Initial Public Offerings (IPO)

Introduction

Initial Public Offering (IPO) is a crucial method for companies to raise equity capital directly from the public. Economic growth requires capital investment. Banks are the primary source of capital for firms. However, with the modernization of the Indian economy and capital constraints faced by the banks, the significance of the alternate source of raising capital through debt and equity has gained predominance. Fund raising through public issues remains a principal route for financing business growth, without which the development of the Company is hindered. The majority of the companies that have gone public have shown remarkable growth in performance & profitability. This module focuses on equity capital raised through Initial Public Offerings.

Primary Market:

The primary market is involved in the issue of fresh securities such as stocks and bonds for sale to the public. The primary market serves as a medium for corporations to borrow money from investors with surplus cash.

When a company decides to go public, it decides to go for an Initial Public Offering or IPO through the primary market route. A company may need to raise capital for various uses including expansion of business, foraying into newer markets, to meet their working capital needs, paying off debts, investing in a project, etc.

Issues through the primary market can be allotted either privately or publicly.

The Companies Act, 2013 defines private placement as a term wherein issue of security results in allotment to less than two hundred people. Likewise, an issue becomes public if the securities are allotted to more than two hundred people.

For Example: Company A Limited requires funds. It issues shares in the primary market. When the company issues shares for the first time, it is called Initial Public Offering (IPO). A further issue of shares is known as Follow-on Public Offer (FPO). Both IPO & FPO issuances fall under the ambit of Primary Markets.

Secondary Market:

Secondary Market refers to the market where securities are traded after being initially offered to the public in the primary market and/or listed on the Stock Exchange.

The Secondary Market is further classified as follows:

- Spot market or Cash Market: The delivery and payment of securities are done on a cash & carry basis i.e., immediately. Nonetheless, the actual settlement cycle followed is T+2.

- Futures Market or Derivatives Market: Securities are bought and sold for some predetermined future date.

What is an IPO?

When a company wants to raise the capital, it can do so by selling its shares to the public. Initial Public Offering (IPO) is the process by which companies can go public by issuing new shares for the first time or existing shareholders sell part of their shareholding for the first time to the public.

The Company offering its shares is called the Issuer.

Once an IPO is offered to the public, it is subsequently subscribed by the investors. The company will receive money from the investors in exchange for shares issued. The company can use these funds to finance project expansion, pay off debts, working capital needs, acquisitions, etc. Investors, in return, expect a share of the company's future profits through dividends and capital growth through stock price appreciation.

Post the issue of shares, the shares of the company subsequently get listed on the stock exchange (secondary market) and are freely traded.

Though we have understood- what is an IPO? But No wonder why do even companies go public? Let us understand that in the next unit.

Why Do Companies Go Public?

Companies raising money through Initial Public Offering are reckoned as going public (since earlier, the company was privately owned by a group of individuals and now the shareholding pattern will change). Smaller and newly incorporated companies largely go for Initial Public Offerings to raise funds for expansion. On the other hand, large privately owned companies intend to become publicly traded through IPO. Going public is a strategic decision which provides a long term solution to capital raising and business development. Further, capital raised through Initial Public Offering neither involves any interest charge nor has to be repaid (last in seniority of claims when the company liquidates).

Advantages of going public:

- Money raised through IPOs can be utilized by the company either for growth, expansion, acquisition, diversification, pay off debts or even to meet its working capital requirements.

- Increasing liquidity for equity holders

- International credibility and visibility

- Increase in market share

- Enabling cheaper access to capital

- Strengthening or Diversifying equity base

- Employee Motivation and retention through stock options

So, we have learned the several advantages for companies making a public issue. But do you know there are even different types of public issues? Let us discuss them in the next section.

Types of Public Issue

When a company raises funds by selling or issuing its equity shares to the public through an offer document it is called a public issue. Public Issues can further be classified into Initial public offer (IPO) and Further / Follow on public offer (FPO).

Join our dynamic share market course online & Take the first step towards financial success today!

Types of Public Issue

Initial Public Offerings (IPO):

Initial Public Offering is a type of issue where an unlisted company raises capital by making a fresh issue of securities or offering its existing securities for sale to the public for the first time.

Further Public Offer (FPO) / Follow-on Public Offer (FPO):

When a listed company wants additional capital, it makes either a fresh issue of securities or an offer for sale of existing securities to the public it is called a Follow-on Public Offer (FPO). For instance, Yes Bank launched FPO (July 15th - July 17th 2020) to recover from huge bad debt and generate funds from the share sale to enhance the capital base. It was subscribed 0.93 times.

Offer for Sale (OFS):

Institutional investors like venture funds, private equity funds etc. invest in a company at its nascent stage. Once the company grows bigger these investors sell their shares to the public through the issue of offer document and subsequently shares get listed on the stock exchange. Offer for sale (OFS) is also a special mechanism through which the promoters can sell their stake in the market. Only promoters or shareholders holding more than 10% of the share capital in a company can come up with such an issue. Both retail and institutional investors can invest in an OFS and buy shares of the Company. The Government of India sold its 15% stake in Hindustan Aeronautics (HAL) in August 2020. The ₹5,000 crore offer for sale (OFS) was fully subscribed. The OFS received an application for 5.21 crore shares as against the issue size of 5.01 crore shares.

Now, in the next section, let us discuss some primary reasons or benefits behind companies' floating IPOs.

Why an IPO? What are Its Benefits?

Companies come up with initial public offerings for various Funding and Non-Funding Purposes. The primary reason for a company going public via IPO is raising capital quickly from a large number of investors. The company utilizes the funds raised through IPO for business expansion, research & development, or to meet its working capital requirement. Listed companies always have an added advantage of being prestigious, and can also attract new talents by offering stock options.

Primary reasons for an Initial Public Offering by a Company

How does an IPO work?

There are several steps a company goes through for its Initial Public Offering. They are:

- Initial Public Offering is regulated by the Securities and Exchange Board of India (SEBI). In order to file for an IPO, companies must first register with SEBI. Then SEBI scrutinizes the documents submitted by the company.

- After completing all the formalities, companies fixed the number of shares to be offered along with the price or price bands at which they will offer to the public.

- Investors then subscribe to the shares of the company. Generally, Initial Public Offerings are oversubscribed, which means companies receive more applications than they have offered.

- In case of oversubscription, the company offers partial allotment to its investors.

- After the shares are issued to the investors in the primary market, it gets listed in the market or stock exchange for trading.

We will elaborate on all the steps in the next unit. We will also discuss the process of filing an IPO in India.

Note: IPOs are generally underpriced with a view to maximize investor interest. This encourages investors to subscribe to the issue for listing gains or a long-term portfolio bet.

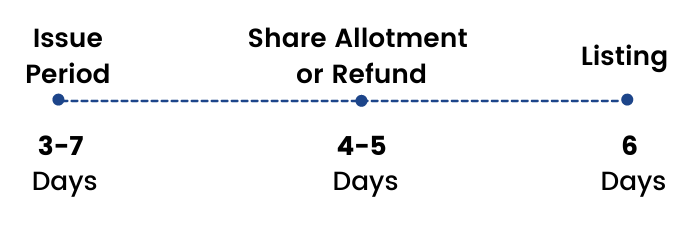

What is IPO procedure in India?

IPO Issue Process

Step1: Appoint an Investment Bank

The company seeks advice from a team of underwriters or investment banks to initialize the process of IPO. The team works on the company’s current financial situation, future projects, and plans to cater financial needs. The underwriters sign the agreement with the company and assure the capital they will raise. Some of the leading IPO underwriters are Goldman Sachs, Morgan Stanley, Merrill Lynch, JM Financials, Kotak Securities, amongst others. They are also known as Book Running Lead Managers.

Step 2: Registration with SEBI

The company and the underwriters together prepare an offer document which contains all necessary information for investors to make an informed decision. The offer document is then submitted to SEBI for approval. Further, it should fulfill all mandatory requirements and comply with all rules and regulations. SEBI scrutinizes the document and cross-checks all the information provided.

Step 3: Draft the Red Herring Prospectus

An initial prospectus detailing financial records, future plans of the company and the specification of the expected share price range is prepared with assistance from underwriters. This is called Red Herring Prospectus (RHP) as it contains a warning signal that IPO is pending SEBI Approval. This is then shared with prospective investors who would be interested in buying the stock.

Step 4: Move on Road Show

Before the Initial Public Offering goes public, the executives of the company go on countrywide roadshows visiting the major trade hubs to largely attract corporate and Qualified Institutional Buyers (QIBs). The marketing agenda includes the presentation of facts and figures of the company, its future plans and growth potential.

Step 5: SEBI Approval to Go-ahead

Once SEBI is satisfied with the registration statement, it gives the approval to go-ahead for the IPO and to fix the date for the same. Sometimes SEBI may ask for amendments in the prospectus before it is made available to the public. The company is then required to select a stock exchange for listing its shares.

Step 6: Decide on Pricing of IPO and Number of Shares

After getting approval from SEBI, the company with the help of the underwriter decides on the fixed price or price band of the shares as well as the number of shares to be offered.

There are Two Types of Issues:

Fixed Price: The Issuer decides the issue price and mentions it in the offer document.

Book Building: When the price is determined based on the maximum bid received at a particular price in the given price range it is called price discovery through the book-building process.

Step 7: Publicly Available for Purchase

On the planned date, the prospectus and application forms are made available both online and offline. Investors can also obtain forms from the designated banks or brokerage firms. The application forms are filled and to be submitted by investors along with a cheque or can apply online as well. IPOs are generally open to the public for three working days during which investors can subscribe to the issue, with maximum bids received on the last working day.

Note: There are several categories of investors in an Initial Public Offering, which we will discuss in the next section.

Step 8: Share Allotment and Listing on the Stock Exchange

Once the IPO is closed and all subscriptions are received, the final price at which the allotment is to be made is determined. However, in the case of oversubscription, Investors will get refunds directly in the investor’s bank account. After allotment of shares, the company gets listed on the stock exchange and is open for secondary market trading of its shares.We will discuss more on the topic of how the shares are allotted to investors in our upcoming units.

What Are The Categories of Investors in an IPO?

There are four different types of investors in an Initial Public Offering. They are:

Retail Individual Investors (RII): This category of investors cannot apply for a bid more than ₹ 200,000. NRIs who apply less than ₹200,000 are considered as RII category.

High Net worth individuals (HNI)/ Non institutional investors (NIIs): If retail investors apply for more than ₹ 200,000 are considered as High Net worth individuals (HNIs). NIIs are individual investors like NRI’s companies, trusts, etc. who bid for more than ₹ 200,000. They are not required to register with SEBI like RIIs.

Qualified Institutional Bidders (QIBs): QIBs are those institutional investors who have expertise and the financial strengths to analyze and invest in the capital markets. They are mostly financial institutions like Banks, FIIs, Mutual Funds who are registered with SEBI.

Anchor Investors: Anchor investor introduced by SEBI in 2009, refers to a QIB making an application for a value of ₹10 crores or more through the book building process. They invest in an IPO before it opens to the public and thereby attract investors and gain public confidence before the IPO goes public.

In a book-built issue, allocation of securities to Retail Individual Investors (RIIs), Non-Institutional Investors (NIIs), and Qualified Institutional Buyers (QIBs) are in the ratio of 35: 15: 50 respectively.

In case of fixed price issues a minimum of 50% of securities are required to be allocated to Retail Individual Investors (RIIs) and balance to other investors including corporate bodies/ institutions irrespective of the number of securities applied for.

QIB's are prohibited by SEBI guidelines to withdraw their bids after the close of the Initial Public Offerings. Retail and non-institutional bidders are permitted to withdraw their bids until the day of allotment.

Who are the Participants in an IPO?

There are three broad categories of participants in an IPO. They are:

Issuers

- Unlisted companies. Ex- Bundl Technologies Pvt. Ltd.(Swiggy), ANI Technologies Pvt. Ltd.(OLA) etc.

- Listed companies. Ex- TATA steel, ITC etc.

Intermediaries and participants

- Merchant Banks. Ex- Goldman Sachs, Morgan Stanley etc.

- Syndicate members. Ex- Kotak Securities, Axis Capital etc.

- Underwriters. Ex- UTI, SBI Capital market etc.

- Depositaries. Ex- CDSL & NSDL

- Stock exchanges. NSE, BSE, MCX etc.

Investors

- Retail Investors

- Non institutional investors

- Qualified Institutional Bidders

- Anchor investors

Is IPO Grading Mandatory? How Does It Help Investors?

SEBI has made it mandatory for all IPOs to obtain grading from at least one credit rating agency registered with SEBI. The grade indicates the assessment of the company’s fundamentals, future growth potential, and market comparisons with other listed equities at the time of issuance. This is an additional tool for investors to facilitate their analysis for an investment decision. IPO grading is generally assigned on a five-point scale with higher grades indicating strong fundamentals and vice versa.

What is the Cut-Off System in the Bidding Process?

In the last unit, we learned when and how shares are allotted to investors. But prior to that, investors are required to bid for a particular number of shares as per their eligibility. In India, there is a cut-off system in the bidding process of an IPO.

Retail investors are allowed to invest in Initial Public Offerings using the cut-off system that indicates their willingness to subscribe to the shares at any price discovered within the price band. Supposedly, the price band for an IPO has been fixed at ₹350-₹360 and Mr. X places bids for a certain quantity of shares at a price of ₹354. Mr. X will not be eligible to receive the shares if the final price of allotment works out to be greater than ₹354 However, if Mr. X would have subscribed the issue at the final cut-off price, the shares would have been credited to his account at the final allotment price. Generally, the allotment price works out to be the upper end of the price band i.e., ₹360 in this case.

How does One Increase Chances for an Allotment?

In case of oversubscription of issue, retail investors are eligible to receive a maximum of one lot per issue. If applications are made using multiple demat accounts under the ownership of a single person, the application shall be forfeited.

Retail Investors can apply for shares under the HNI quota that requires bids for a minimum of ₹2 lakh or higher. However, the chances of allotment are even smaller as the HNI portion is likely to be more oversubscribed than the retail quota.

The best available alternative hence is to apply from demat accounts of other family members to increase chances of allotment.

What are the Different Ways of Filing an IPO Application?

Now that we have learned the cut-off system in the bidding process from our previous unit let us discuss the different ways to apply for an Initial Public Offering.

Investors can apply for an IPO through online mode/offline mode. The SEBI has made it mandatory to issue shares only in the dematerialized form, hence a demat account is an essential pre-requisite so that the shares allotted can be credited to the Investor’s account.

Online Mode:

The most suitable and convenient way to apply in an Initial Public Offering online is using a 3-in-1 account (bank account, demat account & trading account) offered by banks.

- Open a demat account/trading account with a financial institution that provides online facilities to apply for IPO.

- Login into your trading account and select the IPO you wish to invest in.

- Transfer funds from your bank account to your trading account.

- Select the number of shares you want to apply for and the price at which you want to bid for (or use cut off option) and then press the submit button.

- If the applicant gets allotment, shares will be credited to demat account and the blocked money shall be debited from the account.

- In case of non-allotment, the amount is unblocked immediately and is ready to use freely.

What if your bank does not offer ASBA Online?

Step 1: Go to ASBA E-Forms on NSE

Step 2: Select the IPO you want to apply.

Step 3: Click on Bid-cum Application Form Download.

Step 4: Fill up the online form with all requisite information such as the name of the applicant, PAN number, demat account number, bid quantity, bid price, and other relevant details.

Step 5: Download the form.

Step 6: Submit the form to the designated branch along with a photocopy of your PAN Card.

How can one apply for IPOs offline?

This is the traditional way of applying in IPO by filling a physical application:

- Collect ASBA form, available at the designated branches of the banks approved for providing the facility known as self-certified syndicate bank (SCSB).

- Fill in the form details such as name of the applicant, permanent account number (PAN), Demat account number, bid quantity, bid price, and other relevant details.

- Submit the form to their designated banking branch with an instruction to block the amount in their account. In turn, the bank uploads the details of the application in the bidding platform.

- Investors must ensure that the details that are filled in the ASBA form are correct; otherwise, the form is liable to be rejected.

- A photocopy of the PAN Card must be attached for applications greater than ₹50,000

Analysing IPO – Investment Research

Till now, we have covered the topics related to applying for an IPO, but it is important to analyze before applying for the IPO. But how? The answer is going through the Red Herring Prospectus (RHP). So let us begin:

What Should Investors Look for in the Red Herring Prospectus?

Red Herring Prospectus or RHP is a preliminary document submitted to the SEBI containing all relevant information and disclosures about the company wishing to go public through sale/issue of equity shares.

For the screening & evaluation of an IPO, Investors should carefully read the prospectus and go through all the details disclosed by the Company. However, the problem is that RHP is an unusually long document and few people take the pain of going through it exhaustively. Nonetheless, investors must pay close attention to a few headers under the RHP before committing their capital:

IPO Terminologies:

Issue Name

It is the name of the company going for IPO.

Issue Type

There are two major types of issue i.e, Fixed Price & Book Building.

Issue Size

This is the total number of shares to be issued to the public.

Face Value

The face value is the nominal value of the stock and issue price is decided as premium over the face value of a share.

Price Band

In case of book building maximum and minimum ( Cap & Floor) price within which the bid process takes place.

Category

There are four main categories of investors namely, Retail Investors (RIIs), High Net worth individuals (HNIs)/ Non institutional investors (NIIs), Qualified institutional bidders and Anchor investors.

Start Date/End Date

Opening and closing date of the issue generally 3-7 days in case of book building.

Minimum/Maximum Investment value

Application value more than ₹ 200,000 are considered as HNIs and anything below ₹ 200,000 is considered Retail institutional investors (RIIs).

Minimum Order Quantity

This is the minimum number of shares investors can apply while bidding in an IPO. If investors want to bid for more shares, they can apply in multiple lots.

Lot Size

It is the quantity multiple for issue. For example if the lot size 50 and the investors want to apply for 300 shares, he can apply for 6 lots (50x6=300 shares).

Tick Size

It is the price multiple within the specified price band. For example, if the price band is ₹ 200-250, and tick size is ₹ 10, then the acceptable price value is ₹(200,210,220,230,240,250).

Lead Managers/ Book Running Lead Managers (BRLM)

They are involved with the company in the complete process of IPO. They have to get the pricing of the IPO right, along with compliance and ensure success of the issue. Few renowned BRLMs are Goldman Sachs, Morgan Stanley, Merrill Lynch, etc.

Listing Exchange

Listing of shares can be done on Bombay stock exchange (BSE), National stock exchange (NSE) or both.

Credit Rating

Higher credit ratings indicate the company's strong fundamentals.

Registrar to the Issue

They are mainly involved in processing IPO applications, allocate shares to applicants based on SEBI guidelines, process refunds through ECS or cheque and transfer allocated shares to investor’s Demat account.

Pre-IPO Placement

Pre-IPO placements are an excellent barometer of investor demand for the issue. Often, these are used as marketing tools by the company to publicize their Initial Public Offerings by citing marquee investor interest. For instance, ahead of its public issue, Avenue Supermarts or D-Mart raised ₹561 crore by issuing 1.87 crore equity shares at the higher end of the price band to 35 anchor investors, including General Atlantic Singapore, Fidelity, Franklin Templeton, Goldman Sachs, JP Morgan, HSBC, Motilal Oswal, and UTI, among others in December 2019. Rossari Biotech, which launched its IPO from 13th July to 15th July 2020, raised ₹100 crore in pre-IPO placement in March 2020 by placing equity shares with Malabar India Fund, White Oak, Kotak Infina, Axis AMC, Mirae Asset, Sundaram Mutual Fund, IIFL and ICICI Lombard General Insurance.

The Objective of the Issue

It is of vital importance for an investor to know the purpose of an IPO i.e., how does the management plan to utilize the IPO proceeds. Investors should check the RHP detailing whether the funds will be utilized for funding future expansion, debt repayment, or to meet the company’s working capital requirement. Investors should be cautious if the promoters or private equity firms want to exit the company by offloading their shares.

Company Background & Business Profile

Company background and business profile shall provide investors with the framework of the industry the company operates in. Investors must cross-check management claims from other sources in their personal capacity. Also, the following points must be made note of:

- What are the future prospects or the demand of the product or service offered by the company? What are the plans for expansion? Is the company going to enter into new markets? How does the company intend to raise funds in the future?

- What type of industry does the company operate in? Is the majority organized or unorganized? Is it cyclical in nature? What is the company’s market share and competitive advantage for the business's products or services? Is there an instance of client or geographic concentration?

- Are the operating margins of the company stable? What is the company’s plan of action in case of a sustained rise in the prices of raw materials? Is it able to pass on the higher cost to its customers in the form of price hikes or does it take a hit on its margins?

- Compare the business metrics with listed peers locally as well as globally. Analyze the reason behind considerable deviations from the average.

Promoters & Management

Management pedigree is the single-most paramount factor affecting investment decisions. The promoter’s experience, the management team, their expertise, backgrounds are few factors to be considered before investing in an IPO.

- What kind of goals has the management set out for the company?

- Do they have a successful history in business ventures?

- Do they have business expertise and qualifications to run the company?

- Does management itself own any shares in the business?

- Are the promoters cashing out in the IPO? If yes, analyze the reason.

- Do the people involved have previous experience running a publicly-traded company?

The IPO should be avoided in case the investor notices significant red flags.

Concerns / Risk Factors

The section on risk factors in the initial page gives information if there are legal cases pending against the company. It is advisable to wait for clarity on this front if the dispute has a consequential bearing on the fortune of the company before investing your money. A lot of pending cases might be an indication of poor corporate governance practices in the organization.

Financial Statements

The Balance Sheet must be carefully analyzed to gauge the financial position of the company. A high gearing ratio can be a sign of stress in the company. Investors must analyze the historical financials of the company before forming investment decisions. The key financial parameters to analyze before investing in an Initial Public Offering are:

- The trend in Revenue and Profit – Positive/Upward sloping

- Operating and Net Profit Margins – Higher the better

- Earnings Per Share – Higher the better

- Return on Net worth and Capital Employed – Higher the better

- Debt to Equity Ratio – Lower the better

The companies with high volatility in financial numbers should be avoided for investment.

Valuation

Investors also need to analyze if the issue is worth considering at the offer price. The Price-Earnings (P/E) multiple is one of the tools that can be used to gauge the attractiveness of the issue.

The P/E multiple is the ratio of the share price to Earnings Per Share. The P/E Multiple of the company should be compared with the industry average and the other listed companies in that sector. A Lower P/E indicates the company is undervalued. Investors should not blindly subscribe to an issue just because of a lower P/E multiple & must examine the reason behind such undervaluation.

Other metrics such as Price to Book Value (P/B Ratio), Post-Issue Market Capitalization to Sales, Price to Earnings Growth (PEG Ratio), EV/EBITDA, Equity (Net Worth) Growth rate, Operating Free Cash Flow Growth Rate, amongst others must be used in conjunction with P/E ratio to evaluate the lucrativeness of the investment.

Do not worry! We will discuss- What is Grey Market? and also understand the other factors considered for investing in an IPO.

What is IPO Grey Market?

IPO grey market is an unofficial Over-The-Counter (OTC) market where buying and selling of IPO applications or shares take place before they become officially available for trading on the stock exchange. All transactions are settled in cash. The network operates amongst a small group of trusted people and is unofficial in nature with no intervention by the regulator.

What are Grey Market Premium & Kostak rates? How does It Help Investors?

Grey Market Price/ Grey Market Premium (GMP) is the tentative/expected price at which the company is expected to be listed on the stock exchange. It can be positive or negative based on demand & supply of the issue. Many investors bid for IPOs by considering its GMP.

A high/positive GMP usually indicates that the IPO will be oversubscribed and it will be difficult to get allotment. Hence, an investor can expect quick listing gains if he/she gets a successful allotment.

However, it is advisable not to do so as GMPs are highly volatile and subject to manipulation by vested interests.

Kostak Rate is the premium one gets by selling his/her IPO application (in an off-market transaction) to someone else even before allotment or listing of the issue

What are the Factors Considered for Investing in New Issues?

Factors Considered for Investing in New Issues

There are major factors to be considered for investing in a new issue. They are:

- Understand Sectors and sectoral sentiments: It is essential to understand the sector in which the company operates. We should ask the question, How is the sector currently performing in the economy? If we analyze the sector is performing well, then there is a possibility the Initial Public Offering will be a success.

- Plan Investment horizon: It is essential for all investors who are applying for the IPO to decide their investment horizon. It can be either held for listing gain or may hold for a long-term horizon.

- Study Red Herring Prospectus (RHP): This document is handy to investors as it contains all information related to the company's business operations, financials, and promoters details. It also offers how the company is going to use the money raised through IPO.

- Valuations: The IPO valuations are normally done as per the demand and supply of shares in the traded market. To figure out appropriate IPO valuations, company leaders, investment banks analyze the health and performance of the company.

- Read Brokerage reports: It is very important for every investor to read reports of different brokerage firms to get an idea of how various financial analysts are taking their calls to subscribe to the IPO or not subscribe.

- Grey market premium: A grey market is an unlisted marketplace where participants buy and sell applications among themselves in exchange for money. It is unorganized and not regulated by any regulatory body. It is usually the case that the higher the grey market premium, the higher the possibility of listing gains.

What are the Risks and Concerns Involved in Investing in an IPO?

Investing in an IPO is risky. There are many risks and concerns involved in applying for an IPO and some of them are:

1.There is no guarantee of share allotment. In the case of oversubscription, the shares are allotted on proportionate basis. At times, it gets extremely difficult to get an allotment.

2.Investor's money also gets locked for some time.

3.The benefit of share allotment in case of oversubscription is marginal to retail investors as they can get only a single lot of shares.

4.After listing, shares may quote at a lower price than the IPO offering price due to change in market sentiments. Investing based on GMPs is never a good idea as they are prone to volatility and manipulation.

What are the Risks and Concerns of an IPO from the Company's Perspective?

There are several disadvantages of IPO to a Company as listed below.

- Expensive: There is a significant accounting, legal & marketing cost involved in an IPO.

- Reporting Responsibilities: It is required for a company to disclose several financial and business information. Companies may misuse competitors, suppliers and customers information.

- Funding risk: The expected funding from the IPO may not be raised.

- Loss of control: Ownership is transferred to the new shareholders.

IPO investors can be divided into the two:

1)Traders looking for short-term gains- usually exit after a quick pop on the day of listing. Bull markets are a breeding ground for such types of market participants since listing gains can be quite significant in such an environment.

2)Investors with a long-term view- IPOs are best suited for long-term investors since they can own a chunk of the company at a favorable price(since IPOs are generally underpriced). In many instances, quality companies have quadrupled in value in a few years of their listing.

Note: We have covered all the major learning areas related to IPO in India. Yet, we have a special section called 'ELM Special Gyan.' in the next unit so that you can get the best out of this module and succeed in IPO investing.

ELM Special Gyan

Initial Public Offerings should not be reckoned as a fast-track method for earning huge profits. With IPOs, it is generally advisable to invest for the long term.

Here are the not-to-forget smart tips you should consider before participating in an IPO in India:

Smart Research

Trusting a third-party website’s views on the company is not a wise idea as he/she may have vested interests. It is better to check the Qualified Institutional Buyers (QIB) data for the issue. Also, check the company’s annual growth for the past few years against the growth of that particular industry. This will give you a clear insight into the company’s performance. The DRHP, Company Website, Brokerage Notes, Social Media Interest can also be used in the decision-making process. A thorough research must also be done on the sector/industry in which the company operates.

Check the Promoters

Never commit the mistake of risking your capital without conducting a basic background check on the promoters. Management integrity is a consequential factor in accessing investment decisions.

Also, remember to check the performance of other listed companies of the same promoter (if any).

Companies with Foreign Collaborators

Domestic companies with foreign partners must be preferred for investments as they provide the local partner with technical know-how, thus enabling operating efficiencies.

Check the Company Prospectus

Check the company’s prospectus to know details as to how the company plans to spend the funds collected from the issue. The prospectus shall also give you crucial insights about the growth of the company, future plans for expansion, inherent risks in the business and most importantly the mindset of the promoter.

Know Your Risk Bearing Capacity

Debuting companies usually spend heftily on marketing activities with a view to garner investor interest in the Initial Public Offering. However, it becomes extremely important to separate the wheat from the chaff. Not all IPOs live up to their hype and end up disappointing investors.

Best Time to Invest in IPOs

The performance of IPOs are closely related to market trends. Listing gains are almost sure-shot and certain in bull markets. On the flipside, bull markets bring with them high valuations as investors simply turn a blind eye to the issue price.

Do Not Borrow to Invest

Present-day, leveraged investments in IPOs have become more or less a norm. This is an acceptable level of risk for investors belonging to the retail quota as the investor is only eligible for a single lot of shares, and that too with a lot of luck.

Note- We have assumed that the Initial Public Offering has been oversubscribed

Nonetheless, many institutions and other individuals frequently arrange for a bank loan to fund their IPO purchases. They usually apply through the HNI quota and intend to exit by making a quick listing gain. Such practices are an example of unsound risk management as GMPs are their primary decision-making tool. Reiterating what has been said earlier, GMPs are extremely volatile and are prone to manipulation by people with vested interests.

The stock has to list at a very high premium compared to its issue price to make up for the interest payments and turn profitable for those acquiring shares through margin funding. The investor faces a double whammy in case the issue lists at a discount as he also has to account for the interest charges on the entire amount he applied for.