Tax Planning through savings and investments

Different Income-tax Sections For Tax Savings

Most people are generally aware of the income tax section 80C. However, that’s not all. Several other sections offer options to claim tax benefits.

Before we proceed, keep in mind that from FY 2020-21, an individual can file taxes under two regimes – old and new. Concessions through investment are available only for people using the old regime. In the new regime, deductions and tax exemptions are not allowed.

However, in both tax regimes, a rebate can be availed of if the net taxable income does not exceed ₹5 lakhs during a financial year. This basically means that there will be no tax if the net income is less than ₹5 lakhs.

Deductions allowed under income tax:

Section 80C

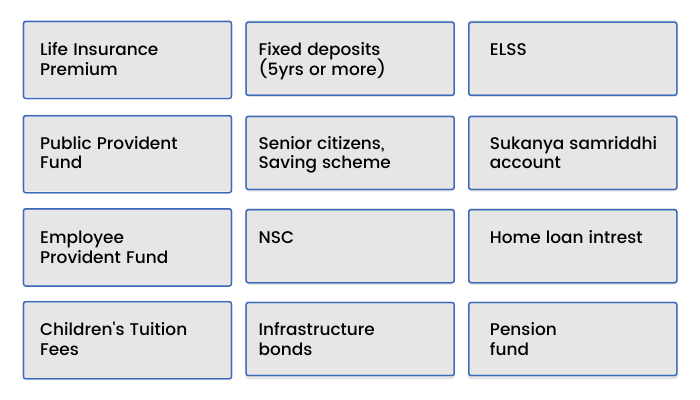

This is the most commonly used section where tax can be saved by investing or spending a maximum of ₹1.5 lakhs in a financial year through specified avenues. There are a host of available options to invest in under this section. Some of the most common ones are highlighted in the illustration below:

We have discussed many of them in the later sections of this module.

Section 80CCD

Section 80 CCD allows further tax deduction by investing in National Pension Scheme or Atal Pension Yojana. National Pension Scheme and Atal Pension Yojana have been discussed in detail in later sections of this module.

Section 80 CCD has 3 subsections that allow a total deduction of ₹200,000 for individuals:

1. Section 80 CCD (1)

As per the provisions of this section, subscribers can claim a deduction for their contributions to the National Pension Scheme. This provision applies to all individuals investing in the scheme including self-employed individuals, government, public and private sector employees. The provisions are also applicable to senior citizens. The maximum deduction allowed under this section is ₹150,000.

There is a limit for the maximum deduction - 10% of the salary in the case of a salaried individual and 20% in the case of a self-employed individual.

2. Section 80 CCD (1b)

This section provides an additional deduction of up to ₹ 50,000, in addition to ₹150,000 of section 80 CCD (1). This additional deduction is available to both salaried and self-employed individuals.

3. Section 80CCD (2)

This deduction is available on the employer’s contribution to an employee’s Tier – I NPS account. Employers can make contributions to the NPS account in addition to EPF and PPF contributions. The contribution made by the employer can be equal to or higher than the employee’s contribution. However, a maximum of 10% contribution of the basic salary plus dearness allowance (if applicable) is allowed under this section.

It is important to mention here that effective FY 2020-21, the employer’s contribution of more than ₹7.5 lakhs into retirement funds, EPF, NPS, superannuation funds will be taxable in the hands of the employee. The interest earned on such a contribution will also be taxed in the hands of the employee.

Section 80D

Section 80D allows a deduction for premium paid on a health insurance policy for self, spouse and dependent children. But the maximum cap under this section is ₹ 25,000 of premium paid. Additionally, one can avail another ₹ 25,000 for the premium paid for health insurance of parents. If your parents are senior citizens, then this maximum amount will go up to ₹ 50,000.

Therefore, if your parents are senior citizens, you can avail of a deduction on up to ₹75,000 of premium paid. If both the taxpayer and the parents are senior citizens, then this amount will go up to ₹100,000.

Please note that if your senior citizen parents are not covered under any health insurance policy, then the medical expenditure incurred on them is also deductible under section 80D. The maximum amount under such deduction is ₹50,000.

Section 80DD & Section 80DDB

In addition to Section 80D, Section 80DD and Section 80DDB sections also include medical expenses. However, to avail deduction under these sections, the expenditure has to be made for disabled and/or specified persons.

Section 80DD offers a deduction for medical expenses incurred for dependent disabled persons which may include spouse, children, parents and siblings. The amount of deduction depends on whether the dependent is disabled or severely disabled. It allows a maximum deduction of ₹75,000 if the dependent is 40% disabled. Disability of 80% or more, is considered a severe disability and a maximum deduction of ₹1.25 lakhs is allowed.

Section 80DDB allows a deduction for medical expenses incurred for treatment of specified illnesses such as cancer, chronic kidney disease, etc. It can be claimed on self or dependant. A maximum deduction of ₹40,000 is allowed for individuals below 60 years of age. For individuals above 60 years of age, the maximum deduction allowed is up to ₹1 lakh.

Below is a list of some of the diseases mentioned above. The entire list can be found in the income tax act.

- Malignant Cancer

- Chronic Renal failure

- Neurological diseases, with disability levels of 40% and more and covers Chorea, Motor Neuron Disease, Dementia, Ataxia, Aphasia, Parkinson's Disease Dystonia Musculorum Deformans, and Hemiballismus

- AIDS- Acquired Immuno-Deficiency Syndrome

- Hematological disorders like Hemophilia or Thalassaemia

To avail of the tax benefit, the assessee has to provide proof of the need for medical treatment and proof that treatment has been undertaken.

Section 80U

Individuals with a disability of 40% and above can claim tax benefits under this section. The maximum amount of deduction is the same as that under section 80DD.

Please note: You can claim deduction only under one of the schemes between 80U and 80DD. They cannot be claimed simultaneously. Under 80U, the deduction is claimed by the disabled individual, whereas under section 80DD, deductions are claimed for the dependent for whom the expenses are incurred.

Section 24

We mentioned that under section 80C, one can avail deduction on home loan principal repayment.

Under section 24, one can avail benefit on the interest paid on a home loan during a financial year. The maximum amount that can be claimed is ₹2 lakhs.

This deduction is allowed only for a loan taken on a self-occupied property. In case you are paying a home loan for an under-construction property, this benefit is available after the possession of the house, provided it happens within 5 years. The interest paid during the construction period can be accumulated and claimed after the possession of the house in five equal installments.

Section 80EEA

Individuals who have bought a house under the affordable housing segment can claim an additional tax benefit on interest up to a maximum of ₹1.5 lakhs. This is over and above the deduction available under section 24 mentioned above. However, certain conditions have to be satisfied before claiming tax benefits under Section 80EEA.

Some of these conditions are:

- This scheme is only applicable for first time home buyers. The individual should not own any other property.

- The home loan should be taken by the individual from a financial institution or a housing company for buying a residential house property.

- The individual should not be eligible to claim tax deduction under Section 80EE.

- The stamp duty value of the purchased property should be ₹ 45 lakhs or less.

- The maximum amount of deduction permitted under this section is ₹ 1.5 lakhs in an assessment year.

Section 80G

Under this section, individuals contributing to any charity can claim tax benefits. This is applicable only for donations to specified government notified funds. Up to 100% of the donation amount can be deducted from your gross total income, thus reducing your total taxable income.

Section 80 TTA

We all earn interest on balances kept in savings accounts and post offices, right? This interest income has to be shown under the head “Income from other sources” while filing the income tax. However, up to ₹10,000 of income filed under this held can be claimed as a deduction from the gross total income under section 80TTA.

Please note: Senior citizens cannot claim deduction under this section. However, theyare eligible for deduction under section 80TTB.

Section 80 TTB

This section is meant for senior citizens (aged 60 years and above). They can claim a total maximum deduction of ₹ 50,000 from the gross total income. The deduction can be claimed on income earned from specified sources such as savings accounts, fixed deposits, senior citizen savings accounts and others.

Section 80E

Individuals paying interest on education loans can claim deduction under this section. There is no maximum limit on the amount that can be claimed. The interest is deducted from the gross total income of the individual in a financial year.

Please note:

1. Section 80E is applicable only for individuals, and not for HUFs.

2. The benefit can be claimed for a maximum of 8 years from the starting date of the loan repayment.

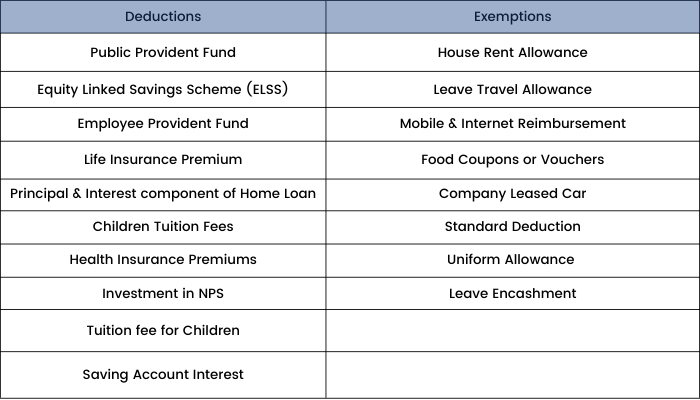

Apart from these deductions, an individual is also eligible for exemptions under the Old Tax regime.

Please note that there is a slight difference between deductions and exemptions. A deduction is a subtraction, or an amount that can be used to reduce taxable income. Exemption means exclusion, which means that if certain income is exempt from tax, it does not contribute to a person's total income.

Here is a list of deductions & exemptions under the Old tax regime:

This brings us to the end of all the sections under which a person can claim tax benefits.

Life Insurance

When it comes to investment for tax saving, perhaps life insurance is one of the first things that comes to our mind. Honestly speaking, saving tax or not, everyone should have a life insurance policy to cover the two vital risks – ‘dying too young and living too long'

Coming back to tax savings, the premium paid on a life insurance policy qualifies for tax deduction under Section 80C of the Income Tax Act 1961. The maximum amount that can be claimed is ₹ 1.5 lakhs.

However, the tax benefits of a life insurance policy don’t stop here. The maturity benefits obtained from a policy are also tax-free as per section 10 (10D) of the same act. In a case where the insured person passes away and the benefit is received by the nominee, the maturity benefits become tax-free in the hands of the nominee.

However, the maturity becomes tax-free only when the premium does not exceed 10% of the actual sum assured. What is ‘actual sum assured’? It basically means the lowest sum assured in all the policy years and does not include any bonus amount to be paid to the policyholder. It also does not contain any premiums which are to be returned to the policyholder. For policies issued between 1.4.2003 and 31.3.2012, this amount is 20% instead of 10%.

Moreover, if the maturity benefit is not tax-free under section 10(10D), it will attract a TDS of 2% as well.

The world of life insurance is vast. If you want to learn the intricacies and nuances of life insurance policies, we recommend you to read our detailed module on Life Insurance.

Public Provident Fund

One of the most popular tax savings schemes for decades, Public Provident Funds (PPF) offer deduction under section 80C. The maximum amount eligible for deduction is ₹1.5 lakhs. One can open PPF in banks or post offices.

The main reason for the popularity of PPF is that it falls under the exempt-exempt-exempt category. As we mentioned earlier, the investment is deductible under section 80C. The interest and maturity are also exempt from tax.

PPF accounts have a lock-in period of 15 years. On maturity, the investor is given two options – either to withdraw the proceeds from the account or continue for any number of years for a block of 5 years.

Here are some of the things to note about PPF investments:

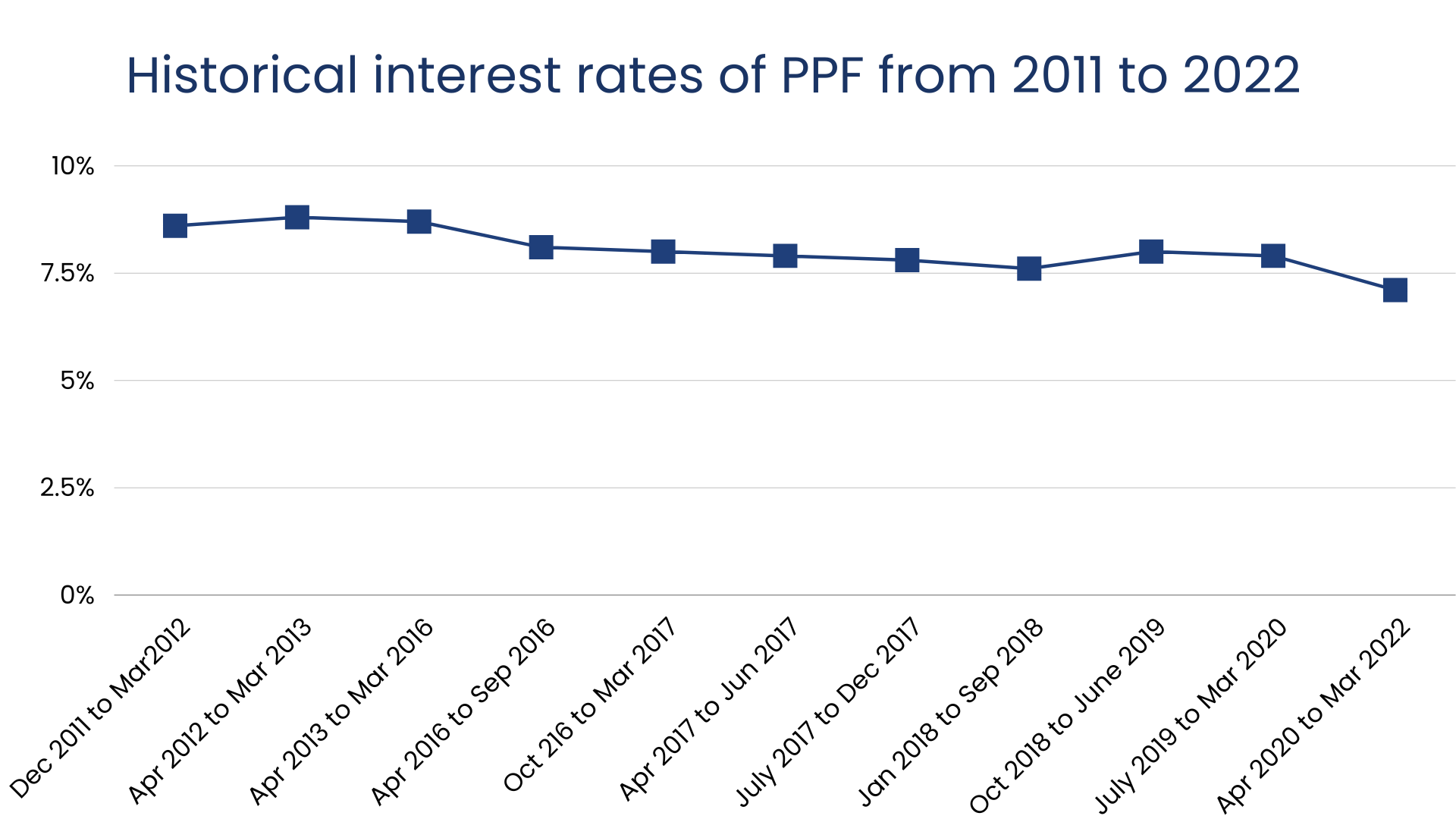

Now let us come to the question that must have been hovering in your mind – what about the interest rate?

As we all know, the interest rate is announced by the government from time to time. The PPF interest rate for Q2 (July-September) FY 2022-23 is 7.1%.

Here’s a graphical representation of the PPF interest rates from 2011 to 2022:

Equity Linked Savings Scheme

Another very popular tax saving option, Equity Linked Savings Schemes or more commonly ELSS are basically mutual funds with a lock-in of 3 years. The lock-in period being the lowest among all the tax savings schemes makes it a very popular option among taxpayers in India.

Investment in ELSS is tax-deductible under section 80C. However, bear in mind, the maximum amount is ₹1.5 lakhs.

As the name suggests, a large part of the investment is made in equity. Investment can be made as both lump sum and systematic investment plans (SIP). In case the investment is made through the SIP route, the 3-year lock-in will be applicable from the date of installment payment.

For example, in the case of a monthly SIP of ₹ 10,000, every month starting from 1st April 2022, the installment paid on 1st April 2022 is eligible for withdrawal after 1st April 2025, while the installment made on 1st May 2022 is eligible for withdrawal after 1st May 2025.

These are equity-oriented mutual funds that invest a minimum of 60% in equity and equity-linked instruments. The mandatory lock-in helps the fund to grow and helps the investor earn a sizable return.

ELSS can be open-ended or close-ended. Often towards the end of the financial year, mutual fund houses launch ELSS schemes with fixed lock-in periods that remain open for only a certain period. Once the investment period gets over, no further investment can be done till the end of the lock-in period.

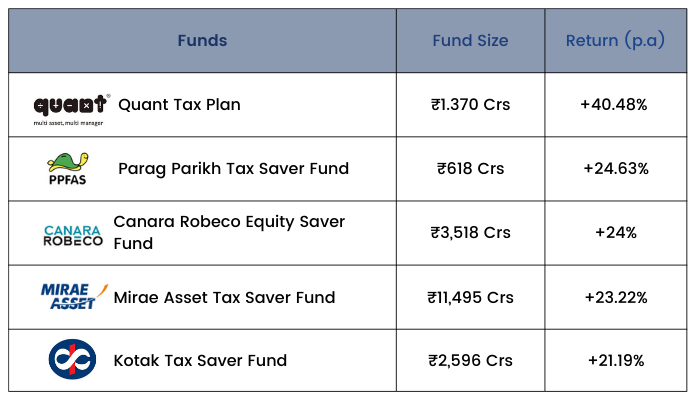

Now, let us take a look at the returns of some of the ELSS funds available in the market at present. For the benefit of the reader, we have listed only open-ended ELSS schemes where investment can be made by anyone at any time during the year.

Data as on 8th Aug 2022 (3 years return)

Sukanya Samridhhi Yojna

Launched as a part of the ‘Beti Bachao Beti Padhao’ campaign in 2015, Sukanya Samriddhi Yojana is a small deposit scheme for the girl child. The investment obtains tax benefits under section 80C of the Income Tax Act. Furthermore, the interest accrued and the maturity benefit is also exempt from tax.

The interest earned on this account, which is compounded annually, is also tax-free under Section 10 of the Income Tax Act.

The parents are required to invest a sum of money at regular intervals to earn interest on it. The rate of interest is decided by the government of India. The interest is accrued quarterly and is payable on maturity. The scheme has a lock-in of 21 years and matures automatically after the expiry of 21 years.

A minimum deposit of ₹250 needs to be paid every year for 15 years. In case of failure to pay this minimum amount, the account gets disconnected. The account can then be reactivated by paying a penalty of ₹50 along with the original deposit of ₹250.

Important aspects of a Sukanya Samriddhi Yojana account:

- Parents or legal guardians in the absence of parents can open a Sukanya Samriddhi Yojana account

- Only girl children can claim the benefits of the scheme

- Only one account can be opened for one girl child

- Parents can hold two Sukanya Samriddhi Yojana accounts simultaneously for two girl children

- Minimum entry age- at birth

- Maximum entry age 10 years

- Minimum deposit per year - 250

- Maximum deposit per year-150,000 At the end of every year, a payment of 250 has to be made over and above the minimum annual deposit to confirm the reviving of the account

- Due to the untimely death of the account holder, the account can be closed prematurely.

- Deposits can be made in the form of cash, cheque or demand draft

- When the girl child reaches 18 years of age, the account holder is allowed to withdraw 50% of the accumulated amount.

Well, at the heart of everything is the fact that your money grows into a lump sum so that your girl child can benefit from it. But what is the rate at which it grows?

The chart below shows the historic interest of the Sukanya Samriddhi Yojana since the scheme was announced:

How to invest in Sukanya Samriddhi Yojana?

All public and private sector banks, as well as the post office, offer the benefit of the Sukanya Samriddhi Yojana account. All you need is your KYC documents and an initial deposit cheque to open this account.

If you open the Sukanya Samriddhi Yojana account with a bank, you can check the balance through your net banking. However, the post office still does not provide the benefit to check the balance online. You will have to visit the post office and get your passbook updated to see the balance.

You will find a lot of calculators online to calculate how much you should save every month. You can fix the final amount that you will need when your child grows up and then work backwards to understand the yearly amount required to be saved to reach that desired figure.

Tax saving FD

When it comes to investing, fixed deposits rank first in terms of safety. Apart from normal fixed deposits, you can open a fixed deposit to claim deduction under section 80C.

Here are the things you need to know about tax-saving fixed deposits:

- They have a minimum lock-in period of 5 years.

- The investment is eligible for deduction under section 80C.

- The interest rate varies from one bank to another (as with normal fixed deposits).

- Senior citizens can get a higher interest rate on investment.

- In the case of a joint fixed deposit, the tax benefit can be claimed by the primary holder only.

- A premature withdrawal facility is not available for these fixed deposits, during the lock-in period of 5-years.

- The documents required for opening a tax-saving fixed deposit is the same as those for normal fixed deposits.

- The interest payout can be taken on maturity, quarterly or monthly.

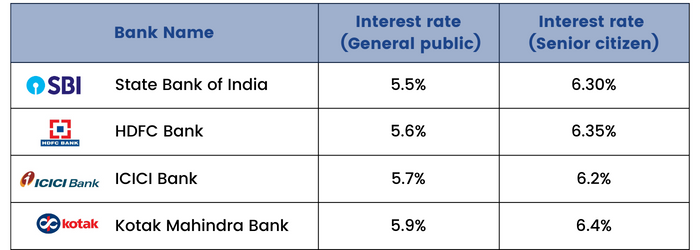

Tax-saving fixed deposit rates

Here are the fixed deposit rates of some banks as on 10th August 2022:

Please note: Interests on fixed deposits are subject to TDS deduction if the interest earned during a financial year exceeds ₹ 10,000. However, if the interest earned is less than ₹ 10,000 then the amount is not subjected to a tax deduction. In case the interest earned is less than ₹10,000 please submit form 15G or form 15H (for senior citizens) at your bank so that TDS is not deducted.

Senior citizen savings scheme

As the name suggests, a senior citizen savings scheme is available to all citizens of India who are aged 60 years & above. They can invest in this scheme through banks and post offices. This is a government-backed retirement benefits program where senior citizens can invest a lump sum individually or jointly and obtain regular income along with tax benefits.

The minimum amount of investment is ₹1000 and multiples thereof. The maximum that can be invested in a single installment is ₹15 lakhs. In this scheme, the deposits mature after a period of 5-years. However, the depositors can extend the maturity period by another 3-years.

The investment qualifies for deduction under section 80C of the Income Tax Act up to ₹150,000. However, please note that the interest is fully taxable and is liable for a tax deduction if the interest is above ₹50,000. The interest compounds and is paid out annually.

Who can open a senior citizen savings scheme account?

- Individuals aged 60 years and above.

- Individuals aged below 60 years but above 55 years who have retired on superannuation.

- Individuals aged 55 years and have retired before the implementation of this scheme.

- Retired Defence Services personnel, irrespective of their age. However, they have to meet certain criteria.

- HUF and NRIs are not eligible to open a senior citizen savings scheme account.

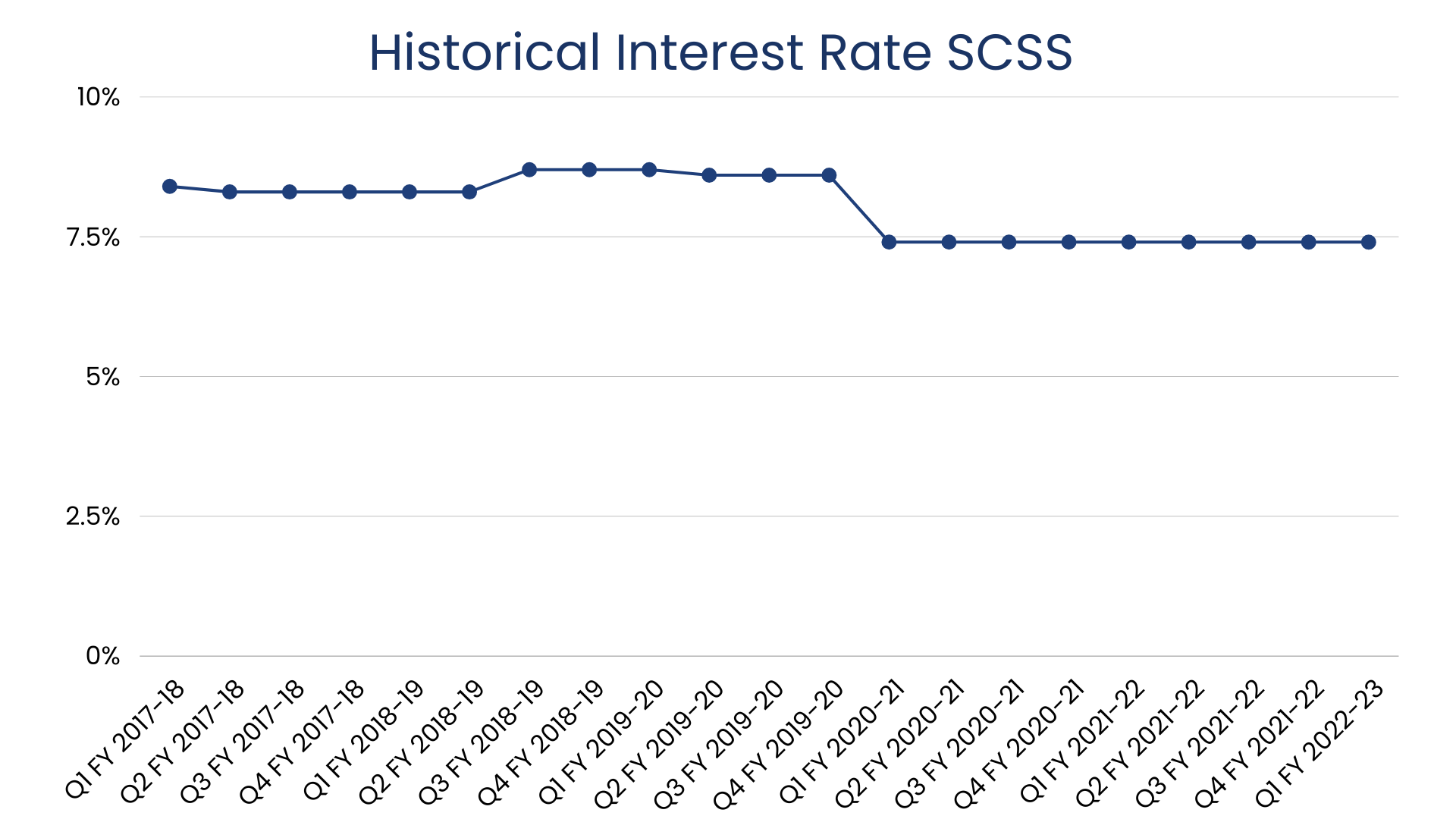

The graph below shows the historical movement of the interest rate of the senior citizen savings scheme:

National pension scheme

Another popular tax saving option is the National Pension Scheme (NPS). It is available to both government and private sector employees. The basic purpose is to help citizens create a retirement corpus and receive a fixed monthly payout so that they can live a comfortable life after retirement.

Any individual can invest in NPS during his/her employment at regular intervals. It provides the option to withdraw up to 60% of the accumulated fund when the depositor attains the age of 60 and invest the rest in an annuity. The amount invested in the annuity is received by the investor as a monthly pension. However, if the depositor wants, he/she can continue the NPS investment till the age of 70 and then make the withdrawal.

This is a safe and long-term option that allows investors to obtain market-linked returns.

Types of NPS accounts

There are two types of NPS accounts:

- Tier 1

- Tier 2.

Tier 1: Tier 1 has a lock-in period till the depositor reaches 60-years. During this time partial withdrawals are allowed under certain circumstances. The contributions made to this fund is tax-deductible under section 80CCD (1) (up to ₹ 150,000) and 80 CCD (1B) (up to ₹ 50,000). This means in a financial year, an individual can invest up to ₹ 200,000 in NPS.

Tier 2: This fund enables voluntary contribution and allows withdrawal whenever they like. NPS Tier 2 however is not eligible for a tax deduction. To open a Tier 2 account, one has to open a Tier-1 account first.

Important aspects for national pension scheme

- Contributions to NPS are mandatory for central government employees up to the age of 60. It is optional for others.

- The maximum deduction is capped at 10% of the salary as per section 80 CCD (1) in the case of salaried employees and up to 20% in the case of self-employed individuals.

- When an individual opts for NPS, he/she is allotted a Permanent Retirement Account Number (PRAN).

- Once an investor retires, he/she gets the option to withdraw a partial amount as a lump sum (maximum 60% of the fund). The rest is invested in an annuity plan from an Annuity Service Provider. Usually, a licensed insurance provider is an annuity service provider.

- The annuity service provider has to be mandatorily empanelled with Home-Pension Fund Regulatory and Development Authority in order to provide annuity service to investors under the NPS scheme.

- Investors have multiple annuity schemes to choose from such as annuity for life, annuity for life with return of purchase on death, and others.

Please note: The returns under the NPS scheme are not guaranteed and are dependent on the performance of the market-linked instrument where the investment is being made – equity, corporate bonds, government bonds, etc.

Premature withdrawal of NPS

As mentioned before, an NPS Tier 1 account matures when the depositor reaches the age of 60. However, if the depositor wants, he/she can stay invested till the age of 70. Moreover, under certain special conditions, depositors in Tier-1 accounts are allowed to withdraw up to 25% of their own contribution, provided the subscriber has stayed invested for at least 3-years.

To make a partial withdrawal from a Tier-1 account, the depositor must submit a withdrawal application along with necessary documents to the National Pension System Trust or the central recordkeeping agency for their approval. However, withdrawals from Tier-2 accounts can be done without any restrictions and limits.

In case the investor passes away and the nominee decides to close the NPS account, then the amount received by the nominee is exempt from taxation.

Please note: The depositor can withdraw up to 25% of their own contribution and cannot withdraw any part of the employer’s contribution.

Tax implications of national pension scheme (NPS)

An investment made into the national pension scheme is tax-deductible under section 80 CCD. In this case, three subsections of section 80 CCD are applicable:

Section 80CCD (1): The provisions under this section provide a tax benefit to all investment made into the NPS scheme by employees in the government, public and private sector as well as self-employed individuals. The maximum limit of such deduction is ₹150,000.

Section 80 CCD (1b): Under this section, taxpayers can claim an additional deduction of ₹ 50,000 for their contributions to the NPS scheme. This section also includes contributions to the Atal Pension Yojana, which we have discussed in detail in the next section.

Section 80CCD (2): Apart from employees, employers can also make contributions into Tier – I NPS accounts. These contributions are allowed in addition to the regular employer contribution into EPF and PPF accounts. However, the maximum contribution is restricted to 10% of the basic salary plus dearness allowance (if applicable).

It is important to note that effective FY 2020-21, the employer’s contribution of more than ₹7.5 lakhs into retirement funds, EPF, NPS, superannuation funds are taxable in the hands of the employee. The interest earned on such a contribution will also be taxed in the hands of the employee.

Atal Pension Yojana

Aimed at the unorganized sector, Atal Pension Yojana was launched with a goal to provide protection to every Indian citizen during illness, accidents, diseases in old age and give them a sense of security.

The private sector does not provide its employees with certain benefits such as a pension. Hence, Atal Pension Yojana aims to mitigate that risk.

Each individual investing in Atal Pension Yojana has to contribute a certain amount to the fund every year. The contribution amount depends on the age at which one starts contributing as well as the amount of pension he/she wants to receive when they retire.

The table below shows the contribution amount as per age and desired pension to be received:

You can access the full list by clicking on the source link

The Government also makes a co-contribution of 50% of the total contribution or ₹1000 per annum, whichever is lower to all eligible subscribers who had joined the scheme between June to December 2015 for a period of 5-years. However, to receive this government contribution, the subscribers should not be a part of any other statutory social security schemes such as EPF or should not be paying income taxes.

Atal Pension Yojana provides a fixed pension of ₹1000, ₹2000, ₹3000, ₹4000, ₹5000 once individuals reach the age of 60. The amount of pension is dependent on the individual’s age and contribution amount.

If the contributor passes away, the contributor’s spouse can claim the pension. However, if the contributor passes away before attaining the age of 60 then the spouse is provided with an option to either exit the scheme and withdraw the corpus or continue the scheme for the balance period.

Like the national pension scheme, the fund collected under this scheme is managed by the Pension Funds Regulatory Authority of India (PFRDA).

Important things to know about Atal Pension Yojana

- Since the contribution is made periodically, the amount is deducted automatically from the bank account.

- The premium can be increased or decreased at your will. This can be done by contacting the bank through which you have signed up for the scheme.

- In case of default in payment, a penalty is levied at the rate of ₹ 1 per month for a contribution of every ₹100 or part thereof.

- In case of default for consecutive 6 months, the account will be frozen. If the default continues for 12 months, then the account will be closed and the remaining amount paid to the subscriber.

- Premature withdrawal is allowed only in cases of death or terminal illness. In such cases, the subscriber or his/her nominee will receive the entire amount back.

- In case the scheme is closed by the subscriber before he/she turns the age of 60, only their contribution and interest earned on that sum will be returned. The depositor will not be eligible to receive any government contribution or interest earned on that amount.

Atal Pension Yojana is one of the best-performing pension funds available in India. In 2019-2020, the fund has given over 11% return, much higher than all its counterparts.

How to apply for Atal Pension Yojana?

Almost all banks in India offer this scheme. You can visit your bank and apply for the scheme. Forms are available in English, Hindi, Bangla, Gujarati, Kannada, Marathi, Odia, Tamil, and Telugu.

Tax benefits for Atal Pension Yojana:

The contributions made by you into the Atal Pension Yojana are eligible for tax deductions under section 80CCD. Under section 80CCD (1) a total of ₹150,000 is eligible for a tax deduction. Additional ₹50,000 can be claimed under section 80 CCD (1b).

Health insurance

Section 80D allows a variety of deductions on premiums paid on health insurance as well as medical expenses incurred. Various sections of this section provide various forms of deduction, as mentioned earlier.

Let us summarize them for a better understanding:

Health insurance premium

As you can see from the table above, one can claim a tax benefit of up to ₹25,000 for the following:

1. Premium paid for health insurance covering self, spouse and/or dependent children.

2. Contributions to Central Health Government Schemes.

One should consider taking medical insurance not just for obtaining tax benefits but for meeting medical expenses too. As we all know, medical emergencies come unannounced and medical treatments can be very expensive. Medical insurance is your friend in times of need.

Types of health insurance policies available in India:

To understand the nuances of medical insurance, you can read our module on health insurance.

Interest on education loan

The interest paid on an education loan is tax-deductible under section 80E. This deduction is only available to the person paying the education loan. If the loan is being repaid by the parent, then the tax deduction will be available to him/her. In case the loan is being repaid by the child, then he/she can claim the deduction.

This deduction is available for a maximum period of 8-years or till the interest is paid, whichever is earlier. Usually, education loans have a moratorium period as in the loan is first provided for higher education and repaid only when the candidate starts a job or the elapse of a certain period (usually 6 months) after the course completion. The deduction is applicable only when the loan repayment starts.

Please note: Only the interest amount of the education loan EMI is tax-deductible under section 80E. The principal amount is not tax-deductible.

Tax Deductions on Home Loan Repayment

Buying a house is everyone’s dream. In order to encourage individuals to invest in a home, the government of India has provided tax deduction on home loan under section 80C. But that’s not all. Multiple tax deductions are available on home loans making millions of dreams come true.

To be eligible for tax deduction, a home loan must be taken for the purchase or construction of a house and the purchase or construction must be completed within 5-years from the end of the financial year in which the home loan was taken.

A home loan EMI consists of two components – the principal and the interest.

Deduction on principal repayment on home loan EMI

The principal portion of the EMI is also tax-deductible under section 80C. The maximum amount that can be claimed in a financial year is ₹150,000. However, if the property is sold within 5-years of possession, then the deducted amount will be added back to your income in the year of sale.

Deduction on interest paid on home loan EMI

The interest paid on the EMI is tax-deductible under section 24 of the Income Tax Act. The maximum total amount of deduction allowed in a financial year is ₹200,000 for self-occupied property. However, for property put on rent, there is no maximum limit.

Deduction for interest paid on a home loan during the construction period:

In case you have bought an under-construction property, and are already paying EMIs without taking possession of the house, the above two sections do not apply. However, this does not mean that you lose out on tax benefits on the EMI that you pay for an under-construction property.

The interest portion of the EMI can be claimed as pre-construction interest through deduction in five equal installments starting from the year of possession of the property. This is over and above the deductions, you are eligible for under section 24 mentioned above. However, the maximum cap of such a claim remains ₹200,000.

Deduction for stamp duty and registration charges:

We all know that stamp duty and registration charges while a property can be quite high. The good news is these payments are also eligible for tax deduction under section 80C. The maximum limit is ₹150,000.

Please note: This can be claimed only in the year in which the expenses have been incurred and not anytime later.

Additional deduction under section 80EE

- Homebuyers can claim an additional deduction of up to ₹50,000 under section 80EE if the following conditions are met:

- The loan is sanctioned between 1st April 2016 to 31st March 2017.

- The amount of loan taken should be ₹35 lakhs or the less or the total value of the property is less than ₹50 lakhs.

- The individual is a first-time homeowner, as in he/she does not own any other house, as on the date of sanction of the loan.

Additional deduction under section 80EEA

- Section 80EEA provides additional deduction to homeowners up to ₹ 150,000 if the following conditions are met:

- The loan must be sanctioned between 1st April 2019 to 31st March 2020.

- The stamp value of the property does not exceed ₹45 lakhs.

- The individual does not own any other house i.e. he/she is a first-time buyer at the time of buying a house.

- The individual should not be eligible for tax deduction under section 80EE.

Tax deduction for joint home loans:

Many home loans are taken jointly these days and both borrowers file taxes. In this case, both can claim a deduction. The maximum limit for deduction on the principal is ₹200,000 and interest is ₹150,000 for each borrower.

Please note that to claim this deduction, both borrowers have to be co-owners of the property as well.

Let us now summarize the various provisions related to tax deductions on home loans:

If you are interested to learn about home loans in detail you can read our detailed module on home loans. This module can serve as a guide before taking a Home Loan.

National savings certificate

National Saving Certificate (NSC) is a fixed income investment scheme that is considered as secure as a provident fund. This is a government of India initiative where investors can invest as per their investment habits and income profile. You can invest in NSC through post offices by filling up a form and submitting your KYC documents. Investments in NSC earn fixed returns and qualify for income tax deduction under section 80C. The maximum deduction that can be claimed is ₹1.5 lakhs.

Important things to know about NSC:

- Fixed-income investment.

- Tenure: 5 years

- Interest rate: 6.8% per annum (as of 5.7.2021)

- Minimum investment: 1000

- Tax-deductible under section 80C

- Maximum amount eligible for tax deduction: 1.5 lakhs

- Nomination facility is available.

- NSC can be used as collateral for obtaining loans.

- Premature withdrawal is generally not allowed. Can be done only under special circumstances.

Advantages of investing in NSC:

- The interest earned in NSC is compounded yearly and reinvested in the invested amount. This helps in multiplying the total investment amount faster.

- There are a range of benefits for investing in NSCs, some of which are tax benefits & ability to invest in the fund even after maturity.

Tax benefits of NSC:

- As mentioned earlier, investment into NSC is tax-deductible under section 80C of the Income Tax Act.

- The interest earned in NSC is considered a new investment and hence are eligible for tax deductions as well.

- TDS is not applied to NSC. However, tax has to be paid on the interest earned as per one’s income tax slab rate.

Premature withdrawal of NSC

Generally, premature withdrawal of NSC is not allowed till it reaches maturity at the end of 5-years. However, premature withdrawal can be done only under the following circumstances:

- The investor passes away.

- The certificate is forfeited. In such a case, the pledgee must be a gazetted government officer.

- If ordered by a court of law.

Conclusion

To quickly recapitulate what we have learned from this module:

- The different sections of the income tax act allowed or deduction; and

- What are the different savings and investment avenues through which we can avail such deductions and save tax?

Thus, after learning all the sections of this module, you can easily decide and plan your tax filing while saving a handsome amount of money at the same time in the form of tax savings.