Learn to Earn - Peter Lynch

Introduction

About the book

Learn to Earn is one of the best books for anyone who is an amateur and elementary learner interested to learn the basic principles of investing in the stock market. It gives a sneak peek into the recent history of America and its development into a corporate giant and superpower. Although the book talks about the US markets, it is very relevant to Indian investors, as the principles of finance and investing remain the same all over the world.

It explains the principles of investing in a simple and lucid manner. If you want to become rich and multiply your money, you need to learn how money works. It also teaches how to pick quality stocks or companies for investment.

About the author

Peter Lynch is an American Investor, a philanthropist, a former fund manager at Fidelity Investments and the author for some of the best-selling books on investing and stock markets like Learn To Earn and One Up On Wall Street. He has also written and co-authored a number of other books and papers on investing strategies.

Buy the Book

The book serves you as a complete guide in your stock investing journey. We highly recommend you to read the entire book. (affiliate link)

The Companies Around Us

Principles of Finance are simple and easily grasped.

- Saving equals investment- Those who save and invest for the future will be more prosperous in the future than those who run out and spend all the money they get their hands-on.

- Why USA is a rich country? At one point they had one of the highest savings rates in the world. It's not how much money you make that determines your future prosperity but how much money you put to work by saving and investing it.

Companies around us

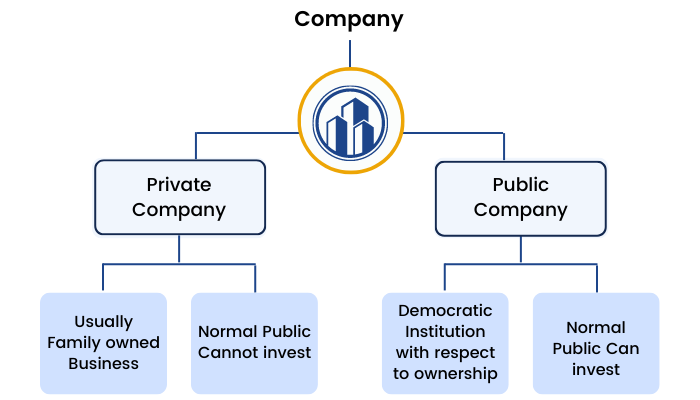

- What is a Company? A company is a corporate body which has filled legal papers with an address to get incorporated.

- Beauty of a corporation is that although it can be sued as can its managers and directors but the shareholders are protected.

- That’s why “Limited” is put at the end of the name, to show that liability is limited. Without limited liability nobody would want to buy a single share of stock.

History Of Capitalism

- Few hundreds of years ago capitalism was an alien concept.

- People did not exchange goods and services in exchange of money. Kings owned all the land and people served them for free. The idea of lending money or getting ahead or business for profit was an x-rated activity. Kings,queens and churches ran the show.

- By the late 1700s, the world had opened up for business with brisk trade between nations and markets were cropping up everywhere. The new merchant class became more powerful than dukes and princes.

- The merchant made the transition to capitalism by making profits from the ownership and control of the means of production.

- In the past few years we have realised that democracy includes free enterprise, the right to make things, buy and sell things, own land, car, house, business which until now, half of the world population couldn't do.

- 1602- World’s first popular stock United Dutch East India company was formed. Millions of money raised in stock sale to outfit a few ships- which were to be sent off to India to bring Eastern merchandise. First adventures to far off lands were funded by these investors.

- Dutch West India investment was another stock company wherein- Peter Minuit bought Manhattan for $24. If the company stayed in business till date, it would have owned the expensive Downtown of New York now. Seeing Dutch, the English followed suit.

“Every school child learns how the Pilgrims risked their lives to find religious freedom, how they crossed the cruel ocean in a tiny ship, the Mayflower, how they suffered through the cold New England winters, how they made friends with the Indians, how they got their squash and pumpkin recipes, but nothing about the remarkable story of how they got their money.” - In short, America Inc. was sponsored by a lot of money coming in from England and Holland.

Early entrepreneurs and Father of Financial System-

- America was the first country to adopt the idea of companies on a large-scale. No other industrial Nations -Great Britain, France, Germany or Japan had adopted this.

- Alexander Hamilton was the Father of the Financial system. During those times, banking was a controversial subject and paper money was distrusted. He realised that the country couldn't get along without money and for money it needed banks. Bank of New York was the first stock to trade on the NYSE in 1784.

- Just to bring things into perspective- In 1830, 31 shares changed hands.In 1995, 338 million shares traded on the same day.

Concept of Free markets and Capitalism was introduced for the first time

- “Market” was opening all over the place and a new breed called “economists” emerged to describe what happens when individuals have freedom to seek their fortunes. Invisible hand was coined by Adam Smith how the market forces, supply and demand and price could take care of itself in a free economy market.

- “Self- accumulation” and “capitalism’” was finally considered a positive impulse and created opportunities, an increase in overall Pie, unlike the feudal system which existed for centuries.

American inventiveness

- Capitalism brought machines to life which was America’ response to lack of manpower. People were amazed with American products and the system of manufacturing that standardized the quality of each item to get standardized products. (the first factories and mass production- assembly lines)

National brands

- A thousand trademarks got registered in the US and jingles were created which pop even today. Mass production became the watch word of the day. Household products became celebrities.

- Machine age and Mass production came along so fast that people hardly had time to prepare for it. Property laws had to be rewritten, New rules of communication established.

- Foreigners bank-rolled (sponsored) America’s fantastic progress by investing in America’s emerging market and 150 years later America is returning the favour by investing huge sums of money in emerging markets of Asia, Africa and LatinAmerica.

- Capitalism meant new machines, insecticides and harvesting equipment and made America the most effective Food bank on earth.

Railroads and Commerce

- Major railroad expansion opened up the territories. Heavy industrialisation caused all traditional homemade products to be brought into stores.

- Thomas Edison’s invention of ticker-tape. Every time a stock was bought or sold, a record of this would help people, all around the world, to know about how stocks were doing from far off.

- People from all over the world came to America because however bad situation was over here, it was better than the situation back home. Life was better in America. It was known as the land of opportunity.

The Industrial era and Monopolies

- Soon after the establishment of America Inc. Monopolies became a big threat to American life, with few insiders controlling prices and wages free market, capitalism would cease to exist. The unions, newspapers, courts and some courageous political leaders all had a hand in rescuing America from a greedy few.

Dows Famous Average

- Henry Dow put together 11 important stock and closing prices and divided it by 11 and was called the Dow’s average. Helped people to follow the overall stock market.

Karl Marx and theory of Communism

- Karl Marx projected that at the rise of machinery, working hours would prolong and paycheck will become less. This was proven wrong. And instead, working hours were reduced with the invention of efficient machinery and pay became better. So, countries with factories became prosperous and Communist system was thrown over in Russia.

Famous crash of 1929

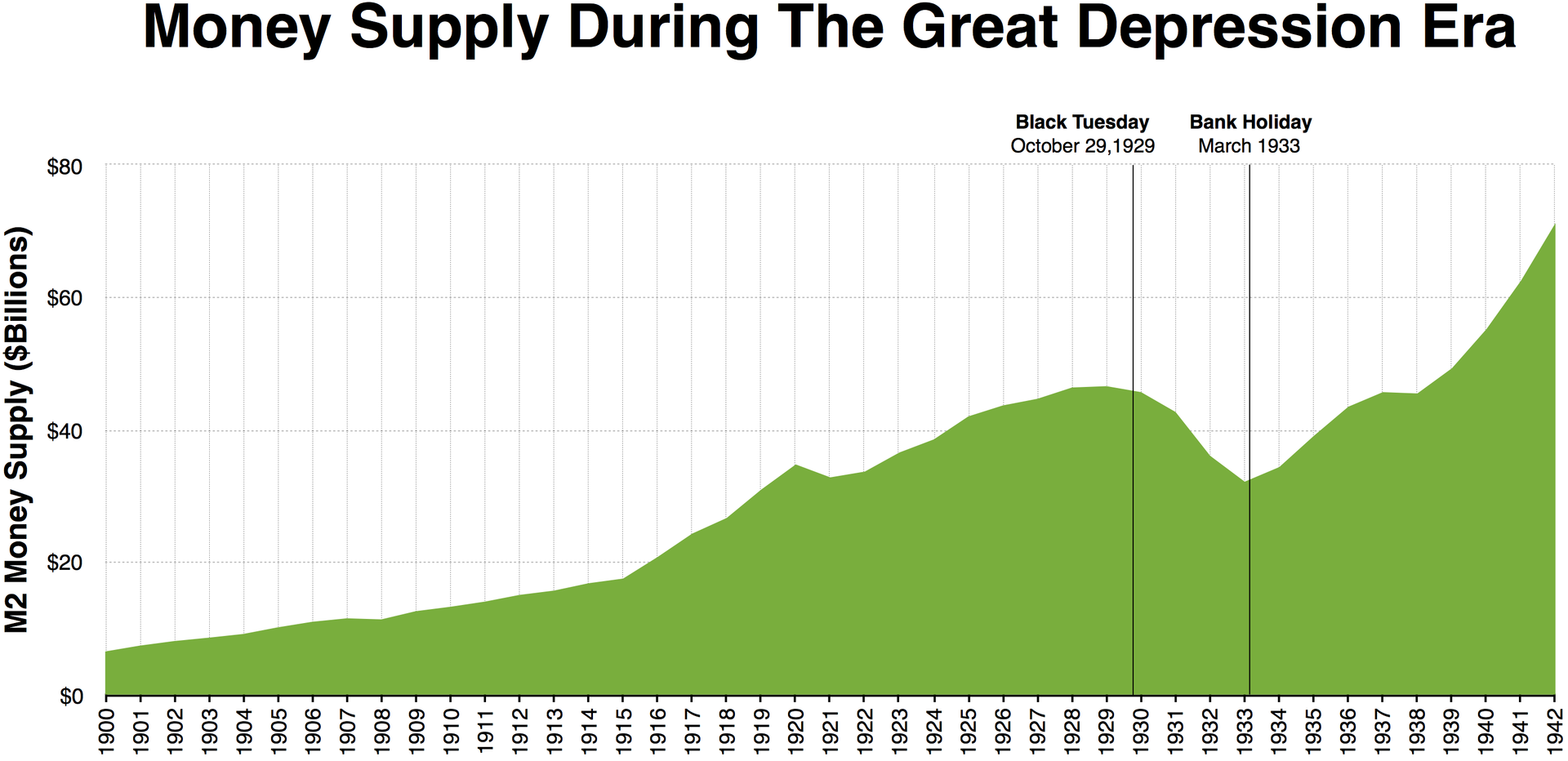

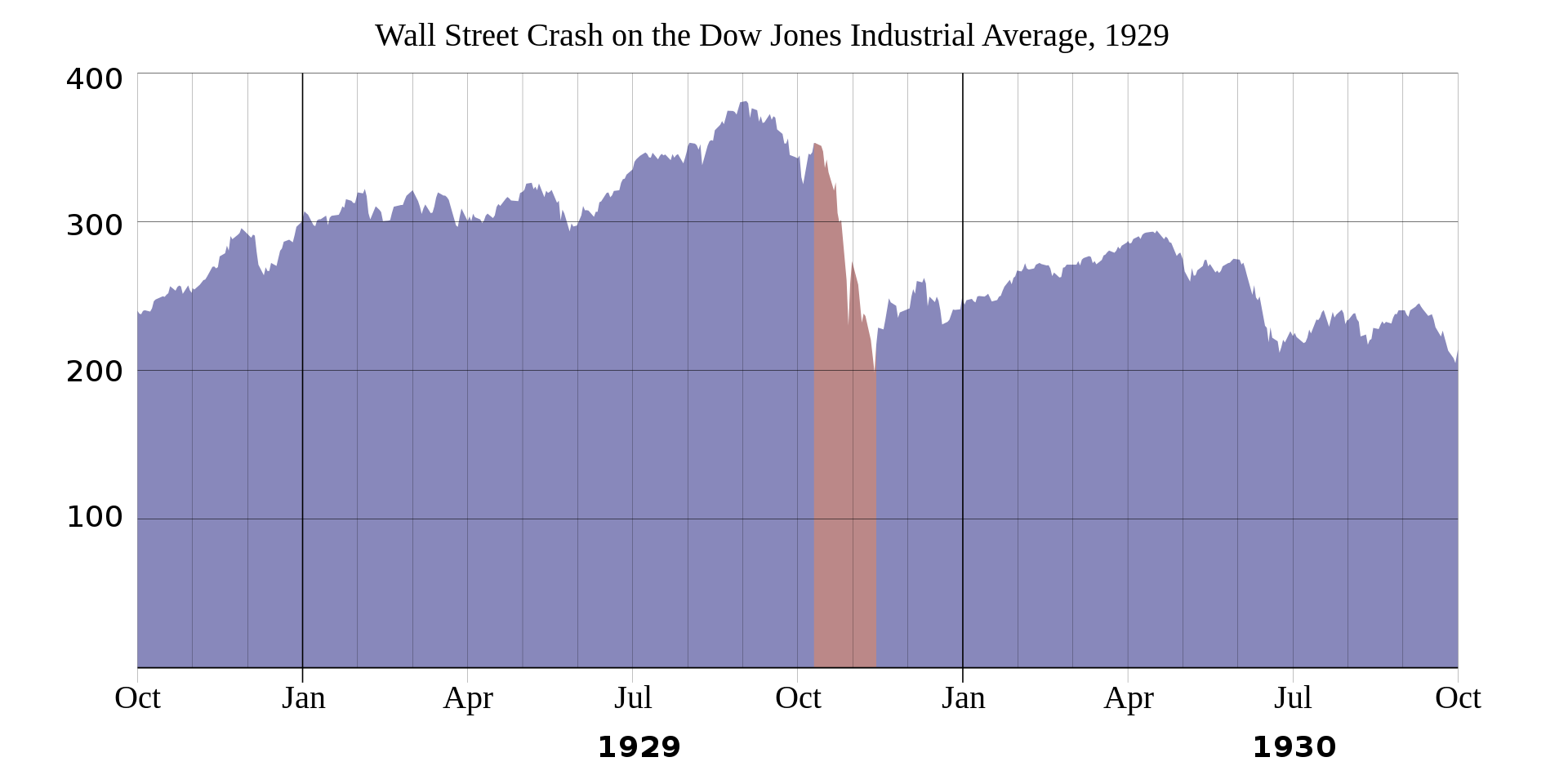

- In 1929, the American stock market and economy took a deep plunge. It was the most pernicious collective phobia that kept millions of people from buying stock and making profits they could’ve used.

- The Great Depression brought the economic slowdown and government mishandling of the money supply by raising interest rates at the wrong time. Instead of putting more cash in circulation to perk up the economy, the government did the opposite, pulling cash out of it. The economy came to a halt.

- But now we found a permanent cure for depression. As long as the Government and its army of spenders is throwing money around, the economy may slow but never come to a halt like in the 1930s.

- In fact, what we learnt is that stock would bounce back as always eventually. Looking at the positive side a crash is the Unique opportunity to buy stocks cheap but sometimes it can take a lot of time to recover.

Source: Wikipedia

Investor protection

After the crash, the following changes were incorporated in stock exchanges to ensure better investor protection.

- Introducing truth in Advertising laws

- Strict rules details report by companies

- Insider trading was prevalent but now banned

- Market manipulation by Robber barons was strictly taken care of

- SEC was established

- Very tight scrutiny on trading stock policies

Basics Of Investing

1. Invest now: what are you waiting for?

The right time to invest is as early as possible. The legendary investor Warren Buffett said: “I made my first investment at age eleven. I was wasting my life until then.”

By the time you realise you ought to be invested, you've wasted valuable time, the stocks could have been working in your favour, your money could have been piling up. Start investing as early as possible and don’t wait for your thirties, forties.

The average high school student is familiar with Nike, Reebok, and McDonald's. Nearly every teenager in America drinks Coke or Pepsi, but only a very few own shares in either company or even understand how to buy them. By 18, one must own shares. Financial education should be a part of the school curriculum.

Putting your money to work

a. Money is a great friend, once you send it off to work. Put extra cash in your pocket without you having to lift a finger. Your money earns interest.

b. If you invest your money in stocks, instead of putting it in a bank there are chances that your money will earn money while you do nothing.

On an average, you will double your money every seven to eight years if you leave it in stocks. Smart investors have learnt to take advantage of this. They realised that capital (money) is as important to the future as their own jobs (labour).

Warren Buffett saved money, put it into stock and is one of the richest men in America. One penny saved was capital earned.

Author has called upon three situations:

- A+

- C-

- F

-

1. The A+ of the best situation is when you are saving and investing a portion of your pay check

2. C- situation is when you are spending the whole amount of your paycheck.

3. F Situation is where you’re paying interest to somebody else usually a credit card company. Instead of your money making money for you, the company's money is making money on you.

- To a credit card company, you are a better investment than a stock - with an 18% interest rate generated from you.

- When you purchase on credit without having cash you lose out. Why? Only for your need of instant gratification. Earlier, people actually waited till they had cash in their hands which is often more enjoyable than instant gratification.

- It's ok to pay interest on a house or an apartment with an increase in value but not on cars, appliances, or closets that are decreasing in value.

- Debt is Saving in reverse.

- Not only that, A country with the highest savings rate can pay for roads, phoneline, factories equipment, innovations that help companies make better and cheaper products to sell to the world. Example, Japan which revived itself after World War II because it was the nation of savers.

- People of Japan, China, India, Taiwan save up to 10% to 20%. But, the US saves only 4% now.

Save as much as you can, you are helping yourself and helping the country.

Pros And Cons Of The Five Basic Investment Tools

1. Putting in a savings account, T-Bills, money market instruments and CDs- Though safe, these instruments have low interest rates, sometimes lower than inflation. When the inflation rate is higher than the interest rate you get from a CD, treasury bill, money market account or saving account, you are investing in a lost cause.

2. Collectibles- Collect things so that you can sell them at a profit in future. Why do their prices increase?

- Things become more desirable

- Inflation robs cash of its buying power, which raises prices across the board.

But they can get lost, stolen, stained, damaged by fire, general wear and tear, although their value increases as they get older. The constant hope of collectors is that the age of the thing will raise its price more than the condition of the thing that will lower it.

3. Houses or apartments: House has two kinds of advantages over other types of Investments. We can live in it while we can wait for the price to go up, and we can buy it on borrowed money. We are not scared out of it by bad housing markets unlike stocks.

4. Bonds- The government pays back the money, plus interest- not to the grandparents, but to the grandchildren. You should consider the inflation risk when buying a bond. They should pay a higher interest rate than treasury bills as they mature over a much longer period of time. Longer the duration, higher the interest rate. Longer the duration, higher the interest rate.

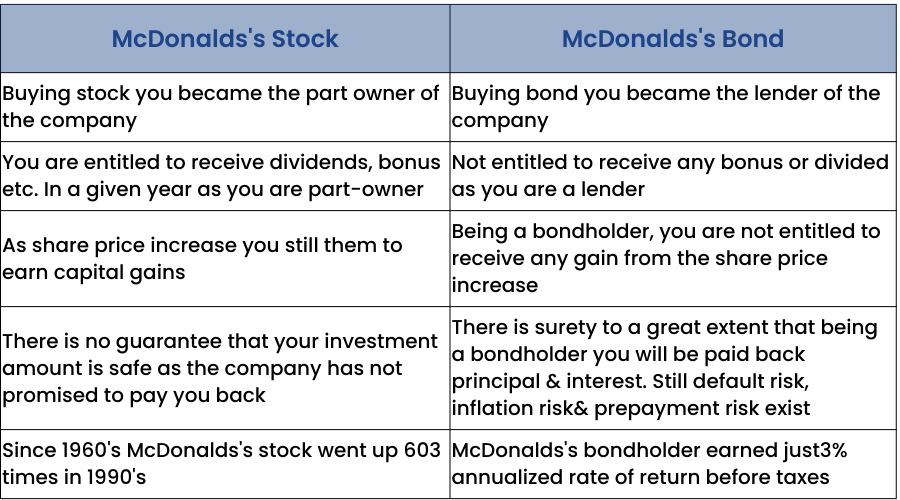

Stocks are riskier than bonds but they are potentially far more rewarding. Consider buying two options: one is McDonald's bond and another McDonald's stock.

5. Stocks- Likely to be the best investment outside of the house. Empirical evidence shows that stock is not a gamble. But you need to invest with a plan and sound knowledge of fundamentals. It has the highest annual rate of returns amongst all investment avenues.

Invest for the long term:

- Being young give you big advantage over old folks. A small amount of money invested early is worth more in the long run than a large amount of money invested later.

- Time makes money –Let time and Money do the work while you sit back and await the results.

- 20 years or longer is a right time frame that long enough for stock to rebound from the nastiest erections on record and its long enough for the profits to pile up. 11 % a year in total returns is what's stocks have produced in the past. Nobody can predict the future, but after 20 years at 11%, an investment of $10,000 is magically transformed into $80,623.

- It's not always brainpower that separates good investors from bad, often its discipline.

- Buy shares in Solid companies with earning power and don't let them go off without a good reason. The stock price going down is not a good reason.

- Crisis makes long-term investors into short term investors. Emotions get the better of them. Don’t let that happen.

- Being fully invested you'll get the full benefit of those magical and unpredictable stretches then stocks make most of their gains.

Mutual Funds

- Mutual Funds were invented for people who want to be invested but can't be bothered about details on fundamentals.

- Your only job is to send the money, which gives you a certain number of shares or units in the fund. Whether you invest $50 or $ 550 million, you still own a piece of all the stocks in the fund.

This is less risky than owning only one stock, if you are a novice investor.This is less risky than owning only one stock, if you are a novice investor. - As an added attraction, many funds pay cash bonuses in the form of a dividend.

- Along with the chance to share in the gains from a fund, you’re also paying a share of the management fees in the fund expenses.

- Professional stock pickers have the knack for picking the right stocks but unlike professional doctors or sport players, stock picking doesn't require exceptional skill and an amateur has a decent chance of beating a professional stock picker.

- In particular, professionals overlook the newer, inexperienced companies that often turn out to be star performers in business and biggest winners in the stock market.

What are the important points to be considered when investing in a Mutual Fund?

- Buy Mutual Funds directly from companies that manage them.

- When buying through a broker, always know his commission and whether a better product can be available at a lesser rate.

- For Long term investment, go for pure stock funds instead of debt and hybrid funds.

- Look at Past performance of the fund and make sure that the manager who compiled the great record is still there.

- It's more profitable to invest in small companies and large companies. The funds that invest in small companies beat out the large cap funds by a self-sufficient margin.

- Don’t take a chance on a rookie (newly recruited manager) fund when you can go for a veteran fund.(old manager)

- It doesn't pay to be a fund jumper.

- Go for a no-load fund which doesn't charge an entry fee.

What is an Index fund? It is a kind that is guaranteed to match the average; it doesn't need a manager, it runs on autopilot automatic mode. It simply buys all of the stocks in a particular index and holds onto them.Find out the index fund as per your requirements.

Picking your own stocks

- Picking stocks involves a lot of hard work than investing in a mutual fund, but there is great deal of satisfaction in choosing your own stock.

- If you own 10 stocks and three of them are big winners, they will more than make up for the one or two losses and the six or seven that have done just OK.

- You can always have a stimulating experience and do a trial run by purchasing a few stocks. Playing the stock market game can be fun as well as educational as long as the players are taught the basics of investing and don't take the results too seriously.

5 Basic Methods Of Stock Picking

Starting with the most ridiculous and the most enlightened:

1. Darts is the lowest form of stock picking method. It is a Random selection, wherein you pick the stock on an absolute random basis based on no criteria at all. If you are so clueless, it is better to invest in mutual funds.

2. Hot tips- The second lowest form. This method is based on hunch. In this, someone else tells you to buy a particular stock. You buy out of, for the fear of losing out profit. But you never really lose out if you don't buy. You lose out if the stock goes down.

3. Educated tips- Professional Experts who have the expertise and have done their homework. (It is not based on hunch like hot tips). But the problem is that, when the expert changes his mind you have no way of finding out. You will be holding onto the stock because you think the expert likes it, long after he stopped liking it.

4. Broker’s buy list- Stock brokers who provide “full service” have their own recommendations which usually come from analysts who are well trained to understand the affairs of the company.

The brokers collect ‘buy’ signals from the analyst which are usually divided into categories: - like stocks for conservative investors, aggressive investors, stocks that pay dividends etc.

One can build an excellent portfolio by turning stocks from the buy list, that is you put your own brains over the brokers research and get the best stocks.

One big advantage over the brokerage firm over educated tips is that, when the broker changes their mind and moves a stock from ‘buy’ to ‘sell’, the broker will inform you of this fact.

5. Doing your own research: It is the highest form of Stock picking. You choose a company after you've done your research inside out.

The more you learn about investing in companies, the less you have to rely on other people's opinions, and the better you can evaluate other people's tips. You can decide for yourself what stocks to buy and when to buy them.

We need two kinds of information:

a. Studying the numbers and the fundamentals

b. General observance in studying by walking into the store and keeping your eyes open. For example walking into a McDonald's and seeing for yourself about the management of the store, employees, crowd, operations etc. These are important clues that can lead you to the right stocks.

Earnings, sales, debt, dividend, price of the stock: These are some of the key numbers stock pickers must follow. It is important to know how to decipher the balance sheet.

It’s impossible to keep up with thousands of stocks traded on major exchanges.

That's why stock pickers are forced to cut down on their options by specializing in one company or another. They could specialize in:

- Company that have a habit of raising dividend

- Companies that grow 20% a year

- Turnaround companies

- Particular industries etc.

An investor has to make an educated guess about the future and not blind ones. Your job is to pick good stock and not pay too much for them.

Twelve baggers: Don’t confuse the price of a stock with its story, if the story is good the stock will gain Momentum in spite of odds and that will be your twelfth Bagger.

What a company does with its earnings is as important as the earning itself!!

- Plow back into the business- Reinvesting in the profitable business is best for shareholders. This creates greater wealth for shareholders in the long term than any other method.

- Waste money on corporate jets, double salaries of employees etc. Nothing in it for shareholders.

- Buy back its own shares –With fewer shares in the market, the remaining shares become more expensive. Very good for stockholders.

- Pay Dividend-Added source of income to Shareholders but avoids the company and shareholders from possible growth and reinvestment.

The Life Of A Company

The Company at Birth Someone has a brainstorming idea and invents a new product. It could be anyone, not necessarily a VIP, PhD, college graduate. It could be a high school or a school dropout even.

- Example Body Shop—Started in Anita Rodrick’s garage. She was a British housewife looking to do something while her husband was away on business trips.

- Hewlett Packard started in a packard garage.

- Apple was produced in a garage by two college dropouts- One was Steve jobs and other was Steve Woznaik.

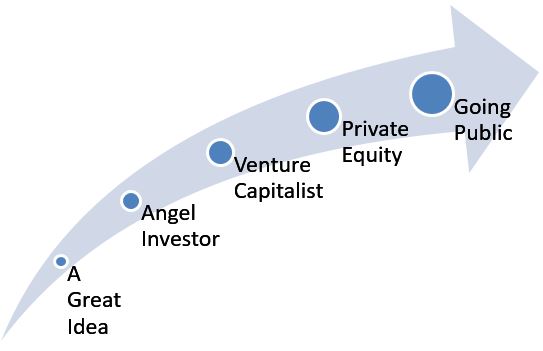

These are the stages:

- A person has a great idea but you cannot succeed if he is selfish and keeps 100% of profit ownership for himself.

- The Next stage is to find an Angel investor who is a rich uncle, aunt, father who likes the idea and wants to invest in the project.

- This is followed by the next stage which is a venture capitalist who is convinced about the product and would like to take the risk on that.

- Then comes the second line of investing like private equity etc.

- And lastly, it's the public investing when the company goes public.

Going public:

- The life of a politician is no longer his or her own, and neither is the life of a company that goes public.

- A company has two birthdays – the day it incorporates and the day it goes public i.e. the day of its INITIAL PUBLIC OFFERING (IPO)

- The company appoints an Underwriter to undertake the IPO process

- The Underwriters are bankers who are entrusted with selling shares to interested parties. They even go out for “road shows” trying to convince the people to buy the stock.

There is a Prospectus that explains everything about the company, including all the reasons why they should and they shouldn’t buy. These warnings are written in large red letters and are called “red herrings”. - Once the IPO is complete-a small chunk of money goes to the underwriters, another chunk goes to the founders of the company, Angels capitalists, VCs –who might use the offering to sell some shares and the rest of the money is returned to the company itself. This is the capital used to expand the business.

- The only time a company benefits from its own stock is during public offering.

Different Stages Of A Company

Company when its young

- Company survival is far from ensured as a lot of problems can crop up like the “great” idea wasn’t that great after all or the company spent all its money before the product is manufactured and shipped to stores, or the company gets sued for stealing the idea, another company comes with a better product etc.

- It is easy to see why one half of all new businesses are dissolved within five years then why the most bankruptcies happen in competitive industries. Example: Electronics.

- Because of high risk in a Juvenile company, the investment needs close attention to the financial health of the company. The biggest problem is that young companies are running out of cash.

- But the good part is that starting from scratch, a young company can grow very fast. It's small and it’s restless and it has plenty of room to expand in all directions.

Companies during Middle age

- Proven record of Reliability.

- More braced to face challenges.

- Need to reinvent in case of midlife crisis. Example: Apple lost its reputation when Apple III came out with some problems. People lost faith in Apple and IBM gained territory. To gain ground, apple reinvented itself by ironing product problems and rigorous MARKETING.

- A company’s midlife crisis puts investors in a quandary. If the stock is already dropped in price, investors have to decide whether to sell it and avoid even bigger losses or hold onto it and hope that the company can launch a comeback. In hindsight, the recovery may look obvious, as in the case of Apple, but at the time of the crises, recovery was far from assured.

Companies during Old age

They had been Great Earners in the past but can’t be expected to keep up to the momentum. It can't stay on top forever. U.S. Steel, General motors and IBM are perfect examples whose most exciting days are behind them.

Why should you invest in blue chip companies?

- Less risky. No danger of going out of business.

- Likely to pay a dividend.

- Valuable assets that might be sold off at a profit.

- Lastly patience is a virtue but not well rewarded when one owns stock in a company that past its prime. Hence, one must exit the stock whose Company has little or no future growth prospects. The last half of the 20th century saw U.S. steel as the most precious stock. But with the beginning of the electronic age at the turn of the century, the stock sold for less in 1995 than it did in 1959.

Extinct companies

Companies are so important to the health and prosperity of a country that it's too bad they aren’t a Memorial someplace to the ones that have passed away. There ought to be a book that tells the story of interesting companies that disappeared from the economic landscape and describes how they lived, how they died and how they fit into the evolution of capitalism.

Economic climate

- Economic climate means outside forces that companies must contend with, which help determine whether they make money on lost money, and ultimately, whether they thrive or wither away.

- Three basic conditions: Hot, cold and warm.

- Hot climate makes investors nervous. A cold climate depresses them. What they are always hoping for is the warm climate also known as the Goldilocks climate. Goldilocks climate is when everything is just right.

- Hot climate is when everything is going well, too much prosperity leading to inflation and shortage of things.

- Demand slows down due to inflation. There is an economic deep freeze also known as a recession.

- Only the things which people can't do without or what you can easily afford, can sail through recession. People can make “recession proof” portfolios by buying companies that do well in cold climates. Cyclical companies suffer in cold climates.

- Warm Goldilocks climate is preferred and the government can ‘aid’ in that.

What is the role of government?

Government is now the permanent cure for depression

- Government through its Federal Reserve Bank system, lowers interest rates and pumps money into the economy to jolt it back into action.

- There are millions of people on social security and pensions with money to spend on no matter what.

- 18 million government employees at all levels are an army of spenders.

- Deposit insurance at bank and savings and loan, so if the banks go for bankruptcy people won't lose money as it is insured by other banks or government itself.

- Government rises to stardom. Government has a leading role in the economy. In the 1930s it was only a supporting role. In short, the Government's massive spending power is protecting us.

- History doesn't have to repeat itself. When someone tells you that it does, remind him or her that we haven't had a depression in more than half a century. People who stay out of stock to avoid 1929 style tragedy are missing out on all the benefits of owning stocks.

Bulls & Bears:

- When the bulls are having their run sometimes 9 out of 10 stocks are hitting new highs every week. People are rushing around to buy as many shares as they can afford.

- When stock prices fall 10% from their most recent peak, it's called a “correction”.When stock prices fall 25% or more, it's called a “bear market”.

- In trying to time the market to sidestep with the bears, people often miss out on the chance to run with the Bulls.

- Buy shares in good companies and hold on to them through thick and thin.

- There’s an easy solution to the problem of Bear markets. Setup a schedule of buying stocks or stock mutual funds. You're putting in a small amount of money every month, or four months, or six months. This will remove you from the drama of Bulls and the bears. This process is also known assystematic investment planning (SIP).

The Invisible Hands

Who Is Rich And How They Got That Way?

- It's not easy to hold on to money, even among billionaires. Inheritance taxes put a big dent in any large fortune that’s handed down from one generation to the next.

- Secondly, America is a land of opportunity. Smart young people like Bill Gates of Microsoft can end up on the Forbes list ahead of the inheritors.

- Warren Buffet is the first stock picker in history to reach the top. He follows the simple strategy: no tricks, no gimmicks, no playing the market, just buying the shares in good companies and holding on to them until it gets very boring. The results are far from boring. $10000 invested with Buffet when he began his career 40 years ago would be worth it a million dollars today.

- We’re seeing fewer sons and daughters of yesterday's tycoons and more successful entrepreneurs who came out of modest backgrounds. They rose to the top on pluck,luck and a great idea.

- There are all kinds of rich people: short, fat, tall, skinny, good looking, homely, high IQ , not too high IQ, big spenders, penny pinchers, tight-fisted, generous. It's amazing how many people keep up their frugal old habits after they've made it big.

- There is a lesson from America Inc. Find something you enjoy and give it everything you've got and money will take care of itself. You’ll be having too much fun at the office to stop working.

- In this book Peter Lynch also gives us very interesting anecdotes of companies like Coke, Wrigley, Campbell soup, Home depot device, Ben and Jerry and Microsoft and offers a great deal of learning from their history.

Success Stories

The COKE Story

Coke was made by Dr. Pemberton by mixing a bunch of ingredients (sugar, water, extract of coca leaf, kola nut and caffeine) as a medicine - “brain tonic and cure for all nervous afflictions.” This was the original Coca–Cola. Not finding many buyers for the product, Pemberton sold the recipe to Asa Candler for $2300 in 1905.

Candler removed the coca leaves (as it was a drug) and revamped the recipe.

The revamped Coke recipe is the best kept secret of the century, still guarded in the vaults of the Trust Company of Georgia.

To the new recipe, soda water was added for the fizz, and they bottled in curvy bottles that we can identify with even today.

In 1916, Candler sold the company for $25 million to an Atlanta banker, Ernest Woodruff in order to avoid paying higher taxes as per the latest Congress regime.

Coke soon became public under Woodruffs in 1919 at $40 million paid up capital. It survived the Great Depression, and even though people had little money to spend, they kept buying Cokes. It turned out to be recession proof and made eight times money when everyone around was predicting the end of the world.

It survived another calamity World War II and when people around the world saw GIs drinking coke, they became the most effective unpaid sponsor in the history of commercial advertising.

Coke is still identified as an American way of living.

How Wrigleys got Started?

Wrigley chewing gum started as a freebie with baking powder. The chewing gum became so popular that gradually the company dropped making baking powder and started manufacturing and selling gums. Started in 1893, By 1910 Wrigleys was America’s favourite brand.

Levis

Levis Strauss was an immigrant from Bavaria, Germany who made pants out of tent canvas and sold them to prospectors who came during the Gold rush in California in 1849. While most prospectors went empty handed, Strauss found goldmine in his blue jeans and took out a patent on the denim version in 1873.

The company went public in 1971 but the company bought back all its shares by 1985 and is private again.

Ben and Jerry

After trying hands-on jobs like driving taxis, mopping floors, flipping hamburgers, running carnival games on an individual level, when Ben & Jerry crossed paths, they decided to start a restaurant as they had nothing else to do. They spent $ 5 on an ice cream course. With $6000 as savings and $2000 as borrowed money, they started ‘The Scoop shop’ in 1978 at a gas station.

The Rich and Creamy ice-cream went instantly popular with the people and they couldn’t get enough of it. The company had to expand to keep up and went straight to the public. In 1984, it became public and is one of the most interesting companies on record as the bosses came to work in tee shirts and Bib overalls and never wore suits!

Microsoft

Bill Gates, born in 1955, was captivated with computers as a child. He spent much time in the computer lab with his friend Paul Allen. While experimenting with primitive Hardware and software, Gates and Allen invented DOS. They were the pioneers of Software. Scientists and engineers in fancy research labs couldn’t accomplish what these young hackers in blue jeans accomplished by themselves.

While in respective high schools, the two friends got bored and dropped out to invent a new computer language called BASIC.

MITS, a small computer company Allen was working with had hired Allen to create a version of BASIC for a computer chip by Intel. So BASIC was entailed into a lawsuit as to who had the rights for it: MITS, Gates or Allen. The courts ruled in favour of inventors, as they’d developed BASIC before they got to MITS.

After winning the lawsuit, they put all their energy into Microsoft, their company.

In 1980, Gates impressed the personal computer giant, IBM and under contract with IBM created MS DOS, the most popular operating system till date!

According to Lynch, there are two kinds of Heroes. Usually the person who got the company started and the person or persons who kept it going. These are the invisible hands of the 1990’s.

- Since 1982, companies of all kinds have dedicated themselves to becoming more efficient overall. On Wall Street this is known as restructuring, rightsizing downsizing, or getting leaner and meaner. Whatever you call it, it means reducing costs and boosting productivity not just to survive recession but to become more profitable and more competitive as a matter of course.

- Much of this prosperity has to do with the change in the way companies do business.

- The companies can be classified into three kinds: companies that have kept growing for decades (Walgreen, McDonald’s for instance); companies that had lost their way before the hero arrived to turn them around; and companies that were doing OK but then got a second wind and accomplished amazing things, given that they were getting old and people thought their best years were behind them.

- The importance of Heroes cannot be undermined by corporate offices. The nation's prosperity depends on all companies getting big and big companies getting more competitive for an optimum growth in jobs.

Conclusion

Stocks markets provide a good platform to invest and grow money provided one can do his background work and research, and follow certain guidelines. To aid this and facilitate this research one must study the financial statements very well. There are various tools and aides available to help in such research.

Stock Picking Tools:

Computers, software programmes like Bloomberg and various sorting techniques have contributed big to research and stock picking.

- Companies are reaching out to small investors and one can learn a lot through Annual reports and quarterly reports online.

- Financial news published by magazines like Forbes.

- Mutual funds trackers.