Personal Loans

Introduction

Financial needs can arise anytime. They can be planned, such as a family holiday or children’s wedding, or they can be unplanned, such as a medical emergency. It is not always possible to have a surplus fund to fall back upon in times of need. Personal loans are our friends during such times. They are easy to obtain and can be used for any purpose. In this module, we will talk about the different aspects of personal loans – from what they are? What are the documents needed to obtain them? And a few tips on dos and don’ts.

Let’s begin!

What are personal loans?

Personal loans are unsecured loans (i.e. it does not require any collateral) taken from a bank or a non-banking financial institution (NBFC) to meet any personal financial needs. The loan is provided based on several criteria such as income level, repayment capacity, credit history and others. Since it does not require any collateral, personal loans carry more risk for the lenders (banks and NBFCs) and hence, typically their interest rates are higher.

What can the money be used for?

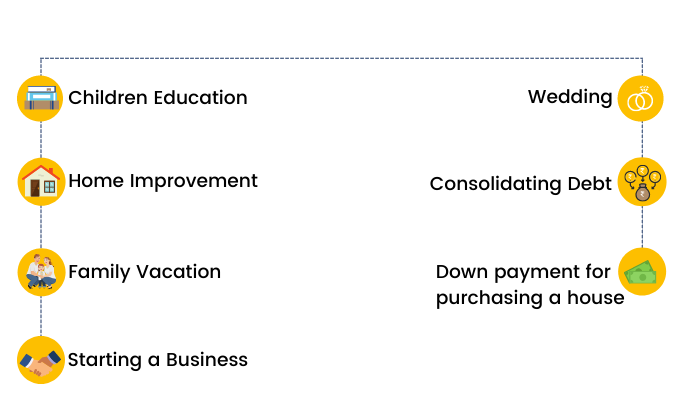

Herein lies the beauty of personal loans. The money obtained through personal loans can be used for any purpose, other than gambling. The bank or NBFC will not monitor the use of the funds. From financing a child’s education to consolidating debt – the fund can be used for a variety of purposes.

Some of the common uses of personal loans proceeds are given below:

Of course, one can take a home improvement loan for renovating a house and pay much lesser interest. However, home improvement loans need collateral, which may not be readily available. Similarly, there is a range of business loans available in India. However, most of them need a sound business track record and are not suitable for a person who is starting a business. Personal loans are hassle-free and hence often preferred by people to start a business.

What is Debt Consolidation?

We spoke about consolidating debt. Let us tell you in brief what it is. Debt consolidation is combining multiple debts from multiple lenders into one debt from one lender with more favorable terms.

Suppose a person has a credit card with the outstanding amount of ₹ 60,000 from credit card A, ₹ 75,000 from credit card B, and ₹ 50,000 from credit card C. So, he has a total outstanding of ₹ 1,85,000. Now, the average credit card annualized rate in India is around 40%. So, you can imagine the huge amount of interest he pays on these outstanding amounts.

Instead, he can choose to take a personal loan of ₹ 1,85,000 from a bank at 15% interest and pay off those credit cards. He will be saving on a huge amount of interest. He can also pay back this personal loan in a few years through EMI that will not create a huge dent in his monthly salary.

This entire process is known as debt consolidation.

What is the typical tenure of a personal loan?

Personal loans are given for flexible tenures which typically range from 12 months to 60 months. The longer the tenure, the lower will be the EMI.

Benefits of taking a personal loan

Personal loans have a range of benefits. Here are some of them:

- Easy financing option: Personal loans are an easy financing option where funds can be used for any purpose and the disbursement is done in a matter of days with minimal documentation.

- Short tenures: Personal loans are given for shorter tenure which ranges for a maximum period of 60 months. You can choose the tenure you are comfortable with and that meets your needs.

- No collateral required: This is probably the single reason why personal loans are so popular across the world. You don’t have to mortgage an asset to avail a personal loan.

- Attractive interest rates: With a good credit history and reliable employment history, it is possible to obtain a personal loan at a good interest rate which makes the EMI quite affordable.

- Simple eligibility criteria: Personal loans usually have very simple eligibility criteria making it convenient for anyone looking for a financing option. We have discussed more on this in our upcoming section of this module.

Letter of continuity

While taking a personal loan, you might be asked to sign a letter of continuity. It is basically a legal document acknowledging the loan amount and it will be completely paid off in due time.

Interest Rate

Now let us come to the most important aspect of personal loans – the interest.

What are the typical interest rates of personal loans?

Honestly speaking, there is no hard and fast rule about the interest rate of personal loans. Since it is an unsecured loan, lenders are free to decide their own interest rates. The interest rate depends on a variety of factors such as the borrower’s credit history, salary, the amount borrowed, employer, city of residence, and others.

If a borrower has a good credit rating or has a good history of paying their loans on time or is employed with an established organization, the risk is considered to be low and the interest rate offered is also lower.

Below are some of the personal loan interest rates charged by banks and NBFCs as of 17th November 2021:

*Please note that the actual interest rate and the lending amount varies on a case to case basis. Also, interest rates are subject to change by Banks/NBFCs.

How is interest calculated on a personal loan?

Interest on most personal loans is calculated based on the system of reducing balance. Let us understand what it means.

Each EMI that a borrower pays on a personal loan consists of two components – principal amount + interest amount.

So, with each EMI, the borrower pays back a part of the principal along with the interest. In the reducing balance system, the interest is calculated on the remaining principal only.

Let’s understand this through an example.

Suppose a borrower borrows ₹ 100,000 for 24 months at the interest rate of 12% per annum. His monthly EMI will be ₹ 4.707. The EMI breakup for the first month will be like this

So, in month 2, the interest will be calculated on the outstanding principal amount of ₹ 96293 and not the total of ₹ 100,000. Thus the first 12-month principal + interest breakup will look something like this:

Other charges:

Apart from the interest rate, there can be other charges associated with a personal loan such as processing fees, EMI bounce charges, penal interest etc. Please learn about these carefully at the time of taking the loan to avoid any surprises later on.

Some of the most common charges incurred while availing a personal loan are:

- Loan processing charges: Since the lender has to bear some administrative expenses while processing and sanctioning a loan, they charge a processing fee from the borrower, which varies from one lender to another. But in general, it ranges between 0.5% to 2.5% of the total loan amount.

- Verification charges: Sometimes, banks hire an external agency to conduct a verification of the borrower to assess whether he/she can repay the loan. The charge for this is taken from the borrower in the form of a verification charge.

- EMI default penalty: In case a borrower defaults on an EMI, a charge is levied on the loan as the EMI default charge. It is strongly advised not to default any EMI, not just to avoid this charge, but to add a bad record to the credit history.

- Duplicate statement fees: The bank/NBFC regularly sends statements to borrowers. However, in case the borrower asks for a duplicate statement from a bank, the bank charges a fee for statement generation.

- GST Tax: Any additional service required during the tenure of the loan will attract a GST tax, which has to be borne by the borrower.

- Prepayment/Foreclosure fee: In case the borrower wants to pay off the loan, ahead of the tenure, the bank may charge a fee for foreclosure. This amount usually varies between 2-4% of the loan amount. We have discussed this in detail in the next section of this module.

Prepayment Vs Part Payment

In-case you receive some surplus cash in the form of bonus or gift, you can consider making a prepayment or part payment. Let’s understand these options in details:

Full prepayment

You can choose to pay the loan back in full. If this is done early into the tenure of the loan, it can save you a lot of interest. However, most personal loans have a lock-in period (usually 1-year) only after which the prepayment can be done.

Part prepayment

Some lenders allow part prepayment of personal loans where you can pay at least 3 EMIs at one go. This can help you to decrease the loan EMI or tenure. However, a part prepayment may attract some part payment charges, which can vary from one lender to another. Therefore, check the charges before considering making the part prepayment.

Effect of full or part prepayment on the credit rating

While part prepayment may not have much effect on your credit rating, full prepayment does have a positive effect on your credit rating. However, part prepayment does reduce your loan burden, and hence, is definitely a good idea.

Eligibility Criteria For Personal Loans

While different lenders will have different eligibility criteria, here are some of the common ones:

- Age between 21 to 60-years (salaried individuals) and 65-years (self-employed individuals).

- Salaried individuals must be employed in public sector undertakings such as central, state and local bodies and select private limited companies. Also, there will be minimum salary criteria.

- Personal loans are also offered to self-employed individuals such as professionals and non-professionals. From doctors to business owners, this segment covers all non-salaried individuals. Of course, there will be individual income criteria for each segment also.

Importance of credit rating in determining personal loans

Cibil score is a three-digit score (ranging from 300 to 900) which shows the credit history of every individual. This data is shared between different lenders. This is the first data that lenders access to determine the repayment capacity of a borrower. You can read our module Types of Loans to learn more about Cibil score.

As with all the other loans, Cibil Score plays a very important role in determining the eligibility of a personal loan. A Cibil score of 750 and above is considered to be ideal. However, if all other criteria are met, the lender can decide to give out the loan with a rating lower than 750 as well. However, this is completely at the discretion of the lender.

What is FOIR?

You might come across this term while researching about personal loans. The full form of FOIR is ‘fixed obligation to income ratio’. It is a person’s expenditure as a percentage of his/her net income per month. This reflects the true disposable income of a person and is a clear indicator of the borrower’s repayment capacity.

To calculate FOIR, all the monthly obligations of a person are taken into account such as:

- Rent payments

- Credit card bills

- EMIs towards existing loan repayments

- Other debt obligations

- Recurring living expenses

A FOIR of 40% to 50% is preferred by lenders while assessing the personal loan application. What does it mean? It means that all the monthly obligations of a person should not exceed 50% of the person’s monthly income. For high net-worth individuals, the FOIR can go up to 70% as well.

How to improve your chances of getting a personal loan?

Yes, with a little bit of discipline, it is possible to increase your chances of obtaining a personal loan. Apart from maintaining a good FOIR, within 50% as mentioned above, here are a few other things you can do:

- Pay all your debt on time: By paying your credit card bills on time, and if possible in full, you can build up a good credit history for yourself. In case you have other loans, ensure that you never miss an EMI payment. These things can improve your Cibil score, which in turn will facilitate smoother processing of a personal loan application.

- Use lesser credit: Try not to use the maximum limit of your credit card. Using the maximum limit reflects that your income is not sufficient to finance your lifestyle. Lenders will always be wary of such borrowers.

- Submit the right documentation: Your loan executive will give you a list of documents required for the personal loan application. Ensuring that all the right documents are submitted, as per the list greatly increases the chance of obtaining the loan as well as faster processing of the application.

Documents Required For Availing Personal Loans

As mentioned earlier, personal loans require minimal documentation. The common documents required by most lenders are given below:

- Identity proof

- Address proof

- Last 3 month’s salary slip/current dated salary certificate with the latest Form 16

- Last 3 months bank statement

Personal Loans Vs Gold Loans Vs Credit Card Loans

Ready to master finance basics? Enroll now in 'A2Z Of Finance: Finance Beginner Course' and take control of your financial future!

Which one is better?

Often you will be faced with a dilemma of whether to go for a personal loan or a gold loan or a credit card loan to obtain finance. To help in your decision making, we have compared the options below:

Ready to master finance basics? Enroll now in 'A2Z Of Finance: Finance Beginner Course' and take control of your financial future!

Impact Of GST On Personal Loans

GST or Goods and services tax was implemented from 1st July 2017 which brought all goods and services in India under the ambit of taxation. GST has impacted personal loans as well. Before the GST era, a borrower had to pay a 15% service tax along with a processing fee. In the post GST scenario, a borrower is charged processing fee + 18% GST.

FAQs

Now that we have a fair idea about personal loans, let’s see the answers to some frequently asked questions:

What happens if you don’t repay the personal loan?

Not repaying a personal loan is completely discouraged since it can attract a range of negative impacts such as:

- Penal interest: The lender may charge a penal interest on the loan, for failed EMIs – a charge that you would want to avoid.

- Negative effect on your Cibil score: Any missed payment reflects in your credit history and negatively impacts your Cibil score. This is not to be taken lightly and should be avoided at all costs.

- Legal actions: The lender may opt for legal action to recover the outstanding money.

Can you get multiple personal loans at the same time?

It entirely depends on the lender. Usually, the same lender does not issue more than one loan to one customer at the same time. However, another lender can extend you a loan. But it entirely depends on the lender and your repayment capacity.

Conclusion

So, now that you know all the nitty-gritty of personal loans, it will definitely make you street smart when you apply for a personal loan for yourself. It is always better to know things before you jump in. Hope you have enjoyed the learning journey of the module. There are many such interesting modules we have curated for you in our ELM School. Do read them as well.

Happy learning!!