Succession Planning

Introduction

What is Succession Planning?

“In this world nothing can be said to be certain, except death and taxes.”

Succession planning in simple terms refers to the passing of assets and investments down from one generation to another. You can decide how much of your estate whether it be property, cars, shares, bonds, Gold, mutual fund units and other financial investments, etc. Its core objective is also to distribute wealth in a predetermined manner to a certain beneficiary or beneficiaries to whomever the owner wishes. It is a dynamic exercise that needs to be reviewed at regular intervals to include any changes that might happen in our life or in the applicable laws of the country.

What is the need for Succession Planning?

- Dying intestate (i.e. without a legal Will in place), can lead to various complications like bickering and serious disputes among family members potentially destroying peace and happiness.You might have read about family battles in the media fighting it out in the courts over the estate of the deceased.In most cases, they turn out to be a painful and traumatic experience of settling a will for the various litigants involved.

- In fact, the situation of families suffering financially due to not getting access to the deceased’s assets is repeated over and over again in thousands of homes every year and the courts take years to resolve the issue.

- If you look around yourself, you are sure to find many real life examples which would make you feel that this situation is like “Kahani Ghar Ghar Ki ” prevailing in several homes but still people in India do not plan for succession.

- The social and family structure in India is increasingly turning nuclear and the number of the affluent rises thanks to the India growth story and aspirations of the next generation vary from the previous one.

- Today, professionals earn more but at the same time the incidence of divorces has increased, which creates an apprehension of the family wealth going to outsiders.

- There is a need to cater to their overall wealth planning for their dependents.

Example:

The battle over the late Priyamvada Birla’s Will, in the year 2004, brought to the surface the crucial role played by a Will and the importance of succession planning.

There are several other celebrity cases that have been doing the rounds of the media, where siblings fight each other over the succession of the deceased.

Thus, in our next unit we will discuss the necessity of involving family in financial matters especially in succession planning.

What Is The Need To Involve Your Family In Financial Matters?

It is important to involve your family in financial matters like succession planning and discuss with them in-depth because it is a very crucial aspect in their life.

The following points will help you recognise the importance of discussing your financial affairs with family: -

Involving your spouse:

- In our country, most financial decisions are taken by the head of the family. In this process, the views of the spouse (usually the wife) are generally not taken into account.

- Although it may sound irrelevant to you, it is important to include your better half while creating or reviewing your financial plans.

Her opinions about various subjects can bring a great deal of clarity and another perception to you while thinking about the long-term financial needs of your family.

Creating awareness among children:

You would agree that children learn a great deal by observing. Many of you would see that today’s generation are very smart and are fast learners. They have the acumen and inquisitiveness to learn.Therefore, discussing with them will create curiosity in their mind and help them understand financial matters better. Schools and Colleges today are educating children on personal finance.

However, as a parent it is vital that you too involve children while making financial decisions for the family, especially the ones that will affect them, and inculcate in them the value of money.

Financial independence:

Involving your family in financial matters can help them become financially independent and confident in the long run. It will help them to appreciate the importance of budgeting, financial planning and succession planning.

Remember that while you involve your family, pass on all vital information to your family members. Also, be open and honest regarding the financial history of the family. Let your experiences, whether favourable or unfavourable be a teaching lesson for them. This will avoid the confusion and tension that may occur in the future

You must understand that discussing money matters with family is not a taboo. Thus, start sharing all financial issues with your family before it's too late.

If you are not confident, take help of an expert who can guide you and your family.

Debunking The Myths About Succession Planning

People are under many illusions when it comes to succession planning. Here are a few common myths or wrong notions they possess in their mind-

Myth 1: Succession planning is meant only for the wealthy

Fact: It is essential for everyone, and ensures that your hard-earned assets are passed on to those you wish to. So, irrespective of the quantum of wealth owned and the society or economic class you come from, succession planning is important.As it potentially avoids the bitter disputes amongst loved ones later and leads to peace of mind and happiness.

Myth 2: Succession Planning should be thought of only after retirement

Fact: Life is unpredictable and uncertain and hence, the earlier one thinks through and plans, the better it is. Ideally, you should begin succession planning when your children are young and your assets are also growing like when you are between 35 to 45 years of age or when you are between 45 to 55 Years. If you die an untimely death due to an accident or some disease without making a succession plan, then your family can suffer a lot.

Myth 3: My legal heirs will handle it maturely

Fact: You could be day dreaming if you think that your heirs know how to access your assets in absence of any succession plan or proof left behind by you. In most cases, the situation becomes acrimonious between different family members who fight with each other in the courts to get their share of your estate. This type of situation can be avoided if your heir happens to be a lawyer or law expert but this is not the situation in everybody’s family.

Myth 4: I have registered my nominee(s); they will anyways be the beneficiaries of my assets

Fact: This is not true in most of the cases. Most people in India feel that adding a joint account holder or doing a nomination is enough for succession planning. But the fact is that the nominee is just a trustee of the assets only for time being, to whom the Bank or any financial institution will transfer the monies in case of the death of the holder of the assets. But this does not mean that the nominee will always be the owner of the assets. The owner of the assets will be the legal heir as per a Will, or if one has died intestate (i.e. in the absence of a Will), the transmission would be as per the country's succession laws.

Myth 5: I don't need to seek legal opinion

Fact: You should hire the services of a wealth adviser, a chartered accountant and a trusted lawyer to see the process through. This is to ensure that succession planning is done legitimately considering the nitty-gritty involved. It is highly unlikely that you are equipped enough to draft a proper succession plan by yourself. Nowadays, there are many websites which make will and other types of succession plan at a cost. But this option is for very savvy people only. Succession planning, if done in a systematic way, can prevent financial and legal grief after death.

Tools For Succession Planning

There are several tools that are used for family succession or inheritance planning. They are highly customized and depend a lot on the individual's finances. Some of the common ones are as follows–

Finding the appropriate way for succession planning is a customized task that involves a mix of different tools that are mentioned above. You should probably set up a meeting with your lawyer and Chartered Accountant and share everything about your family and the objectives that you want to achieve through succession planning.

What are the laws applicable to succession planning?

Nominee

Previously, while discussing myths of succession planning, we have learned that the nominee is considered as a trustee of an asset but may not be the beneficiary. In this section, we will learn and understand the importance of nominations in succession planning.

Nomination

a) A nominee is the trustee of your assets, to whom the bank or any financial institution (mutual fund, insurance company and so on) will transfer your funds in case of your death.

b) Often, individuals think that nominees are their legal heir. But actually that is not true.

c) The owner of your assets will be your legal heir as per your Will, or if you have died intestate (i.e. in the absence of a Will) the transmission would be as per the India’s succession laws.

- Nominee is only a trustee

- Nominee may not be always the legal heir

- Legal heir as per the Will

Beneficiary in case of different assets :

Financial assets

- For most financial assets such as (mutual fund investments, bank accounts) and so on, a nominee is not compulsorily or necessarily the beneficiary, but only a trustee responsible for distributing the assets to your legal heirs as per the Will or Succession laws.

- For some financial assets such as shares, the nominee can be the owner of the assets after your death and not the legal heirs. In 2010, the Bombay High Court passed the judgement on the 'Harsha Nitin Kokate' case that the nominee would inherit the shares and not the legal heirs.

- In 2015, in 'Salgaonkar-Ghatalia' judgement the above mentioned was overruled by Justice Gautam Patel of the Bombay High Court and upheld the view that rights of the heirs supersede that of the nominee.

- For E.P.F.(Employees Provident Fund) it is the nominee and not the person stated in the will, who inherits the amount. In fact, according to the rules, you cannot nominate any person other than a family member to your EPF account, unless you do not have a family at all.

- To address this kind of ambiguity and to avoid the court battle, a way out is to appoint the intended beneficiaries only as nominee.

It is also advisable to write a clear Will, which shall automatically supersede everything else.

Insurance

- There are different categories of nominees in case of insurance.

- A category called 'beneficial nominee' wherein if you nominate someone as your beneficiary nominee, such nominee does not have to share insurance money with another legal heir. A policyholder can appoint multiple 'beneficial nominees' mentioning their share.

- Another category 'collector nominee' is also there wherein the person mentioned will simply receive money from the insurance company and facilitate the transmission to legal heir which may happen based on succession laws.

- A nominee has a right to claim money even at maturity in case an insured person survives the term of insurance but dies before claiming the maturity benefits.

Property

- The nominee may not be the ultimate beneficiary of the assets but may be required to pass them to the legal heirs. In cases where the nominee is not willing to pass the asset(s) to the legal heirs, can be taken to the court. The legal heirs then would need to back up their claims by producing a succession certificate or a probated/registered Will.

- So, in order to transmit your assets to your loved ones smoothly, you should nominate your intended beneficiaries only as nominees to avoid confusion and also make a Will and state the name of your beneficiaries for every asset in a clear manner in your Will. In the absence of this, someone else can make a claim on your assets and your family might have to go through time consuming, exhaustive and costly legal procedures to get possession of assets which are rightfully theirs and may result in a lot of fighting at the time of distribution of assets.

Simply nominating a person at the time of creation of an asset does not necessarily make that person the beneficial owner of the asset after your death.

Every asset is governed by different laws which might change over time. Therefore, succession planning needs to be undertaken carefully to ensure easy transfer of wealth.

Nomination vs. Assignment

Earlier, we learned the importance of the nomination for different assets. But in succession planning, there is a similar concept called Assignment, which is basically a legal term whereby a person, the assignor, transfers rights or benefits to another, the assignee. Let us now discuss a few differences between nomination and assignment.

- In case of a life insurance policy making nominees is restricted to immediate family members such as spouse, parents and children as the ultimate beneficiary so that the insurance money can go to the intended recipient.

- Nomination is a right given to the policyholder to appoint person(s) to receive the money in case of the demise of the holder. One can appoint multiple individuals as nominees and can also specify their shares of the policy proceeds in percentage terms.

- In case of an assignment of a life insurance policy, the nomination automatically stands cancelled.

- An assignment of the policy automatically transfers the right of the policyholder (assignor) and his/her nominee to receive the sum assured on death of the policyholder or on maturity of the policy to the assignee.

- Assignment must be in writing and a notice to that effect must be given to the insurer. But the catch is that once the assignment has been done, it cannot be revoked. After assignment, the assignee will be eligible to receive the proceeds from the policy, and not you, even if you survive the tenure, (unlike nomination).

- The assignment of life insurance policies can also be used as collateral while taking a loan. If an insurance policy is assigned to the lending bank and the policy holder expires during the tenure, the insurance company shall pay the outstanding loan amount to the bank and the remainder (if any) will be paid to the legal heirs of the policy holder.

In this case, if the holder survives the tenure, the bank will reassign the policy back to him/her.

Next, let us learn some other concepts that are heavily used in succession planning:

Joint Holding Account

- When you open a bank account or any other investment account then you are given a choice to hold it in either ‘Single’ mode or ‘either or Survivor mode’ – this is the joint mode of holding the investments or bank account.

- It is better to hold joint accounts with your spouse. Such joint accounts hold signatures of either holder valid to carry out a transaction.

Having a joint account with your spouse and nominating your child is a good way to ensure easy transfer of your financial assets as the surviving members get seamless access. - If both account holders die, the nomination helps the child to get immediate possession of funds.

Power of Attorney (PoA)

- It is a legal authority given by one person (donor) to another (donee) to act on his behalf.

- A PoA can be general, which enables the donee to carry out all deals on behalf of the donor, while a specific PoA is given for a particular purpose.

- A PoA can be revocable or irrevocable.

- A PoA can be misused if given to an unsuitable person. Moreover, it is not a substitute for a will as it ceases to be valid immediately on the donor's demise.

Transfer of property & Mutation

- Transfer of property refers to the process of shifting the title of the property from one person to another.

- Both movable and immovable properties can be transferred.

- Property can be transferred through various means like sale or under a Will.

- Once the transfer is done, the new owners must do mutation which simply means getting the immovable property registered in his/her name in the records of the municipal corporation or land revenue department.

Life insurance

- Life insurance serves a very good tool for estate planning apart from providing risk cover.

- This is because of the reason that one has to pay lesser premiums in total when compared to the sum assured the beneficiaries can receive.

- Generally in the case of insurance the earlier one starts the more benefits one will get in terms of lesser premiums.

- Term insurance and whole life insurance specially serve as good estate planning tools for the simple rule that they offer protection for the whole family apart from building an estate.

Will

You probably heard of the term Will quite a number of times when any topic of Succession Planning arises. In fact, in the earlier units of this module, there are many occurrences where you read about Will. It is a very important concept when it comes to Succession Planning. So, without any further ado, in this section, let us discuss the concept of Will:

What is a Will?

A will is a legal document that expresses a person's wishes, who is known as the testator as to how their property or the estate is to be distributed after their death.

Simply put, a Will is a written document in which an individual specifies how his/her wealth should be distributed or utilized after death.

Benefits of writing a Will:

- Provides the testator an understanding of his/her current financial status and even an opportunity to improve in the remaining life span.

- Brings clarity about passing of assets among loved ones.

- Avoids disputes within the family and ensures proper distribution is done thus preventing financial and legal hassles later on.

- Enables provisioning for minor children and children with special needs as per your wish

- Possible to Enables to disinherit some relatives who are troublemakers

- Helps address transfer of digital assets

- Helps address transfer of offshore assets

- Can specify funeral wishes

- Can specify wish to donate organs

- Ensures peace of mind and happiness

We will focus on some of the disadvantages of not writing a will in the next unit.

Who can make a Will and when?

- Any person who is above the age of 18 is eligible to make a Will. He should be of sound mind i.e., capable of understanding his actions and should be free of any influence at the time of writing the Will.

- As soon as a person is 18 years old he should write a Will. As we live in uncertain times where people meet untimely death due to accidents, heart ailments or other lifestyle diseases and even terror attacks.

- Do not wait to create lots of assets / wealth till you turn old like 60 – 65 years of age. Because many times people in their old age suffer from physical and mental illness, sometimes they lose their capability to understand. If will is created at such an age when a person is not in his proper senses may create doubts, misunderstanding and disputes in the family later on.

- Therefore, there is no specific age when you should make a Will.

As long as you're a major. But in the following circumstances you must consider making a Will right away–

- Married or in a relationship

- Started a family

- A situation of divorce or remarriage

- Terminal Illness

Disadvantages Of Not Writing A Will

Let us now discuss some of the disadvantages of not writing a will:

- When you die without writing a Will (called “intestate” in legal language), your assets are distributed as per Succession Laws applicable to you. India is a diverse country with different Succession laws governing different religions and also different assets.

- Such succession laws have a fixed proportion to distribute properties to family members which may not be as per your wishes. There could be chances of delay in distribution of properties and may lead to legal cases, disputes amongst family members and not to forget financial distress can also happen till the time beneficiaries get possession of assets.

- The Court would decide who would look after minor children.

- There will be no executor or guardian and appointing another person potentially has the risk of delays, additional expenses and even a loss.

- There could be bickering and fighting within the family over assets turning the environment acrimonious. Your children and/ or spouse would be left fighting legal battles. Certain assets that you wanted to keep within the family, maybe sold.

- In case of a common disaster, where your whole immediate family passes away; your assets may get passed on to relatives whom you may have never spoken to or you were not on good terms with, as against considering passing them on for charity.

- Transmission of moveable and immoveable may be expensive and time consuming.

Points to consider while writing a Will:

- A Will can be prepared by anyone who is 18 years of age, of sound mind, and free from any coercion, fraud and undue influence.

- Use the title 'Last Will and Testament Of (state your name here)' to make it clear that the document is your Will and legal. Herein, state your full name, current address, and also mention that you are of sound mental health and under no pressure from any one to make the Will.

- Name an executor - a person who will secure permission (called probate) from Court for distribution assets as per Will. A trustworthy person should be named as an executor and you must get their permission before nominating them. This is because if they refuse to become an executor later, then there might be no one to execute the Will, leaving it to the court of law to appoint an administrator. Also, it will be a good idea to inform the executor and family members about the location of your Will in order to avoid confusion later.

- A will can be handwritten or typed out.Stamp paper is not necessary. You can write a Will on a plain paper, sign and date it with minimum 2 witnesses and keep it in a secure location. Also, it is not compulsory for one to register a Will with the Registering Authority, but it is advisable to get it registered to avoid litigation later on.

- While bequeathing assets to any minor children, make sure to appoint a guardian for the assets until such time the minors reach an adult age.

- It is extremely important for a Will to be simple, precise and clear.

- It is possible to make changes or minor alterations in a Will if you want to do so (this is called ‘codicil’). However in case there are too many or major changes, it will be better to make a new Will altogether.

- Always put a date on your Will. If more than one Will is made then the one having the latest date will supersede all other Wills.

- Each page of the Will should be serially numbered and signed by the Testator (that is the person making the will) and the Witnesses. This is to prevent the Will being substituted, replaced, or pages being inserted by people intending to commit fraud. At the end of the Will the Testator should indicate the total number of pages in the Will. Corrections if any should be countersigned.

- While writing a Will along with the laws of the country, one's religion also plays an important role. For example, in case of Hindus, any assets that have been acquired by oneself can be bequeathed as per one’ wishes. However any inherited property cannot be transferred according to your wish, as the laws of inheritance would apply.

- Although it is possible to draft a Will on your own, it is always better to take the advice of a trusted lawyer or online will making websites while writing a Will. This will reduce any chances of misinterpretation or litigation from relatives.

Online Or Offline Will

A Will can be written both online and offline, but which one you should consider is dependent on a number of different factors.

- If you have a simple and small family structure and you are not having any business but earning a salary and wealth through the same; you may consider making a Will online if there are no complexities involved.

- Many online Will writing portals are backed by companies providing legal services that have emerged lately in India, and are cost effective. With the growth of nuclear families, the concept of an online Will is gaining popularity.

In most cases the process too is very simple.

a) Register on the portal

b) Enter your details in the prescribed form

c) Make payment

d) Receive first draft then finalisation happens and Will is delivered via email or at your address (offered by some companies)

- Also, you have the freedom to revise the online Will (within a given time frame) if you find it is not drafted as per your requirement or to account for any change in circumstances.

- Some Will writing portals also offer add-on services like registration of a Will and appointment of the executor, but it’s not necessary for the customer to get it done by them only.

Who should go for offline Will writing?

In complex cases like the following, it makes sense to take the offline route to make a Will and hire a lawyer or avail services of legal firm: -

Witness And Executor To The Will

Witness and Executor are two pillars of a strong Will. In this section, we will learn whom we should consider as a Witness and Executor of the Will.

- Choose witnesses carefully as their purpose is to prove in Courts that the Will is authentic.

- Minimum two witnesses are needed to execute a Will while at least one is needed to prove the Will in court. There is no bar on the maximum number of witnesses.

- Try to choose witnesses who are younger to you due to higher probability of survival. The best practice would be to have a trusted doctor and/or a lawyer as a witness to sign the Will.

- Remember, it is not mandatory for a witness to read the contents of a Will before signing it; because he/she only confirms that the Will has been signed in his/her presence.

- A beneficiary cannot be a witness.

Who should be the executor of the Will?

- An executor is a person who takes care of your assets as a custodian until they get transferred to the intended beneficiaries. So the role of an executor is very important.

- It is common practice in India to appoint family members / friends as executors. But executing a Will is not easy as the executor must have legal and finance knowledge plus he has to spend a lot of time and effort to get the Will probated and then executes the Will.

- It is a good idea to appoint someone as your executor who is younger to the testator. Thereby, the executor has chances to outlive the testator.

- One should avoid appointing a beneficiary as an executor to avoid conflict of interest. But in the case of nuclear families, where the number of members is less, and the asset structure is not very complex, then beneficiaries (individuals) can be appointed as executors.

- Appointing an individual as executor is a cost effective option, as people close to the testator generally do not charge a fee for their services.

- But before you nominate an individual as your executor always seek his/her permission. This is because if they refuse to become an executor later, then there might be no one to execute the Will, leaving it to the court to appoint an administrator.

- If you don’t find a competent person as an executor for your Will, professionals such as lawyers, chartered accountants and other corporate entities offering executorship services can be chosen as executors for a fee.

- If the number of members in a family are large or if assets to be distributed are of large value and complex in nature then it is a better idea to appoint a corporate entity offering executorship services as your executor.

- As no individual is perpetual in existence and may also hold a bias, increasingly, people are considering ‘professional executorship and trust companies’, which by law, have perpetual successions and are independent experts in the domain.

Registration Of Will

Now that we have decided both witness and executor of the will, it is time to register the will. So, let us learn the process and the importance of registering a will.

- Registration of the will is the most important part of the Will making.

- As stated earlier, it is not mandatory to register a Will but advisable. Will can be registered with the registrar/sub-registrar of assurances in your area by paying a nominal registration fee.

- The testator has to be personally present at the registrar’s office along with the witnesses for registration. If the registrar/sub-registrar is satisfied with the documents furnished, an entry will be made in the register with the year, month and date mentioned, and you, the testator, will be issued a certified copy.

- Note that once your Will is registered, it is in the custody of the registrar. Therefore it cannot be tampered, mutilated, stolen or destroyed. You are given only the certified copy. In case you need to make changes in your registered Will, it would be better to re-register the amended Will, although it is not compulsory. The new amended will be considered to be a valid one and old Will previously made and registered will be considered invalid. Therefore, whenever you make amendments in the existing old will or make a new will , do not forget to register it.

- Registration can serve as an evidence of genuineness of the Will in the court in case of legal dispute after the death of the testator.

Gifts

We often give gifts to each other. But when it is the case of any gifting asset like property, it should be legally transferred with a gift deed. Therefore, in this section, we will understand gifting more deeply.

What is a Gift?

- As per Transfer of Property Act, 1882, a gift is considered to be valid only when it is made voluntarily; it is without consideration; there has been an offer by the donor; and the offer has been accepted by the donee, and the donee actually accepts the gift.

- A gift deed must be executed by the donor and the donee. Further, the gift deed must be attested by two attesting witnesses. Stamp duty must be paid on the gift deed and the same must be registered.

- A gift deed is a compulsorily registrable document under the Registration Act, 1908 and will have to be registered with the sub-registrar of assurances. The applicable registration charges will also have to be paid.

Who can give gifts and what can be gifted?

- Generally immovable property is gifted by a legal registered document known as the gift deed which should be legally attested.

- Movable property can be gifted just as immovable property or by delivery. Sometimes gifts can be made even by book entries.

- A person gifting any property should have a valid ownership of the property.

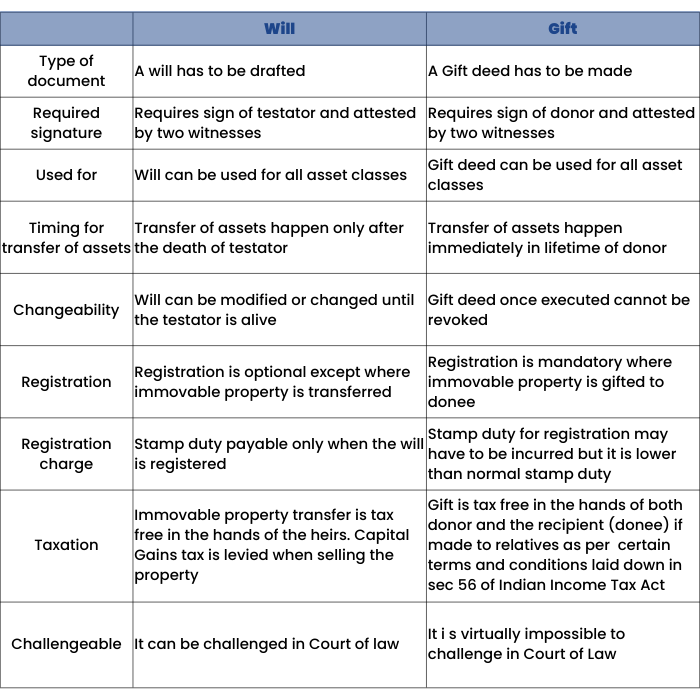

Comparison Between Gift And Will

Earlier, we have discussed both will and gift. So, in this section, let us now compare them breifly:

- The difference between a will and a gift is that a gift has to be executed during the lifetime of the donor unlike in the case of a will.

- Cost of writing a will depends on the complexity of assets and the structure of the succession plan laid out in the will and also on the preparer whereas the cost of writing a gift deed is very minimal but one has to pay stamp duty for registration of immovable property. The stamp duty varies from state to state but in most cases is significantly lower than the normal stamp duty and is payable usually at the circle rate or ready reckoner rates as published.

- A will is relatively easy to write and it can be revoked with a new will or amended through a codicil as many times as one wants till the testator is alive but a gift deed is irrevocable once executed and thus does not allow for any changes even if one changes his mind.

- A will is not required to be registered in court of law (although advisable) and can be challenged in the courts thus prolonging the process of transfer of wealth to the beneficiaries but a gift deed for immovable properties needs to be registered for it.

- Under a gift deed the transfer of assets happens during the life-time of the donor and the transfer happens immediately compared with using a will which is a much longer process.

- The taxation for gift deeds in being tax-free for both the donor and donee when in favour of defined relatives is also beneficial.

HUF (Hindu Undivided Family)

Till now, we have learned succession planning for individuals like you and me. But a few rules and regulations for a Hindu Undivided Family (HUF) are completely different. So, let us begin with the understanding of HUF.

The Hindu Undivided Family (HUF) concept is a kind of “Joint Hindu Family” which enjoys a separate tax status under the provisions of Section 2(31) of the Income-tax Act, 1961.

The affairs of the HUF are managed by the eldest member of the family, who is known as the Karta (manager) of the HUF.

A typical HUF consists of a Karta, wife, his sons, grandsons, great- grandsons and daughters. All members are also known as coparceners.

The daughter(s) on marriage continue to be the coparceners in her father's HUF, but are considered to be members in the husband’s HUF post-marriage.

The male members are by and large called the coparceners of the HUF.

Rights of Coparceners and members of HUF:

- Once a property is assigned to a HUF, all coparceners have an equal right to it. Even the Karta cannot transfer the property unless he gets consent from all coparceners.

- All coparceners can at any time demand partition of an ancestral property assigned to a HUF by way of distribution of HUF property among the coparceners. While each coparcener would be entitled to a share of the property, the members would be entitled to receive maintenance from the HUF.

- If a coparcener decides to separate himself from the HUF, the others being his father or brothers may continue to be coparceners to the extent of their share. In case he has a family, then he will become the head of a new joint family. If he obtains any property on partition with his father and brothers, that property will become the ancestral property of his branch.

- The interest of coparcener in property on death shall transfer by testamentary will or intestate succession and not by survivorship.

- The discrimination between son and daughter has been removed vide amendment to Section 6 of Hindu Succession Act 1956 w.e.f. September 9, 2005,i.e, unmarried daughters as well as daughters married are regarded as coparceners

They are also eligible to demand partition of an HUF, and receive equal share in the HUF property just like the sons.

Properties Or Assets That Can Be Classified As The Assets Of A HUF

Next, in this unit, we will learn the classification of assets or properties of HUF.

- Ancestral property or assets inherited from father, grandfather or great grandfather.

- Any property or assets received on partition of a larger HUF of which the coparcener was a member in the past.

- Property or assets acquired with the aid of joint family property.

- Separate property or assets of a coparcener, blended with the family property.

- Any assets or property received as a gift by the HUF from close relatives or friends.

- Assets bequeathed by a Will that specifically favours the HUF.

- It is noteworthy that the term ‘Coparcenary Property or Joint Family Property’ is wider in connotation than the term ‘ancestral property’. While an ‘ancestral property’ is the one inherited from father, grandfather or great grandfather, in which the share is allotted on partition;

- 'Coparcenary property or joint family property’ is the one acquired by the coparceners with joint efforts – so for example, father and sons would be joint family and hold coparcenary property.

- There may be an instance where a single male member in the family having no ancestral or coparcenary property, receives gifts from relatives or friends of family members of family.

If the single male member of such a family decides to add this gifted property into joint family property, then such property would neither be ancestral nor coparcenary property but certainly be a HUF property. - While there can be a gift or a Will for the benefit of a HUF, it is immaterial whether the giver is male or female, whether he or she is a member of the family or an outsider.

What matters is that the gifted property is for the benefit of the whole family. - The Karta of the HUF can make a gift of an ancestral immovable property within a reasonable limit keeping in view the total extent of the property.

The Karta can even gift his self-acquired property to the branch HUF of his Son, through a Will, which will then become the ancestral property of the son’s HUF.

What Happens In Case Of Death Of The Karta?

In our previous units, we have learned that the 'Karta' of a Hindu Undivided Family (HUF) is considered the head of the family. So, what happens if the Karta die. Let us discuss:

a) The Karta manages the family property, which is regarded as the joint property of all the coparceners. On the death of the Karta, his HUF can continue and the next senior-most coparcener of the family shall be the Karta.

b) If under given circumstances, the senior-most coparcener is not in a position to discharge his obligation, then the next senior coparcener can be the Karta of HUF with mutual consent.

Hence with mutual consent, the HUF can also appoint any coparcener as the manager.

The assessing income tax officer / income tax department should also be intimated about the death of the Karta and the appointment of the new Karta.

c) In case of death of a coparcener, his share in the property of a Joint Hindu family shall devolve by testamentary will or intestate succession, as the case may be, and not just by survivorship.

A coparcener can bequeath only his share in the HUF property and not the entire property of the HUF.

d) In case the coparcener does not execute any Will, the property will devolve as per the rules of intestate succession applicable to Hindus under the Hindu Succession Act, 1956, as stated below:

- The daughter is allotted the same share as is allotted to a son;

- The share of the pre-deceased son or a pre-deceased daughter, as they would have got had they been alive at the time of partition, shall be allotted to the surviving child of such pre-deceased son or of such pre-deceased daughter; and

- The share of the predeceased child of a predeceased son or of a predeceased daughter, as such child would have got had he or she been alive at the time of the partition, shall be allotted to the child of such predeceased child of the pre-deceased son or a pre-deceased daughter, as the case may be.

These guidelines will help you to make right decisions while transferring assets and properties of a HUF.

While doing this, don’t forget that the will must be in writing, signed by the testator in the presence of two or more witnesses, who should also sign as witnesses on the Will.

Also, note that any part of the property can’t be bequeathed to the signing witness.

Partition Of HUF

In earlier days, there were so many joint families in India, but as time passed, they all divided into small nuclear families. So, what will happen if a HUF gets divided. We will discuss the consequences of the partition of HUF.

a) Partition of HUF means physical division of property along with the income arising out of the property. Partition of only one of the above mentioned (i.e. property and even the income arising out of it will not be termed as a valid partition under law.

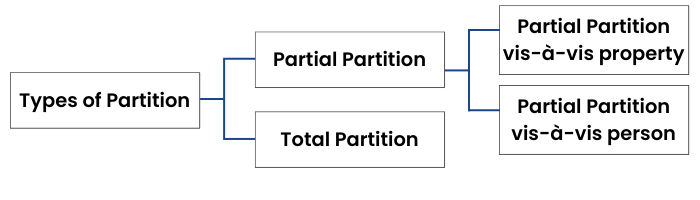

b) Every coparcener has a right to ask for partition, which may be total or partial.

Types of Partition:

a) A partition is total when all properties of the family are divided among the members, and on such a partition, the HUF ceases to exist.

b) Partial partition is of two types: partial partition vis-a-vis property, which means distributing certain property to the members and retaining balance properties with the family; partial partition vis-a-vis person, which implies distributing certain properties to some members of the family, following which such member won't remain part of the family any longer.

c) In partial partition, an HUF continues to be a separate entity. The only change is some of the property/ coparceners don't continue to be part of the family.

d) Female members are entitled to a share equal to that of a son in the event of a partition.

Tax impact on partition of HUF:

a) If the capital or income base of the HUF is large, it may be more viable to make a total partition of the HUF property.

On the partition of the larger HUF each of the married sons will receive the property for and on the behalf of his own smaller HUF. If the smaller HUFs are in the lower tax bracket, it will help save tax in view of spreading income of the larger HUF.

b) Partition of property does not attract capital gains tax.

c) Partial partition is not recognised for tax purposes. Income earned on the property received by a member on a partial partition would be clubbed with the income of HUF as if there's no partition.

Trusts

Previously we have learned and discussed Will. But unlike a Will, a Trust helps businesses to continue without any difficulty even in case a family member passes away. Before we understand the concept of trust, let us first get familiar with a few terminologies.

Terms and Terminologies:

a) Author of the trust: He is a person who creates a trust. The property or other assets mentioned in the trust deed belongs to the author of the trust. Author of the trust is also known as Settlor or Grantor.

b) Trustee: He is a person on whom the author of the trust places the responsibility of managing the trust and executing the trust deed.

c) Beneficiary of the trust: it refers to an individual who benefits from the transfer of the property or assets under the trust.

d) The subject matter of the trust is the trust property or trust money.

What is a Trust?

- A trust is simply a legal arrangement / vehicle in which the Settlor transfers ownership of property and other assets to the trust, the named trustee then manages and controls the assets for the benefit of the named beneficiary.

Why is a Trust created?

a) Private trusts are created to specifically earmark funds intended for minor children, elderly parents, disabled dependents and other beneficiaries.

b) The main advantage of creation of a trust is that the property passes on directly to the beneficiary absolutely hassle free.

c) Another reason for creating trusts can be to deny beneficiaries direct access to funds which they may squander away, while ensuring adequate income flows from it for their maintenance.

d) A trust can be a valuable succession planning tool in many situations, but many do not know exactly how creating a trust may benefit their estate.

For the more affluent, who own businesses governed by families, a trust is a vehicle that provides effective and hassle free wealth management, asset protection and tax efficiency.

Types Of Trusts

Now that we are familiar with the concept of trust, we will learn to create trust. But before that, let us discuss the different types of trust.

a) A trust structure comes with certain inherent advantages. A trust provides the flexibility to be set up in more than one form or in hybrid forms as per the requirement.

b) A trust can be either private or public. A private trust is a trust generally for the convenience and support of individuals or families.

c) Trust can also be structured as revocable or irrevocable.

d) A revocable trust can enable the settlor to exercise control over the property but can be prone to clubbing provisions under the tax laws.

e) An irrevocable trust can provide safeguard against future creditor claims on the assets in case of bankruptcy, since the settlor ceases to have the title to the trust property, yet at the same time enables indirect control over the property through terms of the trust deed. This is one of the main benefits of a trust structure which allows for preservation of your wealth.

How can a trust be created?

a) A living trust is a trust that is created while the settlor is still living, and in that case, they may also be the trustee as well as the beneficiary until a triggering event, such as their incapacitation or death, after which named successors take over.

This allows a living trust to also act as a mechanism for managing finances in the event you can no longer manage them on your own.

b) A trust can be also formed according to instructions in a will. This is known as a testamentary trust.

c) Assets that can be transferred and owned by a trust include real estate, stocks, bonds, valuable personal property and businesses.

A trust, in relation to an immovable property, must be in writing and registered.

Practical Matters – Investors

Paperwork relating to succession planning is cumbersome. But if you want to avoid trouble in future then it pays to know the nitty-gritty regarding drafting, attestation and registration of documents.

A small error like a typographical error or wrong spelling of name or a delay in registering a document can lead to a long legal conflict.

Even improper or incomplete attestation may lead to a major court battle as the court refuses to accept the validity of documents due to the mistakes stated above.

Advantages of Registering the documents:

- Enables to find out any existing liability or ongoing litigation

- Ensures transparency and secure deals

- Helps prevent forgeries

- Proof that document was actually drawn

Attesting a will:

When a will is signed by two independent witnesses, it is said to be attested. It is not necessary for the witnesses to sign in each other's presence but they must see you sign your will or at least acknowledge that you were mentally fit to execute the will. Also, the witnesses or their spouse should not be the beneficiaries of the will. If you do so, the will is valid. The witness cannot inherit the property. Though a relative who is not inheriting your wealth can attest the will, it is better to appoint an independent, third person as a witness, like a chartered accountant and a doctor

Mandatory Registration

In the past, various courts across the country have held transfers of property to be invalid on the premise that documents affecting such a transfer were not registered.

It is clearly stated in Section 17 of the Indian Registration Act that the instruments purporting to transfer or assign any interest in immovable property should be registered.

That means documents like sales deeds or gift deeds, which relate to immovable property, must be mandatorily registered, failing which the transfer would be invalid and not recognised by law.

Transfer of immovable property through a general power of attorney would also be invalid.

The Supreme Court judgement clearly established the rule that a transfer would be valid only through a registered deed of conveyance.

Source: https://indiankanoon.org/doc/1565619/

Also, if transfer of property is involved in a Will then it must be registered as required by the Indian Registration Act to be considered a valid will.

(Source: Supreme Court case https://indiankanoon.org/doc/141466740/ )

Registration also means that records are available to you to find out about the person who has the title and right to the property, and whether there is an existing liability or ongoing litigation, before you decide to buy it.

Since the documents are in the public domain, it helps prevent forgeries and fraud in transactions, especially the evasion of income tax or stamp duty.

Registration Cost

Cost of registering a document is not very high. Although it differs from state to state, on an average, it would cost Rs 1,000-2,000 to register a document, excluding the stamp duty charges, if applicable.

Optional registration

As per the Indian Registration Act, all documents are not required to be registered. Mandatory and Optional registration has been clearly distinguished.

According to Section 18 of the Act, the documents that relate to the transfer of movable property, as well as wills, are not required to be registered.

A power of attorney with respect to movable property need not be registered.

Even here the law experts advise that it is better to register the documents as it lends more sanctity to the document.

Pitfalls Of Forming HUFs

Creating and registering an HUF is fairly easy but complications arise later on. You should first understand the following disadvantages of forming a HUF before you decide to form one.

Once a property is assigned to an HUF, all coparceners have equal right to it (also includes an unborn child in the womb of a mother).

Now the assets belong to the family and not to any specific individual.

Moreover, assets cannot be transferred or sold without the consent of all coparceners, and even the Karta cannot transfer it to anyone without everyone’s consent.

If there is a legal dispute around the property, then selling it can become extremely difficult.

If there are few members in HUF, then things run smoothly.

But problems appear mostly when the number of coparceners increases.

Since all lineal descendants are part of an HUF, every child, whether boy or girl, who gets added to the family, becomes a part of the HUF.

One cannot stop the ownership, it is assigned by birth.

Earlier joint families were the norm in India, but now nuclear families are the norm and with it divorce cases are also increasing.

Divorce can add to complications as once someone becomes a coparcener in an HUF, the person cannot be moved out.

Difficult to dissolve:

An HUF can be dissolved only if all the members agree for complete partition. It is only on a complete partition that the assets or property can be shared by the coparceners.

Partition of real estate belonging to an HUF can be a nightmare and leads to disputes and court cases very often.

A partial dissolution (partial partition) can be done but is not recognised by income tax law.

Perceived Money laundering tool:

The goal for which the HUF is created has to be clear. If the purpose is only tax saving, it will work only for the initial years.

As income and number of members grow, complications, too, increase.

If the income tax authorities feel that the HUF has been created to launder money, it may choose to take suitable action against it.

Taxation of Assets:

Taxation of assets may be an issue as personal funds are put into an HUF, they will actually be clubbed with the coparcener’s individual income.

This move might not work if the original purpose of starting the HUF was tax-saving.

Domicile change by family members:

HUFs are essentially an Indian phenomenon. Some family members move abroad either to study or work and the computation of income can be difficult as many countries do not recognize HUF.

The computation of income in such cases is still a grey area.

Complex laws and poor understanding:

The root-cause of most problems is poor understanding of the laws that govern HUFs.

These laws are not codified and are read along with the Hindu Succession Act and the Income-tax Act.

Younger generation, mostly, do not understand these laws, especially because laws around HUFs are complicated.

Then they either do not agree with their Indian members or get into disputes with them.

Comparison Between Will And Trust

Writing a Will or registering a Trust has its own advantages and disadvantages. Here in this section, let us compare the two:

What Your Family Should Know Before Your Death?

You should make a comprehensive list containing the details and location of all important documents and other possessions. One such elaborate list is given below:-

1. Bank Locker Key and related information

2. Various Bank / email accounts and passwords

3. Credit and debit cards information

4. Investment details such as bank fixed deposits, bonds, mutual funds, demat account, EPF and PPF accounts related information

5. Current liabilities such as credit card bills , outstanding loan details

6. Health care benefits

7. Life insurance policy

8. Car insurance policy

9. Property and fire insurance policy

10. Will

11. Property ownership information

12. Car title

13. Home/Property deed of sale

14. Income tax returns (including any refund information)

15. Identification documents such as Birth certificate, Passport, Driving License, Marriage certificate, PAN Card

16. People to contact in case of emergency such as insurance agent, doctor, lawyer, CA and financial planner / wealth manager, property agent

You can easily make such an emergency list in MS Excel or Google spreadsheet. Don’t forget to update the above list regularly. How frequently you should do so depends on you, but at least on an annual basis it should be done.

Also, inform and keep this list with at least one family member/ trusted CA or lawyer so that your heirs can access them easily without hassles and running around.

Make Emergency list + Organize & Update + Handing to trusted person= Easy access and peace of mind for heirs.

Conclusion

So, now that we are at the end of this module. You are probably by now convinced about the fact that Succession Planning is extremely important in everyone's life. Every individual should make a plan for succession planning to avoid any discrepancies among the family members. You should probably take the help of any chartered accountant or a lawyer to create a Will. No matter how wealthy you are, succession planning is necessary for everyone. Hope the learnings of the module will help you while preparing your own Will at some point of time in your life. If you enjoyed reading this module, share it with your friends. And there are also a number of modules we have curated for you on ELM School. Do check them out for more such interesting content on finance.