Irrational Exuberance

Introduction

About the book

The book Irrational Exuberance by Robert J. Shiller (author) centers predominantly upon behavioural economics and market volatility. The sheer unpredictability and unstable nature of the market postulate that the irrational exuberance of the stock and the real estate markets has been ended by an economic slump of a magnitude not seen since the Great Depression of the 1930s.

The lessons from this book are simple yet timeless. It also explains the herd mentality that creates speculative bubbles. The term "irrational exuberance" clearly depicts the mood of the market.

About the book

Robert J. Shiller is a renowned American economist and Nobel Prize winner at the turn of the 21st century. He was a professor at Yale University and is ranked among the most influential economists in the world. He has written on economic topics that range from behavioural finance to real estate and risk management. His book Irrational Exuberance (2000) – a New York Times bestseller – warned that the stock market had become a bubble in March 2000 (the very height of the market top) which could lead to a sharp decline.

Buy the book

The book is extremely useful to understand booms and bursts of the stock market and helps you to predict when the next bubble bursts so that you can decrease your risk on investments. We highly recommend you to read the entire book. (affiliate link)

The Stock Market Level In Historical Perspective

The locution "irrational exuberance" was first coined by Sir Alan Greenspan on December 5th, 1996 to better express the behaviour of stock market investors. Soon after which, the stock markets fell impetuously. The reaction to this specific phrase reflected the public's apprehension that the markets may indeed have been bid up to inordinately high and untenable levels under the influence of market psychology. It strongly suggested that the stock market would become a less promising investment in the near future.

MARKET HEIGHTS

Large stock price increases suddenly occurred in various countries across the globe at the same time. The impending question loomed large above everyone - whether the current period of high stock market pricing would be followed by a poor or negative performance in the upcoming years, as had been the case in the past.

PRICE RELATIVE TO EARNINGS

Earnings seemed to be oscillating around a slow and steady growth path that had persisted for over a century. Using the 'ten-year average of real earnings' as proposed by Benjamin Graham, such events as the temporary burst of earnings during World War I and the temporary decline during World War II, or even the frequent boosts and declines that we see due to the business cycle, were smoothed out.

What is extraordinary today is the behaviour of price, not earnings.

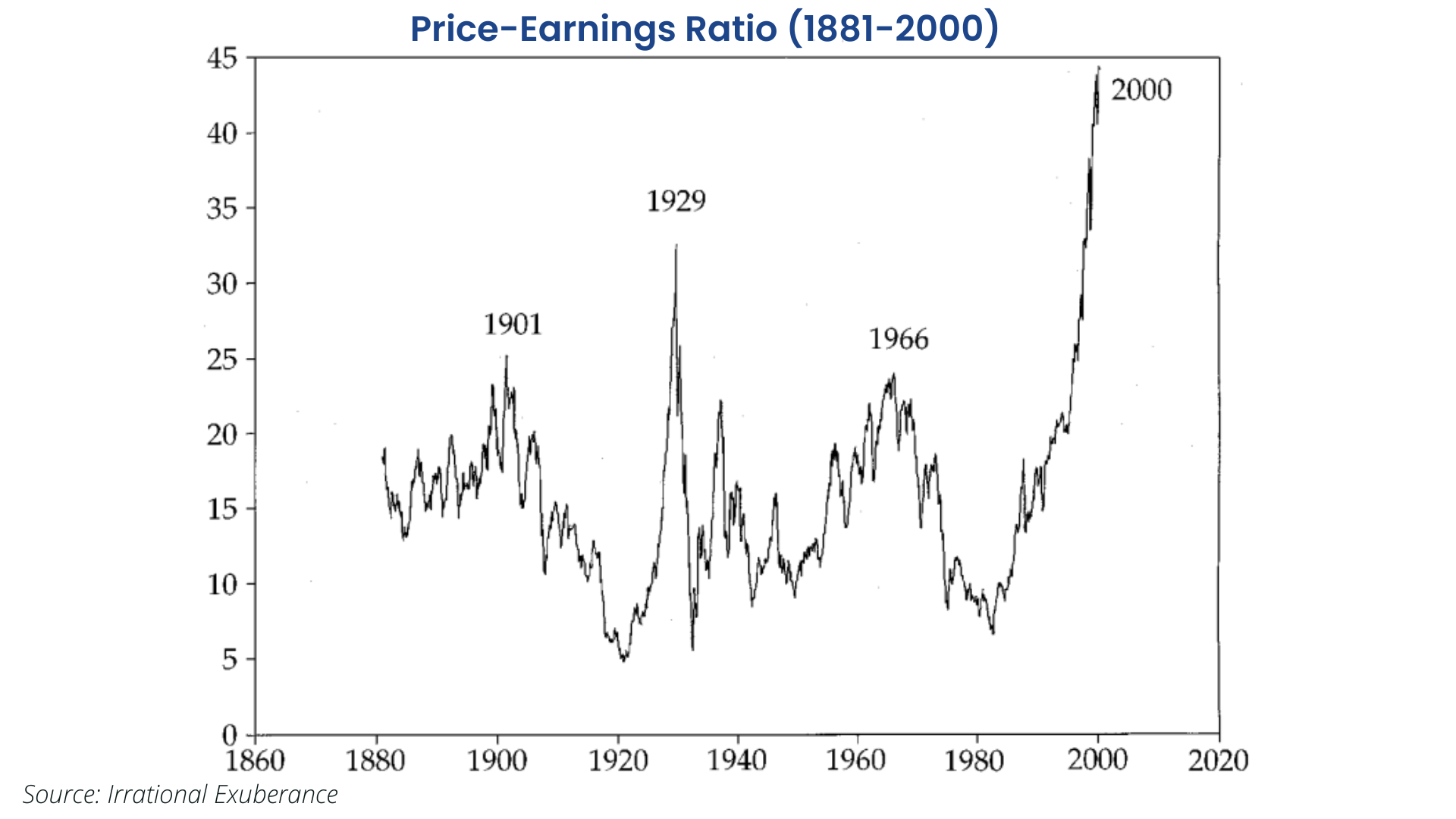

PRICE-EARNINGS RATIO

The peak of high price-earnings ratio occurred in January 1966 which was popularly referred to as the Kennedy-Johnson peak. The simple logic- that when one is not getting much in dividends relative to the price one pays for stocks, it is not a good time to buy stocks - also proved to be correct.

WORRIES ABOUT IRRATIONAL EXUBERANCE

Most people are left baffled by the seemingly high levels of the market. People are in a quandary whether the high levels of the stock market reflect unjustified optimism, the kind of optimism that might pervade our thinking and affect many of our life choices. No one quite knows what to make of any sudden market correction in recent times. There is always an apprehension about the previous market psychology returning.

It is still a conundrum whether the market levels make any sense or whether they are indeed the result of some human tendency that might be referred to as "irrational exuberance"

Precipitating Factors - The Internet, The Baby Boom, And Other Events

The remarkable surge in the value of the stock market - since 1982 caused the price-earnings ratio to pass its former high record set in September 1929. It is insufficient to say that the market in general is vulnerable to irrational exuberance.

Owing to a market's ability to respond appropriately to such factors as - growth in earnings, or change in real interest rates - that the well-functioning financial markets promote rather than obstruct economic efficiency.

The precipitating factors that exist in the background of the market include:-

1) THE ARRIVAL OF THE INTERNET AT A TIME OF SOLID EARNINGS GROWTH: The internet and the World Wide Web have become a categorically significant part of our lives since the 1990s. The occurrence of profit growth simultaneously with the appearance of a new technology i.e, the Internet easily created the impression that the two episodes were in a way connected. The effect of new technology on the existing companies could either boost their profits or reduce them remarkably. What is actually important for a stock market boom is not the reality of the Internet revolution but rather the public impressions that the revolution creates.

2) TRIUMPHALISM AND THE DECLINE OF FOREIGN ECONOMIC RIVALS: Confidence in the former capitalist system has transformed into confidence in the market, the US stock market being the most prestigious. Triumphalism is associated with feelings of patriotism. Popular slogans used during the bull markets of 1920 were "Be a Bull on America" and "Never sell the US short".

3) CULTURAL CHANGES FAVOURING BUSINESS SUCCESS OR THE APPEARANCE THEREOF: The bull markets have been followed by a considerable rise in materialistic values. Such values often influence people's demand for stocks. The idea that investing in stocks is the path to quick riches has a certain appeal to materialists. A key factor in the decline of labour unions is the erosion of solidarity and loyalty among the workers.

4) A REPUBLICAN CONGRESS AND CAPITAL GAINS TAX CUTS: The change in government of the United States in the 1980's boosted public confidence in the stock market. This was because of a variety of controls that the legislature can exert over corporate profits and investor returns. People were afraid to sell their assets even at appreciated rates fearing capital gains taxes.

5) BABY BOOM AND ITS PERCEIVED EFFECTS ON THE MARKET: Soon after World War II there was a significant increase in the birth rate in the US. Progress in the birth control technology and the acceptance of the legality of contraceptions and abortions brought about a decrease in the rate of population growth. The Baby Boom and the subsequent Baby Bust have created an enormous crisis in many countries as the number of young people available to support the elderly will decline worldwide.

The Baby Boom theory fails to consider 'when exactly' the Baby Boom should affect the Stock Market. People of different age groups have age-related differences in risk-tolerance. The stock market is relatively high now because the people in their forties are naturally less risk averse than older people. Public perceptions about Baby Boom and its presumed effects are seemingly more responsible for the surge in the market.

6) AN EXPANSION IN MEDIA REPORTING OF BUSINESS NEWS: The first news television station, CNN appeared in 1980 and gradually grew. The Financial News Network was later absorbed into CNBC. These networks together produced an uninterrupted stream of financial news, related to the stock market. Such enhanced business reporting led to increased demand for stocks.

7) ANALYST'S INCREASINGLY OPTIMISTIC FORECASTS: Analysts are now reluctant to provide recommendations to investors to sell anything. A sell recommendation can quite possibly incur the wrath of the company involved. An increasing number of analysts are also employed by firms that underwrite securities The analyst's quantitative forecasts of earnings growth show an upward bias.

8) THE EXPANSION OF DEFINED CONTRIBUTION PENSION PLANS: Changes over time in the employee pension plans have incentivized people to accept stocks as investments. By offering multiple stock market investment categories for employees to choose from, employers can create demand for stocks. The interest / curiosity value of stocks encourages investors to buy more of them. And this apparently unconscious interest has helped bid up the price of the stock market.

9) THE GROWTH OF MUTUAL FUNDS: The boom in the stock market has coincided with a boom in the mutual fund industry as well. Part of the reason that equity mutual funds proliferated is that they are used as a part of pension plans. Another reason is that they have paid for a great deal of advertising. The popular concept that mutual fund investing is sound, convenient and safe has encouraged many non-investors to come forward and join the market.

10) THE DECLINE OF INFLATION AND THE EFFECTS OF MONEY ILLUSION: High inflation is perceived to be a sign of economic disarray. Low inflation is viewed as a sign of economic prosperity and social justice. A decreased inflation rate boosts public confidence, and in turn the stock market valuation. Public confusion about the effects of a changing monetary standard is referred to as "monetary illusion".

11) EXPANSION OF THE VOLUME OF TRADE - DISCOUNT BROKERS, DAY TRADERS, AND TWENTY-FOUR HOUR TRADING: A higher turnover rate may be symptomatic of increased interest in the market. Another reason for the rising turnover rate is the declining cost of making a trade. The development of online trading and the opening of markets for extended hours led to heightened volatility.

12) THE RISE OF GAMBLING OPPORTUNITIES: The pervasiveness and convenience of gambling opportunities and the strength of the marketing campaign undertaken to promote gambling are unmatched in US history. The rise of gambling institutions and the increased frequency of actual gambling have increased risk taking in other areas, like investing in the stock market.

Amplification Mechanisms: Naturally Occurring Ponzi Process

The effect of the precipitating factors listed previously is magnified by mechanisms involving investor confidence, investor expectations for future market performances and related influences on investor demand for stocks. These can be described as a naturally occurring Ponzi Process. These mechanisms work through a sort of feedback loop.

HIGH INVESTOR CONFIDENCE

A prominent feature of the recent bull market has been the high level of investor confidence in the stock market. People's belief in the flexibility of the market seems to stem from a generalized feeling of optimism and assurance, rather than a belief in the long-run stability of prices. People do not perceive any real downside risk, which explains their willingness to buy stocks even when, by traditional measures such as price-earnings ratios, are so greatly overvalued.

SOME REFLECTIONS ON INVESTOR CONFIDENCE

The numerous cases of persistent bad performance in the stock market history are not eminent in the public mind. The reason that the recent domestic market performance is more prominent is simply because they have experienced these. By presenting successful investing as a process of mastering one's own internal impulses rather than taking into consideration our present situation in history - it invites the investors to forget about the present levels of the stock market. An important reason behind today's strong investor confidence is the unstoppable rise in the Consumer Price Index (CPI), which has put an upward pressure on prices of all commodities.

EVIDENCE FOR UNDIMINISHED EXPECTATIONS DESPITE A HIGH MARKET

Despite a fiercely rising stock market over the past couple of years, average expectations among high-income individual investors have also been rising. The Paine Webber/ Gallup polls have reported much more optimistic average expectations among individual investors. Altogether, expectations for the market among most investors are not so extravagantly high as was suggested by some of the polls. But expectations do appear to be a bit higher and at least remain as powerful as they were in 1989, despite a very high market.

SOME REFLECTIONS ON INVESTOR EXPECTATIONS AND EMOTIONS

Economists usually like to imitate people by calculating their investment decisions as accurately as possible, based on presumptions of future price changes and estimates of the risk in alternative investments. Investors often feel that the experts have little or no idea what to expect of future price changes or how much risk there actually is. Investors must therefore base their judgements on basic principles on which most experts agree upon. The feeling that the stock market is "the only game in town" in some emotional sense, plays a pivotal role in the decision-making of investors. How one feels about the stock market at any given time certainly depends on one's recent experience in investing. The psychological cost of a potential future loss may not be so much greater relative to the very real regret at having been out of the market in the past. The emotional state of investors when they decide on their investment is without a doubt the most crucial factor giving rise to the bull market.

PUBLIC ATTENTION TO THE MARKET

The magnitude of public interest and attention to the market changes conspicuously over time. Writers such as John Kenneth in his book "The Great Crash :1929", have indicated that 1929 was a time of dramatically heightened investor attention to the stock market. Over the 1920s the percentage of articles about the stock market almost quadrupled. Another source of evidence on investor attention to the market is the increasing number of investment clubs. The crude conformity of the number of investment clubs to the performance of the market is noteworthy, suggesting that investors' attention is indeed attracted by bull markets. Economists Statman and Thortey state that the persistent effect of returns on volume is due to the impact of higher returns on investor confidence. It is a tendency for investors to interpret their investing success as confirmation of their own abilities, which in turn reinforces their interest in trading stocks.

FEEDBACK THEORY OF BUBBLES

In feedback loop theory, initial price increases influence more price increases as the earlier price increases creates a surge of demand. This increased investor demand transforms into a sort of a loop where the price keeps on increasing. The phrase "speculative bubble" appears to refer to such a feedback. Feedback theory can occur due to –

a) Adaptive expectations feedback that takes place because past price increases generate expectations of further price increases.

b) Increased investor confidence occurs in response to past price increases.

c) The theory of habit formation as proposed by economists John Campbell and John Cochrane.

d) Negative price bubbles can also occur, in which initial price declines discourage investors causing further decline and so forth.

PERCEPTIONS OF FEEDBACK AND BUBBLES AMONG INVESTORS

It is natural to wonder whether public perceptions of such a speculative bubble might be influenced by the recent high asset prices. Shiller finds little evidence that people have been thinking, during the recent market highs, that we are in a temporary speculative bubble. The prominent feature of the current high pricing is high confidence that the market will perform well.

PONZI SCHEMES AS MODELS OF FEEDBACK AND SPECULATIVE BUBBLES

In order to prove that feedback mechanisms do play a role in financial markets, the Ponzi scheme is examined. By means of this scheme, fraudsters pose as the managers of a scheme and promise to make large profits for investors by investing their money. But little or no investment in any real asset is actually made. Instead, the manager pays off the initial investors with the proceeds of the second group of investors, the second with the third and so forth. The perpetrator may then hope to exit without paying the last and largest round of investors and then hide from the law.

SPECULATIVE BUBBLES AS NATURALLY OCCURRING PONZI PROCESSES

It can be deduced that speculative feedback loops are in effect naturally occurring Ponzi schemes without the involvement of a fraudulent manager. When prices go up a number of times, investors are rewarded, just as they are in Ponzi schemes. There is no direct manipulation, but the backstory is almost similar.

IRRATIONAL EXUBERANCE AND FEEDBACK LOOPS TODAY

Perceived long-term risk is down. Expected returns on investments are not down, despite a high-flying market. Emotions and heightened attention to the market create a desire to get into the game and get away with profits. Such is the irrational exuberance today in the United States. As prices continue to rise, the level of exuberance is intensified by the price rise itself.

The News Media

The history of speculative bubbles begins approximately with the advent of newspapers. Although the news media present themselves as detached observers of market events, they are themselves an intrinsic part of these affairs. Media Houses are essential vehicles for the spread of ideas. They play an important role both in setting the stage for market moves and in prompting the moves themselves.

THE ROLE OF THE MEDIA IN SETTING THE STAGE FOR MARKET MOVES

Survival for the media house industry requires focusing attention on news that have word of mouth potential and displaying stories that can capture the audience's attention. The financial market provides constant news in the form of daily price changes. The financial markets can present their everlasting lead, the market's performance, as an ongoing story- that in turn brings in the most loyal repeat customers.

MEDIA CULTIVATION OF DEBATE

In an attempt to lure in audiences, the news media endeavours to present debates about issues of national interest. Predictions of stock market crashes are displayed quite rarely on national news shows. During the conduct of these debates, the media often disseminates ideas that are not supported by real evidence. Due to this, the consciousness of the public is constructively narrowed.

REPORTING ON THE MARKET OUTLOOK

There is a shortage within the media accounts of relevant facts or considered interpretations of them. The news story may talk about typical factors behind economic growth, such as the Internet Boom. It is the nature of sound-bite-driven media that superficial opinions are preferred to in-depth analyses.

RECORD OVERLOAD

The media is known for amplifying record highs. While talking about the stock market, many writers mention "record one day price changes" measured in points on the Dow Jones rather than through percentage terms. This impression that novel and significant records are being set repeatedly encourages an avoidance of individual assessment of quantitative data.

DO BIG STOCK PRICE CHANGES REALLY FOLLOW BIG NEWS DAY?

People often believe that it is the reporting of serious news events that affect the financial markets. It was observed that days with news of significant world events corresponded to days that saw big stock price movements. News events that represented crises were more likely to influence the market prices.

TAG-ALONG NEWS

News stories that occur on days of huge price changes often cannot account for their changes or at least not their full extent. The collapse of the United Airlines (Erstwhile: UAL) buyout had a huge impact on the entire world because its failure was viewed by the market as a watershed event foreshadowing that other such pending layouts would also fail soon. People mostly react to news as an interpretation of the behaviour of investors.

THE ABSENCE OF NEWS ON DAYS OF BIG PRICE CHANGES

There have also been days where there are unusually large price changes without any exceptionally important news coinciding with it. A multitude of factors may cause a significant market change, even if the independent factors are not newsworthy. News functions as an initiator of a chain of events that changes the public opinion about the market.

NEWS AS THE PRECIPITATOR OF ATTENTION CASCADES

Facts can attain newfound prominence in the wake of breaking news flashes. Sequences of attention are called cascades. Market reaction to news shows how media attention leads many investors to eventually take seriously news that would normally be considered irrelevant.

NEWS DURING THE CRASH OF 1929

The role of the news media in causing the market crash of 1929 has been a controversial subject. On October 28, 1929 the Dow Jones fell 12.8%, recording its biggest single day drop. The second biggest market crash in history (until 1987) occurred the following day, when the Dow Jones fell by 11.7%, totalling a 23.1% fall in just two days. On reading the major newspapers over the weekend, one could easily come to the conclusion that there was no significant fundamental shift. This fall can be seen as a negative bubble operating through feedback effects of price changes and an attention cascade.

NEWS DURING THE CRASH OF 1987

The stock market crash on October 19, 1987 set a new record one-day decline (22.6%). The crash had considerably to do with a psychological feedback loop amid the investors. It was set off by a surprisingly high merchandise trade deficit and proposed tax legislation. The introduction of "portfolio insurance" made many investors more reactive to past price changes. It was the changed nature of the feedback loop that was responsible for the crash.

THE ROLE OF NEWS MEDIA IN PROPAGATING SPECULATIVE BUBBLES

The media actively shapes public attention and creates the environment within which the stock market events are played out. The media can foster strong feedback from past price changes and hence affect current and future price changes.

New Era Economic Thinking

Stock market expansions are associated with the idea that the future is less uncertain than the past. The term "new era" is used to describe such a time. A Rise in the standard of living coupled with a decline in the impact of economic risks on individuals accelerates the adoption of this term.

This theory emerged after-fact-interpretation of a stock market boom. It appears that the stock market often creates new era theories, as reporters scramble to justify stock price movements.

THE 1901 OPTIMISM: THE TWENTIETH CENTURY PEAK

The first of the three major peaks occurred in June 1901. Observers reported real speculative fervour. The high-tech age, the computer age and the space age seemed to be just around the corner. This period was later referred to as 'The Age of Optimism'.

Many stock market forecasters saw the formation of numerous combinations, trusts and mergers in businesses, as momentous (As an instance- US Steel). Elimination of competition might create monopoly profits for corporations and thus boost their share prices. New era thinking centers on the effects of events currently dominant in the news and little attention is paid to 'what - ifs', even if they have substantial probability. This theory finds it unimaginable that there could be a selling panic among the public.

THE 1920s OPTIMISM

The Bull market of the 1920s was a time of relatively heightened public enthusiasm and interest in the stock market. There was rapid economic growth and widespread circulation of technological innovation. It was the epoch of massive technological progress with the introduction of automobiles, expansion of radio broadcasting and the like. The merger movement of the 1920 allowed economies of scale. Money started being spent to provide higher standards of living, investments and savings banks. We know from the level of the stock market itself that the public sentiment was tremendously positive in the 1920s.

NEW ERA THINKING OF THE 1950s and 1960s

New era thinking underwent a sudden surge in the 1950s, when the market increased 94.3% in real terms. A substantial growth in earnings was soon witnessed. Investors were pretty optimistic and confident about the prospects of the market. Corporations were cashing in on this prosperity. Early 1950s saw the introduction of televisions. Businesses were able to draw up plans more conveniently for the future. The demand for stocks was stable enough to prevent any downturn. The increase in the use of consumer credit and the election of John Kennedy as the President also contributed to success. In the 1960s, investors believed that if inflation broke out, the stock market would go up rather than down. Thus, inflation became a reason to own stocks. A conceivably notable factor behind the 1960s market peak was the Dow's approach to 1000.

NEW ERA THINKING DURING THE BULL MARKETS OF 1990s

Increased globalization, moderating inflation, falling interest rates, boom in high-tech industries and surging profits, all caused the markets to prosper. In the 1990s, it was again thought that if inflation broke out, the market would go down rather than up. "Bootle" declared that they were entering the "zero era" brought on by global capitalism, privatization and the decline of labour unions. Service employment became more stable than industrial production. There emerged a change in the media's attitude and optimistic hyperbole was out in the 1990s.

THE END OF NEW ERA

High pricing of the market in 1901 was not followed by any immediate price decline. Most of the commentary of the 1920's period focused on the 1920-21 recession, which was unusually severe. Highly speculated prices were described as a thing of the past. Market psychology had at that time become mysteriously negative. The depression of the 1930s gave the idea that our economic system was failing. It was believed that the American economy had reached a stage of stagnation. In 1965, "stagflation" was observed.

New Eras And Bubbles Around The World

Large stock market moves like in the US have also occurred in numerous other countries which suggests that speculative bubbles that are associated with "new era" theories are in fact common. It was observed that record price movements in these countries reversed afterwards.

THE LARGEST RECENT STOCK MARKET EVENTS

The below table shows the twenty-five largest recent five-year real stock price index increases. It is based on monthly data starting at roughly the same dates. The rightmost column also shows what happened during the five years after each of these dramatic price changes.

Largest Recent Five-Year Real Stock Price Index Increaes:

Source Image: Irrational Exuberance

STORIES ASSOCIATED WITH THE LARGEST PRICE CHANGES

The biggest one-year real stock market increase of all (683.4%) happened in the Philippines from December 1985-86. The biggest five-year real price change of 1,253% also happened in the Philippines. One might suspect that the very low values for the Philippines stock market in December 1985 were the results of a negative bubble.

The second biggest one-year increase and one-year decrease occurred in Taiwan. Booming exports had pushed economic growth rates, saving rates were extremely high and the country was investing heavily in its future. Volume of trade soared and the price-earnings ratio reached 45.

The third largest one-year price increase of 384.6% occurred in Venezuela from January 1990.

The fourth largest one-year price increase at 360.9% took place in Peru from August 1992.

The stock market increase in India from April 1991 began just as the assassination of Rajiv Gandhi ended the thirty eight-year Nehru family dynasty. If there actually was a new era, it seemed to many observers to be only in terms of market psychology.

ENDS OF NEW ERAS AND FINANCIAL CRISES

The impact of the astonishing price increases were highly variable. They were quite frequently followed by dramatic reversals. Often the ends of bull markets appear to be caused by concrete events that are unrelated to any irrational exuberance in the stock market. For example - banking or exchange rate crisis. The ends of the "new eras" have a narrow technical basis, rather than a psychological or social basis. The 1994 Mexican crisis appears as the aftermath of one of the most spectacular five-year stock price increases. The Asian financial crisis of 1997-98 was also much more than a stock market crisis. It is assumed that the collapse of a speculative bubble in the various countries preceded the crisis and was part of the ambience that produced it. However, attention centered on changes in currency exchange rates, the sudden withdrawal of foreign investors, banking problems, inflation and labour difficulties.

WHAT WENT UP (DOWN) USUALLY CAME BACK DOWN (UP)

If the price increases are, on average, reversed, then we have some evidence that the fundamental reasons were not sound. It was discovered by Werner De Bondt and Richard Thaler that winner stocks (if winner status is measured over long intervals of time such as five years) - tend to do poorly in subsequent intermissions of the same length. And that loser stocks (if loser status is measured over equally long intervals) tend to do well subsequently. With freer capital movements and more global investors seeking profit opportunities, markets may become more stable. The possibility of major speculative bubbles now and in the future cannot be ignored. Human tendencies bear on the plausibility of our view of speculative bubbles.

Psychological Anchors For The Market

To understand the true nature of the anchors of the stock market, we must also consider the psychological factors. Investors are observed as frenzied or euphoric during booms or stock market crashes. Solid psychological research shows that there are patterns of human behaviour that suggest anchors for the market that would not be expected if the markets worked entirely rationally. These patterns are the result of the character of human intelligence reflecting the strengths as well as the limitations. Two kinds of such psychological anchors are considered here –

a)Quantitative anchors: These give indications for the appropriate levels of the market that people use as indicators of whether it is a good time to buy stocks or not.

b)Moral anchors: People operate by determining the strength of the reason that compels people to buy stocks.

QUANTITATIVE ANCHORS FOR THE MARKET

Using quantitative anchors, people weigh numbers against prices when they decide whether stocks (or other assets) are priced accurately. Ranges on questionnaires serve as "anchors" to which people make their answers conform. People's decisions are almost always influenced by whatever anchor is available at the given moment. While making judgements about the level of stock prices, the most feasible anchor is the most recently remembered price. This enforces the similarity of stock prices. Another anchor can be the nearest breakthrough of a prominent index such as the 'Dow Jones'. This may help to explain unusual market behaviour. Past price changes may also prove to be an anchor. For individual stocks, price changes tend to be anchored to the price changes of other stocks and the price-earnings ratio is anchored to other firms' price earning levels.

MORAL ANCHORS FOR THE MARKET

With moral anchors, people compare the intuitive or emotional strength of the argument for investing in the market against their wealth. The market is not prevented from going up to arbitrarily high levels because people do not have an idea about what its intrinsically 'right level' is. Underlying this notion is the psychological principle, that much of the human thinking that results in action is not quantitative but instead it takes the form of storytelling and justification. Our culture may give us reasons to hold stocks and other savings vehicles that are related to our identity as responsible and level headed persons. Investing millionaires who do not test the market by trying to cash out and consume their wealth are just the type of moral anchors needed to help sustain an unusual bull market.

OVERCONFIDENCE AND INTUITIVE JUDGEMENT

There appears to be a prevalent human tendency toward overconfidence in one's beliefs. People think they know more than they actually do and they often act on things they know very little about. Perhaps, in evaluating the soundness of their conclusions they forget about many elements of their reasoning that could be wrong. The reason for overconfidence may also be associated with hindsight bias. Patterns of cogitation referred to as "magical thinking" or "intuitive thoughts" by psychologists also play a role. People tend to make judgements in uncertain situations by looking for familiar patterns and assuming that future patterns will resemble the past ones. This peculiarity of human judgement is called the 'representative heuristic'.

Overconfidence is a major factor in promoting the high volume of trade that we observe in speculative markets.

THE FRAGILITY OF ANCHORS: DIFFICULTY THINKING AHEAD TO CONTINGENT FUTURE DECISIONS

News events have an impact on people's reasons that even they could not have anticipated. This is responsible for the dramatic shifts of the market. According to psychologists, people cannot make a decision until the events actually occur. The effect of news stories on the stock market sometimes have more to do with 'how we feel' about the news. People discover things about their own emotions and inclinations, only after the price changes occur.

Herd Behaviour And Epidemics

It is a known fact about human society that people who communicate regularly with each other, think similarly. The reason that people's judgements are similar at times is because they are reacting to the same information.

SOCIAL INFLUENCE AND INFORMATION

Renowned social psychologist Solomon Asch's findings were widely cited in the media for providing a scientific basis for claims that people do not have fully independent judgement. "The Asch conformity experiment" revealed the degree to which a person's own opinions are influenced by those of others. He found that people were willing to ignore reality and give an incorrect answer in order to conform to the rest of the group. People experienced anxiety and distress and thought that their own senses were somehow not reliable. Results of Stanley Milgram can also be considered here. Thus, many people are accepting of the perceived authority of others related to stock market valuation.

ECONOMIC THEORIES OF HERD BEHAVIOUR AND INFORMATION CASCADES

Herd behaviour, although individually rational, produces group behaviour that is irrational. This herd-like behaviour is assumed to arise from an information cascade. The popular notion that the level of market prices is the outcome of a sort of vote by all the investors about the true value of the market is wrong. Rather people are rationally choosing not to exert any individual impact on the market. In the end, all such information cascade theories are theories of failure of information about true fundamental value to be propagated and evaluated.

HUMAN INFORMATION PROCESSING AND WORD OF MOUTH

A vital component of information processing ability is effective communication of important facts from one person to another. Evolutionary changes within the human brain have created an emotional drive to communicate effectively. In modern society, a rapidly spreading conversation about a buying opportunity or news related to the stock market is more likely to happen. Transmission of such knowledge is effortful, infrequent and imperfect.

FACE TO FACE COMMUNICATIONS VERSUS MEDIA COMMUNICATIONS

The ability of conventional media to generate active behaviour is still limited. Interpersonal and interactive communications have the most powerful impact on our behaviour. The work of the market surveillance units at the exchanges and within the Securities and Exchange Commission (SEC) have amply illustrated the power of interpersonal, word of mouth communication. This form of transmission of information can proceed with great speed and across various social groups. It is an important contributor to day-to-day or hour-to-hour stock market fluctuations. The written or electronic sources do not carry any emotional weight and thus it is difficult to remember information from them. The telephone is the most important artificial medium for interpersonal communication today. The proliferation of telephones made it easier to sell stocks to the public. Continued technological progress in communications media that allow better stimulation of face-to-face communication will make the transmission of ideas more effective in the future.

EPIDEMIC MODELS APPLIED TO WORD-OF-MOUTH COMMUNICATION

Economist "Alan Kirman" discovered that the epidemic models also seemed related to stock market price changes. Epidemic models have been used by sociologists to predict the course of word-of-mouth transmission of ideas. The accuracy of transmission however, falters as the chain continues. An important national news unrelated to financial markets may lower the infection rate of ideas related to speculative markets by deflecting attention from them.

Conversely, national news that ties in with or encourages discussion of the stock market may raise infection rates. Word of mouth may function to amplify public reaction to news events. Thus, the likelihood of any event affecting market prices is enhanced if there is a good and vivid story about the event. By analogy, news events are more likely to contribute to the contagion of ideas. Word of mouth communication, either positive or negative, is an essential part of the prison of speculative bubbles.

A POOL OF CONFLICTING IDEAS COEXISTING IN THE HUMAN MIND

A reason why the transmission of ideas can happen so rapidly is that the ideas in question are already in our minds. Even conflicting ideas can coexist in our minds at the same time. People sometimes think that they have heard both views being endorsed by experts and so they are able to hold these conflicting views simultaneously. People do not worry about the apparent contradictions because they believe that the experts have already thought everything through. People have no clear attachment to many of their views.

SOCIALLY BASED VARIATIONS IN ATTENTION

The human brain is structured to have a single focus of conscious attention at any given time and to move rapidly from one focus to another. The ability to focus our attention on things that are important is one of the defining characteristics of intelligence. One of the mechanisms to direct attention properly is 'socially based selectivity'. We pay heed to a lot of the same things that others around us are paying attention to. This concept of social attention is one of the greatest creations of behavioural evolution. Thus, markets on opposite sides of the globe move together.

PEOPLE CANNOT EXPLAIN CHANGES IN THEIR ATTENTION

People often find it difficult to explain what made them decide to take a particular course of action; the original attention trigger may not be remembered. This is a major reason why changes in speculative asset prices often seem inexplicable. Most of the investors in rapid-price-increase stocks themselves say that they are unsystematic in their decision-making. By analogy, a stock market boom can start for no better reason than these irrational actions.

THE STORY SO FAR

This chapter concludes that irrational exuberance is at work in producing the elevated stock market levels.

Efficient Markets, Random Walks And Bubbles

The theory that financial markets are very efficient, forms the basis for arguments against the idea that markets are vulnerable to excessive exuberance or bubbles. Financial assets are always priced correctly, at all times. Price may appear to be too high or too low at times, but according to efficient market theory, this appearance must be an illusion. Price changes are unpredictable as they occur in response to new information, which by the very fact that it is new is unpredictable.

BASIC ARGUMENTS THAT MARKETS ARE EFFICIENT AND THAT PRICES ARE RANDOM WALKS

The term efficient markets first became widely known through the work of "Eugene Fama" and his colleagues. "George Gibson" had written in his book that when shares become publicly known in an open market, the value which they acquire may be regarded as the judgement of the best intelligence concerning them. The efficient market theory has been commonly used to justify elevated market valuations, for example, the 1929 stock market peak. It is difficult to make a lot of money by buying low and selling high in the stock market. The impact of smart money as claimed by the efficient markets theory, is to drive asset prices to their true values. They would be buying under-priced stocks and consequently tending to bid their prices up.

REFLECTIONS ON "SMART MONEY"

The efficient markets theory holds that differing abilities do not produce differing investment performances. It claims that the smartest people will not be able to do better than the least intelligent people in terms of investment performance. According to this theory, there can be no such profit opportunity for smart money. Effort and intelligence mean nothing in investing. The smartest money has already mostly taken over the market through its profitable trading and has set the prices correctly. Another explanation in support of the efficient markets theory is that professional investors, institutional money managers or securities analysts do not seem to have any dependability to outperform the market as a whole. The reason that stronger evidence has not been found to prove that people who are smarter tend to make more money is because there is no good way to measure how smart the investors are. Though from the available evidence, we can say that smart people will, in the long run, tend to do better at investing.

EXAMPLES OF "OBVIOUS MISPRICING"

Despite the general authority of the efficient markets theory, one often hears examples that state the opposite. Recently many of these examples have been Internet stocks: judging from their prices, the public appears to have an exaggerated view of their potential. The valuation the market places on stocks appears ridiculous to many observers and yet the influence of these observers on market prices does not seem to rectify the mispricing. The investors in these stocks do not think clearly about long-run investment potential.

QUESTIONING THE EXAMPLES OF OBVIOUS MISPRICING

Despite the apparent obviousness of some examples of mispricing there are those who question the examples. Siegel mentioned a list of fifty stocks that were apparently called the "Nifty Fifty" as early as 1970. These were glamorous stocks for which people had high expectations and that traded at very high price-earnings ratios. Analyses by Siegel and Garber impugn some of the popular examples of irrational prices in speculative markets. If one considers the top twenty-five firms in the Nifty-Fifty when ranked by the price-earnings ratio these firms are still underperforming the market. Siegel himself does not claim that his evidence suggests that all prices are right, and argues that today many internet stocks have indeed become overpriced.

STATISTICAL EVIDENCE OF MISPRICINGS

There is no shortage of evidence that firms that are "overpriced by conventional measures" have indeed tended to do badly later. There is a sort of regression to the mean for stock prices. These findings have developed an approach to the market called "value investing". Value investors buy under-priced assets and bid up their prices. They also divert demand away from overpriced assets. Their strategy is to pull out of overvalued individual stocks but not out of the overvalued market as a whole.

EARNINGS CHANGES AND PRICE CHANGES

Stock prices approximately track earnings over time - that despite great fluctuations in earnings, price-earnings ratios have stayed within a remarkably narrow range. There have been only three bull markets (periods of sustained and dramatic stock price changes) until now:

a)bull market of the 1920s terminating in 1929.

b)bull market of the 1950s and 1960s.

c)the bull market from 1982 to the present.

The first bull market was a period of rapid earnings growth. In terms of overall economic growth, the 1950s were a little above average. In the third bull market, price earnings were not viewed as a simple reaction to earnings increase.

DIVIDEND CHANGES AND PRICE CHANGES

Some economists claim that there is a good relation between real stock price movements and real dividend movements. Stock price movements cannot be considered to have been caused largely by the speculative behaviour of investors if they correspond to dividend movements. In Kenneth Froot's theory, stock prices overreact, in a certain sense, to dividends, but yet there are no profit opportunities for trading to take advantage. Co-movements between real prices and real dividends is the response of the latter to the same factors - that irrationality influences prices. They are both determined by fashions and fads.

EXCESS VOLATILITY AND THE BIG PICTURE

Anomalies discovered within the efficient markets theory include the January effect, the small-firm effect, the day-of-the-week effect and others. Miller states that we abstract from all these theories because they distract us from the pervasive market forces that should be our foremost concern.

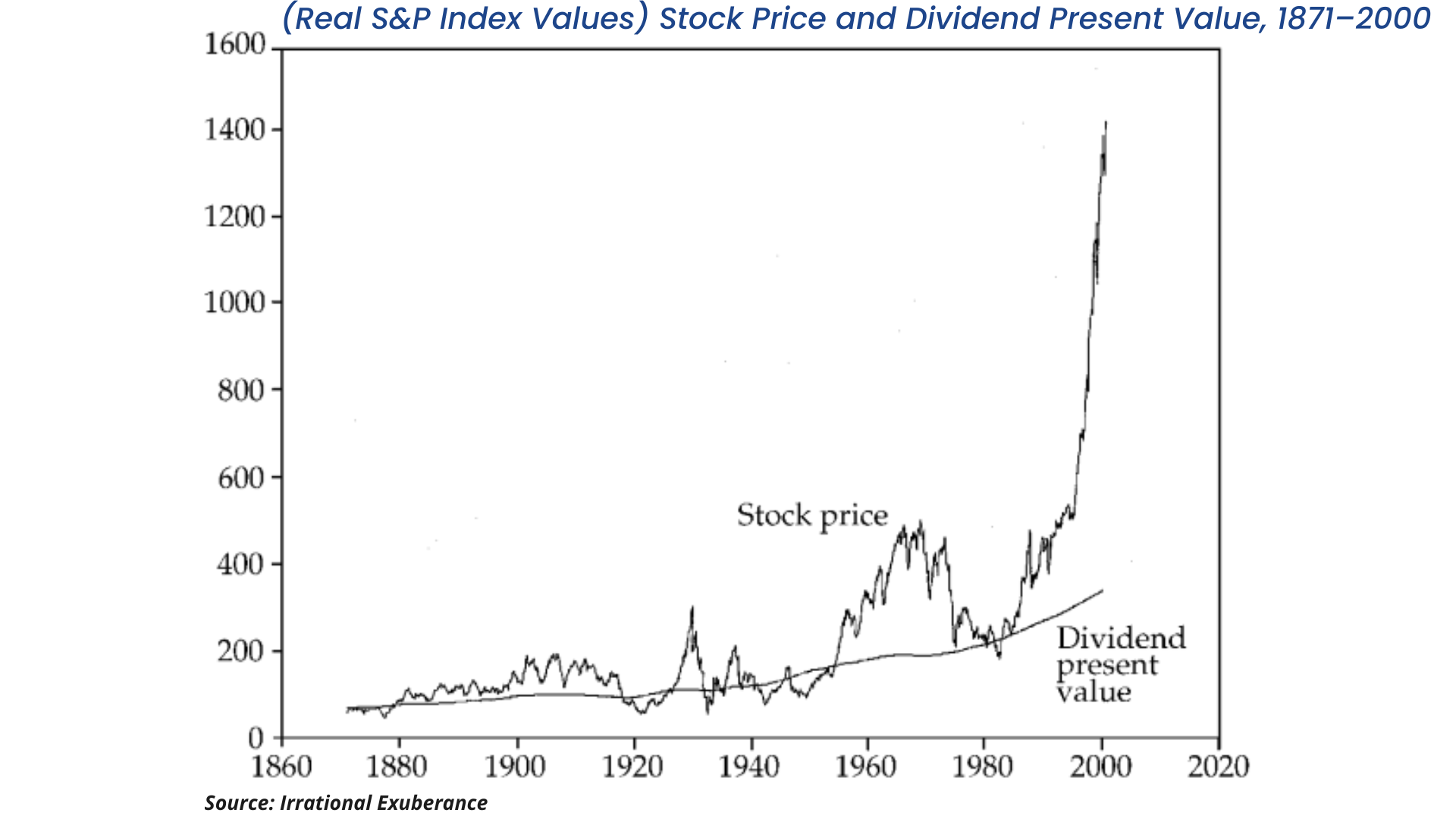

If stock price movements are justified in terms of future dividends that firms pay out, then under efficient markets we cannot have volatile prices without having subsequently volatile dividends. An updated version of the S&P Composite Stock Price Index showing both the stock prices and the dividend present value are shown above.

Stock prices seem to be too unstable to be considered in accord with efficient markets. By considering the above figures, we learn that the interpretation given in the media for stock market fluctuations in terms of the outlook for the short-run business cycle is generally misguided. A substantial fraction of the volatility in financial markets is probably justified by news about future dividends on earnings. Excess volatility due to speculative bubbles is one of the factors that drive speculative markets.

THE GRAPH UPDATED

One interpretation of the above graph is that the sudden spike represents the "big, rare event" that might finally reconcile the efficient markets theory with this data. But it would have to be a sudden sharp spike in the dividend series, not the price series to suggest such a reconciliation.

Investor Learning And Unlearning

According to the efficient markets theory, the market is higher today because the public has now learned simple facts about historical average returns and diversification. This argument differs from the efficient markets argument in supposing that the market was previously priced too low due to public ignorance. Society has now learned that the stock market is much more valuable than it was once thought to be.

"LEARNING" ABOUT RISK

People have recently discovered that the stock market is a much more secure investment than they once thought. This "learning" is apparently the result of widespread media coverage about the historical superiority of stocks as investments and of the publication of Jeremy Siegel's Stocks for The Long Run in 1994. Armed with this new knowledge, investors have now bid up stocks to a much higher level. The old prejudice against security markets and the fear of them were largely dispelled by public education regarding stocks and bonds. Three major peaks of the price-earnings ratio have also been identified - peaks in June 1901, September 1929 and January 1966. In each of the twenty-year periods following these peaks, the stock market has performed poorly in real (inflation-corrected) terms.

Today, we have long-term inflation indexed bonds yielding over 4%, guaranteed against the effects of inflation. The proof that stocks will always outperform bonds over long time intervals simply does not exist. It could be that, with investors invigorated by past successes in the stock market, there is now far-flung over investment. Given the high price-earnings ratios mentioned previously, the market is more highly priced than ever before. Stocks are therefore, by the very definition, risky.

THE "STOCKS HAVE ALWAYS OUTPERFORMED BONDS" THEME IN INVESTING CULTURE

Knowledge about the long-run historical records that dates back to at least 1924 cannot be held directly responsible for the sudden upsurge in stock prices to record levels in the late 1990s. The public's belief that any downturn in the market will soon be reversed has gained remarkable strength in recent years. This confidence derives from such things as a feedback mechanism from past price increases.

LEARNING ABOUT MUTUAL FUNDS, DIVERSIFICATION, AND HOLDING FOR THE LONG RUN

It was noted that the investors had become much more educated about stocks due to mutual funds and the media. They learned to hold stocks for long terms and see price declines as temporary and as buying opportunities. Investors had learned that diversified portfolios of stocks are not risky. However, it should also be noted that stock market declines can persist for decades and thus, even the long-run investors should see risk in stock market investments. In response to heightened investor interest, the mutual fund industry has brought forth thousands of new funds, with a constant proliferation of ads and mailings.

LEARNING AND UNLEARNING

It seems that the public has learned that stocks always go right back up after they go down. However, stocks can go down and become overpriced and underperform for many years altogether. The public is said to have learned about the wisdom of investing in stocks via mutual funds whose management teams have proven track records. Picking mutual funds that have done well give much smaller benefits than investors imagine. Someday, investors might 'unlearn' these facts.

Speculative Volatility In A Free Society

The market is high because of the combined effect of indifferent thinking by millions of people who are moved significantly by their own emotions, random attentions and perceptions of conventional wisdom. The news media offers them quantitative analyses that give them an incorrect impression about the aggregate stock market level. The tendency of speculative bubbles to grow and then contract can make for an extremely uneven distribution of wealth. Although the market appears to have substantial long-term forecast ability when it is very overpriced or alternatively, when it is under-priced, there is always considerable uncertainty about its outlook.

THE OUTLOOK AT THE BEGINNING OF THE NEW MILLENNIUM

If the precipitating factors continue to support the market at its recent record level, and do not increase the market's value anymore, then returns in the stock market will be confined to dividends. The precipitating factors are most likely to grow in the 21st century and cause substantial increases in the stock prices. Participation in the Internet gives people a personal sense of technological progress which in turn may give them an exaggerated sense of the promise of technology.

With the expansion of online trading of stocks, creation of new electronic stock, derivative exchanges, and the implementation of twenty-four hours trading, there has been an enormous growth of opportunities to trade stocks.

The focal point of news may shift away from investments soon. There is a fundamental uncertainty whether the extremely low rates of inflation that were seen recently would continue. Low inflation would continue to promote low nominal yields on fixed-income investments and thus encourage high valuation on stocks. The rise of gambling activities seems unlikely to be reversed. The strong perception that the Baby Boom supports the stock market will eventually fade. All of the changes suggest a poor long-run outlook for the stock market.

POSSIBLE NEW FACTORS

New precipitating factors, supportive and destructive of market value will undoubtedly develop. Some of the factors that could interrupt earnings growth are - decline in consumer demand, heightened foreign competition, an oil crisis, decline in employee morale and productivity, failure of major technological initiatives, etc. A number of these problems could occur together as it tends to precipitate others through its effect on society and the economy.

ISSUES OF FAIRNESS AND RESENTMENT

Many of the potential causes of earnings reversal have to do with changes in morale, loyalty and sense of fairness among the investors. It was such resentment of business that ended the "community of interest boom" in 1901 and encouraged the growth of socialist and communist movements. The Internet is the symbol for much that is new and exciting in technology today and it is the US software companies that seem to dominate it. If a moral basis for resentment gains solid ground in public thinking, it could lead to heightened efforts to compete with or totally exclude American corporations.

SHARING THE LIMITS TO GROWTH

The concern about the adverse effects of atmosphere polluting emissions drove the 1997 Kyoto Protocol to instruct various countries to cut down on their emissions of carbon dioxide and other greenhouse gases. But instead, the level of emissions has been increasing rapidly, mostly in the developing countries.

WHAT SHOULD INVESTORS DO NOW?

A substantial fall in the market would leave some people extremely poor while leaving others considerably rich. Some people who rode the market up to new prosperity will have lightened up on their stock holdings and would walk away with profits, whereas others who had recently entered the market would only take losses. The effects on the lives of people who had become too dependent on stocks as investments, is unimaginable. The first step for investors should be to reduce holdings of stocks. One should not be overly dependent on any one investment itself. Investors should also increase their savings rate.

RETIREMENT PLANS

401(k) and similar plans are designed to give ordinary people economic security in retirement. The shift toward defined contribution pension plans has been good as it is indexed to inflation. Properly designed defined benefit plans offer risk-reducing advantages, which are important for lower-income pensioners. Government bonds would be a much safer option than the stock market. And yet, there is little encouragement on the part of employers or the government to make people shift their retirement funds into bonds. The current policy of providing choices to participants by employers, without any strongly worded advice to diversify invites serious errors. In the future, as a greater number of risk management contracts become available, employees should be advised to take advantage of them.

SOCIAL SECURITY

Having marvelled at the high returns in the markets, Americans are wondering why they have earned so much lower a return on their contribution to social security. The old family system of taking care of your aging parents out of feelings of love, gave rise to effective intergenerational risk sharing. The problem with the family acting as an economic risk sharing institution is that it is unreliable. In the US, social security is primarily a pay-as-you-go system. Inflation investment bonds are not investments for society as a whole since their net value is zero. The first generation's "windfall gain" was probably offset by reduced levels of care from their children. Reforms of social security should take the form not of investing the fund in the stock market but of making the system more responsive to economic risks.

MONETARY POLICY AND SPECULATIVE BUBBLES

There have been cases where tightened monetary policy was connected to the bursting of stock market bubbles. For example, in 1929, the Federal Reserve raised the rediscount rate from 5% to 6%, for the purpose of checking speculation. The Fed continued the tight monetary policy and saw a deep stock market decline and a recession into the most serious depression ever. Interest rate policies affect the entire economy in fundamental ways. For instance, authorities should not normally try to burst a bubble through aggressive tightening of the monetary policy.

THE STABILIZING AUTHORITY OF OPINION LEADERS

A popular way of restraining speculation in financial markets is for intellectual leaders to call the attention of the public to over and under-pricing errors as and when they occur. In each of the three major market peaks, that is - peaks of the late 1920s, mid-1960s and mid-1990s, the Head of The Federal Reserve System issued warnings that the stock market was overpriced. A warning against stock market excesses by a Federal Reserve Chairman was not made again until Alan Greenspan's "irrational exuberance" speech in December 1996. The pronouncements of opinion leaders and moral leaders can have a stabilizing effect on the market.

DEALING WITH BUBBLES BY INTERRUPTING OR DISCOURAGING TRADE

Another method used for reducing market volatility has been to shut down the market in times of rapid price changes. For instance, the "circuit breakers" mechanism adopted by the stock exchanges. It is not clear whether these relatively short closings do very much to restrain one-day price-changes. These long-term price movements take place over years and represent really big stock price shifts. Other suggestions include slowing the pace of trading to discourage frequent trade. James Tobin proposed that the speculative price movement in the market for foreign currencies be restrained by levying a transaction tax on them. Institutional investors have bubble expectations, in essence, expecting an increase and then a decrease in stock prices. Real estate market seems to be extremely vulnerable to speculative bubbles and crashes.

DEALING WITH THE BUBBLE BY EXPANDING OR ENCOURAGING TRADE

In order to ensure longer-run economic stability, the best stabilizing influence on markets can be to broaden them to allow many people to trade as frequently as possible. Speculative bubbles are heavily influenced by word-of-mouth effects, foreign investors are less likely to go along with a bubble, and they may even trade in a way that would tend to offset it. Sudden price changes are not as bad, (in terms of their impact on the welfare of the economy), as the development of a speculative bubble that results in a worse crash in the future. Brennan proposes to shift public attention to fundamentals rather than to longer-run holdings. New institutions or markets should be created to make it easier for individuals to get out of their exposure to the stock market. This will allow trading of major risks that are untradable today. Retail institutions such as home equity insurance or pension plan options that correlate negatively with labour income or home values will help people make use of risk management tools. Creation of new markets may have the benefits of creating new risk management opportunities and might broaden the scope of market participation. The diversity of investment opportunities and the attention focused on fundamental risks by the macro markets ought to stabilize our economies and our lives.

ALTERING CONVENTIONAL WISDOM ABOUT DIVERSIFICATION HEDGING

In order to encourage proper risk management, authorities should stress more upon genuine diversification. People must invest outside the US stock market or US equity mutual fund to achieve true diversification. They must pay attention to other existing risks. Since labour income and home equity account for the bulk of most people's wealth, offsetting the risk to these is the critical function of risk management. Making such risk-offsetting investments is called 'hedging'.

POLICY TOWARD SPECULATIVE VOLATILITY

The problems posed for policy markets by the tendency for speculative markets to show occasional bubbles are deep ones. Speculative markets perform critical resource-allocation functions, and any attempt to tame these bubbles interferes with these functions as well. We cannot shield the society from the effects of waves of irrational exuberance or irrational pessimism entirely. The most important thing to remember while experiencing a speculative bubble in the stock market is to not let it distract us from important tasks such as the encouragement of increased participation of people in more and freer markets, and designing better forms of social insurance and creating better financial institutions.

Conclusion

Now that we are at the end of this book, let us discuss a few key learnings that this book had offered:

1) It has been empirically observed that consumers, investors, bankers and the public kept expecting the stock market prices to increase further during the 1920s. The extremely high levels of the market reflected unjustified optimism and faith in the market. Increased volumes of trading despite extremely high levels of the market became common.

2) There was rapid asset price inflation and prices increased faster than incomes. The arrival of the Internet, the growth of mutual funds and the effects of the Baby Boom were regarded as the most important precipitating factors. Enhanced business reporting by the news and print media led to increased demand for stocks.

3) Mechanisms such as heightened investor confidence and high investor expectations for future market performances deeply magnified the effect of the precipitating factors. The formation of speculative bubbles causes the prices to increase further and a feedback loop occurs.

4) News media acts as an essential vehicle for the spread of ideas. The exaggeration of financial news by the media rouses the public which leads to the creation of more bubbles. They focus their attention on news that have word-of-mouth potential.

5) The term “new era” is used to describe a time when people think that the future is less uncertain than the past. This in turn causes huge stock market expansions. Observers reported real speculative fervour.

6) There emerged a tendency to ignore the possibility that the stock prices will fall in the future and that the economy might sink into a recessionary period. The rapid price increases were followed by incredibly dramatic reversals. There was a subsequent fall in the savings ratio and increase in borrowing activities.

7) People are often seen to be overconfident about one’s own thoughts & beliefs. This overconfidence proves to be a major factor in promoting the high volume of trade that we observe in the speculative markets

8) Herd behaviour gives rise to group behaviour that is irrational in nature. A growth in speculative or Ponzi lending has also been detected. People borrow money with the hope that the rising prices will earn them a huge profit even though they are not competent enough to repay their debts.

9) Markets are vulnerable to excessive exuberance or bubbles. Excess volatility due to speculative bubbles is one of the factors that drives speculative markets

10) Due to widespread “media coverage”, people now believe that the stock market is a less risky investment than what it once ought to be.

11) A rise in the interest rates & currency exchange rates is associated with the formation of bubbles. We observe the creation of inflated asset prices that are associated with the formulation of speculative bubbles.

As the wise men say, all bubbles eventually pop!