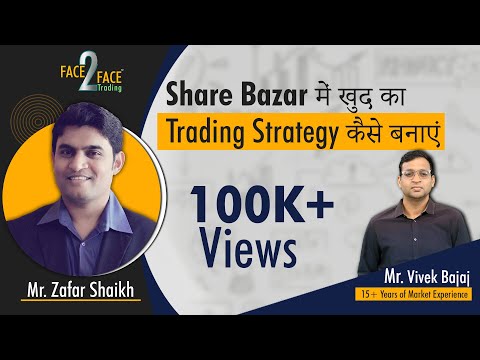

In this instalment of the Face2Face series, watch a candid conversation between Mr. Vivek Bajaj, co-founder, StockEdge & Elearnmarkets, and Mr. Zafar Shaikh, an expert trader and investor, who will focus on wealth creation and trading-strategy making for aspiring traders in the share bazar. We will first talk about Mr. Zafar Shaikh’s background and the events that led him to become a share market trader. Following this, we will start our technical discussion with the importance of risk management for beginners and how under-investing of capital can help us maintain a suitable position in the stock market.

We will also touch upon the importance of discipline and strategy to set up a track record of profitable trades through the various phases of the stock market and set up a defence to your capital before starting share trading. We will also talk about the limits we should set upon our reserved and disposable capital in the share market. Next, we will start our conceptual discussion of trend following in trading strategies. We will first talk about the basics of trading strategies, like the products available for us to trade, and the different basic types of strategies, like options trading and common futures trading strategies.

We will touch upon the importance of share market investing positions with trading to accommodate long-term wealth creation. Further, we will discuss the advantages of trading in the share market and how trading wins over a job. We will also touch upon a lot of challenges that traders face, which people have to overcome with the right kind of discipline and knowledge. Next, to help beginners accommodate to the market, Mr. Zafar Shaikh will discuss some points to highlight some hard truths about the share bazaar, and bust some myths about earning money in the stock market.

Following this, we will discuss how working professionals can make the best trading strategy for their trades and the various technical principles and tools we can use. Finally, we will discuss the various decisions that one has to take before creating and implementing a suitable trading strategy. We will also discuss the definitions of some terms and chart situations we might encounter while creating our strategy, like consolidation, trends, etc.

Your Speaker

Zafar Shaikh

Your Host

Vivek Bajaj

_1741885609.webp)