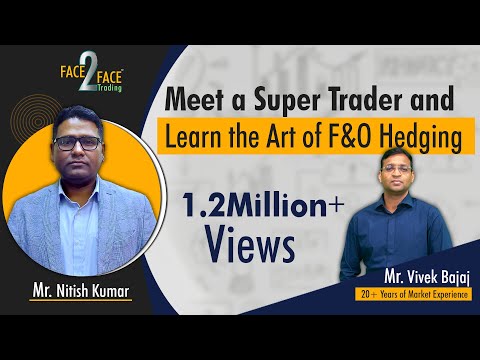

In this video of the face2face series, we have with us Mr. Vivek Bajaj, co-founder, StockEdge, Elearnmarkets, in conversation with Mr. Nitish Kumar, a passionate trader, investor, and a teacher who aims to teach people all about Hedging - how to hedge with options, what it is, why is it done and how people trading in futures and options derivatives can hedge successfully.

The discussion starts off with delving into Mr. Nitish Kumar's background and what drives him to help other traders and investors maximise gains while limiting losses. He discusses typical myths about hedging, such as the idea that only big investors like FIIs and DIIs may use it. The emphasis then shifts to long-term share market investors and traders looking to make a living from Nifty trading. Additionally, hedging strategies for options and futures derivative trading and investing are discussed.

Mr. Nitish Kumar highlights the Nifty as a safe haven for investors and traders and provides advice on the benefits of investing in Nifty BeES. The right pairing of call and put options is further discussed in the video, along with illustrative examples. Particularly for individuals who are considering this technique as part of their retirement planning, the necessity of discipline over greed is emphasised. The N100 or Motilal Oswal NASDAQ 100 ETF is also discussed as a safe and rewarding alternative to direct investment in American stocks for long-term stock market investments. Next, we will look at the best way to hedge profitably with derivatives.

Watch this video to discover all about options and futures derivative hedging strategies as Mr. Nitish Kumar explains the idea of hedging, common misconceptions about it, and its advantages. Learn about Nifty trading, disciplined investing, and the N100 ETF as a safe stock market investment alternative.

Your Speaker

Nitish Kumar

Your Host

Vivek Bajaj