Types of Savings and Investment

Introduction

Investing, savings, taxes and retirement are all aspects of financial planning. Financial planning is the process of evaluating all aspects of your finances and making a specific financial plan that will reach your goals. In this entire module we will discuss the different types of savings and investment avenues available to us.

Savings Bank Account

A Savings Account is an interest-bearing bank account. The main idea of this account is to promote the habit of savings within people. Benefits of a savings account include - moderate interest on deposits, low risk, convenience, ease of use etc. At the time of opening the account, the account holder gets a cheque book, a passbook and a Debit cum ATM Card. This account has become popular because of its liquidity and low risk. There is a cap on the number of withdrawals and deposits in this account. A Savings Account channels idle household cash into savings. There are also different types of Savings Bank Account that we will discuss in our next section.

How to Open an Account

The following documents are required to open a Savings Bank account:

- Proof of identity - Passport, Driving license, Voter’s ID card, etc.

- Proof of address - Passport, Driving license, Voter’s ID card, etc.

- PAN card

- Form 16 (only if PAN card is not available)

- 2 latest passport size photographs

Guarantees

The interest rate in a savings bank is guaranteed up to the first ₹5 lakhs balance in the account. This rate varies across banks since the Reserve Bank of India deregulated the savings bank deposit interest rate on October 25, 2011. Banks are now free to determine the interest on the balance in a savings bank account, which has to be uniform for all types of accounts up to ₹5 lakhs in an account but varies for accounts with a higher balance.

Types of Savings Bank Account

1. Basic Savings Bank Deposit Accounts (BSBDA) or No-Frills Account:

It is a zero-balance account with no restrictions on minimum and average balance. This account does not offer any unnecessary services or frills. It is mainly for the low-income groups. However, If the balance in a no-frills account exceeds ₹50,000 or if the cumulative value of credit transactions exceeds ₹1 lakh in any financial year, the account will no longer be treated as ‘no frills. The Pradhan Mantri Jan Dhan Account falls under this category.

2. Salary Account:

A Salary Account is one where the organization credits an employer’s monthly salary. This is somewhat like a zero-balance account as there is no minimum balance maintenance requirement. However, if salary is not credited for 3 consecutive months, then it is treated as a Savings Account.

New Age Banking (e-banking & Mobile Banking)

These days, banks offer various facilities through net banking and mobile banking. Fund transfer facilities like National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS), Unified Payment Interface (UPI) and Immediate Payment Service (IMPS) are offered through net banking and mobile banking. IMPS, NEFT and RTGS can be done 24X7. NEFT can be done for any amount till ₹10 lakh, IMPS up to ₹2 lakh per transaction. The minimum amount for an RTGS transaction is ₹2 lakhs, and it does not have any upper limit. These facilities attract nominal charges, which differ from Bank to Bank. Funds can be transferred from one account to another in a matter of seconds through these facilities available on the Bank’s mobile app or through net banking. People can also check their account balances in these ways without having to visit the Bank.

Tax Implications

Interest up to ₹10000 earned from savings bank account is exempted from tax under Section 80TTA of the Income Tax law. This exemption can be claimed by both individuals and HUF’s. However, any amount exceeding ₹10,000 will be subject to taxation.

Risk associated with Savings Bank Account

The Deposit Insurance and Credit Guarantee Corporation Scheme of India (DICGC) insures the balance in an account including bank interest up to ₹5 lakhs. In case of a bank winding up, or becoming insolvent, the bank is liable to pay a maximum of ₹5 lakhs per account. For example, suppose Sumit has ₹10 lakhs in a savings account of XYZ Bank.

One day XYZ Bank becomes insolvent. The maximum amount that the bank is liable to give Sumit is ₹5 lakhs.

Sumit would only receive ₹5 lakhs out of his deposit of ₹10 lakhs. Savings bank accounts are not inflation protected. If inflation turns out to be higher than the nominal interest rate of the Savings Account, there would be no real returns available.

Bank Fixed Deposit

As discussed earlier, we can simply deposit our money in a savings bank account to earn a nominal interest on our money. It offers the highest liquidity. But what if we want a higher rate of interest on our money? Is there any kind of banking products available? Yes, of course, these are called bank deposits. It can be a fixed deposit or a recurring deposit. In this section, we will learn about fixed deposits, and in the following unit, we will discuss recurring deposits. So, let us start:

What is a Fixed Deposit?

A fixed deposit is an instrument which gives a higher rate of interest than a savings account, but the deposit has to be for a specified time period, for example, 7 days, 1 year, 2 years and so on. In India, a Fixed Deposit can be made for a maximum of 10 years. For fixed deposits greater than 1 year, interest is compounded quarterly. People are attracted towards fixed deposits because they offer fixed returns. The interest rate is fixed in the beginning as per the terms and conditions of a particular bank and is valid till maturity of the fixed deposit.

Types of Bank Fixed Deposit

Depending on the need, one can opt for a normal fixed deposit wherein a certain deposit is made at a fixed interest rate which holds till maturity, or one can opt for tax saver fixed deposits wherein the deposit has a lock in period of 5 years. In case of a Tax Saver FD, the deposit cannot be liquidated before 5 years. Senior Citizens are offered higher interest rates as compared to normal individuals. A normal fixed deposit can be pre-matured, but after paying a penalty.

How to Open a Fixed Deposit Account

The following documents are required to open a Fixed Deposit account:

- Duly filled Application Form with a photograph

- Age Proof (PAN Card, Passport, Any other Certificate from Statutory Authority)

- PAN Card

- Residence Proof (Passport, Driving License, Telephone Bill, Ration Card, Election Card, Any other Certificate from Statutory Authority)

It is not necessary to have a savings account in the same bank where the FD has been opened if it is booked in interest compounding mode. But it is required to have a savings bank account in the same bank where one has booked a fixed deposit if one wants to receive interest payout credited in savings bank account. The Fixed Deposit can be opened either by filling a form online or by visiting the bank branch.

Interest Rate Mechanism

For Fixed Deposits interest can be compounded monthly, quarterly or annually. The present rate of interest is between 6.5% and 7.5%.

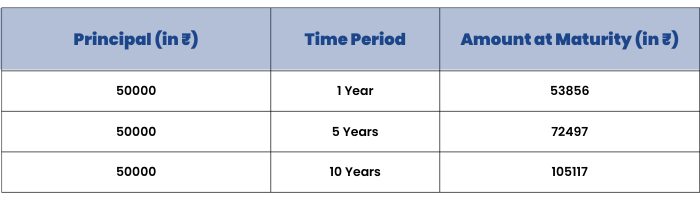

For example, we take the interest rate as 7.5% compounded quarterly. The following table shows what would be the amount receivable at maturity if we invest ₹50000 for different time periods:

Tax Implications

The Principal of Tax Saver Fixed Deposit is eligible for deduction under Section 80C. However, interest earned from them is taxable. If interest earned is greater than ₹10,000, it would be liable to taxation. These days, if interest earned is greater than ₹10,000, the tax is deducted at source (called TDS) and the rest of the amount is transferred to the holder’s account.

Risk associated with Fixed Deposit

If linked to the savings bank account, the fixed deposits are counted as a part of savings capital, hence, on the whole, the amount is protected up to ₹5 lakhs by the Deposit Insurance and Credit Guarantee Scheme of India (DICGC). If inflation turns out to be higher than the nominal interest rate of the Fixed Deposit, there would be no real returns available. Hence, it is not inflation protected.

Recurring Deposit Account

Let us now talk about Recurring Deposits; what are they? How can you open such accounts? What are its benefits?

What is a Recurring Deposit Account?

It is similar to fixed deposits that we have learned previously. Instead of fixing a lump sum amount at once, in a recurring deposit account an individual can deposit any amount each month for a predetermined period and earn a fixed interest on the deposits. A minimum period for RD is 6 months and maximum is 10 years. The interest rate for recurring deposits is a bit lesser than that offered to fixed deposits. A recurring deposit has a lock-in period, but, it can be pre-matured after paying a penalty. Recurring Deposit is a good way to enable forced saving.

How to Open a Recurring Deposit Account?

The following documents are required to open a Recurring Deposit account:

- Duly filled Application Form with a photograph

- Age Proof (PAN Card, Passport, Any other Certificate from Statutory Authority)

- PAN Card

- Residence Proof (Passport, Driving License, Telephone Bill, Ration Card, Election Card, Any other Certificate from Statutory Authority)

It is not necessary to have a savings account in the same bank where the RD account has been opened. But, it is beneficial to start a Recurring Deposit in the bank where one holds a savings bank account. Then, the Recurring Deposit can be opened either by filling a form online or by visiting the bank branch.

Interest Rate Mechanism

For Recurring Deposits, interest is compounded quarterly. The present rate of interest is between 6% and 7.25% p.a. For senior citizens, the interest rate is between 6.75% and 7.75%. Recurring Deposit interest rates vary according to the tenure of deposit.

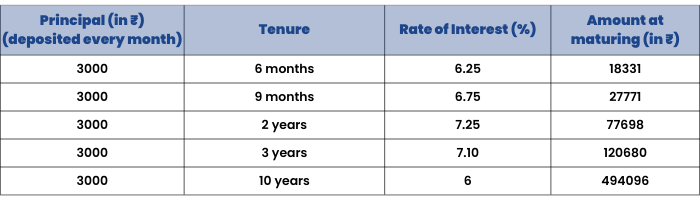

We see the table below for some comparisons:

Tax Implications

There is no tax relief for Recurring Deposits. If interest earned is greater than ₹10000, the tax is deducted at source (called TDS) and the rest of the amount is transferred to the holder’s account.

Risk associated with Recurring Deposit

If linked to the savings bank account, the recurring deposits are counted as a part of savings capital, hence, on the whole, the amount is protected up to ₹5 lakhs by the Deposit Insurance and Credit Guarantee Scheme of India (DICGC). If inflation turns out to be higher than the nominal interest rate of the Recurring Deposit, there would be no real returns available. Hence, it is not inflation protected.

Post Office Recurring Deposit

Earlier, we have discussed Recurring Deposits offered by Banks. In the section, we will focus on Recurring Deposits offered by the Post office. However, the concept remains the same; there are a few key differences between them. So, let us begin.

What is a Post Office Recurring Deposit?

It is an account wherein an individual can deposit any amount (minimum of ₹10) in multiples of ₹5 each month for a minimum period of 60 months and earn a fixed interest on the deposits. The account can be opened in any Post Office across India. A recurring deposit has a lock-in period, but it can be pre-matured only after 1 year after paying a penalty. One can also borrow from the recurring deposit.

How to Open a Post Office Recurring Deposit Account?

The following documents are required to open a Fixed Deposit account:

- Fill the Post Office Recurring Deposit (RD) Account Opening Form.

- Furnish all details provided in the form like PAN details, address proof, nomination details.

- One must carry the original PAN Card, Address Proof, and ID proof for the in-person KYC verification purpose.

- Submit the same and start operating the account.

It is not necessary to have a savings account in the same post office where the RD account has been opened. But it is beneficial to start a Recurring Deposit in the post office where one holds a savings account to get the interest credited.

Interest Rate Mechanism

For Recurring Deposits, interest is compounded quarterly. Presently, the interest rate is 7.3% p.a. The interest rate is linked to G-Sec rates. The interest rate is subject to change as and when G-Sec rates change, but once a Recurring Deposit is booked, the interest rate prevailing at the time of booking the Recurring Deposit would hold till maturity.

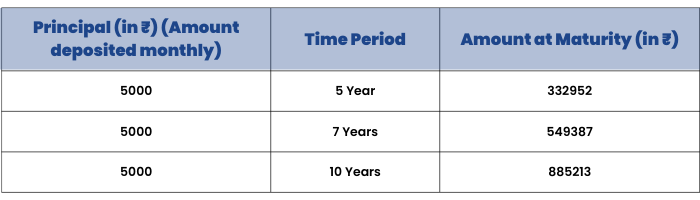

The following table shows what would be the amount receivable at maturity if we invest ₹5000 monthly for different time periods:

Tax Implications

There is no tax relief for Recurring Deposits. The interest earned is subject to taxation. TDS is not deducted from the interest earned. However, there is an exemption limit of up to ₹50000 on the interest earned for senior citizens.

Risk associated with Post Office Recurring Deposit

There is no risk involved as these deposits are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the Recurring Deposit, there would be no real returns available. Hence, it is not inflation protected.

Post Office Time Deposit

It is similar to a bank fixed deposit, but it gives a marginally higher rate of interest than a bank fixed deposit. A post office FD can be made for a period ranging from 1 year to 5 years. The minimum amount for this FD is ₹200 and there is no maximum amount. The interest rate is fixed at the beginning of the FD and holds till maturity. A Post Office fixed deposit can be pre-matured, but after paying a penalty.

How to Open a Post Office Fixed Deposit Account?

The following documents are required to open a Fixed Deposit account:

- A deposit opening form provided by the post office

- Address and identity proof such as copy of the Passport, PAN (permanent account number) card or declaration in form No 60 or 61 as per the Income Tax Act 1961, Driving license, Aadhaar Card, voter's ID or ration card

- One must carry original identity proof for verification at the time of account opening

- Choose a nominee and get a witness signature to complete the formalities to start the deposit

It is not necessary to have a savings account in the same post office where the FD account has been opened.

Interest Rate Mechanism

For Fixed Deposits interest is payable annually but calculated quarterly. The interest rate ranges from 6.9%-7.8% p.a. for one year to five-year FD's. The interest rate is linked to G-Sec rates. The interest rate is subject to change as and when G-Sec rates change, but once a Fixed Deposit is booked, the interest rate prevailing at the time of booking the Fixed Deposit would hold till maturity.

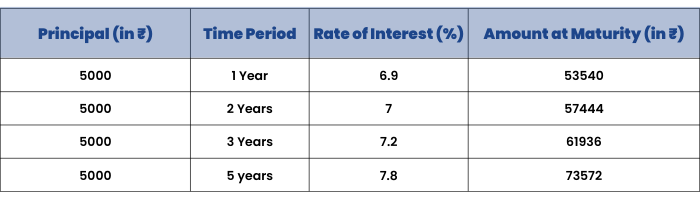

The following table shows what would be the amount receivable at maturity if we invest ₹50000 for different time periods:

Tax Implications

The principal amount of a Five-Year Fixed Deposit is eligible for deduction Section 80C. However, interest earned from the deposit is taxable. If interest earned is greater than ₹10000, it would be liable to taxation, meaning TDS will be deducted but there is an exemption limit of up to ₹50000 on the interest earned for senior citizens.

Risk associated with Fixed Deposit

There is no risk involved as these deposits are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the Fixed Deposit, there would be no real returns available. Hence, it is not inflation protected.

Post Office Monthly Income Scheme

This scheme offers a guaranteed return on investments made in post offices. Interest on deposits is paid monthly to scheme holders. A minimum deposit of ₹1500 needs to be made to avail this scheme. The maximum investment that one can make in this scheme is ₹4.5 lakh singly or ₹9 lakh if held jointly. This account can be held either singly or jointly. Premature withdrawals can be made, but after paying a penalty.

How to Open a Monthly Income Scheme Account?

- Fill the account opening form

- Two passport-size photographs.

- Address and identity proof – any of the following – Aadhaar card, driving license, voter ID, passport, ration card, PAN card, or declaration in form 60 or 61 as per the Income Tax Act.

- Choose a nominee

Interest Rate Mechanism

For the MIS Scheme, interest is 7.7% p.a. payable monthly. The interest rate is linked to G-Sec rates. The interest rate is subject to change as and when G-Sec rates change, but once a MIS begins, the interest rate prevailing at the time of starting the MIS would hold till maturity.

For example, if one deposits ₹50000, the person would receive a monthly interest payout of ₹320 till maturity.

Tax Implications

There is no tax relief for Monthly Income Scheme account holders. The interest earned is subject to taxation. TDS is not deducted from the interest earned.

Risk associated with Monthly Income Scheme

There is no risk involved as these deposits are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the Scheme, there would be no real returns available. Hence, it is not inflation protected.

Public Provident Fund

In this section, we will discuss 'Public Provident Fund' (PPF), which is a retirement savings scheme offered by the Government of India. It aims to provide a secure post-retirement life to everyone.

Public Provident Fund (PPF) is a scheme wherein one can save for long term and enjoy tax benefits on the principal as well as interest. This scheme aims to provide income security to the self-employed and people working in the unorganised sector. It was introduced by the National Savings Institute of the Ministry of Finance in 1968. There is a lock-in period of 15 years before which the account cannot be closed or liquidated. However, one can avail a loan from their own PPF account, 3 years after the commencement of the account. Withdrawals, subject to various conditions are allowed from the seventh year of the commencement of the account. After 15 years, the scheme can be increased in blocks of 5 years.

How to Open a Public Provident Fund Account?

The following documents are required to open a Public Provident Fund account:

- Duly filled PPF account opening form

- Proof of identity. For example, driving license, Aadhaar Card, PAN card, Passport, Voter’s ID Card

- Proof of residence or current address proof

- Couple of passport size photographs

This account can be opened in both, post offices as well as banks. It is not necessary to have a savings account in the same financial institution where the Public Provident Fund account has been opened.

Interest Rate Mechanism

For PPF Accounts, the interest rate is 8% p.a. compounded annually. The interest rate is linked to G-Sec rates with a spread of 0.25%. The Government reviews the interest rates quarterly and any changes in interest rates would be applied to old as well as new deposits.

The following table gives a detailed description of interest earned from a PPF account by making yearly deposits of ₹50000:

Tax Implications

The scheme has exempt-exempt-exempt (EEE) status, where the deposits, the interest earned as well as the maturity amount are tax-free. The sum invested in the PPF account is eligible for tax deduction under Section 80C subject to a maximum of ₹ 1.5 lakh in a financial year. On maturity, the entire amount, including the interest, is tax free.

Risk associated with Public Provident Fund account

There is no risk involved as these deposits are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the PPF, there would be no real returns available. Hence, it is not inflation protected. A major benefit of PPF account is that it cannot be attached by Court in respect of any debt or liability.

Sukanya Samriddhi Yojana

The next type of deposit scheme that we will discuss here is 'Sukanya Samriddhi Yojana' which is a small deposit scheme of the Government of India meant exclusively for the girl child and is launched as a part of 'Beti Bachao Beti Padhao Campaign'. The scheme is meant to meet the education and marriage expenses of a girl.

The minimum amount that needs to be invested is ₹1000 and a maximum of ₹ 1.5 lakh can be deposited in a year. Parents or guardians of a girl who is 10 years or below can open this account. Withdrawals cannot be made till the girl attains 18 years of age. A depositor can open only one account in case of one girl and two different accounts in the name of two different girls.

The scheme will mature after the completion of 21 years from the date of opening of the account. According to the scheme rules, a depositor is required to make deposits every year till the completion of 15 years from the date of opening of account. Between the 15th year and 21st year, no deposits are required to be made. However, the depositor will be earning interest on the earlier deposits made.

How to Open a Sukanya Samriddhi Yojana Account?

The following documents are required to open a Sukanya Samriddhi Yojana account:

- Birth Certificate of the girl

- Proof of identity of the parent/guardian. For example, driving license, Aadhaar Card, PAN Card, Passport, Voter’s ID Card

- Proof of residence or current address proof of the parent/guardian

This account can be opened in both, post offices as well as banks. It is not necessary to have a savings account in the same financial institution where the Sukanya Samriddhi Yojana account has been opened.

Interest Rate Mechanism

For Sukanya Samriddhi Yojana Account, the interest rate is 7.6% p.a. compounded annually. The interest rate is linked to the government bond yield. The Government reviews the interest rates quarterly and any changes in interest rates would be applied to old as well as new deposits.

The following table gives a detailed description of interest earned by the father of a daughter who has opened this account as his daughter completed 2 years of age. He deposits ₹50000 yearly:

Tax Implications

The scheme has exempt-exempt-exempt (EEE) status, where the deposits, the interest earned as well as the maturity amount are tax-free. The sum invested in this account is eligible for tax deduction under Section 80C subject to a maximum of ₹ 1.5 lakh in a financial year. On maturity, the entire amount, including the interest, is tax free.

Risk associated with Sukanya Samriddhi Yojana account

There is no risk involved as these deposits are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the scheme, there would be no real returns available. Hence, it is not inflation protected.

Senior Citizen Savings Scheme

In this unit, we will be discussing a deposit scheme that is specially launched by the government of India for all the old age citizens of our country, i.e., 'Senior Citizens Savings Scheme' (SCSS)

The Senior Citizens Savings Scheme (SCSS), launched in 2004, is primarily for senior citizens of India that offers regular income and is a risk-free tax saving investment. Senior Citizens above the age of 60 can invest in this scheme. It has a five year lock-in period. Minimum investment should be of ₹1000 and maximum investment can be ₹15 lakh. Premature closure of this account would attract a penalty.

How to Open a Senior Citizen Savings Scheme Account?

The following documents are required to open a Senior Citizens Savings Scheme account:

- Form A has to be filled for opening an SCSS Account.

- Identity proof like PAN card, Passport.

- Address proof such as Telephone bill, Aadhaar card.

- Age Proof Document like Passport, Senior Citizen Card, Birth certificate issued by Corporation or registrar of births and death, Voter ID card, PAN card etc.

- 2 Passport size photographs.

This account can be opened in both, post offices, as well as select nationalised banks. It is beneficial to have a savings account in the same financial institution where the Senior Citizen Savings Scheme account has been opened to get the credit of interest every quarter.

Interest Rate Mechanism

For SCSS Accounts, the interest rate is 8.7% p.a compounded quarterly. There is a quarterly payout of interest. The interest rate is linked to G-Sec rates with a spread of 1%. The Government reviews the interest rates quarterly but, once a Scheme is booked, the interest rate prevailing at the time of booking would hold till maturity.

For example, if Mr. Jay, aged 61 years deposits ₹ 100000 for 5 years, the amount receivable at maturity would be ₹ 153777.

Tax Implication

Only the principal amount up to ₹150000 invested under this scheme is exempted under Section 80C. Although the maximum amount investible is ₹15 lakhs (₹30 lakhs jointly with spouse).

Risk associated with Senior Citizens Savings account

There is no risk involved as these deposits are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the scheme, there would be no real returns available. Hence, it is not inflation protected.

National Savings Certificate

The next savings scheme that we will discuss here is important for tax planning. The National Savings Certificate (NSC) is a tax saving instrument wherein one can invest in small amounts. It is offered by the Department of Post and is available only in post offices. Certificates are available in denominations of ₹10, ₹500, ₹1000, ₹5000 and ₹10000. It has a lock-in period of 5 years. It can be pre-matured only in case of death of the certificate holder. NSC is transferable as well.

How to Apply for National Savings Certificate

The following documents are required to apply for National Savings Certificate:

- Duly filled Application form.

- Identity proof like PAN card, Passport.

- Address proof such as Telephone bill, Aadhaar card.

- Age Proof Document like a Passport, Senior Citizen Card, Birth certificate issued by Corporation or registrar of births and death, Voter ID card, PAN card etc.

- 2 Passport size photographs.

This certificate can be bought only from post offices. It is not necessary to have a savings account in the same Post Office where the Certificate is being bought from.

Interest Rate Mechanism

For NSC, the interest rate is 8% p.a compounded annually for the 5 year option. The interest rate is linked to G-Sec rates. The Government reviews the interest rates quarterly but, once a Certificate is purchased, the interest rate prevailing at the time of purchasing would hold till maturity.

For example, the maturity amount of a five year NSC of ₹100000 would be ₹146932.

Tax Implication

The principal amount along with accrued interest, up to ₹150000 invested under this scheme (on or after April 1, 2007) is exempted under Section 80C. Interest earned on existing certificates is deemed to be reinvested, hence it is exempted.

Risk associated with National Savings Certificate

There is no risk involved as these certificates are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the certificate, there would be no real returns available. Hence, it is not inflation protected.

Kisan Vikas Patra

The next savings scheme that we will discuss is offered by all the post offices across the country.

The Kisan Vikas Patra (KVP) is a safe small-savings instrument that doubles the invested money in 112 months. Minimum amount to be invested is ₹1000 and there is no cap on the upper limit of deposit. There is a lock-in period of 30 months. Encashment is allowed after 30 months by paying a penalty.

How to Apply for Kisan Vikas Patra?

The following documents are required to apply for Kisan Vikas Patra:

- Duly filled Application form.

- Identity proof like PAN card, Passport.

- Address proof such as Telephone bill, Aadhaar card.

- Age Proof Document like a Passport, Senior Citizen Card, a Birth certificate issued by Corporation or registrar of births and death, Voter ID card, PAN card etc.

- 2 Passport size photographs.

This certificate can be bought from post offices and some nationalised banks. It is not necessary to have a savings account in the same Financial Institution where the Certificate is being bought from.

Interest Rate Mechanism

For Kisan Vikas Patra, the interest rate is 7.7% p.a compounded annually. The interest rate is linked to G-Sec rates. The Government reviews the interest rates quarterly but, once invested, the interest rate prevailing at the time of investment would hold till maturity.

Tax Implication

There is no tax exemption on the principal amount or the interest.

Risk associated with Kisan Vikas Patra

There is no risk involved as this scheme is backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the investment, there would be no real returns available. Hence, it is not inflation protected.

Pradhan Mantri Vaya Vandana Yojana

In this unit, we will discuss another retirement cum pension scheme announced by the Indian Government, i.e, 'Pradhan Mantri Vaya Vandana Yojana' (PMVVY). It is a social security/pension scheme for senior citizens. The scheme guarantees an interest rate of 8% payable monthly for a period of 10 years. It is like a fixed deposit held with LIC. Minimum amount to be invested is ₹150000. Maximum amount that can be invested is ₹1500000 subject to prescribed mode of holding. Premature exit is allowed in case of critical illness wherein 98% of the deposit will be refunded. One can also avail a loan up to 75% of the deposit made after completion of 3 policy years. On completion of the policy term, the principal would also be returned along with the last instalment.

How to Apply for Pradhan Mantri Vaya Vandana Yojana (PMVVY)?

The following documents are required to apply for Pradhan Mantri Vaya Vandana Yojana:

- Duly filled Application form.

- Identity proof like PAN card, Passport.

- Address proof such as Telephone bill, Aadhaar card.

- Age Proof Document like Passport, Senior Citizen Card, Birth certificate issued by Corporation or registrar of births and death, Voter ID card, PAN card etc.

This scheme can be bought online from the Life Insurance Corporation of India (LIC) website or offline by visiting any LIC office.

Interest Rate Mechanism

For Pradhan Mantri Vaya Vandana Yojana, the interest rate is 8% payable monthly.

For example, if one makes a one-time investment of ₹150000, the monthly pension payout for 10 years would be ₹1000.

Tax Implication

The deposits made in this scheme are exempt from income tax under section 80C of Income Tax Act, 1961. But, there is no tax exemption on the interest received.

Risk associated with Pradhan Mantri Vaya Vandana Yojana

There is no risk involved as this scheme is backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the investment, there would be no real returns available. Hence, it is not inflation protected.

National Pension Scheme

In this unit, we will discuss another type of investment that is helpful for retirement planning, i.e., the National Pension Scheme (NPS)

It is a pension scheme by the Government of India which aims to provide old age income, a reasonable market based return over long run and old age security to all its citizens. It is mandatory for government employees to invest in this scheme while private sector employees can choose between NPS and Employees' Provident Fund Organisation (EPFO). NPS is regulated and managed by the Pension Fund Regulatory and Development Authority (PFRDA). One can withdraw up to 25% of the contributions made after being in the scheme for 3 years. However, these withdrawals are for certain defined expenses like children's higher education or marriage or construction of the first house etc.

Types of NPS Accounts

NPS has two parts: Tier I and Tier II.

- Tier I: This is a mandatory no-withdrawal pension account and is eligible for tax benefits. The annual minimum amount to be deposited in this account is ₹1000. If one wishes to exit before the age of 60, 80% of the corpus should be used to buy an annuity and the rest, 20% can be withdrawn which is subject to taxation as per one’s income tax slab. For people retiring at the age of 60, 40% withdrawal from NPS is tax-free. Out of the rest 60%, 40% of the money needs to be used to buy an annuity and the rest can be withdrawn which is subject to taxation as per one’s income tax slab.

- Tier II: It’s a voluntary-withdrawal savings account, from which individuals can withdraw money anytime. It has no tax benefits. There is no annual minimum deposition limit.

How to Open a National Pension Scheme Account?

One needs to visit a Point-of-Presence (PoP) and fill out the prescribed form and submit the required documents for KYC compliance. Alternatively, one can open an account online at enps.nsdl.com and follow the steps mentioned therein.

Once registered, the Central Record Keeping Agency (CRA) will assign a Permanent Retirement Account Number (PRAN), which is unique to all subscribers.

Select the amount to invest and the investment option.

List of Pension Fund Managers (PFMs)

Following is the list of NPS managers:

- HDFC Pension Management Company

- ICICI Prudential Life Insurance Company

- Kotak Mahindra Asset Management Company

- LIC Pension Fund

- Reliance Capital Asset Management Company

- SBI Pension Funds

Interest Rate Mechanism

For NPS Accounts, there is no guaranteed rate of interest. The rate of return would vary according to the returns given by different asset classes. NPS offers different funds with varying exposure to Equity, Corporate Debt and Government Securities. The following Investment options are available:

Active Choice Investment: An investor can choose the exposure to different asset classes himself with maximum allocation towards equity being 50%.

Auto Choice Investment: Here investment allocation is done based on the investor’s age. In default version of this scheme, the equity portion is 50% till age 35, after which it reduces by 2% per year until it becomes 10% by age 55. The corporate debt portion is 30% till age 35, after which reduces by 1% per year until it becomes 10% by age 55. Other options within auto-choice are the aggressive and conservative life-cycle funds which begin with an equity allocation of 75% and 25% respectively. These are reduced as the NPS subscriber’s age advances.

Tax Implications

Under NPS, one can avail tax deduction on investments up to ₹ 1.5 lakh under Section 80CCD and ₹50,000 under Section 80CCD (1B) in a financial year. 40% of the amount received at the completion of the term is tax-free.

Risk associated with National Pension Scheme account

There is risk involved in this scheme as returns are linked to the market. If inflation turns out to be higher than the return rate of the scheme, there would be no real returns available. Since returns are market linked, the rate of return almost beats the inflation rate or stays at par with it.

Atal Pension Yojana

Previously we have discussed the National Pension Scheme, which was only catering towards the organized sector of our economy like salaried individuals. But what about individuals like daily wage earners who belong from the unorganized sector of the economy. Therefore, the government of India launched the Atal Pension Yojana which is a pension scheme for workers in the unorganized sector. The minimum age of joining is 18 years and the maximum age is 40 years. One cannot exit this scheme before completing 60 years of age.

How to Start Atal Pension Yojana

A bank account and an Aadhaar Card is needed to enroll in this pension scheme.

Pension Payout

Under the APY, subscribers receive a fixed pension of ₹1,000, ₹2,000, ₹3,000, ₹4,000 or ₹5,000 per month at the age of 60 years, depending on their contributions.

Tax Implications

Tax is exempted on contributions and accumulation but chargeable on the maturity amount.

Risk associated with Atal Pension Yojana

There is no risk involved as this scheme is backed by the Government of India. However, the returns are not inflation protected.

Stocks

The next type of investment that we will discuss here is stock investing which is quite different from other investment schemes that we have discussed earlier. Investing in stocks comes with its own set of risks and rewards. So, let us first understand the concept of a share/ stock/ equity.

A share is a unit of ownership of a company. Shareholders are a part of the ownership of the company and if the company grows, they also grow. Shareholders are also entitled to receive dividends. Dividend is a part of the company’s profit which is distributed by it. The company may distribute the profit or it may retain it back for further expansion of the company.

A shareholder earns Capital Gains or incurs Capital Losses. One earns capital gain by selling the share at a higher price than what it was bought at. A person incurs capital loss if he sells the share at a price lower than what he had bought it at.

The main motive behind investing in share markets is to make capital gains. Equity is the most risky asset class but it offers the highest returns. One can either invest / trade in the stock market directly by himself or indirectly through mutual funds.

Investing involves buying fundamentally sound companies for a long period of time. Trading involves buying and selling of shares in a very short span of time so as to earn quick profits. Trading is a risky activity. Investing in mutual fund entails less risk because of a diversified portfolio.

How to start investing/trading in shares?

Trading is done through stock exchanges. There are two stock exchanges in India–

National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). One needs to open a DEMAT account first. The Demat Account stores the shares in an electronic format. There are two depositories in India – National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL).

One needs to visit a share broker and get the trading and demat account opened. Documents such as Aadhaar Card, PAN Card, any other identity proof are required along with passport size photographs to open trading and demat account with the broker. One can opt for brokers like HDFC Securities, ICICI Securities, IIFL or any other company depending on which broker suits them the best.

Tax Implications

There is a capital gains tax of 15% if one sells a stock within a year. There is a tax of 10% on the gains exceeding ₹1 lakh if a stock is sold after holding it for more than a year.

Dividends earned from the stocks in a year are not taxable up to ₹10 lakh, in the hands of the investor. Dividends above ₹10 lakh are taxable at the rate of 10%.

A 0.1% tax called STT (Security Transaction Tax) is imposed on the value of each stock in case of delivery of shares (whether buying or selling). In case of intraday transactions, 0.025% tax is charged at the time of selling only. STT is deducted by the stockbroker.

Risk associated with equities

Capital is not protected when investing in the share market. The share market does not give any guaranteed returns as well. However, stocks are capable of beating inflation if one can hold the investment for a long term. Stocks are quite liquid as well. There is no lock-in period. One can sell shares and get the money in 2 working days.

Mutual Funds

The next type of investment that we will discuss is Mutual Funds. We will also learn the different types of mutual funds available in the market and their benefits, but first, let us understand the concept of mutual funds in this unit. So, let us start:

A mutual fund pools the money of many investors and uses this money to invest in market securities like equities, bonds etc. Asset Management Companies (AMCs) run mutual funds. They have different mutual fund schemes. When investing in mutual funds, retail investors need not worry about individual buying and selling of securities. Each scheme has professional Fund Managers who manage the fund and take decisions regarding buying and selling of securities. One can start investing in Mutual Funds with an amount as low as ₹500 in urban areas and ₹100 in rural areas. The Securities Exchange Board of India (SEBI) and The Association of Mutual Funds in India (AMFI) are the regulator bodies of the mutual fund industry.

Mutual Funds are liquid as well. However, liquidity depends on whether the scheme is open-ended or close-ended. Open-ended funds are always available for buying and selling at the current Net Asset Value (NAV). One usually receives money in 3 days after redemption. Closed-ended funds have a lock in period. One can only invest in them at the time of initial offer. These funds are then listed on stock exchange for buying and selling. However, it is not wise to sell these funds after listing as one would have to sell at a lower NAV. It is advisable to hold on to these funds till the lock-in period is over.

Types of mutual funds:

There are different types of mutual fund categories in India, such as Equity mutual funds, Debt mutual funds, Hybrid mutual funds, and others like Index Funds, ETFs, Fund of Funds (FoFs) etc. Kindly read this module to have clarity on the different types of mutual fund schemes in India.

Benefits of Mutual Fund:

Let us now discuss some benefits offered by mutual funds.

Some of them are listed below:

- Mutual Funds spread money across a large number of investments hence reducing the risk of a loss.

- Mutual Fund schemes are managed by professionals. They take care of buying and selling of securities. Hence investors don’t need to worry about the buying and selling themselves.

- There are different varieties of mutual funds that suit the needs of individuals.

- Both, investing as well as redemption from mutual funds is easy.

- Mutual Funds are tax efficient. If individuals keep buying and selling stocks, they would have to pay taxes on each profitable transaction. However, that is not the case in mutual Funds. The fund manager can keep buying and selling to maximise profits. The individual will only have to pay a tax at the time of redemption of units.

- There is transparency in the operation of funds. The holdings and activities of each scheme are published.

- Through mutual funds, people get to invest in such assets which is not possible if they want to do it individually.

What is Load and How to exit from a Mutual Fund?

Load is a fees charged by an AMC which is a small percentage of the investment made. Usually funds charge 1% exit load when an individual redeems all unit before one year. Load varies across different schemes.

One can exit from mutual funds either by completing the formalities online or offline. It is quite easy to exit mutual funds.

Mutual Funds Vs Shares

For most investors, investing in equity mutual funds is more viable as they get the gains of stock investing with less hard work. However mutual funds carry a fee and are subject to certain constraints. Thus, investors who are willing to devote a reasonable amount of time to analysing and evaluating stocks may find stock investing more suitable.

Tax Implications

Only investment in ELSS funds up to ₹150000 qualify for tax exemption under Section 80C.

For equity oriented schemes, there is a long term capital gains tax of10% on gains exceeding ₹1 lakh. Long term capital gains apply to units held for more than 12 months. There is a short term capital gains tax of 15%. Short term capital gains apply to units held for less than 12 months.

For schemes other than equity oriented scheme, there is a long term capital gains tax of 20% and short term capital gains are taxed as per the individual’s tax slab. Here, long term capital gains apply to units held for more than 36 months and short term capital gains apply to units held for less than 36 months.

Risk associated with Mutual Funds

Capital protection is not guaranteed in mutual funds. Mutual funds invest in market linked securities hence losses are not inevitable. However, one can beat inflation if invested in good equity oriented schemes over a period of time.

How to invest in Mutual Funds?

One can invest directly by contacting an Asset Management Company. These AMCs offer direct plans which offer higher returns as they have a lower expense ratio. One can also get in touch with intermediaries who sell schemes of mutual funds. A list of intermediaries is mentioned on the Association of Mutual Funds of India (AMFI) website www.AmfiIndia.com

One needs to complete the Know Your Customer (KYC) process by providing relevant identity and address proofs.

“Systematic” Ways of Investing

Some systematic ways of investing and redeeming money from mutual funds are mentioned below:

- Systematic Investment Plan (SIP): It is an investment strategy where one needs to invest a fixed amount in a particular mutual fund at fixed intervals, for example, monthly, quarterly etc. SIP helps to average out the price. If one starts a monthly SIP, then each month an amount would be deducted from the investor’s bank account and it would be used to buy units of a mutual fund scheme. The number of units bought would depend on the Net Asset Value (NAV) of the scheme on that day. SIP helps people solve the problem of timing the market. It is a good way for capital appreciation in the future.

- Systematic Withdrawal Plan (SWP): This plan enables investors to withdraw a fixed or variable amount from the mutual fund scheme on a pre-decided date be it monthly, quarterly etc. SWP provides the investor with a regular income and returns on the money that is still invested in the scheme.

- Systematic Transfer Plan (STP): This plan allows investors to periodically transfer a certain amount / switch (redeem) certain units from one scheme and invest in another scheme of the same mutual fund house. Thus at regular intervals an amount/number of units that an individual chooses is transferred from one mutual fund scheme to another of the individual’s choice. This facility thus helps in deploying funds at regular intervals.

Company Deposits

Company deposits are deposits made by the public with companies. Just like in a Fixed Deposit, people hold deposits with the bank, here deposits are held with Non-Banking.

Finance Companies (NBFC). The Company pays a fixed rate of interest on the deposits. The interest rate depends on the amount and tenure of the deposit. Interest can be paid out monthly, quarterly, half-yearly or annually.

The company needs to get its credit rating done first from institutions like CRISIL, CARE or ICRA. The better the rating, more will be the belief of people in the company. It would also assure the people that they would get their money back. These deposits are governed by Section 58A of the Companies Act.

How to invest in Company Fixed Deposits

Offers for investment are announced directly by the company. One can invest in them either through brokers or directly, by applying online or offline. In order to invest, the application form needs to be filled first and Xerox copies of some identity documents need to be submitted.

Tax Implications

Principal and interest earned are fully taxable as per one’s income tax slab. There is no exemption provided for these deposits. TDS (Tax deducted at source) is applicable if interest exceeds ₹5000/- in a year.

Risk associated with Company Fixed Deposits

Getting back the principal along with the interest rate is not guaranteed. Some companies fail to service their debts. One should always make these deposits with companies which have a high credit rating. Their chances of defaulting on payments is very low. The interest rate offered by companies is not good enough if the inflation rate turns out to be higher than their rate. Hence, these deposits are not inflation protected.

These deposits are not highly liquid as well. Some companies do allow premature withdrawal, after charging a high penalty.

RBI 7.75% Savings Bonds

Before we proceed with the next saving instrument, i.e., RBI 7.75% Savings bonds, we need to understand the concept of bonds. So, what is a bond? A bond is a fixed income instrument that represents a loan from an investor to the borrower (in this case, RBI). Now, let us get the details of it.

RBI 7.75% Bonds offer 7.75% interest rate over a tenure of 7 years. The minimum investment has to be of ₹1000 and there is no cap on maximum investment. The principal is locked in throughout the tenure of 7 years for people under the age of 60. However, premature encashment is allowed for people above 60 years of age.

How to Apply for RBI 7.75% Savings Bonds?

The following documents are required to apply for RBI 7.75% Savings Bonds:

- Duly filled Application form.

- Identity proof like PAN card, Passport.

- Address proof such as Telephone bill, Aadhaar card.

- Age Proof Document Passport, Senior Citizen Card, a Birth certificate issued by Corporation or registrar of births and death, Voter ID card, PAN card etc.

This bond can be bought from banks and Stock Holding Corporation of India Limited (SHCIL) offices. It is not necessary to have a savings account in the same Financial Institution where the Bond is being bought from.

Interest Rate Mechanism

For RBI 7.75% Savings Bonds, the interest rate is 7.75% in payout mode and if compounded then the interest rate is effectively 7.90 % p.a. Compounding is done on a half-yearly basis.

Tax Implication

There is no tax exemption on the principal amount or the interest.

Risk associated with RBI 7.75% Savings Bonds

There is no risk involved as this bond is backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the investment, there would be no real returns available. Hence, it is not inflation protected.

54 EC Bonds

The next type of investment that we will discuss is a fixed income instrument that provides capital gains tax exemption under section 54EC to the investors and hence the name 54EC Bonds.

It grants the investor an exemption from the long-term capital gains (LTCG) tax arising as a result from the sale of land, building, or both. The tenure of these bonds is 5 years. One needs to buy a minimum 1 bond priced at ₹10000. The Face Value of each bond is ₹10000. One can buy a maximum of 500 bonds of ₹10000 each in a financial year. This is a totally illiquid bond as it has a lock-in period of 5 years.

How to buy 54 EC Bonds

These bonds are issued by NHAI, REC and PFC. These bonds can be bought directly from the issuers. Some banks are authorised to sell these bonds. One can also buy these bonds from the banks. To buy this bond, one needs to fill the application form first. A Copy of PAN Card along with some identity proof needs to be provided as well. These bonds can be held either in physical form or in demat form.

Interest Rate Mechanism

The interest rate is 5.25% payable annually on March 31 every year. This interest rate may vary across different bond issuers.

Tax Implications

To claim tax exemption with 54 EC bonds, the following conditions should be satisfied:

- A long-term specified capital asset, i.e., land or building held by the assessee for more than two years.

- The amount invested in 54EC bonds needs to only be to the extent of the capital gains on the asset and not net consideration received on the sale of the long-term capital asset.

- The amount exempted from tax under this section is the amount of capital gain or the amount invested in capital gain bond, whichever is lower, up to a maximum of ₹50 lakh.

- The capital gain should be invested in the capital-gain bond within six months from the date of transfer or sale of the specified capital asset.

- The interest income from 54EC bonds is added to one’s total income and taxed as per the tax slab applicable.

Risk associated with 54 EC Bonds

There is no risk involved as these bonds are backed by the Government of India. Principal and Interest are guaranteed. If inflation turns out to be higher than the nominal interest rate of the Bond, there would be no real returns available. Hence, it is not inflation protected.

Ready to master the A2Z of Finance? Enroll now to kickstart your journey in savings and investment with EC Bonds

Sovereign Gold Bonds

Similar to RBI 7.75 % bonds that we have learned earlier, sovereign gold bonds (SGBs) are also issued by the RBI. The only difference is that investors' earnings are linked with the return of gold. Also this bond scheme provides gold like returns along with some interest. This scheme has been launched by the Government of India. It was launched in tranches. The first tranche was offered in November 2015, second tranche in January 2016, third tranche in October 2017.

Gold bonds are issued by the RBI on behalf of the Government. Under this scheme, gold bonds are issued in multiples of 1 gram. The main objective of SGB is to encourage people to hold gold in electronic form rather than in physical form. This would eliminate the risk and cost of storage.

Gold bonds are held in demat form. One needs to buy a minimum of 1 gram of gold. Maximum of 4 KG of gold can be subscribed by an individual in a financial year. One needs to hold this bond for eight years. Exit options are available from the fifth year on the stock exchange. These bonds are transferable.

How to buy Sovereign Gold Bonds

These bonds can be bought from banks, post offices and Stock Holding Corporation of India. One needs to provide identity documents and get the bond issued thereafter.

Interest Rate Mechanism

The interest rate is 2.5% payable semi-annually on the initial value of the investment. But this interest rate can vary from particular issue to issue.

Tax Implications

The gains from redemption of this bond are exempted from tax if sold after completing full tenure of 8 years. If the bond is sold before completing 8 years then the seller has to pay capital gains tax.

Risk associated with Sovereign Gold Bonds

There is no risk involved on the part of interest payouts as these bonds are backed by the Government of India. Capital protection is however not guaranteed as the price of this bond is linked to real gold prices. If inflation turns out to be higher than the nominal interest rate of the Bond, there would be no real returns available. Hence, it is not inflation protected.

Gold Monetization Scheme

The next type of investment scheme that we are going to talk about is also related to gold which is the ‘Gold Monetization Scheme.’

This scheme allows a person to earn interest on the gold one owns. To avail this scheme, one needs to deposit gold in physical form. Interest is earned on gold weight. One can get back the gold either in equivalence of 995 fineness gold or INR. Method of redemption needs to be mentioned at the time of making the deposit. The banks lend out this deposited gold to jewellers at some interest rate which is a bit higher than the interest paid to the customers. As little as 30 grams of gold can be deposited in this scheme. One can opt for this scheme for either 1-3 years, or 5-7 years, or 12-15 years.

How to avail this Scheme

One first needs to get the gold tested for purity in a gold collection and purity testing centre. A certificate of gold purity and gold content would be provided which needs to be produced in the bank. This gold will be melted and one would not get back the gold in the same form in which it had been deposited.

Interest Rate Mechanism

The interest paid is valued in terms of gold.

For example, 1% rate of interest on 100 grams of gold would be 1 gram.

Tax Implications

The gains from this scheme are exempted from tax.

Indian Gold Coin

Indian Gold Coin is a part of the Gold Monetisation Program. It is the only BIS hallmarked gold coin in India. It has the national emblem of Ashok Chakra engraved on one side and a picture of Mahatma Gandhi on the other. The Indian Gold Coin is available in both, coin form with denominations of 5 gram or 10 gram and in bars of 20 grams. These bars and coins are tamper proof, of advanced security and of the purest form.

Conclusion

So, at the end of this module, we completed discussing the different types of savings and investments available to us. Besides, there are several other modules in ELM School that will surely enlighten your knowledge of financial planning.