Health Insurance

Introduction

Every day, we come across instances of people dying due to their inability to get timely treatment. Not that there is a paucity of hospitals or treatment facilities in India, but because the hospitalization expenses and costs of medical treatment have risen to a level that very few can afford. Inflation has had an overbearing effect on medical costs, which explains the increasing need to buy health insurance.

What is health insurance?

Simply said, it is a kind of risk cover against increasing medical and surgical expenses. A health insurance policy is an agreement between the insurance company and the policyholder in which the former is liable to pay for the hospitalization and treatment expenses of the latter in lieu of regular payment of premiums during the policy term. With a health insurance policy in place, the policyholder can seek the benefits of either cashless treatment or reimbursement of the amount spent on treatment, if and when required. However, the insurer is liable to pay off the medical bills subject to the condition that the total billing amount does not exceed the amount of sum assured and premiums are paid on time.

Let’s understand the concept of health insurance with the following example:

Jogesh Kumar, aged 34, is a married man with two children. In addition, his aged parents are also living with him. The entire family runs on Jogesh’s income. This means that Jogesh is not only responsible for their financial security but has to also take care of their hospitalization and treatment expenses irrespective of whether the medical treatment is planned or sudden. Suppose Jogesh’s wife has been suddenly hospitalized and needs to be treated for some medical disorder. The total hospital bill amounts to ₹3,69,000. Jogesh who already had bought a health insurance plan with a sum assured totaling ₹4,00,000 and had opted for the cashless treatment option, will simply submit the health insurance card at the insurance desk of the hospital. The insurance company is now liable to pay off the medical bills, thus, relieving Jogesh from the liability of having to pay such a huge medical bill from his accumulated savings.

Important Points About Health Insurance

From our previous example, we saw how a health insurance policy could be extremely beneficial. But before buying one, you should know some important points that we will discuss over here.

The most important point to note here is that your health insurance policy will cover only those medical expenses that are not incurred on the treatment of illnesses not covered or excluded under the policy. Almost every health insurance plan sold in India covers hospitalization expenses, daycare treatment, the amount expended on domiciliary care, organ transplantation, ambulance expenses, etc. Additionally, health insurance policies take care of pre and post-hospitalization expenses too.

Though many health insurance policies in India cover both pre and post-hospitalization expenses, it is important to keep in mind the following points before opting for a health insurance plan. These include:

- The insurance companies do not cover pre and post-hospitalization expenses for an infinite period. Most insurance companies cover the expenses incurred for 30 days or 60 days before hospitalization. Similarly, they cover post-hospitalization expenses for 60 days or 90 days after getting discharged from the hospital.

- The actual number of days for which pre-hospitalization and post-hospitalization expenses would be covered differs from one insurance company to the other, thus, making it important for the policyholder to read the details of the policy before buying it;

- The insurance company is liable to pay for the pre-hospitalization expenses subject to the condition that the expenses were incurred for the illness or disease for which the insured was hospitalized. Similarly, the insurer would pay off the post-hospitalization expenses only if they are incurred on the ailment for which the insured had been admitted to the hospital.

Health Risks

Uncertainty is the only certain element in one’s life. This explains why some people are always in a hurry to achieve, succeed, and ensure complete financial security for their loved ones. Sadly, health gets ignored in the daily grind of life. While we all have been taught the importance of the age-old adage “Health is Wealth”, people always tend to ignore and undermine the need for maintaining good health in the pursuit of wealth.

Common health problems affecting Indians:

Indian society is fraught with lifestyle problems stemming from smoking habits, drinking culture, sleeping late at night, eating junk food, dependence on vehicles even for traveling short distances, etc. Those with smoking and drinking habits have to pay greater amounts of premiums on non-smokers and non-drinkers. This explains why some insurance companies require their customers to go through certain essential medical tests before deciding on their health insurance proposal.

For example, Anmol Jha, a resident of Bihar, is a chain smoker. Little does he realize that his smoking habits will make him prone to serious health problems. Anmol Jha opts for a health insurance plan sold by a private insurance company after going through all the policies being sold in the market and comparing their features and benefits. The insurance company he has chosen agrees to sell health cover to customers with smoking habits too subject to the condition that the customers have to undergo a complete medical checkup as prescribed in the terms and conditions of the policy. Anmol will have to bear the expenses of the medical checkup before buying the policy.

Now, Anmol has two options. Either he assents to the idea of getting through a thorough health checkup as prescribed by the insurance company or opts for a different insurer that does not seek any medical test before selling the policy. However, in either case, Anmol being a smoker will have to pay higher premiums if he wishes to avail of the benefits of having a health insurance plan to ensure health coverage for himself and his loved ones.

Pollution is another reason that makes an increasing number of people susceptible to health hazards. A sedentary lifestyle adds to the existing list of disorders affecting Indians of all age groups unbiased of their economic conditions. Some common illnesses that most Indians are afflicted with include:

- Respiratory Problems;

- Gastrointestinal Diseases;

- Obesity;

- Cancer;

- Cardiovascular Disorders;

- Hormonal Imbalance;

- Food Allergies;

- Mental Illnesses.

Importance Of Health Insurance

The penetration of the health insurance concept is relatively low in India, which explains why many people are bereft of timely medical aid. The rising cost of treatment in the country has led to inequitable access to health care services. According to details published in the National Health Profile 2018 unveiled in June 2018, only 27 percent of the country’s total population has health coverage. This means that there is still an ardent need to improve and expand the insurance coverage that covers only a percentage of the country’s vast population. Out of the total number of Indians who have bought health insurance to date, roughly 79 percent were covered by the public insurance companies whereas the rest had accessed the necessary cover from private insurance companies.

While the National Health Programmes have played a prominent role in tackling the grievous health disorders in India, the share of public expenditure on health by the Centre is gradually decreasing. Many people in their younger years do not realize the need for having an adequate medical cover to tackle the burden of sudden medical emergencies. Since the young are less likely to fall ill or be diagnosed with any serious disorder, they fail to realize how paying a nominal premium for health insurance will ensure them the freedom to seek the best possible treatment in the long run. Moreover, the insured can get themselves treated at their choice of hospital, provided that it is listed in the network of hospitals of the insurance company they have chosen to be associated with.

Why Do You Need Health Insurance?

Lifestyle habits, increasing pollution levels, aggravating stress levels, and augmenting pervasiveness of diseases have enhanced the risk of suffering from unforeseen health problems. A sudden need for treatment may leave the patient’s family financially distressed as they have to dig deep into their savings to pay for the costs of treatment. Some families also have had to liquidate their investments to ensure that the loved ones get the best possible treatment. Health plans, on the other hand, keep the policyholders and their loved ones protected by paying off the medical bills and, thus, relieving the families from an unwarranted financial crisis.

Listed following are some factors that shed light on why buying health insurance is important, but must be included as an essential financial instrument. These may include:

- Financial security is the ultimate aim of every individual or family belonging to any income group. However, the extent of financial security not only depends on how much you invest but to the extent you can save on your income levels. Ignoring the need to invest in a health insurance plan results in many people having to pay their medical bills by withdrawing from their savings account. Hefty bills may also cause them to postpone investing in important financial instruments that provide security in the long run. Health insurance plans not only defray rising costs of medical expenses but ensure added tax benefits too as the insured can claim a deduction on the premiums under Section 80D of the Income Tax Act.

- A shift in lifestyle may have many medical complications. As opposed to earlier days when people used to walk for long hours or indulged in manual labor, most of them live a sedentary lifestyle, thus, resulting in continued health problems. Having a health insurance policy in place ensures that the policyholder avails medical checkups regularly, and gets the much-needed treatment at the best available medical treatment facilities.

Health Insurers

Health insurance plans are an essential element of one’s financial planning. A few thousands of premiums paid regularly in advance can help offset the expenditure worth lakhs of rupees on medical treatment. Buying health insurance is equivalent to paying for one’s security that must be done after a lot of consideration. Some of the top health insurance companies in India include:

- National Health Insurance

- Reliance Health Insurance

- Bharti AXA Health Insurance

- Bajaj Allianz Health Insurance

- Aditya Birla General Insurance

- SBI Health Insurance

- HDFC ERGO Health Insurance

- Max Bupa Health Insurance

- IFFCO Tokio General Insurance

- Future Generali Health Insurance

- Star Health Health Insurance

- Apollo Munich Health Insurance

- ACKO General Insurance

- Royal Sundaram Health Insurance

- Tata AIG Health Insurance

Different Types Of Health Insurance Policies In India

Not all health insurance policies sold by the insurance companies in India are the same. More than ever before, the health insurance sector in India is undergoing a sea change as insurance companies are constantly innovating and re-inventing their products in a bid to grab a larger market share. Customization of health insurance plans is the buzzword as insurers modify their products to suit their customers’ needs.

Whether you are opting for cashless settlement or reimbursement of the claims made, you will always find a health insurance plan suited to your needs. While many people buy health insurance policies to cover medical expenses stemming from planned treatment in the future, policies that meet medical emergencies are also available. Some of the popular health insurance policies include:

Individual Health Insurance Policy:

Are you planning a health cover for yourself? Afraid not as many insurance companies sell health insurance plans that ensure a health cover to individuals against illnesses while covering the risk of hospitalization and medical treatment. These policies offer benefits like cashless hospitalization, reimbursement of medical expenses, pre and post-hospitalization charges in addition to add-on cover benefits. However, as the name suggests, this cover is available for an individual only, and hence, the sum assured must be chosen accordingly.

Family floater health insurance:

Nothing matters more than family. This is precisely what family health plans or family floater insurance plans are all about. The idea to ensure that your family avails the necessary treatment at their choice of a hospital without worrying about the resulting hospital charges. This kind of cover brings the entire family under one umbrella. These plans offer a fixed amount of sum assured, which means that the insurance company will pay for treatment of the family members (one or more than one) subject to the condition that the hospital bill does not exceed the amount of sum assured predetermined while buying the policy.

Senior citizen health cover:

Seeking cover for aged parents used to be difficult once. This is because old people are more likely to fall ill or seek treatment for major health disorders. Since the risk associated with their health is high, most companies refrained from providing them with any kind of health cover. However, the insurance scenario has drastically changed in the last few years with new players entering the market.

Maternity cover health insurance:

Family planning has its own place in financial planning too. That is why many insurance companies sell health insurance policies that cover the expenses on pre and post-natal care, child delivery, and vaccination of the newborns in the family. However, the expenses on the treatment of the newborn child are supported by the insurance company only until the policy is active. There are other policies too that cover additional expenses including covering the amount expended on Ambulance while driving the mother to the hospital of your choice.

Top-up plans:

As the name suggests, these plans have the advantage of top-up or the benefits of an added coverage amount, i.e., over and above the amount of cover you had opted for while buying the plan. These plans are bought as supplementary plans, i.e., a plan in addition to the basic health cover that you had bought in the first place. The top-up plans operate on the concept of “deductible limit”. This means that the plan will not come into force until the hospital expenses exceed a particular limit also called the deductible limit. If the claim made by the policyholder exceeds the deductible limit, then the insurance company is liable to pay the excess amount.

Super top-up plans:

These plans are way better than the top-up plans and must be bought by those whose loved ones are prone to serious disorders due to a family history of illnesses. Since the treatment of these illnesses incurs a very high expenditure, it makes sense to pay for these plans so as to offset the rising medical expenses in the long run. As opposed to top-up plans where each claim over and above the deductible limit is said to trigger the plan, in super top-up plans the aggregate claims incurred during any particular year are considered.

This can be explained with the help of an example. Take, for instance, Shyam Sundar has bought a super top-up plan with a threshold limit of ₹100,000. Suppose Shyam has made two health insurance claims of ₹80,000 and ₹70,000 respectively. Since the total claim made on the two plans amounts to ₹1,50,000 which is in excess of the threshold limit of the super top-up policy, then the insurance company is liable to compensate to the tune of ₹50,000 (aggregate of the two claims – threshold amount limit).

Fixed benefit plans:

These are also called defined benefit plans. Instead of compensating for the claim made by the policyholders, these plans promise a fixed benefit predetermined while buying the plan. The plan benefits are irrespective of the claims made on them and may exceed or be less than the claim amounts.

There are different kinds of fixed benefit plans. These include:

Critical Illness Plans:

These are also a kind of health insurance plans that operate differently and provide a specific amount of coverage only during hospitalization or treatment of specific critical disorders only. Every critical illness plan is different in the sense that each plan covers a list of specific critical illnesses only and is activated only if the policyholder receives treatment for that particular grievous disorder only. Instead of paying the claims made on the hospitalization costs, the insurance company is liable to pay in a lump sum the predetermined coverage amount to the policyholder. A majority of the insurance companies selling critical insurance plans cover the following disorders under the policy:

- Major organ transplantation

- Cancer

- Pulmonary arterial hypertension

- Cardiovascular disorders

- Aorta graft surgery

- Coronary artery bypass surgery

- Multiple sclerosis

- Kidney failure

- Paralysis

Hospital Daily Cash Plans:

These plans are also called hospital cash benefit plans and promise a fixed amount for each day of hospitalization in the event of any, irrespective of the nature of the treatment of the insured. The amount of money given out by the insurance company is unbiased of the amount spent on hospitalization and treatment.

Personal Accident Cover:

These are not individual health insurance plans but offered as riders to the health cover bought. Opting for this rider by paying an additional amount of premium benefits the policyholder as the insurance company is liable to pay for hospitalization and treatment in case of an accident. The payout by the insurer is in the form of a fixed benefit and is independent of the amount spent on treatment.

Mediclaim Policy (Group / Family Floater And Individual)

Good health is a necessity. The challenge of being fit and remaining fit is, at times, marred by genetic disorders, congenital problems, or illnesses stemming from pollution and unhealthy lifestyle habits. Advancements in medical science and innovation in treatment methods have ensured that people are able to seek necessary treatment without delay. However, inflation has had its effect on medical expenses too, thus, resulting in many people remaining untreated and suffering from their disorders. Health insurance fulfils the need by availing the necessary medical cover in lieu of regular payment of nominal premiums.

Currently, health insurance plans are sold under two broad categories:

- Individual health insurance

- Family floater health plans

In addition, companies today are availing the benefits of health insurance coverage to their employees under various Group Health Insurance schemes.

Individual health plans are taken by policyholders to insure themselves. The Family health plans are actually extended versions of individual health insurance policies that customers buy to ensure that their loved one(s) or dependent(s) are secure against unforeseen medical disorders and are, thus, able to seek treatment at their choice of hospital. Under family health insurance, one can seek cover for spouse, children and aged parents beside themselves.

A corporate or group health insurance policy is like a benefit that is passed on by a company to its eligible employees. This is one of the perks that most companies are currently giving to their employees to ensure their loyalty and prolonged service. Some group health insurance policies are structured to include the family members of the employees under the ambit of the policies. The top group health plans sold by insurance companies that sell health insurance policies include:

- Star Health and Allied Insurance Policy

- HDFC ERGO Group Health Insurance

- Future Generali Group Health Insurance

- ICICI Lombard Group Health Insurance

Let us understand the kinds of health insurance plans with the help of some examples:

Example of An Individual Health Insurance Plan

Shikha Dhawan, aged 28, works with the private sector and understands the need to buy health insurance. Shikha’s parents are retired Government employees. This means that any expenses incurred on their treatment are reimbursed by the government. Since Shikha is not covered under any health insurance policy, she decides to buy a health insurance plan that would secure her against any future hospitalization and medical costs, if any. Since Shikha chooses to get only herself insured, she chooses to buy an Individual Health Insurance Plan.

Example of Family Floater Insurance Plan

Niladri Shekhar Dutta, aged 34, is a married man with two children and lives with his parents in the same house. Being the only earning member in his family, each member of the family is dependent on Niladri’s income. This also implies that Niladri has to bear every expense including the medical costs of his family members.

Niladri realizes that hospitalization expenses and treatment costs are gradually rising. He seeks a health insurance plan that would cover his entire family in lieu of nominal premiums. He logs on to the internet to read about various family floater plans and chooses one that promises an adequate amount of coverage at reasonable premium rates. Since the family floater health policy covers each member of his family, he is secure from the burden of bearing exorbitant medical costs incurred during the treatment of his family members at the hospital of his choice. Moreover, the insurance company he chooses promises him additional benefits like claim settlement of daycare treatment expenses in addition to the amount expended as pre and post-hospitalization expenses.

Example of a Group Health Insurance Plan

Sakshi Mehra, aged 32, is employed with a company that promises perks and benefits as an effective employee retention method. The company has tied up with Kotak Insurance that covers all its employees under its Group Insurance Cover Plan. In lieu of the premiums paid by the company, each employee including Sakshi is guaranteed a cover, not exceeding Rs 4 lakhs, to secure against treatment costs in case of any sudden medical emergency stemming from illness or accident. Sakshi, who is currently not covered under any health insurance policy, finds it an effective financial instrument to manage future medical expenses, if and when they arise.

However, Sakshi also realizes that this cover is guaranteed only until she remains employed with the company. She will be bereft of this important cover once she resigns or is officially relieved from her services.

Third-Party Administrator

The innovative idea of introducing the concept of Third-Party Administrators (TPA) was first introduced by the Insurance Regulatory Development Authority of India (IRDAI) in 2001. One can find the list of TPAs on the IRDAI website. As evident from the name, these TPAs are third-party entities licensed by the IRDAI to ensure a seamless and hassle-free claim settlement process. They do this by acting as the intermediary between the policyholder, the health insurance company and the healthcare service provider.

For example, Narayanan Krishnamoorthy, aged 35, needs urgent medical treatment as advised by his doctor. He gets in touch with the TPA and informs them about the need to seek medical treatment. The TPA advises the policyholder about the nearest hospital listed in the insurer’s network and aids him in the claim process post-discharge from the hospital. The TPA is liable to help the policyholder irrespective of whether he had opted for cashless claims or reimbursement of the amount expended on hospitalisation and subsequent treatment.

The IRDAI has listed certain guidelines governing the working of the TPAs engaged in providing necessary management solutions to the health insurance companies. The myriad responsibilities of TPAs include timely premium collection, seeking details of the treatment from the policyholder and intimating about the same to the concerned health insurance company, finding details of the network hospital nearest to the policyholder, approving the claims raised by the hospital or treatment facility, approving the cashless claims raised by the policyholders and disbursement of the billing amount to the hospital.

The concept of TPAs came into effect after the government allowed private insurance companies to sell health insurance policies. The inception of TPAs since 2001 has greatly increased the efficiency of the claim settlement process, thus, enhancing the effectiveness of buying health insurance in India. Apart from this TPA has brought many other benefits to policyholders and insurance companies. Let us discuss them in our upcoming units.

Benefits Of TPA To Policyholders

An essential benefit is that the policyholder gets an opportunity to get treated at any of the hospitals in the TPA’s empanelled network and make use of the services as per need and choice. Moreover, for every recurring hospitalisation, the policyholder will have the advantage of knowing whether the treatment he or she wishes to undergo is covered under the health insurance policy bought. Similarly, during emergency hospitalisation, all the policyholder or the dependant has to do is to show the health insurance card and get admitted at any of the network hospitals for treatment. No amount would be charged from the policyholder or any of the insured under the policy at the time of discharge from the hospital. Some TPAs provide added services like an ambulance referral or advising about any surgeon or specialist who can help.

Statistics highlight how a lot of Indians continue to be ignorant. Since most of the customers are unable to understand the technical terms and jargons included in the insurance proposal, they face the risk of claim rejection. TPAs enable an efficient delivery network that ensures that the policyholders do not feel cheated and are the ultimate beneficiaries of the insurance they had paid for.

Before the TPAs came into the picture, lots of policyholders complained about how they found it difficult to get their medical expenses reimbursed from the concerned insurance company. However, as now reimbursements are routed through the TPAs, it is the TPAs who meet the hospital expenses by paying the healthcare provider from their fund and then get reimbursed from the concerned insurance company.

Benefits Of TPA To The Insurance Companies

The TPAs, since they were first introduced, have gone a long way in curtailing the costs of the insurance companies. This is because the insurance companies did not have to spend on increasing or spreading their network throughout the country, especially to the remote areas. TPAs act as the most vital link between the three elements of the health insurance sector including the policyholders, the health service providers and the insurance companies. As treatment facilities scramble to make more money to run their operations and earn profits, insurance companies look at all means to control their costs. As an increasing number of people prefer to opt for the cashless option, it is the role of the TPAs to identify the actual expenses that may have been incurred and the credibility of the amount to be paid by the insurance company.

How Do the TPAs Function?

The TPAs function as the intermediary between the insurance company and the policyholders by facilitating the claim and settlement processes. To customers opting for cashless hospitalisation services, the TPAs issue the ID Cards to the policyholders. These policyholders can show these cards while gaining admission to the hospital for treatment during an emergency. Also, the TPAs assist the policyholders by giving them details about the nearest hospital in the insurer’s network so that they may avail the benefits of cashless settlement. However, if the customer opts for some other hospital outside the insurer’s network, then the TPA enables reimbursement of the claim payment. For easy and quick claim settlements, the TPA collects all the necessary documents including bills and the copy of the claim to the insurance company.

Buying And Maintaining Health Insurance

In this section, we will discuss the different platforms through which we can buy a health insurance policy and also study the important factors to consider while buying a policy. So let us begin.

Buying patterns have largely changed in the past few years. From the brick-and-mortar showrooms, people have moved on to virtual platforms that allow them to shop from the comfort of their homes. Payment methods have also changed, which means that the strain of having to carry cash and fear of losing it has been replaced with online banking methods and payment gateways that ensure immediate payment with just the click of a button.

In addition to buying insurance plans offline, interested customers can now log on to the sites of the insurance companies from which they wish to buy or search for the various insurance plans listed on the websites of multiple insurance web aggregators including Policy Bazaar, Bank Bazaar, Cover Fox, Policy X, etc. With so many platforms offering multiple benefits to people looking to buy insurance products, one could not have asked for more.

Factors to Consider While Buying Health Insurance Policy:

The uncertainties of life have always prompted people to rely on technological innovations and medical advancements for better living. Along with expectations, expenses have also gone up as is evident from rising healthcare costs, thus, explaining the relevance and importance of including health insurance as an essential financial tool. An increasing number of insurance companies have now come up with innovative health insurance products that promise multiple benefits in lieu of nominal premiums. Those looking for added benefits over and above what they are already getting can easily apply for the same by agreeing to pay over and above the basic premium rates.

“Insurance” is not a new concept, especially, in the Indian context. However, most customers continue to be ignorant about the various terms used in insurance and their significance in today’s living. With a multitude of health insurance plans to choose from, customers are sometimes confused and unable to choose the health insurance policy that would serve their needs and defray their medical costs in the long run. However, a careful look at certain essential factors can help to make the right health insurance policy. These include:

- Price of the product: Most customers get attracted to insurance companies selling cheap health insurance plans. What they fail to realise is that the price of any health insurance plan is subjective and has a lot to do with the quality of the product that is being sold. The relationship between price and quality is fine and intricate and must be looked into collectively instead of considering each separately. For any insurance company selling health insurance cover, the price of the product has a lot to do with the underwriting efficiency of the insurer in addition to its operational efficacy. Similarly, the price of an individual plan will always be different from that of a family floater. This is because the price of the latter depends on the number of members covered and the quantum of cover selected.

- Incurred Claims Ratio: Now that one is aware of the various product prices, it’s time to look at the Incurred Claims Ratio (ICR) of each insurance company. The ICR is nothing but the ratio of the total amount paid in claims to the total amount collected as premiums by the insurance company. Ideally, the value of ICR must be between 50 percent and 80 percent. While having an ICR on the higher end does highlight the company’s efficiency in settling the claims made by their customers, an extremely high ICR value also implies that the company is giving away more than it has earned. This may mean that the company may introduce new rules to clamp down on the claim settlement to restrain its capital outflow. Ignore companies with an ICR below 50 percent as this means greater chances of your claims getting rejected when needed.

- Co-payment Clause: The co-payment clause means that policyholders would be required to foot a portion of the medical expenses themselves. Most insurance companies have introduced this clause to refrain their customers from opting for unnecessary surgical procedures or fancy treatments even if they may not be required. Policyholders may be required to opt for co-payment that may vary from zero to 10 percent. While this may seem that accepting the co-payment clause allows policyholders to pay low premium rates, it is equivalent to bearing a part of the medical costs in the long run. Refrain from accepting policies with a co-payment clause.

- Policy Exclusions: While choosing a health insurance plan, most customers look at the policy inclusions only. However, a careful look at the policy exclusions is similarly important. This is because most health insurance plans are embedded with a waiting period, thus, relieving them from paying for claims towards the treatment of pre-existing disorders. This waiting period may vary from 30 days to 4 years depending on the seriousness of the disorder and the amount of money expended in their treatment. In addition to the exclusions for the pre-existing illnesses, some insurers may exclude paying for certain hospitalisation expenses within the first few months of their customers buying the policies. Basic health insurance plans include sub limits for specific treatments that must not be ignored.

Customers opting for family floater plans that would cover their aged parents too must find out if their choice of policy pays for OPD charges and ambulance expenses too.

- Waiting Period: No health insurance plan comes without a waiting period for diseases that the customers had been diagnosed with before buying the policy. The idea is to opt for a plan with a lesser waiting period or that plan which has fewer exclusions corresponding to the waiting period clause.

- Cashless Hospital Network: Statistics by the IRDAI in the past have revealed how the average claim payout in the case of reimbursement settlement is only half the amount settled by cashless claim settlement. Prefer to opt for a cashless settlement claim. Scan through the insurer’s network of hospitals that offer the cashless settlement. One can find the list of network hospitals on the insurance company’s network. Find out if your choice of hospital falls within the insurance company’s cashless network.

Though there is no harm in choosing the reimbursement option, cashless settlement fares better as the policyholders simply have to show the health card issued by the insurer and seek necessary treatment. Also, in the reimbursement option, policyholders would be required to pay for the treatment first and seek claim later. This may put undue strain on their finances, thus, affecting the quality of treatment. Also, opting for the cashless route saves the policyholders the trouble of collecting and collating the medical bills and documents for submission to the insurance company before making the claim.

- Insurer’s Track Record: Never opt for an insurance company that has just entered into business. Experience matters, especially, a company that enjoys the reputation of a sound financial strength and has a good business track record. Apart from the claim settlement ratio of each insurance company, study its solvency ratio as the latter highlights the company’s ability to pay out the claims. Find out if the company has earned enough in premium amounts during the past financial year. High premium growth registered by the insurance companies depicts the growing faith of the people in this company. Expertise comes with experience, which means that longer the company has been into the insurance business, greater is its credibility. This apart, any insurance company with a wider range of insurance products catering to every section of the society is always preferable.

Online Policy Renewal

If you do have a health insurance policy, you might know that these are renewed on an annual basis, not like the life insurance policies where it is valid for term till maturity considering that you are regularly paying the premium.

Earlier renewal of insurance policy takes a lot of time visiting the office of the insurance companies or your insurance agents. But worry not, things have changed quite since that era. All thanks to the internet!

The internet has influenced every aspect of our living. This is true of insurance policies that can be renewed online, thereby, saving policyholders the hassle of having to submit physical documents and queuing outside insurance companies to submit their renewal proposals. Policyholders have to simply log on to their choice of insurance companies or register their details on insurance aggregator sites, type out their policy number, read through the benefits, terms and conditions by their insurers and apply for renewal accordingly.

Irrespective of the kind of policy including life or general insurance policies, application for online insurance renewal and subsequent payment towards the same is now possible.

Health Insurance Portability

Before understanding the concept of health insurance portability, it is important to realise what the concept of “Portability” means in the context of health insurance and its significance to policyholders in the long run.

Every health insurance plan that you buy from any insurance company must involve a level of satisfaction regarding the benefits promised by the insurer in addition to the terms and conditions laid down by it. In the event of dissatisfaction, the insured looks for ways to buy a similar policy from another insurance company that promises greater benefits in lieu of low premium charges.

Portability is actually the right allowed by the current insurance company to their policyholders to move to another insurance company while retaining the existing credit and benefits regarding pre-existing disorders, waiting period and other exclusions that are time-bound pursuant to the original policy bought. The benefit of portability can be availed by health insurance policyholders irrespective of whether they had bought an individual health insurance plan or paid for a family cover health policy.

Also, the policyholders can choose to move from one insurance company to the other or from one plan to another plan sold by the same insurer. However, policyholders can seek the advantage of health insurance portability subject to the condition that they had towards premiums of the previous policy regularly and had maintained the policy sans any break.

The concept of “Health Insurance Portability” was first introduced by the IRDAI in 2011, thus, allowing policyholders to switch from one insurer to the other while retaining benefits including no-claim bonus (NCB) and free medical checkups promised by the previous health insurance policy.

Caveat:

“Nothing Good in Life Comes for Free”, which means that the policyholders can avail the benefits of health insurance portability subject to certain conditions. To secure the interests of the insurance companies, the IRDAI allows them the right to reject any port-in requests. Also, all the requests made by customers for portability would be treated as new. This means that the health details and past insurance claim details would be scrutinised by the underwriter of the new insurer. Only after a detailed evaluation of the risk exposure, the new insurance company would determine the premium charges that would be applicable to the health insurance cover sought by their customers. The health insurance proposal may be rejected or accepted post the risk assessment by the new insurer. In the event of rejection, the policyholder would be required to continue with the existing insurance service provider.

Important Considerations Regarding Health Insurance Portability

- Many people do not realise that age matters when it comes to insurance. This is because the risk associated with health conditions goes up with increasing age. As a result, most insurance companies are reluctant to approve health insurance portability applications proposed by senior citizens. Some insurers may accept subject to payment of high premium charges in addition to a co-payment clause.

- High premium charges is one of the reasons that most policyholders apply for portability of their health insurance portability. Your new insurer may agree to charge you less. However, there is a possibility that the coverage amount is reduced. While this may seem beneficial initially, you may have to spend more for your treatment in the long run owing to the low amount of insurance cover that you had opted for. This means that looking at premium rates is not enough. It is important to check the premium vis-a-vis health insurance coverage.

- Every insurance application including the new one opted for post health insurance portability is based on the “Principle of Good Faith”. This means that filling in wrong information, incorrect details about existing health disorders or inability to submit the previous policy documents mandated during portability may result in rejection of the portability application.

- Increasing age and health disorders have a determining effect on the portability requests made. The new insurance company may seek details of your pre-existing disorders or the claims that you had made on your previous policy in the past. Some insurers also ask their prospective customers, aged above 45 years, to undergo some necessary medical tests. The insurance companies have the right to reject the portability application if the policyholder is diagnosed with medical problems including high blood pressure, diabetes, etc.

- Understand the important waiting period clause during health insurance portability. Any and every kind of health insurance agreement contains the waiting period clause that falls into three categories. Fresh policies come with a waiting period of 30 days. For minor disorders like kidney stones or appendicitis, the waiting period does not exceed two years. However, policyholders afflicted with pre-existing disorders like cardiovascular disorders, cancer or Type 2 diabetes can seek a claim for treatment of the diseases only after completion of the waiting period equal to four years. A policyholder who applies for portability to a new insurer after continuing to pay for their insurance with the existing insurer for three years does not have to again go through the waiting period of 30 days and two years respectively. However, the four-year waiting period clause will continue to be applicable and the insured will have to wait for another one year before filing claims for pre-existing illnesses.

Benefits Of Health Insurance Portability

It is evident that if you are dissatisfied with the services of the current insurer, you will seek a change to another insurance company that offers you the kinds of benefits you are looking for. Dissatisfaction with your current health insurance plan may be due to myriad reasons. To ensure that policyholders feel secure under the cover they wish to avail, the IRDAI had introduced the concept of “Health Insurance Portability” similar on the lines of “Mobile Number Portability”. The policyholders have to submit the portability proposal form 45 days prior to the date of existing policy renewal. The insurer would assess the proposal details and the risk factor associated with the policyholder post which it will accept or reject the proposal within 15 days of receiving the application for portability.

Policyholders who have paid the premiums towards their existing policies without any break will continue to avail the benefits and credits earned during the earlier policy despite switching to another insurer as per the guidelines published by the IRDAI regarding health insurance portability.

Individual Health Insurance

Previously, we have learned there are different types of health insurance policies available in India. In this section, we particularly focus on discussing the features and benefits of the Individual Health Insurance Policy. So, let us begin.

Individual Health Insurance

Nothing in life matters more than good health. Simply said, good health is the basis of all our future endeavours and lays down the groundwork for all the major accomplishments we make. However, lifestyle habits, the pervasiveness of pollution, stress during work and ignorance regarding certain aspects of health planning have resulted in many people suffering from unforeseen health disorders. As medical costs increased owing to the impact of inflation and other factors, buying an adequate health insurance policy became important.

Key Features of Buying Individual Health Insurance:

Many people are now buying individual health insurance plans to ensure that they are able to avail the necessary treatment at their choice of hospital, if and when required. The essential features of any individual health insurance policy include:

- This kind of health insurance affords cover to a single individual only. This means that only the insured individual covered under the policy gets all the benefits of the sum assured and other added advantages pursuant to the policy in lieu of nominal premiums;

- The insurance company covers all the costs of hospitalisation and subsequent medical treatment subject to the condition that the medical bills do not exceed the sum assured;

- There is scope for lifetime renewability in most individual health insurance policies. This means that the policyholder can start early and continue to be covered under the same policy till the end depending on choice and requirements;

- Tax benefits as premiums paid towards individual health insurance plans are eligible for tax deduction under Section 80D of the Income Tax Act;

- Pre and post-hospitalisation costs are also covered under individual health insurance plans;

- Depending on the kind of insurance company one has opted for and the age at which one buys the plan, policyholders may have to agree to the co-payment clause. Agreeing to the co-payment clause proves beneficial as policyholders are guarded against agreeing to unnecessary treatment proposals, thereby, refraining from the tendency to raise exorbitant medical bills;

- Critical Illness Cover is also available.

Benefits of Buying Individual Health Insurance Policies:

Many people prefer to buy health insurance that ensures an umbrella cover over the entire family; there are others who prefer to buy a health policy only for themselves. This is because paying for an individual health insurance plan has its own set of benefits. These may include:

- The individual alone enjoys all the benefits that the plan has to offer;

- This kind of plan is best suited for customers running high risks of health disorders;

- Individuals whose family members are already insured can buy this plan;

- Greater protection than that offered under family floater health insurance;

- Dependents can be later added to the plan, if and when required;

- Cashless claim settlement can be availed while buying this plan;

- No age restriction during policy renewal.

Exclusions Under Individual Health Insurance:

Though individual health insurance policies are more preferred than the family health cover plans, there are some exceptions to the policy that one must not ignore. These include:

- Most individual health insurance policies cover pre-existing disorders subject to a waiting period ranging from two to four years. This can be a cause of discomfort for those not willing to wait so long before availing the benefits of the policy;

- Expenses on prescription glasses, lens and hearing aids cannot be covered under this policy;

- Policyholders cannot claim cover for expenses met on dental treatment or procedures;

- Naturopathy treatment is treated as an exclusion in most individual health insurance policies;

- Customers prone to diseases including cataract, hernia, sinusitis, etc. must beware as they cannot claim cover for the treatment of these disorders during the first year of the policy.

Next, let us discuss the Family Floater health insurance plan in a similar fashion.

Family Floater Insurance

The rising costs of hospitalisation, surgery and other treatment processes can cost a huge amount of money. The impact of treatment expenses is felt most by those people who are the only earning members in their family. This is where buying a family floater becomes imperative and proves to be beneficial in the long run.

Family floater insurance, also called the family health insurance plan, is a kind of health insurance that covers all the members of the family against any expenditure on treatment of unforeseen illnesses, disorders or emergency situations. It is the most reliable method to cover your family by paying nominal premium rates depending on the age of those insured.

Key Features of Buying Family Floater Insurance:

Why should you buy a family health insurance plan? Under what circumstances would a family floater prove beneficial? A keen look at the following features will help understand how family health insurance can keep you and your loved ones secure in today’s times. Some of the important features are:

- The entire family including spouse, children and dependent parents can be covered under the same health insurance policy. Some insurance companies will also allow you to cover your parents-in-law;

- Many insurance companies offer rebates on premium rates when customers opt for a higher sum assured;

- Customers can avail the benefit of No Claim Bonus (NCB). This means that if the customers do not claim for a particular year, they can avail the benefits of an increased sum assured in the subsequent year;

- Customers can avail the benefit of cashless claim settlement at a choice of their hospital;

- There are varying policy terms customers can opt from. Customers can opt for policy terms ranging from one to three years depending on their needs.

Benefits of Buying Family Floater Insurance Policies:

Everyone prefers to keep their loved ones protected. This explains the increasing preference of customers to buy family floater insurance policies. Let us walk through certain benefits of family health insurance policies before proceeding to pay for one. These include:

- First, it helps to save money. Instead of buying individual health insurance for each member of your family, you can always choose to buy a family health cover with a higher sum assured in lieu of nominal premiums. Buying a single family floater is indeed a cheaper option than paying for an individual health plan for each member;

- You can avail tax benefits on premiums towards family floater insurance plans. The premiums paid towards insurance are eligible for deduction under Section 80D of the Income Tax Act;

- Restoration benefit is available in many family floater plans. This means that the insurance company will restore you with the full coverage amount if your claim gets exhausted during any policy term;

- You can choose to add a new family member easily in the family floater plan.

Inclusions Under Family Floater Plans

- In-patient Hospitalization Cover

- Pre-hospitalization Expenditure

- Post-hospitalization Expenses

- Ambulance Charges

- Daily Cash Allowance

- Day Care Treatments

Exclusions Under Family Health Insurance plan

While the benefits are known, there are certain exclusions to family floater policies that one must be aware of. These include:

- Claims raised within 30 days of buying the policy unless the claim arises because of an accident

- Claims raised against treatment of sexually transmitted disease(s)

- Claims raised against treatment of fertility problems

- Expenses incurred during routine medical checkups

- Expenditure on gender reassignment surgery

- Expenditure on plastic surgery, aesthetic treatment or cosmetic surgery

- Claims raised against treatment of any psychological health problem(s)

- Claims against expenses on OPD treatment

- Expenses on treatment or surgery on foreign soil

- Expenditure on treatment stemming from addiction problems

- Claims against treatment of injury sustained during suicidal attempt

- Maternity expenses

Example Of Individual Health Insurance Vs Family Floater Health Cover

Let us understand the differences between Individual health insurance Vs the Family Floater with the help of an example:

Example of Individual Health Insurance Plan:

Udit Desai, aged 34, had bought an individual health plan for ₹2 lakhs. He suddenly meets with an accident and the hospital bills amount to ₹1,75,000. Since Udit is covered under the plan, he opts for the cashless settlement claim benefit. The insurance company, in this case, is liable to pay the hospital bill amounting to ₹1,75,000.

Example of Family Floater Health Cover:

Naman Singh, aged 34, had bought a family cover for ₹2,50,000. Apart from Naman, this plan covers his wife, children and aged parents. Naman has been hospitalized after an accident. The hospital expenses add to a total of ₹180,000. Unfortunately, Naman’s family had already made a claim on the policy during the same year to pay for a surgery amounting to ₹190,000. This means while paying for his medical treatment, Naman has to pay ₹120,000 from his own pocket as he could make a claim for only the remaining ₹60,000 from the family health cover that he had bought.

Critical Illness Insurance

Let us understand what is critical illness insurance cover with the help of an example:

Anil Sharma was suddenly diagnosed with a serious disease called muscular dystrophy. The doctors told him that his treatment would last many years, thus, resulting in heavy medical expenditure. Anil had bought a health insurance policy of ₹10 lakhs. However, the insurance company informed him that it would take care only of its hospitalisation expenses, and therefore, he himself would have to bear the cost of treatment. With such a heavy financial burden to bear, Anil was unable to seek the necessary treatment, thus, resulting in permanent disability.

Should Anil have bought a critical illness plan in addition to paying for a health insurance policy?

Critical disorders are different from common health problems. As opposed to the latter, the former have a damaging impact on health resulting in death or disability, thus, resulting in heavy expenses on the patient’s medical treatment. Elevating healthcare costs and the pervasiveness of critical illnesses prompted many insurance companies to sell critical illness health insurance plans that are different from health insurance policies.

Why Is Critical Illness Policy Important?

More people are now suffering from critical disorders than before owing to shifts in lifestyle habits, rising pollution levels, stress due to work pressure and many other reasons. Common examples of critical illnesses include heart attack, massive stroke, major organ transplantation, kidney failure, dialysis, paralysis, multiple sclerosis, bacterial meningitis, viral hepatitis, muscular dystrophy, etc. This explains why people must consider buying a critical illness insurance plan that secures them against heavy medical costs in the long run. Critical illness insurance is useful for people

- Who do not have enough savings to pay towards the treatment for severe health problems

- Who is not covered under any group health insurance scheme or does not receive any employee benefit packages to look after in the event of sudden illness.

Apart from the fact that critical illness policies defray the treatment costs of serious health problems, some of them also include benefits of free health checkups. Those buying health insurance policies can either opt for cashless benefits or choose to get the hospitalisation expenses reimbursed by submitting the hospital bills. Policyholders paying towards critical illness plans do not have to be necessarily hospitalised to seek the coverage benefits. It is enough that the patient has been diagnosed with a particular critical disorder listed in the plan to seek the critical illness benefits in a lump sum.

In addition, all these plans offer tax benefits as the premiums paid towards these policies are subject to deduction from under Section 80D of the Income Tax Act 1961.

Insurance companies may cover different kinds of critical illnesses in the critical illness insurance plans that they sell. Before buying a critical illness plan, it is important to go through the policy details carefully and read about all the illnesses that are covered under the policy. However, there are a few essential things to consider while buying a critical illness insurance cover. So, let us discuss those in the next section.

Important Considerations While Buying Critical Illness Insurance

Every critical illness plan has its own set of features and benefits, which means that not all plans would cater to your specific needs in future. Apart from reading the list of critical illnesses included in the policy, there are certain necessary factors that must be considered before paying for your choice of the plan. These include:

- The extent of the survival period;

- Waiting period clause;

- Number and kinds of illnesses covered;

- Inbuilt coverage benefits;

- Clause against pre-existing disorders;

- Amount of Sum Assured;

- Claim Settlement Ratio of the insurance companies.

Top Critical Illness Plans Sold By Insurance Companies

Not all insurance companies sell critical illness plans. Also, each critical illness insurance policy differs from the other in feature, benefits and premium prices. Some of the best critical illness plans include:

- Bharti AXA Smart Health Critical illness Policy;

- Care Health Insurance Critical illness Policy;

- Apollo Optima Vital Health Insurance Policy;

- Max Bupa CRITICARE Policy;

- HDFC ERGO Critical Illness Policy.

Critical Policy Exclusions

Though having a critical illness policy helps, there are certain disorders that no critical illness insurance plan covers. Also called policy exclusions, these are:

- Any critical illness detected within the first three months of buying the policy;

- If the patient dies within a month of being diagnosed with the critical illness;

- Any disorder stemming from addiction problems including dependence on cigarettes, alcohol or drugs;

- Any disease resulting from congenital problems;

- Problems stemming from complications during childbirth or cesarean infections;

- Sexually transmitted diseases including HIV or AIDS;

- War or terrorist activities;

- Cosmetic surgery;

- Treatment of infertility problems;

- Gender reassignment surgery;

- Treatment carried out in any foreign country.

Maternity Insurance

In this section, we will try to understand the concept of 'Maternity Insurance' which most Indians are unaware of. Not because it is a novel concept, but because people in the country deem insurance as a cover that secures against death, disability and disease. Maternity insurance is just like any other insurance product and covers the expenses on childbirth up to a certain limit. Customers interested in buying it can either pay for it as a standalone policy or choose the same as an add-on cover to the existing health insurance plan by agreeing to pay an added premium amount.

To understand how Maternity Insurance works, let us look at the following example:

Vivek Singhal and his wife Ishita had been married for the past two years. They are now planning for a family and are looking at possible expenses that would have to be met during delivery and childbirth.

Vivek’s father Subodh recently shared the good news of becoming a father and how his wife had to undergo a cesarean to deliver the baby. The total hospital expenses had amounted to ₹1,60,000. Vivek was concerned about the high maternity costs and subsequent medical care. It is then that Subodh informed Vivek about maternity insurance plans and how they serve to downplay the impact of inflation on medical costs. Subodh informed about how he and his wife had made plans for the child’s delivery by choosing a maternity plan beforehand that also includes health insurance benefits for infants too.

Vivek and his wife, however, continued to be unsure about the concept of maternity insurance and decided to look for details on the web.

How Maternity Insurance Works?

Medical expenses are increasing each year. This includes consultation fees, hospitalisation expenses, costs of medicines and expenses on various surgeries. Complicated surgeries cost more than others. This holds true for hospitalisation expenses during childbirth, especially, if there are complications involved during child deliveries. Most hospitals charge between ₹50,000 to ₹2,00,000 depending on the facilities and the nature of treatment during the childbirth process. Buying a maternity insurance plan in advance helps pay for the childbirth expenses in addition to the amount expended on the baby’s healthcare subject to the condition that hospital charges do not exceed the sum assured amount. This helps alleviate the financial burden that many families face while making payments towards the hospital bills.

When Should You Opt For Maternity Insurance?

No insurance company will grant you maternity cover once you are pregnant. Ideally, the best time to seek maternity cover is before you conceive. While buying any maternity insurance policy, it is important that you read the policy details carefully, especially those that relate to the waiting period before pregnancy. Many insurance companies mandate a waiting period of three to four years before the insured can claim the benefits of the policy.

It is rightly said that the principle underlying the maternity insurance concept is proper family planning as opposed to sudden and unexpected pregnancies.

What Does Maternity Insurance Cover?

Most maternity plans sold by insurance companies in India cover:

- One month’s pre-hospitalisation expenses and two months’ post-hospitalisation costs

- Delivery expenses irrespective of normal childbirth or delivery through C-section

- Expenses on hospitalisation including doctors’ fees, nursing expenses, room rent, surgery costs and anaesthetist’s fees

- Charges of daycare treatment

- Vaccination charges of the newborn infant

- Ambulance charges for carrying the mother to the hospital for delivery

- Cashless facility in network hospitals

Maternity Insurance Does Not Cover

Though maternity plans cover pre-hospitalisation expenses, it does not pay for treatment of disorders existing prior to the pregnancy of the insured. Treatment of infants born with congenital defects is not covered under any maternity plan. Any expenses made on medicines or procedures outside the purview of treatment will not be considered a valid claim. Routine visits to the doctor for checkups and consultation fees after two months of the child’s delivery will not be considered as a part of the maternity insurance claim.

Which Maternity Plans Can You Choose From?

If you are looking to buy maternity insurance, you may choose from the following plans.

- Care- JOY, formerly known as Religare Health Insurance Maternity Plan – JOY

- Star Wedding Gift Insurance

- i Health plan

- Easy Health Plan

- Heartbeat Plan

Senior Citizen Insurance

The next type of health insurance plan targeted towards old-age people is the 'Senior Citizen Health Insurance Plan.'

Insurance is bought to secure against the risk of death, disability and disease. While old age is synonymous with memories and life long experiences, increasing vulnerability to diseases cannot be ruled out. This explains the need for having a senior citizen health insurance policy that ensures financial security to all those aged 60 years and above.

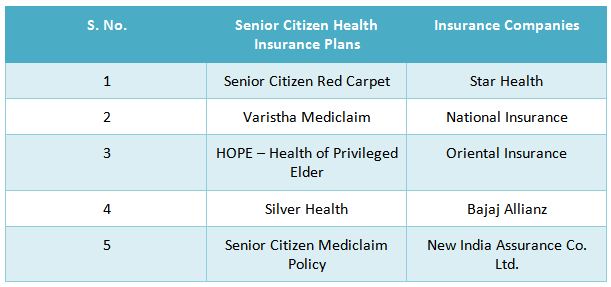

Following are the names of the senior citizen health insurance plans corresponding to the insurance companies that sell them.

Some may argue about how ensuring enough savings can defer the need for buying a Senior Citizen Health Insurance Plan. However, the essential features and benefits of these plans help to understand why buying them can be beneficial in the long run. Some of them include:

- The benefit of a greater amount of sum insured

- Premiums paid towards these plans are eligible for tax deduction under Section 80D of the Income Tax Act 1961

- Daycare costs on the use of special equipment during treatment of critical illnesses like kidney disorders or cancer are covered

- Expenses on yearly health check ups covered

- Cashless treatment facility in hospital network

- Policy renewability option available

- Ambulance expenses to carry the insured also covered under the policy

- Treatment of pre-existing disorders subject to the terms and conditions of the policy are also covered

- Claim settlement is quick and seamless, unlike most other plans

Senior Citizen Health Insurance Policy Exclusions

- Policyholders cannot seek a claim for diseases diagnosed within a month of buying the policy

- Any kind of treatment that is non-allopathic in nature

- Injuries sustained during a suicidal attempt

- Pre-existing disorders before buying the policy. However, these exclusions are subject to the terms and conditions of the policy bought

- Claims on the treatment of addiction problems

- Treatment of sexually transmitted diseases

- Treatment of old-age problems like joint replacement can be availed after two years of buying the policy

- Amount spent on dental treatment

- Cosmetic surgery procedures

- Treatment of injuries sustained during war or terrorist attacks

Since these plans are best suited for retired individuals or aged customers, they can be bought by either the senior citizens themselves or young people for their aged parents.

Note that lifestyle habits are major determinants of premium rates, which means that policyholders who do not smoke cigarettes or drink alcohol would be charged lower than those who drink or smoke. Later in this module, we will discuss the major factors that determine the premium rates. Also, there are many important aspects that a health insurance policy may include or exclude from the cover, which we will discuss next.

Important Aspects Of Health Insurance

Policy Inclusions

Not all insurance policies promise you everything. Knowing which policy allows you certain benefits is equally important as understanding the exclusions of each policy. For example, policyholders can seek claims on 30 days pre-hospitalisation and 60 days post-hospitalisation while treatment of sexually transmitted diseases does not fall under the purview of any health insurance plan.

Other policy inclusions are prolonged coverage for as long as two years from the date of policy inception, wide coverage, claims on expenses towards in-hospitalisation treatment, the amount spent on daycare procedures, costs of domiciliary treatment, restoration benefits and a separate cover for critical illnesses in lieu of added premium payments on health add-on covers.

Policy Exclusions

Despite the growing importance of health insurance in today’s times, customers prefer to compare only the premium rates and their coverage amount promised by each insurance company. While it is an understood fact that one buys health insurance to pay for medical costs in the long run and, thus, ease possible financial burden stemming from elevated healthcare costs, there are certain claims that no insurance company would entertain. Such claims made on various treatments for various reasons are excluded from the purview of most health insurance plans, though the same is subject to the terms and conditions of each insurance company.

Common policy exclusions are:

- Waiting period exclusions: Waiting period is particular to each insurance company. However, one exclusion concerning the waiting period common to every insurer is that no company pays towards claims made on treatment expenses carried out within the first 30 days of policy inception.

- Pre-existing disorder treatment: The waiting period for pre-existing disorders ranges from 30 days to four years. However, there are certain diseases included in the list of pre-existing disorders of each insurer. The claims raised on the treatment of these are covered only after three years of paying the first policy premium.

- Sexually transmitted diseases treatment: Any expenses incurred on the treatment of diseases like HIV or AIDS cannot be claimed under any health policy scheme sold by any insurance company.

- Injuries sustained during war or terrorism: Injuries or disorders resulting from any kind of war or terrorist activities will not be covered under any health plan, thus, implying that policyholders are required to pay for such treatments themselves.

- Treatment of addiction problems: Treatment of drug-induced diseases or any illnesses caused by dependence on cigarettes, alcohol or any kind of narcotic substance are not covered under any health insurance policy. This is an exclusion common to all health insurance plans sold in India.

- Dental care treatment expenses: The treatment of dental care is not covered under any health plan.

- Cosmetic surgeries: Health plans are bought to tackle sudden emergencies and not for defraying costs on surgeries carried out to enhance beauty. While there are many health plans that cover expenses on plastic surgeries, none of them covers the costs of cosmetic surgeries.

- Investigative treatment: Some people tend to participate in medical surveys or give themselves up for medical experiments carried out by various research centers and pharmaceutical companies. Sudden investigative procedures may result in the policyholders afflicted with disorders of the body or mind. Treatment of such diseases is not covered under any health insurance plan sold by any insurer in the country.

Cashless Hospitalisation

Buying a health insurance policy can be a tedious task. Whether buying online or offline through agents, you will come across numerous terminologies that are important to understand while making a choice to buy a health insurance cover. From this unit onward, we are going to discuss some common terms and try to better understand the concept with the help of examples. So, first, let us start with:

Cashless Hospitalization

Prateek Agarwal’s son needed emergency treatment and had to be hospitalised suddenly. Since Prateek did not have enough cash with him, he went to the nearest ATM to withdraw cash. The expenses on his son’s hospitalisation and subsequent treatment were more than he had expected. Left with no other option, Prateek went to his friend seeking financial help.

If Prateek had bought a health insurance plan that included a cashless benefit plan, he would have been in a better position to face this medical emergency. However, unaware of cashless medi claim policies, many people like Prateek fall in a debt trap while paying for necessary medical expenses.

Cashless hospitalisation is just one of the benefits that health insurance policyholders enjoy. This feature helps policyholders to seek necessary medical attention and emergency treatment at their choice of hospital. The insurance companies issue a health insurance card to their customers that they have to show to the insurance desk at the hospital during admission. The insurance company then settles the claim made by the hospital subject to the condition that the amount raised does not exceed the insurance coverage amount.

In India, there are two types of cashless health insurance claims available that policyholders may choose from. These include:

- Cashless Family Health Insurance

- Cashless Health Insurance for Senior Citizens

Policyholders can avail the benefits of cashless hospitalisation unbiased of whether they are opting for planned treatment or have to be hospitalised to meet medical emergencies.

Cashless Hospitalisation Exclusions

While cashless medi claim plans help to defray the rising medical costs of hospitalisation and subsequent treatment, not all kinds of expenses are covered under this kind of treatment. Cashless medi claim plan benefits exclude expenses like:

- Expenditure on attendants hired

- Ambulance charges

- Charges on toiletries used

- Additional service charges

- Additional expenditure on the oxygen mask, diapers, nebulizers, etc.

- Documentation charges

Your Medi claim Policy May Be Rejected. Know Why ...

However, some policyholders find the claims made on their medi claim policies getting rejected for certain reasons. These include:

- Claim on expenses made on hospitalisation and treatment of an illness not covered under the policy;

- Claim exceeding the amount of sum assured;

- Incorrect details regarding pre-existing disorders or incomplete personal details filled in the policy form;

- Delay in intimating about the hospitalisation to the TPA.

Day Care Treatment

Now, let us understand 'Day Care Treatment' with the help of an example:

Vineet Chandihok’s mother was advised of a cataract operation by the ophthalmologist. However, the doctor also suggested that the treatment would be minor and, hence, Vineet’s mother would be discharged a few hours after the surgery. Though Vineet did have a health insurance plan in place, he was not sure if the plan covered expenses on daycare procedures.

Vineet decided to talk to the insurance company and seek necessary advice. He was advised that his plan includes scope for claim settlement of the treatment costs as the surgery falls under the category of daycare procedures. Vineet, though initially unaware of the concept of daycare procedures and its inclusions in most health insurance plans, feels greatly relieved.

The pervasiveness of various disorders and increasing medical costs have changed the structure and scope of health insurance policies in India. Today, a majority of the health insurance plans in India pay for daycare procedures as an additional benefit other than promising the usual cashless mediclaim and reimbursement of claims on treatment expenses.

Understanding Daycare Treatments

Simply said, Daycare treatments are those treatment procedures carried out under the supervision of a local or general anaesthetist in a hospital or day care treatment center. These treatments do not last more than 24 hours and are included under the scope of many health plans sold in India. Some of the health insurance policies that pay for daycare procedures too are:

- Apollo Munich’s Easy Health

- Star Health’s Family Health Optima

- Max Bupa’s Heartbeat Plan

- New India’s Family Floater Mediclaim Policy

- National Parivar Mediclaim Plus

How to file Daycare claims in health insurance?

The daycare coverage is an in-built feature in many health insurance plans, thus, implying that the process of filing daycare claims is the same as that of seeking claims on treatment expenses under a regular health cover. Since most daycare procedures are treatments planned in advance, policyholders can avail the benefit of cashless claims provided that the insurer is intimated in advance about the same.

However, some insurers ask their customers to submit the documents necessary for making the claims and reimburse the treatment expenses accordingly.

Pre & Post Hospitalisation

We all talk about health insurance plans and how they help to tackle rising medical expenses. However, few realise how the various health policies cover pre and post-hospitalisation expenses too.

Before getting admitted to your choice of hospital for treatment, there are certain medical costs incurred by the policyholder. These are classified as pre-hospitalisation expenses. These may include the amount spent on various tests that are needed to diagnose the kind of disorder the incurred is suffering from before prescribing the correct nature of treatment. Such tests may include urine tests, blood tests, MRI scans, CT scans and X-rays to diagnose the exact medical condition of the insured.

Post discharge from the hospital, the incurred expenses have to bear certain necessary medical costs. These are categorised as post-hospitalisation expenses. These expenses may include the amount spent on tests prescribed by the doctor or healthcare provider to ascertain the health status and recovery progress of the insured. These may include the costs of medicines, consultation fees and charges on diagnostic tests. However, insurance companies do not cover therapies like naturopathy, acupuncture, homeopathy, etc.

Most insurance companies pay for the pre and post-hospitalisation expenses subject to certain conditions. The number of days of pre and post-hospitalisation cover differs from one health insurance company to the other. However, most insurance companies cover 30 days of pre-hospitalisation and 60 days of post-hospitalisation expenses.

Important Considerations:

- Policyholders can seek a claim for pre and post-hospitalisation claims provided that the claim for expenses towards hospitalisation is accepted by the insurance company;

- Expenses on pre-hospitalisation must be for the same condition for the patient had been hospitalised and availed necessary treatment;

- Costs of pre and post-hospitalisation will be allowed only for the number of days mentioned in the policy. Any expenses incurred before or beyond the time limit will not be considered by the insurance company.