Start your Investment Journey

Saving & Investment

Amit, a 26 something techie received a call from Sumit, a financial advisor regarding a new investment plan. Amit replied he did not see any need for saving & investment as he believed in living life to its fullest. Sumit understood that Amit needed some lessons on the concepts of Saving & Investment. He fixed up a meeting for a weekend morning. As expected, Sumit turned up and after introducing himself began explaining the following:

What is savings and investment?

In simple and general terms, savings is the surplus amount left from your income earned after deducting all the expenditures.

Hence, Savings = Income earned – expenditures incurred.

Investment, on the other hand, is done out of the savings made. This portion can either be invested in long term or short term investments avenues. Investments are intended to provide a cushion against future liabilities or otherwise. It can be for a child’s education, marriage, purchasing of a car, settlement of EMIs etc.

What is Investment?

The meaning of Investment is spending your time or energy on something anticipating income generation or value addition in the future.

For example: A farmer ploughs his field on a daily basis under the expectation that he may reap some returns in the form of grains after a specified period of time. This means that he invests his time and energy anticipating future benefits within a certain time frame.

Once you have read the aforesaid example, now you already know what an investment means, let us understand the term investment in terms of finance:

In finance, the meaning of investment is purchasing or creating an asset anticipating an interest income, rental income, dividend, profits or any combination of the mentioned returns. For example: I purchased 100 shares of a company anticipating a dividend from these shares. In this case, shares are my investment and I am anticipating dividend income from the investment made.

How is investing different from savings?

As mentioned before, savings is the amount left after meeting expenses and investment is done out of the savings made to meet future uncertainties or obligations.

While money kept in savings bank accounts will give interest, investment in mutual funds or any other dynamic investment avenue which is a blend of both equity and debt will give a value for money (read that investment can lead to growth of capital). This is where the main difference between savings and investment lies.

Also, while investments lead to wealth creation, savings is merely liquid cash.

Why should one invest / why planning for investments is necessary?

You should invest to get the required sum of money for any goal at the correct time. In other words, if you want to achieve your financial goals in life like creating an emergency corpus, retirement corpus, children education corpus etc. then you must start by making an investment plan which will guide you step by step as to how to achieve your goals.

You cannot expect to achieve your financial goals by following blindly the experience and products embraced/practiced by the previous generation. Cost of major milestones have risen manifold in the last 25 years with the growth of Indian economy (read high inflation). There is a good chance of funds shortage as and when your goals come up if you don’t have an investment plan in place right from the beginning.

When to start investing?

The legendary investor, Warren Buffet mentioned “I made my first investment at the age of eleven. I was wasting my life up until then.” Hence, there is no right age to invest. It all depends on your ability to take risk and the foresightedness to get going.

Practically, you should start investing as soon as you start earning money from your job or business so that you can get the benefit of starting at an early age and your money has a long time period to grow.

Amit suddenly realized that he had been working for little more than 3 years and did not have any substantial savings.

What care should one take while investing?

People have a tendency to invest by listening to others including the “so-called” experts on television, newspaper, magazines, neighbors, friends and relatives.

But it may happen that the stock which they are suggesting may be suitable for him/her but not for others since financial net-worth, risk taking capacity and time plays a key role in investing.

Saying a stock which looks a very poor investment in the short run could be a very good investment for the long term.

Hence, the right path would be either to give your money in the expert's hand or rather start with your own research.

A novice investor may face gains or losses initially, however, with experience he shall be able to build his own strategies and will be able to invest based on his own wisdom.

What are various options available for investment?

Market is flooded with different modes of investment. However, it depends on the risk aversion ability of the investor as to whether he invests in high risk options with greater returns, low risk options with moderate returns or no risk modes available.

Accordingly, the categorization can be as follows:

What is meant by Interest?

Interest is the cost of borrowing funds. It is the amount charged in percentage expressed as Interest rate. In other words, interest is the cost of renting money.

Suppose Mr. A borrows Rs. 50,000 at an interest rate of 5% p.a. Hence, the interest charged for borrowing the funds at the interest rate given will be Rs. 50,000*5% = Rs 2500/-

What factors determine interest rates?

Interest Rate is used to regulate Inflation by the central banks. Inflation is the continued increase in the general price levels of an economy. On the other hand; interest is the cost of borrowing funds. The explanation given below will make you understand that the primary factor affecting interest rate is inflation.

Let us discuss two main situations:

To cool down high inflation: the interest rate is increased.

When the interest rate rises, the cost of borrowing rises. This makes borrowing expensive. Hence borrowing will decline and as such the money supply (i.e the amount of money in circulation) will fall. A fall in the money supply will lead to people having less money to spend on goods and services. Hence, they will buy a lesser amount of goods and services.

This, in turn, will lead to a fall in the demand for goods and services. With the supply remaining constant and the demand for goods and services declining; the price of goods and services will fall.

As inflation is a continuous increase in the general price level of goods and services so a fall in the general price level of goods and services will lead to a decline in inflation levels.

In low inflationary situations, the interest rate is reduced

A fall in interest rates will make borrowing cheaper. Hence, borrowing will increase and the money supply will also increase. With a rise in money supply, people will have more money to spend on goods and services.

So, the demand for goods and services will increase and with supply remaining constant this leads to a rise in the price level i.e. inflation.

Discuss the various women centric financial products available in the market nowadays?

Basics of Investment Planning

What is the investment process?

Investment process means a series of steps taken to construct and manage your portfolio.

There are six steps in investment planning process:-

a) Determine what are your objectives

b) Decide a value for your objectives

c) Conduct security analysis :

a. Technical Analysis

b. Fundamental Analysis

d) Construct the Portfolio

e) Evaluate the Portfolio

f) Revision of the Portfolio

What are the factors that determine / affect your investment capability?

a) Family Information - no of earning members, no of dependent members , life expectancy

b) Personal information – age , employability , nature of job , psyche

c) Financial information – capital base , regularity of income (regular or contractual job)

d) Present worth- amount of assets already created and any liabilities undertaken

like any loans

e) Past investment experience (if any)

In short, it can be said that your risk appetite determines or affects your investment profile.

What are the fundamental rules of investments?

There are three fundamental rules of investments:

a) Start Early

b) Invest Regularly

c) Invest for a long period of time

Example:

Raj started investing money to the tune of Rs. 5000 pm diligently. He began this discipline at the age of 22 years of age. He was earning a rate of interest of 12% compounded each year. While his friend, Amrita started investing money to the tune of Rs. 10,000 pm. She was also doing this very religiously. She also earned 12% compounded. She started the process of doing the investments month on month, at the age of 30. What is the total investment adding up to at the age of 50 years of age?

As you can see from the table the cost of waiting / delaying for Amrita is Rs.37,63,806. Raj benefited from eight more years of compounded growth than Amrita.

Therefore it is very important to start investing early. The earlier, the better for your investments.

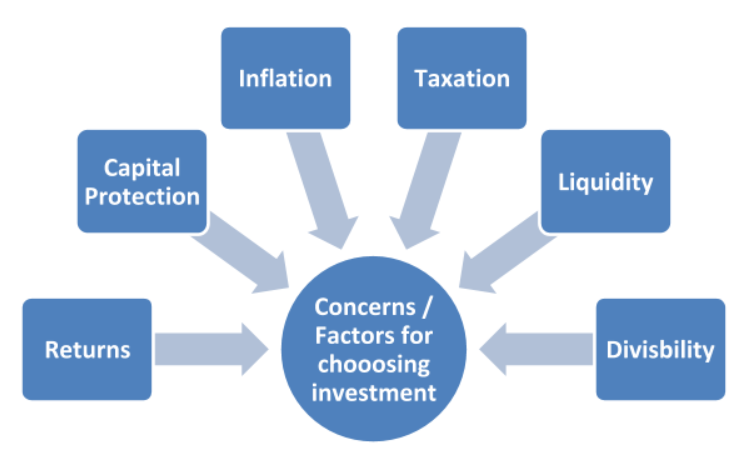

What are the investment concerns that need to be addressed, while investing and choosing the assets?

The most common concerns that needs to be addressed, while investing and choosing the assets are-

Returns

The return from the investment could be in the form of capital gains, cash flows, or both. A retired person might be needing regular cash flows to meet daily expenses, whereas a younger person in the working/accumulation phase might be more concerned with growth of his investment for creating a corpus for his retirement.

Capital Protection

The most important aspect of investment is to protect capital. Majority of Indians are risk averse. We feel investments are risky and thus leave most of our saved money in instruments earning low income, without understanding the effect of inflation, which reduces the value of our money every day.

Risk is part of our lives. There is risk associated with anything or everything we do. Even if we cross a road, there is a risk of meeting with an accident. Risk and reward go hand in hand, higher the risk, more is the reward expected.

Each of the investment assets has its own associated risk and reward/return, which one must understand before investing his money in any of the investment vehicles.

Inflation

By definition, inflation is the rise in the general level of prices of goods and services in an economy over a period of time. When prices rise, each unit of currency buys fewer goods and services, resulting in erosion in the purchasing power of money. The aim of investment is to get returns in order to increase the real value of the money. In other words your investment should be able to beat inflation.

Taxation

Income from our investment assets is liable to taxation, which is going to reduce our returns. You should remember that the real return (read positive return) from any investment product would l be the return after accounting for taxation and inflation.

Liquidity

It is the ability to convert an investment into cash quickly, without the loss of a significant amount of the value of the investment. If you would need a particular amount at a short notice then invest in an investment product with high liquidity.

Divisibility

This is the ability to convert part of the investment asset into cash, without liquidating the whole of the asset. Divisibility may be an important consideration for many investors, while choosing an investment vehicle. For example, while investing Rs. 15 lacs in senior citizen scheme, one could increase the divisibility without affecting returns by dividing this investment in ticket size of Rs. 2-3 lacs, rather than investing Rs.15 lacs in one go.

Before committing your capital to any investment vehicle, it is preferable to consider your financial needs, goals, and aspirations, as well as the risk profile.

What are the avenues for investments?

The various avenues where you can park your saved money are known as ‘assets ‘. In layman’s language or ‘asset class’ in investment parlance. Broadly there are four asset classes in India – equity, debt, gold and cash.

What are the various types of Assets?

- Financial Assets – cash, debt , equity

- Physical / Non-Financial Assets – commodities , real estate

- Alternative Assets – art objects, collectibles , precious stones and Gold,

Financial Plan – Concepts & Factors for Success

What is the time value of money?

You have won 10 lakh in a lottery. Given a choice, would you take the 10 lakh as a lump sum in one shot immediately? Or would you prefer to receive it in equal yearly installments of 1 lakh over the next 10 years?

If you are like most people, you will have taken the money immediately. And this is the right decision. This is because of the Time Value of Money (TVM) which is basically the power of compounding.

FV = PV x (1+R)^ n

Where,

FV: Future Value

PV: Present Value

R: rate of return

N: Number of time periods for which the money is invested

Money that is available today is worth more than money available at a later date, because you can invest it and earn a return / interest on it. So, for example, if you had 10 lakh available today, and you invested it into a 1 year Bank Fixed Deposit offering 7.50% in compounding mode, then in 1 year your money would be worth 10.77 lakhs.

The money you save and invest is the Present Value in your equation.

R is the available market rate of interest – this is not in our control – available investments offer certain approximate rates of return, and what you can do is choose your investment instrument carefully.

The only factor in your control is your N. You can increase your investing time horizon. The earlier you start investing, the higher will be your N, and the greater will be your money’s Future Value.

Power of Compounding is the Eighth Wonder of World – Albert Einstein

Explain - Disciplined and Regular Investing

The most convenient and easiest way to accumulate wealth is by investing regularly and in a disciplined manner.

This can be done with any of the asset classes mentioned previously. For example when investing into the debt market you can opt for a recurring deposit, or investing into equity you can go for SIP (systematic investment plan).

The asset class that grows your wealth the most over a long period of time is equity. Very often while investing, investors try to get the perfect entry and exit point of the market – which amounts to market timing which is very difficult even if not impossible.

Instead of timing the market, try to let your investments spend time in the market!

What are the benefits of investing via a Systematic Investment Plan (SIP)?

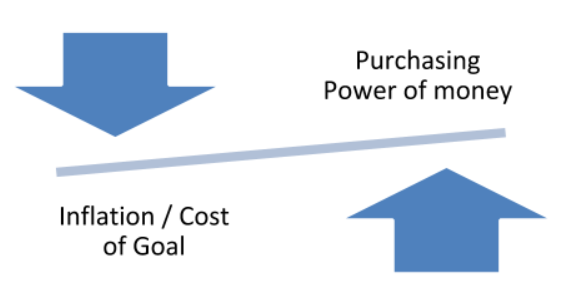

How inflation can affect your financial plan?

Purchasing power is the quantity of goods or services that one unit of money can buy. For example, Rs.100 can purchase much less today than it could purchase say 20 years ago. If your income level stays the same, but the prices of goods or services increases, then it essentially means that the purchasing power of your income has reduced.

This increase in the price level is called Inflation. Thus inflation is the increase in prices that erodes the purchasing power of your money. And this is the most important factor to account for when making your financial plan.

Example:

Mr. Prajwal Ingle has a 6 year old daughter. He plans to send his daughter to college for graduation at age 18 and post graduation at age 21, for which he will spend 10 lakhs and 25 lakhs respectively.

What corpus does Mr. Prajwal need to accumulate for his daughter’s education goals? Assume that inflation in college fees is approximately 10% p.a.

If Mr. Prajwal’s daughter goes to college at age 18 i.e. in 12 years, college fees at that time will be approximately 31.40 lakhs. This is the amount Mr. Prajwal has to accumulate in 12 years to send his daughter for the same standard of college education available today at 10 lakhs. Similarly, for his daughter’s post graduation, in 15 years Mr. Prajwal needs to accumulate approximately 1.04 crore to give the same level of postgraduate education available for 25 lakhs today. This is the effect inflation has had on college education fees.

What is the importance of Asset Allocation?

Asset allocation is a simple concept which means allocating your investments across various asset classes so that the poor performance of any one asset does not affect the overall performance of the entire portfolio.

Different asset classes are differently correlated with one another. For example, when equity does well, debt or gold may not do well, and vice versa. It is this different correlation that makes asset allocation such a critical component of financial planning.

Asset Allocation depends upon the following factors:

- Your risk profile (appetite and tolerance)

- Your financial goal time horizon

Usually, determining the right asset allocation for you is best done by your personal financial planner.

Example:

Consider two persons: Mr. Kautav and Mr. Anand.

Mr. Kaustav is a 30 year old male who is married and has no children. He wishes to plan for his retirement, and so his goal time horizon is 25 to 30 years.

Mr. Anand on the other hand is 45 years old, married and with a 10 year old child. His goals include buying a house i.e. accumulating a down payment in 5 years, sending his son to college in 8 years, and planning for his own retirement in 15 years.

Asset Allocation for Mr. Kaustav and Mr. Anand is given as follows:

Mr Kaustav already has his own house and hence his allocation to real estate is simply the value of his own home.

Mr. Anand is buying a home for which he is accumulating down-payment funds. When he purchases the home he will be buying real estate and hence adding real estate to his asset classes. He has a lower exposure to equity due to the higher number of goals, their comparative nearness in terms of years, and his higher age which reduces his risk appetite and tolerance.

Mr. Kaustav on the other hand has higher exposure to equity, a riskier investment, because his only goal is retirement, and the time horizon of the goal is 25 to 30 years i.e. long term.

Remember, asset allocation is not a one-time process. It is not static, but dynamic. As your goal draws nearer, it is important to reassess your asset allocation and withdraw from risky investments – to de-risk your goal’s portfolio.

You can decide what your asset allocation should be for each of your goals. Here are some guidelines you can follow in deciding asset allocation:

- If your goal is more than 10 years away, you can invest up to 70 – 75% of your investible funds into equity, depending on your risk profile. The remainder of your investment can be put into debt (15 to 20%) and gold ETFs (around 10%).

- As your goal comes closer, for example when your goal is 6 years away, you can maintain an asset allocation of 60% in equity, 30% in debt and 10% in gold ETFs.

- When your goal is less than 3 years away, it would be wise to not expose the corpus to equity market volatility. Maintain a 100% exposure to fixed income instruments.

Remember, those investors who were invested in equity when the markets crashed in 2008 and in early 2018, and had a goal such as their child’s education or their own retirement less than 3 years away, have had to watch their goal funds get eaten away in the market crash. They also may not have had enough time to rebuild their goal corpus. This is why it is absolutely essential to de-risk your goal portfolio as your goal draws nearer.

What’s your risk appetite and risk tolerance?

Risk appetite simply refers to how much risk one is willing to accept. Risk tolerance indicates how much risk our finances can actually handle. The two might be very different.

Example:

Mr. Arka Roy is a young man, married with a child. His risk appetite may be high. This may be based on his investing tendencies, in case he has done well with equity in the past he is confident to do well in the future also and hence has a high appetite for risk.

However, based on his financial situation which comprises factors such as the level of emergency fund he maintains, if he has any loan EMIs that are chipping away at his income and so on, his risk tolerance might be very low indeed.

You should assess your own risk profile to know where you stand compared to your own risk appetite and risk tolerance.

Risk profiling is an exercise to determine how much risk is appropriate for an investor.

Risk profile is subjective. Few persons have the ability or objectivity to determine their risk profile appropriately. This is done by asking several questions as part of a structured data gathering exercise. Examples of few such questions are:

What is your age?

A young investor will have a higher risk taking capability than older person due to sheet fact that he has more time on his side

How many earning members are there in the family?

If the number of earning members are high then risk taking capacity goes up but if there is only one earning member then he can have lower risk taking capacity.

How many dependent members are there in the family?

How stable are the income streams in the family?

If the job is a permanent full-time one as compared to a freelance consultant then the person will be having a higher risk taking capacity .

What is the level of the investor’s current wealth, in relation to the fund requirement for

various needs?

Already if the investor has gathered substantial asset then he can take on higher risk,

What is the liability and loan servicing requirement of the client?

If the investor has single or multiple loan EMI running then a major portion of income gets eaten up by such liabilities leaving little surplus for investing and taking risk.

If the market were to fall down by 10%, how will you respond?

The investor who believes in increasing his position when the market falls is obviously comfortable with risk and losses. If a market fall were to trigger an exit from the investment with whatever can be recovered, then the investor is not a candidate for risky approaches to investment.

Such questions help in understanding the psyche of the investor and accordingly asset allocation is customized for the investor.

How to plan for your life-stage?

You must have heard the thumb rule of how much to invest in equity. It states that you should have (100 - Your Age) % of your net wealth in equity. So if you are 40, you should have 60% of your net wealth in equity.

But is this necessarily correct?

Your equity exposure depends on the proximity to your goals, and it is very doubtful that anybody has only 1 financial goal in their lives. So a single equity percentage based on your age cannot apply.

Two generations ago, life was comparatively much simpler financially. You would go to school, maybe to college, get married in your 20s, have children by your 30s, work in one company for almost your entire working life, buy a home on retirement, and retire peacefully by 60.

Things are different now. Creating a successful and powerful plan for your financial life in today’s times has very little to do with your age and a lot to do with major life stages / events when you make the plan.

Let’s see what these life stages / events are and what the best approach is to deal with your finances in each one.

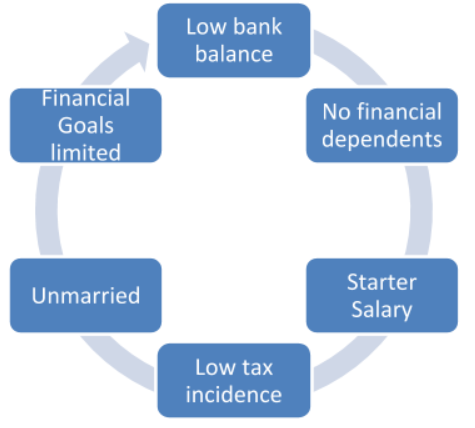

Stage 1 - Your First Job

You’ve graduated and just got your first real job. A critical concern at this time is managing your cash flow.

Start saving

Although you might feel like you don’t have the money, even saving 10% of your income per month is enough to start planning for your retirement. If you’re 23 years old and in your first year of working you manage to save and invest Rs. 24,000 (Rs. 2000 a month for 12 months), then at a growth rate of 15% per annum this Rs. 24000 will grow to Rs. 36.75 lakhs by your age of 60.

Insurance

you most likely have no financial dependents at this time so you might not need life insurance, but you should definitely opt for health insurance. This has dual benefits - firstly, your health is insured and this is most important. Secondly, you can claim a tax deduction of the premium paid, under Section 80D.

Tax Efficient Investment

If your salary brings you into the 5% or 20% tax bracket, the first thing you should do is avail of Section 80C deductions - invest into an ELSS fund (equity exposure) and into your PPF / EPF account (debt exposure). The limit is Rs. 1.50 lakh under Section 80C.

Contingency Fund

Start building up a contingency fund for use only in case of emergencies. Typically this should be the equivalent of 6 to 12 months of your monthly expenses - depending on your personal risk appetite. Set this aside into a liquid mutual fund to earn a better rate of return than your savings bank account. But remember that the aim of this fund is to enable liquidity of money and not just high returns.

If any equity investments are done at this stage and held for a long period like 5 – 10 years or even more would most likely generate a high rate of return, and therefore beat inflation. At this stage of life, equity can be taken for the long run.

Stage 2 - Getting Married, Having Children, Life Goals Increase

Insurance

The first thing you should do is checking your life insurance requirement. Buy life insurance in the form of a simple term plan and not any other type of product. The premium for a term plan is the lowest; the cover you will get for this premium is the highest. This is the best way to protect your family in case of your untimely demise, especially if you also have any liabilities like a home loan / car loan.

A financial planner can help to do an exact assessment of your insurance requirements and suggest the most suitable policy from the universe of hundreds of policies. Also, for health insurance - take a family floater that covers your dependents. Ensure that you have sufficient cover for each member of the family, considering that medical costs can be quite high these days.

Different Kinds of Loans Available and How to Ensure You Don’t Over-Borrow

Unsecured Loans - An unsecured loan refers to any kind of loan that is not attached by a lien on any of your specific assets. This means that in case you default on the loan due to bankruptcy or any other reason, the unsecured debt lender does not have the right to claim any specific asset. Example - credit card debt & personal loan

Secured Loans - A secured loan is one where you, the borrower, pledge some asset of yours as collateral to the loan. In case of bankruptcy / any other reason for defaulting on the loan, the lender has the right to take possession of the asset and sell it to recover some of his loss. Example - car loan & home loan.

Thus there are many options of loans and different lenders (from banks to housing finance companies to your relatives), which can help you take a loan when you need one. Now you face the question of how to ensure that you don’t over-borrow and put a strain on your finances.

A simple way to check whether you are over-leveraged or not is to find out your Debt to Income Ratio.

Formula = Sum of monthly outflows / EMIs / total fixed monthly income

Ideally, this ratio should not be more than 30%, else you might be exerting strain on your income to service your debt.

How to Build your Wealth with a Loan?

Taking a loan can be a great way to build your wealth provided you know how to use it smartly within the laws of land. For example home loan & car loan can help you achieve the financial goal of buying a home or a car (by making payments over a period of time) without having to wait and save enough to make an outright purchase by paying in lump sum mode.

In the case of home loans, there are tax benefits both on principal repayment and interest payment.

Since you are not going to pay in lump sum but via EMIs so it provides a way to build an appreciating asset like a residential flat.

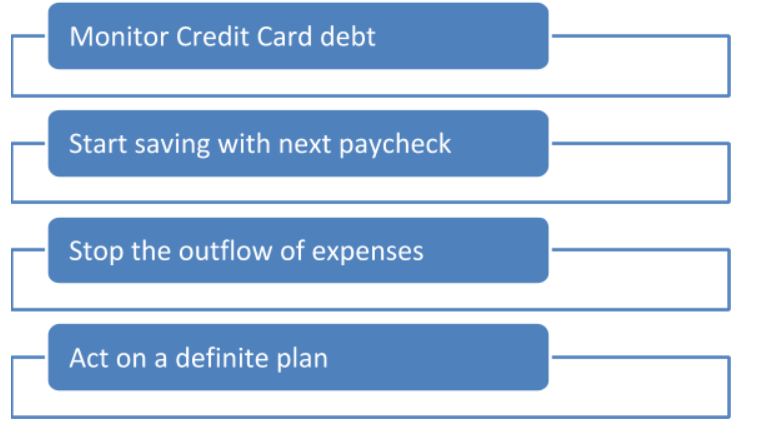

How to save to buy a home?

You can follow the steps given below to ensure savings to buy your dream home:

Don’t let credit card debt suck you dry

If you have a large amount of debt then there is no point trying to save money as the interest you’ll be paying on your loans will far outweigh any return you will see on any savings. You need to get rid of your accumulated debt first.

Also, before you take a home loan, you should put yourself in a position where you do not have any other debt to service. Not only will that free up cash to service your loan but you will be able to take a higher loan simply because you are not bogged down by other such payments.

So the first step is to clear your personal loans and credit card debt.

Start saving with your very next paycheck

You can start investing in an equity fund if you plan to take loan years after some years. Start a systematic investment plan (SIP) where a small amount gets channelized every month towards an equity mutual fund. If you do not have a long way to go, opt for debt mutual funds and select that type of debt fund which matches your time horizon and risk appetite.

Stop the outflow of expenses

Curb your expenses and you will be surprised at how the small savings add up. You can start by eating at home. Reduce your eating out budget and you will see what a big saver that is. Not to mention much healthier. Cut down on cigarettes and alcohol too. Not only will you be healthier but even richer. Cancel unnecessary magazine subscriptions. All these small moves will impact your bank balance positively.

Act on a definite plan

Do you have an idea how much the house is going to cost you? For instance, if you plan to buy a home that costs around Rs 50 lakh, then you will have to ensure that you have Rs 10 lakh as a down payment. So work with definite figures or else your savings may fall way below the actual amount that you need.

Also, work with a time frame. Do you need that amount within a year or within five years? Once you determine that, the actual investment avenue can be determined.

What is an EMI and how are EMIs calculated?

The Equated Monthly Installment, or the EMI, is the amount of money paid by borrowers, each calendar month, to the lender, for clearing their outstanding loan. Generally, EMI payments are made every month on a fixed date, for the entire tenure of the loan, till the entire outstanding amount has been completely repaid. The EMI depends on the loan amount, the rate of interest and the duration or the time of repayment of loan.

Home loan providers offer different varieties of loans that are designed to fulfill the diverse needs of home buyers. But, before opting for the right one, it is important to understand the most integral part of any loan, and that is EMI. So, let us understand the composition and how is EMI calculated?

The Components of Equated Monthly Installment (EMI)

When the loan starts, the interest component is very large, and the principal component is very small. Every month, the interest component becomes lower than the previous month, and the principal component becomes higher than the previous month.

As the loan matures, and as the principal gets paid, the outstanding loan amount reduces.

The EMI is an unequal combination of the principal and the interest.

The EMI amount is a fixed amount each month, except in the following cases:

When the borrower prepays a part of the loan, the lump-sum amount prepaid gets adjusted against the outstanding principal balance, thereby reducing the EMI. The borrower in this case also has an option of maintaining the EMI while increasing the loan tenure.

If the borrower has opted for a floating rate loan, fluctuations in home loan interest rates during the loan tenure will alter the EMI.

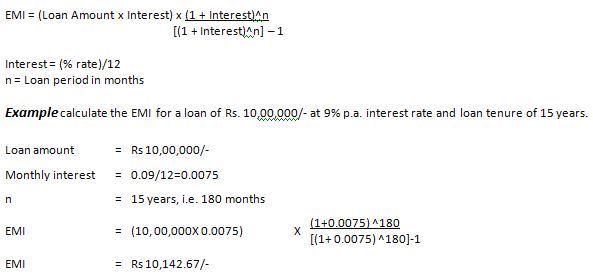

Calculating EMI

Mathematically, EMI’s are computed using the formula mentioned below.

This EMI of Rs 10,142.67 is a combination of both the interest and principal portion of the loan, to be paid every month.

Rising Loan Interest Rates – What should you do?

The most common option when the interest rate goes up is to either increase the EMI or increase the tenure of the loan. But there are other options too besides these as mentioned below:

Increasing the loan tenure and keeping the EMI constant

When interest rates rise, a sudden rise in EMI could be quite a pinch especially for individuals in tight financial conditions, those with more than one debt and those nearing retirement. At such times, keeping the EMI constant and increasing the loan tenure works out as an ideal option.

Lenders accommodate the interest rate increase in the increased loan tenure and retain the monthly outflow at the same level. However keep in mind that by doing so in the long run, you end up paying more interest for your loan.

Increasing the EMI, with the same loan tenure

For those who can afford it, go for a higher EMI and maintain the same loan tenure. This is because, by increasing the EMI and retaining the same loan tenure, though the monthly outflow is higher, the total cost of the loan works out to be much lesser.

Loan Prepayment

For many borrowers, loan prepayment could be the last option in times of high interest rates, as it primarily depends upon the liquidity position. When going in for a prepayment, remember to check on the prepayment charges the lender would quote. Consider prepayment only if the cost of prepaying the loan works out to be much lesser than the rise in interest rate.

Loans could also be part prepaid. By doing so, the loan principal value comes down, thus reducing the total interest amount you’ll pay. The EMI would reduce, or at least, the same EMI would remain even after an interest rate increase. Some banks may not even charge a penalty for up to a certain percentage of prepayment. A combination of a part prepayment with a marginal EMI hike could sometimes work out as an ideal option, if funds are available to do so.

Now comes the big question - when is the best time to prepay a loan?

This question is quite relevant for home loans, as the amounts (and thus, the interest) involved is very large. Towards the end of a loan, you are mostly paying the principal and very little of interest. Whereas towards the beginning of a loan, you are mostly paying interest, and very little in terms of repaying the principal. Therefore, if you repay the loan towards the beginning, you would be saving a lot more on the interest than if you repay the loan towards its end.

Loan Refinance

Loan Refinancing is replacing your existing loan, with a new one, under fresh terms and conditions. When interest rates rise, switching over to a lender who is offering a reduced interest rate, could serve to be a good deal. For a charge, you could switch over from a fixed to a floating rate, or vice versa.

Many lenders are more than happy to attract borrowers by lowering their interest rates. However this process does not come easy. Be ready for a lot of paperwork along with foreclosure charges, and processing fees.

Why It Is Sometimes NOT Better To Prepay Your Loan?

It is not necessary always that prepaying make financial sense. Simple reason is the opportunity cost of your money.

For example, if you have a loan which is charging you interest at 10% p.a., and you suddenly come into some surplus funds which you can either use to prepay full or part of your loan, or to invest, the first thing you should do is check the opportunity cost of these surplus funds.

Would it make more sense to prepay the 10% interest loan, and thereby save yourself from paying the 10% interest? Or would it make more sense to invest the funds into an investment product that can generate more than 10% return - based on your risk appetite and time horizon?

So remember, if there is an investment instrument which would give you a long term rate of return that is higher than the rate of interest you are paying on your loan, it makes financial sense to invest the funds and earn the higher rate of return, than to prepay the loan (in full or in part) and save yourself the lower rate of interest.

What to Do When You Find Yourself in Too Much Debt?

If you find yourself in a situation where you feel like there is too much debt to handle and you need to get out from under the debt as soon as possible, there are some simple steps that will certainly help:

Do Not Increase Your Liabilities If you find that you are already stretched, you may find that well-wishers are advising you to take another loan to pay off your existing loan. You would simply be delaying the time when you do have to sit down and pay off the debt.

Do not add to your existing liabilities by taking on more loans. Once the existing liabilities are cleared, if you find that you need to take another loan – make sure it is easily serviceable by your existing, fixed monthly income, and the terms (tenure, rate of interest) are suitable to you. This should be done only after your existing liabilities have been paid off.

Take Stock of Your Liabilities Maintain a Personal Budget. This simple and oft ignored tool is an excellent resource in your battle against debt and by maintaining a good personal budget, success against debt is achievable.

A personal budget will help you discover the following:

Your exact cash flows, your fixed monthly incomes and all your monthly expenses. Once you know your expenses, you can see where you are spending on luxuries – and rationalize this portion. Spend on the necessities only, save the rest.

Calculate an approximate figure of how much extra money you can save each month – and allocate it towards a debt repayment fund.

Your exact liabilities You can track exactly what debts you have and all their details.

Create a table which contains all details of the various loans taken, loan type, each loan’s outstanding tenure, EMI, rate of interest and outstanding amount. The rule to be followed is pay off the highest interest rate debt first.

Loans restructuring can be done in two ways. First, restructure your loan for a lower Interest rate. Second, refinance your existing high rate loan by taking a fresh loan at a lower rate.

Contingency Fund

Now, you need to assess your contingency (emergency) reserve. This should be 6 to 24 months of your monthly expenses, including EMIs if any. Hold this in a liquid mutual fund scheme. This should be used only in case of a financial emergency, which can occur at any time. Do not use this for big ticket expenses like contributing to a new car or a vacation. You never know when an emergency might occur and how much cash you will need. Think credit crunch year 2008.

Achieve your life goals with the right asset allocation

For this your financial planner has to take into account your risk appetite and tolerance, your cash inflows and outflows, your life goals and their priorities, your existing assets and liabilities, and create the optimal financial plan for you.

The outcome of the above exercise is asset allocation suited to you - how much to invest into each of the asset classes – equity, debt, gold and cash, and in which specific instrument, so that you achieve all your life goals like purchasing property, your children’s educations and marriages, your own retirement, family vacations and so on.

Your planner will also ensure that as your goals approach, your goal corpus exposure is shifted from equity (unsafe, high risk) to debt (safe, low or no risk) instruments. This protects the corpus that you have built. Thus your equity exposure depends on the proximity to the goal and will be different for each goal that you have.

Follow your plan and remember to invest regularly into the markets, through ups and downs. Staying in the market is the key to successful long term investing.

Make a Will

It is also prudent to have a Will in place. In case of your untimely demise, your Will ensures transfer of your wealth as per your wishes mentioned in the document, your beneficiaries get access to your assets without spending too much time and money.

Beneficiaries get these assets either tax-free or pay tax at a lower rate than they would have paid in case of getting these assets without a Will. Also, they would have to run from pillar to post to prove their legitimacy thus spending lots of time along with money in case there is no Will.