Common Stocks and Uncommon Profits

Introduction

About the book

The book "Common Stocks and Uncommon Profits" is one of the best-selling investment books of all times written by Philip Arthur Fisher. It teaches that buying and holding a stock is more important than selling it. This book also explains the long-term growth of a stock is more important than its short-term profits.

Warren Buffet, one of the greatest investors of all time, once described himself as 15% of Philip Fisher and 85% of Benjamin Graham.

About the author

Philip Fisher began his career in 1928 as a Security Analyst in the Anglo-London Bank in San Francisco, USA. He later founded his self-owned finance management company named Fisher & Co. in 1931. His book "Common Stocks and Uncommon Profits" is a guide to investing that has remained in print ever since it was first published in 1958. Fisher is also known as the "Father of Growth Investing".

Buy the book

The book teaches you fifteen points to look for in a Common Stock before investing in it. We highly recommend you to read the entire book. (affiliate link)

Clues Of The Past

This chapter introduces us to the ambition of a good investment in a potential company. Most people are eager to earn some extra income by investing in companies with minimal risks. Philip Fisher highlights the downside of the most common strategies of investment and shares his insight on why investment opportunities have increased over the years.

The most sensible approach is to study the history of the stock market and invest in common stocks that have given the most profitable returns in the past.

Philip Fisher points to an approach of “betting on the business cycle”.

During an unstable banking system, it was more profitable for investors to find a company and stick with it.

Companies which had the potential to give huge returns were available for years at prices that could have provided far better profits than buying shares in a panic during a business downturn. Philip Fisher opines that the stocks which can generate hefty profits in the long run still exist today, and the chances of finding such companies are even higher.

Chances of finding good stocks have increased because there has been a drastic change in the corporate management structure of most companies.

The author further explains that recently companies have started hiring people according to their skills and experience, whereas in earlier days, family-owned companies were run by their own family members irrespective of their capabilities and qualities. A company that has too many family members involved in its day-to-day operations shouldn’t be considered for investing.

Modern corporate management focuses on introducing new ideas and changes and tends to look for improvements.

Companies have also introduced the concept of R&D, which allows innovations at a faster rate. This increases a company’s competitive power in the market, which is exactly why it can be better for investors.

Since 1932, the Federal Government has decided to help companies fight times of recession by lowering taxes. Support from the Federal Government to the companies can increase potential investment opportunities.

In a recession, inflation will rise, and interest rates will go down, which will make a bond cheaper.

It is always better to identify good companies and buy them now rather than buying stocks in times of depression and selling them in the times of boom.

What “Scuttlebutt” Can Do?

In this chapter, Philip Fisher introduces us to the concept of ‘Scuttlebutt’. According to him, the most logical method of investing in a potentially high return generating stock is by gathering information about that company from trustworthy sources.

We should acquire accurate information about a company's production, technology, yearly revenue, sales, and research & development, along with proper data about the company's executives, chief, and its directors.

The best way to extract information about a company is by hiring a skilled person who knows how a company’s management works and use him/her to examine the crucial departments and aspects of a company.

However, this is a highly impractical approach because most companies will not allow an outsider to gain information about their internal matters. Plus, there are only a few individuals who have the knowledge and the expertise to perform a job of this magnitude.

Business “grapevine” is a key factor that allows us to analyse the strengths and weaknesses of a company. In other words, all the entities that are related to a particular company, i.e., competitors, vendors, ex-employees, and customers can have significant sources of information about that company.

Information can also be gathered from Research Scientists in Universities, as well as executives of trade associations. Philip Fisher considered data and information from research scientists, customers, and vendors to be highly accurate.

Ex-employees, on the other hand, can have crucial sources of information. However, their information may contain a bias or a personal opinion, and hence, such information must be thoroughly checked and cross-verified.

Data gathered from different sources can point to different conclusions about the potential of a company. In such scenarios, we should contact the employees of that company and fill the gaps in our information before conducting further research.

Investigating a company with all the above-mentioned sources can help us in making a well-informed investment decision.

The 15 Points To Look For In A Common Stock

In this chapter, Philip Fisher sheds light on 15 aspects that we can consider while evaluating the future growth and performance of a company:

1.The product and service offered by a company:

It is crucial to understand whether a company’s product/service has the potential to generate sufficient demand such that it can gather a significant market share in the future.

Companies can make short-term profits by cutting costs. A company that can anticipate a market change will be able to sustain its sales for a significant period of time. The author gives the example of a radio manufacturer and explains that the sale of radios was high as long as there were no TVs. After the introduction of TVs, the sale of radios went down massively.

2.Research and development of new products to replace existing potential product lines.

According to the author, we should invest in a company that has an ongoing research project to replace existing product lines with better and upgraded products so that it can retain its existing market share. A management that is smart enough will realize that a product tends to do better when its metrics are improved over time when compared to a newly launched product. The management of a company should never be complacent. They should always be on the move and look for new and better ways to improve their products.

3.Company's investment in research and development with respect to its size.

The R&D figure of a company is easily available in its annual report. Many analysts compare this figure to another company in the same industry. Some analysts even compare it with the industry average. What most analysts don’t realize is that the R&D figure can be misleading because it is upon the management to decide which expense will be categorised under this head.

For R&D efforts to be successful, the author suggests three ways:

1.Coordination with the R&D team

2.Coordination between the research team and the business and operations team

3.Coordination with the management of the company

Many companies start researching on a project but stop halfway in. According to the author, the research of an upcoming project should never stop. It should always be completed.

Another activity that complicates the calculation of a research expense is the amount of research that is related to defense contracts. Profit margins from a defense contract are generally very low, and every contract is subject to competitive bidding. For example, a company wins the bid for the first installment of a project but loses the second installment to a competitor. This is why profits from these kinds of projects are not sustainable.

Expenses related to market research should also be considered while calculating the research expense of a company.

A company that puts significant efforts into its R&D is more likely to have a positive outcome in the future than a company which does not.

4.Company’s effort to sales, advertisement, and distribution

A company’s success largely depends on three factors:

A)Outstanding Production

B)Sales

C)Research

Regular sales to satisfied customers is the first benchmark of success in a company. Specific sales ratios don’t always reflect the full picture of a company. These ratios are far too simplified and the nature of a company can’t be understood just by looking at them.

Customers and competitors of a company have the true knowledge of its sales, but it is very hard to get those answers from them. Moreover, a company’s effort to inform a customer/client about its product specifications or service benefits is essential. Proper distribution, such that the customers of a company are easily able to acquire its products is critical for a positive return on investment. A company should make its best effort in finding more efficient ways to improve its service offerings and delivery systems.

5. Does the company have a healthy profit margin?

A company’s sales growth should be corresponding with its profits. If a company’s sales are growing but its profits are stagnant, then there might be a problem in that company. This is why it is a better option to look for the profit margin of a company. A company with a high-profit margin is a good company to invest in. Common mathematical analysis of a company always measures its yearly revenues and profit margins.

6. Company’s efforts towards maintaining and improving its profit margins:

A stock should be purchased on the basis of expectation of its future earning capacity, and not on its current earnings. For example, Tesla is currently a loss-making company, but people expect electric cars to be the future of our world.

Increasing costs can decrease the ability of a company to maintain its profit margins. We should buy the shares of those companies which can maintain their profits by increasing the price of their products. Ideally, we should look to buy those companies which have capital improving programs, and through which they try to design new equipment which can reduce the manufacturing cost of their products.

7. Labour turnover, personnel relations, and employee growth:

Companies which generate profits by reducing wages to a point which is below the industry standards are likely to have negative relations with their laborers. We shouldn’t invest in these companies. To identify these companies, we can look at the grievance cell. Companies that make an effort to solve all the grievances of their employees are likely to have good labor relations. Regular labor strikes is not a good sign, whereas companies that generate high profits and pay high wages as well are optimal to invest in. Companies with high employee retention and growth signify a positive image of personnel relations. Those companies have a higher rate to succeed in the future.

8. Relation with executive personnel:

The company which offers the best investment opportunities is the company where a good executive climate exists. Promotions in a company should be based on the ability of a person. A company’s management is responsible for making crucial decisions and adjustments. Hence, we should analyze the relations between a company and its executives before investing in it.

9. Stability, organization, and approach of the management:

It is vital to have stable and organised management with a good depth of knowledge, where newer ideas and changes can be implemented. This enables the introduction of better processes, efficient practices, and even improved products/services that help a company to maintain a healthy growth rate. A top management which evaluates suggestions from low-ranked personnel in the same organization is a positive sign.

10. Cost analysis, accounting, and auditing techniques:

A successful company should diversify its revenue generation, i.e., it should develop several good products. If one product flops, other products will make up for that loss. The overall cost of an organization should be divided, and all the unnecessary costs should be deleted. Proper accounting techniques provide the opportunity for an investor to make a well-informed decision using economic, mathematical, and statistical analysis of such numerical data.

11. Patents:

A company which has a higher than average insurance costs will have lower profit margins than its competitors. Strong patent positions can give a company an easier path to high sustained profits. As soon as a patent's tenure ends, a company’s profits may suffer badly. Patents are not relevant for every industry.

Aspects such as skilled labors, past experiences, reputation, existing market share, or even patents help a company gain a competitive advantage. Philip Fisher suggests investors evaluate companies with such traits.

12. Does the company focus on short-run or long-run gains in profit?

The author recommends investing in companies which have long-term plans because it signifies they have stronger foundations and relations with their vendors, customers, and clients. Such companies have a higher potential to exploit their existing market share.

A company with a short-term approach will try to generate maximum returns for the current period, while a company with a long-term approach may report losses in the current period but will surely generate high profits in the long run.

13. Does the company have sufficient growth potential to allow stockholders to benefit from that growth?

Investors should analyze a company's debt and its potential to repay its debts. A company which takes heavy debt or equity financing is a bad sign. For checking whether a company is debt heavy or not, solvency ratios like Debt/equity ratio, etc. should be used. Any organization which can finance its growth through its retained earnings or without taking a huge amount of debt is a positive sign. Investors should look to invest in these companies.

If a company has many dilutive securities, it is not a good sign because dilutive securities have the potential to reduce a shareholder’s return.

14. Approach of management towards investors in times of distress:

During times of trouble, the approach of a management and its communication with the investors becomes an important factor to analyse. A company with a strong contingency plan will talk freely with its investors and vice versa.

The demand for a company’s product is bound to go up or down during its life cycle. Companies which don't disclose information freely during a down point will panic. When in panic, a company’s ability to think critically is lost. Hence, such companies should be avoided.

15. The integrity of the company’s management:

Philip Fisher concludes the chapter with this final point that highlights infinite legal ways through which a management can exploit their power for personal gains. This adversely affects the investor and hence, is an important factor.

An investor should look at the integrity of management. To do this, go back 5 years and check whether the management delivered on what it said. This is very important. A company whose integrity is unquestionable is the one we should buy.

What To Buy

People always tend to overestimate their abilities. They think they can make returns by just looking at a stock for 5-10 mins. Whereas an expert investor sits on his/her trading desk, from 9:00 A.M to 3:00 P.M, reads annual reports, analyses price movements, industry, and economy before investing.

Generating the maximum returns while taking the least possible risk should be a goal for any investor.

The author talks about modifying an investment strategy of an individual as per his/her financial condition:

1. Growth stocks are for every kind of investor. Investing in “bargains” instead of growth stocks can definitely help one fetch good money but it may not be as high as investing in growth stocks. For example, If a stock is currently trading at a 20% discount, and you as an investor, buy it. The author says that the returns you will generate from buying this “bargain” stock will be significantly lower than if you had purchased a growth stock.

2. An investor must take a decision after determining the type of the growth stock that he is intending to buy. The author talks about 2 classes of growth companies. The ones that are massive and constantly grow like IBM and DuPont, and the ones that institutional investors are yet to discover. The potentiality that is present in a stock that hasn’t been discovered till now can prove to give amazing returns.

3. If the investor does not have the time, or the skill to manage his own investment portfolio, he can ask an investment advisor to guide him. If he chooses to do so , the investor must take care to appoint an expert with a proven track record based on good investment picks, and not an “expert” who has taken higher or lower risks in the stock market and has simply been lucky with timing. He must also ensure that the advisor has the same fundamental approach to picking stocks as himself.

4. The author suggests not to emphasize on the dividend yields. Growth companies characteristically reinvest all their capital into the business, hence payout of dividends is minimal. Also, growth investing is better than value investing as the perks of value investing are limited.

When To Buy

In this chapter, the author talks about how to time the market. Finding the best stocks is one aspect to make money, but if an investor wants to optimize his profits, he must also pay close attention to the timing of buying those stocks. The author sheds light on various factors that may influence the optimum time to invest. Much of these factors depend on an investor’s temperament and his objective.

All stocks held for a long time will generate a considerable amount of profit.

The most usual method of understanding the optimum time of investment is through analysis of economical data. However, this method is impractical because economic forecasting is rarely accurate.

A good time to buy a stock is when a company is about to launch a new product.

The stock price of a company rapidly rises during the launch of a new product. However, if the launch of a product is delayed due to financial losses associated with the shakedown period, then stock prices fall.

An investor should always look for a company with an exceptionally able management. A company might face troubles during difficult times. However, such issues could be solved in a matter of months by an efficient management. An ideal investor should be able to identify such troubles that are temporarily faced by a company. Stock prices fall during such downturns, and this is time for an investor to buy the stock.

Improvement in technology that increases output or reduces the cost of a company is a strong indicator that the stock prices will rise. Such times are viable investment opportunities.

Philip Fisher concludes the chapter by pointing out the 5 powerful forces that affect the outcome of an investment decision. It includes economic depression, governmental attitude, technological innovation, inflation, and interest rates. These factors are difficult to assess at all times. According to him, always invest in companies that have an undeniable growth potential.

When To Sell

Investors decide to sell their stocks due to a variety of reasons. Some of them could be due to personal needs and others could be based on the sole purpose of maximizing profits. Philip Fisher focuses on the financial side of the story and highlights various scenarios where selling could be best. He believes that there can be three reasons why an investor decides to sell a common stock:

1. When an investor realizes that he has made a bad decision of buying the stock. It requires a great amount of self-control and self-honesty to admit that we made the wrong judgement. It is common to make a bad decision as the entire process of buying a potential stock is complex. Handling this situation is often inhibited by individual ego as nobody likes to admit that they are wrong. An ideal investor should put aside his emotions and follow a rational approach. It is best to sell a stock at the earliest if the investor realizes that they have made a bad purchase. Selling bad investments as early as possible minimizes one’s loss and opens the opportunity to invest the remaining funds into an alternate outstanding stock.

2. The second reason an investor should sell a stock is when the company degrades over time and fails to meet the 15 reasons for which it was bought. A potential company can degrade as management changes over time or the industry as a whole suffers. In the case where management deterioration has led to the downfall of a company, a stock should be sold as soon as possible.

3. The third reason an investor should sell stocks is when he finds a better investment opportunity. Switching to better stocks is the best decision even with the hassle that comes with it. Before making such investment switches, an investor must extensively analyze the situation and minimize risks related to misjudgment.

Moreover, selling stocks based on the prediction of an upcoming business downturn is a bad decision in the long run.

Potential stocks will always rise to original price points even after a phase of strong depression. In the next bull market, there is a high probability for such stocks to reach their new peak.

Philip Fisher concludes the chapter by advising that potential companies that meet the fifteen points of buying will always regain their position and rise through downturns and depression. It is crucial to have patience as strong companies will always come up with a solution to overcome economic downfalls. When a correct stock is purchased, “the time to sell it is --- almost never”.

We have seen this approach from Warren Buffett, who says that he will never sell Coca-Cola stock.

Dividends

A company which is not paying dividends is not necessarily a bad company. It might signify that the company wants to set up a new plant, invest in a better project, etc. This will make a company generate better profits in the long run. A stockholder will not benefit from retained earnings if the company is capable of using the retained earnings properly.

Another way by which a stockholder will not benefit when a company retains its profits is when the management of that company will pay higher salaries to themselves. Our accounting methods don’t show a way by which we can identify what the retained earnings are used for. For example, a company may buy expensive paintings without any reason, but there’s no way to know that.

A person who needs current income should invest in a dividend-paying stock. A long-term investor shouldn’t be bothered about dividends. We as investors get carried away by seeing huge dividends. But we miss the fact that a company forgoes other opportunities to reinvest its earnings to distribute it as dividends. A growing company will most likely not pay dividends at all for several years before its price appreciation stops.

At the end of the day, the important factor is where the capital can be employed in order to provide the highest value to the shareholder. Earnings that are retained could be used for new plants, major cost saving initiatives over the long run, or product development. Whether or not the highest value for the shareholder would be achieved through dividends or through the management retaining earnings is therefore an issue that must be examined from time to time.

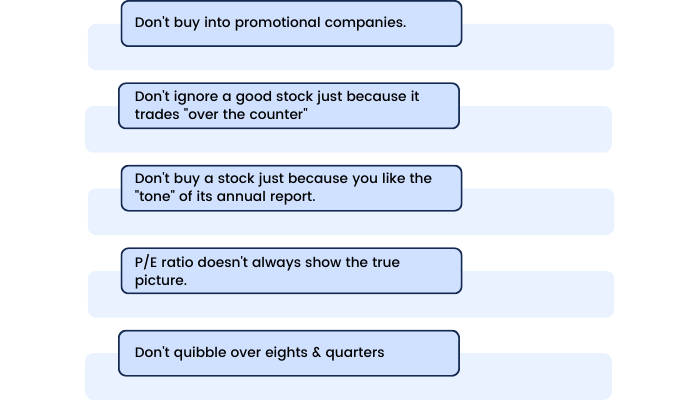

5 Don'ts For Investors

A.Don’t buy young companies:

According to the author, a young company which has just started out is not a good investment option. The reason for this is that a young company has high chances of failing. Fisher preferred to buy companies which had established themselves and had a commercial production line.

For example, an investor who purchased Netflix in 2002 would have generated a 10,000% percent return in 15 years. The problem is that in 2001, it was very difficult to predict that Netflix would generate such high returns in a span of just 15 years.

It would be like taking a guess. Guessing will rarely work.

B.Don’t ignore a good stock just because it trades “over-the-counter”:

Over-the-counter stocks are those stocks which are not listed in an exchange. There might be good stocks available in the OTC market if we look carefully. The disadvantage of the OTC stocks is that they are illiquid. Generally, bid-ask spreads are high on OTC markets, which means the commissions are high as well.

C.Don’t buy a stock just because you like the “tone” of its annual report:

Do not buy or sell a stock because its financial report sounds positive or negative. Instead, look at the quality of the report. See the accounting choices which have been made. It's the management’s job to make their financial reports sound positive.

D.A stock’s P/E ratio doesn’t always show its true picture:

According to the author, a company’s P/E ratio may not show its true picture. A P/E ratio of 20 times does not mean that the company is overvalued. Understanding the nature of a company is very important. A company which keeps launching new products constantly, and if that company is in a high growth industry, it will most likely be a bargain. The P/E ratio, in that case, will not matter.

E.Don’t quibble over eighths and quarters:

If you’re an investor and you don’t want to buy large amounts of a stock at once, the best thing you can do is to buy the stock when it's close to your price target.

Suppose your price target for a stock is ₹50, and the current price of that stock is ₹51. The logical thing to do is buy this stock for ₹51. It is possible that the price will never reach ₹50. If you want to buy large amounts of a stock, then it makes sense to place the order through a broker. If you place the orders yourself, the price of that stock will surge massively.

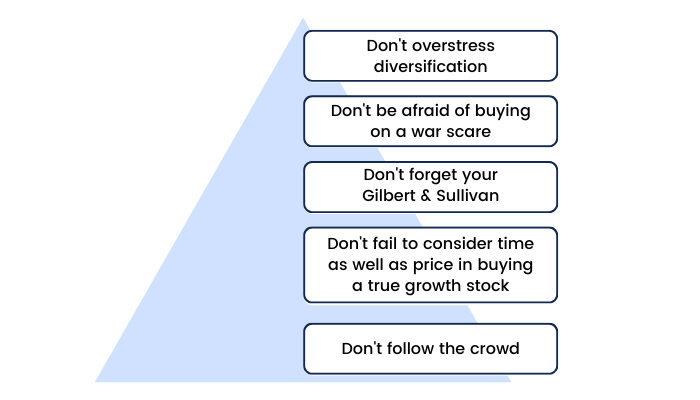

5 More Don’ts for Investors

(Part 1: Chapter 9)

A.Don’t overstress diversification:

Diversification is one of the most important principles in investing.

The author says that almost everyone who is involved in the stock markets considers diversification.

The problem is very few people consider over-diversification.

Don’t buy just for the sake of diversifying. Buying a company when you don't have sufficient knowledge about a company or the industry it operates in, is far more dangerous than not buying a company at all.

If you’re holding a company that is very volatile in nature, you will need to diversify.

The author provides some rules for diversification:

1.Don’t put more than 20% of your investment into 1 company.

2.Never put more than 5% of your investments in small-cap or high-risk companies.

Buying more stocks does not necessarily mean more diversification. For example, if you own 10 stocks, but 7 of your stocks are from the Pharma sector, there is little or no diversification in your portfolio.

B.Don’t be afraid of buying on a war scare:

According to the author, war tensions can lead to good buying opportunities. Investors sell off excessively when a situation of war arrives, which in turn, makes a lot of securities undervalued. This point is not relevant anymore because major wars haven’t happened in the past 2-3 decades.

C.Don’t forget your Gilbert and Sullivan:

In this chapter, the author says that we shouldn’t over-analyse things in the stock market. Just looking at the price of a stock before making a decision is not logical. This is because the price at which a stock was selling 4 years ago may have little or no linear relationship with what its price is today.

We should remember that a stock’s price isn’t based on its today’s earnings. It is based on its future earning capacity. No factor of a company should be looked at single-handedly, like the P/E ratio, volume of sales, etc. We need to look at the whole picture of the company and see whether it makes sense to buy that company at its current price.

For example, the P/E ratio shows the current earnings of a company divided by its today’s price.

If a company’s major consumer canceled the contract, the majority of its sales would plummet. A person who just looked at the P/E ratio of this company will purchase it and regret it later.

This is why it becomes important to look at every single factor of a company before buying it.

D.Don’t fail to consider time as well as price before buying a true growth stock:

According to the author, we should buy a stock at a certain date rather than a certain price.

For example, if the price of Tata Motors is at ₹320 today, and the company says it is very optimistic about its future, but you’re unsure about it. You should wait until the next quarterly reports to release, see if the sales are increasing, whether the auto industry is showing positive growth, and then buy.

E.Don’t follow the crowd:

A stock’s price doesn’t always move for the right reasons. As we have seen many times, certain negative or positive rumors, which may or may not be true, can lead a stock’s price to go up or down significantly. We should evaluate these rumors properly before making a panic purchase.

Certain groups of people always try to manipulate us by spreading fake news about a company.

We should never purchase or sell a stock by following the advice of other investors.

How Do I Go About Finding A Growth Stock?

In this chapter, Fisher goes into more detail about how he identifies the best growth stocks in practice.

The first of two steps he practices is to sort out the immensely high number of potential companies to invest in by speaking to competent investors with a proven track record. The advantage of doing this is that, through their daily work, these experts already have a valid opinion on the fifteen points that need to be met before purchasing the stock.

In these discussions, Fisher likes to investigate whether the company is already in or is steered in the direction of unusually high sales, and whether the market the company is operating in is hard to enter for competitors. A company with a strong moat is hard to break.

The second step comes into play once a company has been found for the investment opportunity. The investor should look into the financial statements, analyzing the sales in the income statements, and the debt in the balance sheet. The “Scuttlebutt Method” should be applied, and as many people connected to the company as possible should be contacted. If the scuttlebutt method rejected the stock, he rejected the stock too.

If the stock still qualified, Fisher would then approach the management to fill gaps in his knowledge about the company. Only after all these efforts, he would invest in the stock.

His methods were time-consuming but rewarded him most of the time over the long-run.

Eternal Principles

Certain new factors have emerged which now need to be considered before investing. Corporate management and economic harnessing of scientific research are some of the factors that have been introduced recently. No matter how many new factors arrive, the author says that the basic principles of investing mentioned in this book will always remain valid.

Conservative Investors Sleep Well

1.The First Dimension of a Conservative Investment

A conservative investor should look for 4 things in an organisation:

A.Low - Cost of Production:

A company should have the lowest cost of production in its industry. There are 2 aspects to this: - A company’s cost should be below the average break-even point of its industry. In a downturn, a company which has low costs will be able to survive easily, whereas a company with high costs of production will most likely exit from the market.

A company with a low cost of production will have high returns and will be able to generate finance internally. This will remove the need for raising additional equity, debt, etc.

The author says that in a boom, the percentage rise in profits will be higher for a high-cost company than for a low-cost company. For example, in a market, there are 2 companies. Company A and B, both sell a watch for ₹10. Company A has a profit of ₹4, whereas company B has a profit of ₹1 per watch. Demand for watches has increased and so the price is now ₹12 per watch. The higher profit-making company “A” increased its profits by 50%, whereas, the high cost company “B” increased its profits by 300%. That's why it's important to look at the profits and not just the profit margins.

B. Strong Market Organisation:

A strong organization should constantly be alert to the changing desires of its customers so that the company can supply what is desired today, and not what was used to be desired.

The author says that just recognising these changes is not enough. A company needs to make its customers aware of the changes which have been made. Efficient production and marketing are the two key areas in which a company should have significant expertise if it wants to be successful.

C.Outstanding Research and Technical Effort:

This point was discussed earlier, A company’s R&D team should come up with products which can be readily sold in the market, or whose customer demand is high. To achieve this, strong market research is required. A product which cannot be sold right now is useless.

D.Financial Skill:

A company should have adequate knowledge about each element of its costs, not just in manufacturing, but in selling and research as well. This will spotlight even the minor phases where a company can reduce its costs. Through skillful budgeting and accounting, a company can create a system through which it can detect anything that can hamper the profitability of a company.

The Second Dimension Of A Conservative Investment

To summarise, the first dimension of a conservative investment consists of outstanding competence in the areas of production, marketing, research, and financial controls.

The second dimension consists of what can produce these results.

1. A company must recognise that the world in which it is operating is changing at an ever-increasing rate: Every company’s accepted way of doing things should be examined on a regular basis to determine whether it is still the best way or not. A way that worked in the past isn’t necessarily the best way today. A company that isn’t challenging itself consistently, will see a downturn.

2. There must be a conscious and continuous effort: When the top management of a company can instill a belief among its employees that it is doing everything in its power to create a good working environment and taking care of its employee’s interests, the productivity of employees in these companies will be way higher. Every employee must be treated with reasonable dignity and consideration. The Pension Plans of a company play an important role in generating employee loyalty.

3. Management must be willing to submit itself to the disciplines required for sound growth: The true investment objective of a growth company should be to avoid losses, not to make gains. A company which reports its profits aggressively may not be able to sustain its profits in the long run.

The Third Dimension

Nothing is more vital than the profitability of a company. The author says a company that is experiencing high profits is bound to attract new competitors. There are two ways by which a company can sustain its profits:

A. Monopoly - Monopolies are generally illegal, and Fisher doesn’t recommend investing in them.

B. Efficiency - Fisher says that the only way a company can sustain its profits is by operating more efficiently than others.

A company should have the following characteristics if it wants to sustain its profits:

- Economies of scale.

- Low Freight costs.

- Lower costs of production and the ability to attract new customers.

- A prominent shelf place for a product can attract more sales.

- As a company’s costs rise, it should not raise the price of that product more than its competitors.

- Technological Development is another aspect which should be looked into when making an investment.

The Fourth Dimension

The fourth dimension of a stock involves the P/E ratio. To understand a company’s P/E ratio, it is important to understand why a company’s price is going up or down.

A stock’s price goes up or down based on the sentiments of a group of investors, i.e., the financial community appraises the stock of the company. There can be a situation where a company has good financials but is trading at a low price. A company trading at a very low P/E ratio can be categorised as a good stock on most of the occasions.

A conservative investor should look at the industry in which a company is operating. When the market perception of an industry is negative, almost all of the stocks in that industry will have a low P/E ratio.

Hence, it becomes important for an investor to analyse an industry before analysing a stock. This is known as a Top-Down approach.

The performance of the stock market is an important factor in determining the returns of an investor. When a recessionary period hits, investors get pessimistic about an economy and sell off excessively. This brings down the returns of an investor and can prove to be a good buying opportunity.

There are three external factors which affect the stock market performance:

1. Interest Rates - When interest rates go up, investors sell their stocks and buy fixed-income securities.

2. Savings Rate - When the rate of savings goes down, money flows out of the stock markets.

3. New Issues - New issues suck money out of stock markets.

Developing An Investment Philosophy

Origins of a Philosophy:

In this chapter, the author starts by talking about his Company, Fisher & Co., and its investment philosophies. After this, he talks about his personal history, his first experience with stock markets, etc. He further discusses how he developed an interest in stock markets.

He explains how he survived the crashing market of the 1920's and what we can learn from it. Initially, Fisher made a lot of bad decisions and lost most of his money. He learned from those mistakes and gradually became a better investor.

Learning from Experience:

In this section, the author talks about a company called Food Machinery Corporation. He says that this company was very small in nature, but had an efficient management, a good product line, and a great research team. Additionally, it had an excellent marketing team.

The Philosophy Matures & Is the Market Efficient?

Fisher talks about how he has made mistakes throughout his career.

He says over the 4 decades of his investment experience, there have been a lot of opportunities to make money from the stock markets.

The greatest investment opportunities came from finding extremely attractive stocks that were significantly undervalued.

Conclusion

We can summarize some key points of Fisher’s investment philosophy:

1. Buy the shares of a company that has plans for ensuring long-range growth. The 15 points that we should look for in a common stock discussed earlier should be considered.

2. Our focus should be on buying the companies which are out of favor in the market.

3. Hold a stock until:

A. There has been a fundamental change in its nature, such as a change in its management structure.

B. It has grown to a point where it cannot grow any faster than the economy as a whole.

4. Focus on capital appreciation, and do not focus on dividends.

5. Making mistakes is part of a person’s life and it is normal in investing. Try to learn from every mistake you make. Only this way will you become a better investor.

6. There are few companies which can prove to be outstanding buys. The shares of these companies are not always available at attractive prices. Therefore, when they are available, full opportunity must be taken. We should be prepared for those opportunities.

7. Do not go with the crowd. If you believe that your judgement is correct, Stick with it.

8. Earning profits in common stock investing depends on hard work, honesty, and intelligence.