income you would like to separate as savings. This will make you plan more efficiently.

2. Identify your income.

Record all the money you earn on a periodic or irregular basis. This is important because you will use this money to manage your expenses. This may include your regular source of income, any passive income, or any other contingent income.

3. Identify your expenses.

Keep track of all the expenses that you incur, whether regular or irregular. Understanding these expenses will ensure that your budget has prepared your income for any outflows you might face in this period.

4. Prioritize the urgency.

Focus on the expenses that will require handling first, before you set out to divide income for other expenses. For example, prioritize fixed payments you have to make while preparing your budget, as you cannot afford to skip these.

5. Devise and execute the plan.

Once you have understood the magnitude of your expenses, execute the budget.

When you start practicing your budgeting process-

- Make sure to be flexible in your approach; and

- Keep making necessary changes to your budgetary limits as you go about your life.

For example, evaluate your budget if you get an increment in your salary, as your purchasing power would have increased because of it.

Since all the expenses are not predictable, prepare an emergency fund.

When following this budgeting process. it's smart to include a category for emergencies. Set aside cash for unexpected expenses in a "miscellaneous" category. This way, you're prepared without dipping into other budget areas.

Steps Of Maintaining Household Finances

Now, let us learn the steps to maintain household finances.

Household finances occupy one of the major portions of the gross expenses of an individual.

A well-maintained household finance strategy -

- Strengthens our budget; and

- Prevents us from running short of any household supplies at any point of time.

Let us know the steps to maintain household finances:

1. Ascertain expenses: Firstly ascertain the monthly expenses which will occur mandatorily. Keep that portion of income separately to avoid any financial crunch.

2. Emergency purchases: There may be certain emergency purchases in a month that may require you to keep certain funds separate. For example: you may plan to keep a separate first-aid box at home, for which you may require medicines, bandages etc. So keep that portion of funds separate from the income portion.

3. Reserve amount: The amount left after allocating to expenses and emergency purchases should be kept for other uses which may be -

- Seasonal expenditure;

- Irregular payments of any kinds; or

- Buying new clothes, etc.

4. Record of expenses: Always keep a record of expenses whether online or in pen and paper. This helps you to keep a track of the expenses done. It is advisable to prepare a statement of net worth to keep track of income & expenses. Let us learn this in our next unit.

5. Look for your Risk Capacity: Before planning your budget, it is necessary to understand your capacity to take risks. This can depend on various factors, such as your income source, daily lifestyle expenses, and more. This will be key in determining what instruments are to be used. High-risk instruments involve equity, small-cap mutual funds and more, whereas low risk.

Follow these steps and improve your household finance management.

What Is A Statement Of Net Worth?

The statement of net worth shows the net value of assets owned by an individual. It can be computed by reducing the liabilities from the assets of the individual.

It basically shows the financial status of the individual.

Why is determining net worth important?

Determining your net worth has the following advantages -

- Your net worth will help you see two important things-

i. Your current financial position; and

ii. What’s stopping you from getting to your ideal financial position? - When you will sit down to calculate your own net worth, you focus will shift from only your assets to your debt and other liabilities as well.

- It will put all the elements of your finances in a new light.

It will help you see what exactly did you do with your finances all this time. - Your net worth also affects your loan applications.

How? Suppose your net worth is negative (your liabilities exceed your assets).

The lender may find it a bad decision to lend to someone who can’t balance their own funds, but this would not be the case if your net worth was positive.

Therefore, it is essential for you to calculate your own net worth and know where you stand, financially.

What’s Included in a Statement of Net Worth

A statement of net worth largely includes the assets and debts of an individual or business. Here are some types of assets and debts that might be included in a net worth statement:

Savings & Checking Accounts

Investments

Life Insurance Policy

Retirement Funds

Personal Property

Real Estate

Credit Card Bills

Mortgage Balance

Unpaid Taxes

Loans

A statement of net worth will include balance sheets, income statements and cash flow statements.

How to calculate your own net worth?

Here is how you can calculate your own net worth -

- Calculate value of cash and liquid assets

- Add the market value of investments.

- Add the value of all tangible property (land, antiques,etc.).

- Add the above amounts to get total assets.

- Deduct all secured and unsecured debt from total assets.

So, with the end of this module we have completed the first step towards financial literacy. But it is a long journey, thus we have created more content on ELM School for all those interested in learning stock market, investing, and personal finance that will help you to achieve financial independence.