Principles by Ray Dalio

Introduction

About the Author

Ray Dalio is a billionaire investor. He manages $140bn of assets under his hedge fund, Bridgewater Associates. Ray Dalio is famous for his innovative practices in the hedge fund industry such as risk management and currency overlay (managing portfolio risk by buying/selling forex future contracts. It is used in case of international holdings in the portfolio). Ray has been titled among one of the 100 most influential by Times Magazine, was among the 100 richest by Forbes and his fund, Bridgewater Associates, was titled fifth most important private US company by Forbes.

About the book

In this book, Ray has communicated the importance of having Principles in life. Principles means rules applicable to certain conditions. As per the book, Ray has been evaluating behaviors and actions since childhood of himself along with other successful people that he idolized. This helped him compare and introspect which decisions were best in a given situation. With years of hard work, he was even able to create an algorithm out of it, in order to help him make investment decisions.

He advises us to decide:

- What we want

- (In light of) What is true – reality check

- What should you do to achieve it

Buy the Book

By the end of the book, you would become a good decision maker. This not only would help in your investing journey but also in your career & personal life as well. We highly recommend you to read the entire book. (affiliate link)

My Call to Adventure

Ray speaks about his childhood.

The chapter has general information about Dalio’s upbringing, his relationship with his mom and dad and his political views. However, by the end of the chapter, he gets into his learning about investments as well. He started investing in stocks from the money he earned by doing small jobs like newspaper distribution in his school days itself. He recalls how he purchased a chunk of shares of an airline company, trading below $5. He alarmed, although it was not a wrong strategy, but got his money tripled and confidence boosted in the early days of his investment journey.

As 1960s was an amazing time for the US stock markets, Ray then began to do “Dollar-Cost Averaging” which is putting in same amount of money in each of the stocks of the portfolio every month. This strategy does not give relevance to the number of stocks purchased, rather the amount which is invested in each stock is a consideration for portfolio allocation. In his teens, Ray was making good money and enjoying his time.

The story in this chapter continues till the year 1966, when the US market peaked. In the next chapter, Ray discusses what mistakes he made, which showed up in the bear phase of the market.

Crossing The Threshold

In the early stages of his career, after losing some money in the stock market, Ray discovered that stock prices are a reflection of people’s expectations. Therefore, it’s not when the financial results are good that a stock price would go up, it is when it’s better than expectations.

Later when Ray entered college, he was introduced to commodity trading by a classmate. Since commodity trading offers higher leverage than stocks, the possibility of making bigger money (if prices move in the desired direction) are more.

Ray says, “You better make sense of what happened to other people in other times and other places because if you don’t you won’t know if these things can happen to you and, if they do, you won’t know how to deal with them.” He said these words in the context of his learnings from the event of 1971 when the US had abolished the currency Gold Standard. Earlier, for each dollar printed, the central bank of the US kept an equal amount of gold. This means that you may exchange dollars for gold. However, in the year 1971, this was abolished and hence the US could print as much currency as it wants.

Ray as per conventional knowledge thought that this was inflationary and hence negative for the markets. However, markets jumped 4% on the day of the announcement. This made him realize that one needs to study instances in history to make sense of the current situation. In his study he found that whenever similar situations happened in the past, stock markets had soared.

Ray, began his professional career as a commodity trader at Merrill Lynch. The inflationary pressure of printing dollar, sored the commodity prices, giving Ray a successful tenure at Merrill Lynch. Soon, he started consulting clients like McDonalds hedging activities through commodity futures in order to tackle raw material price volatility. In 1975, finally he started Bridgewater Associates.

By this time Ray had developed good expertise on the cause and effect relationship of the economic events and prices of commodities. This helped him model this relationship on a computer and run algorithms for buy/sell decision making. For example, Ray used to estimate the amount of meat that was going to hit the market by knowing how many cattle, chickens and hogs were being fed. These types of estimates could help companies like McDonalds that use meat as an important raw material.

This approach can not be perfected in a day. Ray used to refine his model day by day in order to achieve expertise. The approach was to visualise complex systems as machines, figuring out the cause-effect relationships and writing down the principles for decision making and finally coding them so that the computer could make decisions for you.

My Abyss (1979-1982)

In 1978-1980, the oil market was very volatile due to the fall of the Shah of Iran. This affected the prices of other commodities as well.

As per Ray’s understanding of the cause and effect, he figured out that the Federal Reserve (FED) would tighten the monetary policy to control inflation, leading to slower growth in the economy.

In such circumstances, precious metals (such as gold and silver) are a good hedge (against inflation).

Ray narrates a case of silver trade in this chapter. He once met Bunker Hunt, then the richest man in the world at a Thanksgiving party. Bunker had similar views on the economy, like Ray. Bunker was purchasing silver since the price was $1.29 per ounce. He had bought a huge quantity of silver, essentially cornering the silver market around $10. Here, Ray suggested Bunker to square off his long positions on silver as according to him the yield curve was going to invert. This means that the short-term interest rates (say, 1 year treasury rate) were going to rise more than long term rates (say, 10-year treasury bond rate). According to him, every time this has happened in the past, the silver prices have crashed.

However, to his surprise, the price of silver went from $10 to $40 within the next one year.

Well, why did this happen?

This was because the middle east oil producers were concerned about depreciating dollar. When the dollar depreciates, it essentially indicates a lower amount received for every barrel of oil sold.

A falling dollar also indicates lower purchasing power in the US, which in turn means higher inflation.

Hence in order to protect themselves from falling dollar (inflation), they purchased silver as a hedge.

This fact was known to Bunker, as he himself was from the oil industry.

However, in the next three months, silver did fall back to $11. Essentially, Ray was right, but missed a huge rally due to timing. The same is the lesson he wants to impart upon us by this example. Essentially, in the financial markets, timing is everything. Ray acknowledges later in this chapter, that his timing is still not good!

The story now shifts to an economic prediction of Deflation that Ray made in the year 1981. It was based on the fact that during this time due excess liquidity in the markets (FED printing money), the volatility in gold and bonds has increased to a level not seen even in 2007-08. During the 1980s, the FED was struck with dual problems.

- If it keeps on printing more and more money, to save a debt crisis (default due to lack of funds), it would trigger hyperinflation in the country – Inflation was 10% in the 1980s.

- If it restricts the money flow by stopping printing money and increasing interest rates, it would essentially slow an already distressed economy and move it towards depression.

In order to benefit from both these possibilities, Ray bought

- Gold – Gold is a good hedge against inflation

- Treasury Bills – T Bills increase in value during deflation as interest rates fall

However, similar to what happened in the silver story, here as well, Ray’s estimates were wrong. This is because the money involved was much more and his views were public.

So, how did he go wrong this time?

Well, Ray figured out that as money flew out from indebted emerging markets, the dollar kept on rising. A rise in the Dollar moderates inflation in the US economy as imports become cheaper. When inflation is moderate, the central bank (FED) could keep printing money in order to support the economy. This is called Quantitative easing and has helped the economy to run smoothly during the period.

The mistake was big enough to get Ray devastated. All his employees had to leave accompanied by his partner at Bridgewater. Here is a list of lessons he learnt from this episode:

- Never be overconfident about your economic estimates. Also, do not let emotions get over you.

- Read history. A similar debt restructuring instance had already taken place in 1932.

- It’s difficult to time the market.

Lessons to succeed:

- Hire smart people who disagree with you

- Know when you don’t have an opinion

- Develop, test and systemize principles

- Balance risk in a proper manner. “Heads I win, tails I don’t lose much”

My Road of Trials

In this chapter, Ray details how he resurrected from his failure. In the last chapter, we saw that some of the estimation errors led Ray, loose his clients, employees and eventually his firm (Bridgewater) was on the verge of closure. Now it was his determination that led to the success of the firm in its second term.

In the second term, Ray was not left with enough money, however, still he understood the importance of data (computers) and hence kept investing on research. It was only a matter of time when his upswings were higher than downswings. Getting insights from computers through algorithms was not a straight forward one day task. It improved slowly over a period of time. Ray had a habit of doing research side by side with the computer and then tallying the final result as to how to allocate the portfolio. Majority of the time, as Ray quotes, it was the computer which gave him better insights, however, it also happened that Ray (or team) had some more criteria which gave better insights than the computer. These in turn are systematized in order to make the algorithm better.

Ray had tested his algo across markets going back in centuries. This gave him an understanding of how the economic machinery works. The system was made so efficient that they had to override the system’s decision just 2% of the time. These as well, were times that were unprecedented like the 9/11.

In this chapter, Ray introduced us to two important terms, Alpha and Beta which are used vividly in the investment field. Beta is the sensitivity of the stock to the market. For example, suppose the beta of Reliance Industries is 2x, it means that if Sensex (the market) goes up by 100 points, Reliance should go up by 200 points. The same is the rule on the downside as well. The lower the beta, the lower the volatility (risk) of the stock.

Alpha is the difference between the market (Sensex) and the return of the stock (Reliance). So, if Sensex has given a return of 10% in a period of one-year, and Reliance has given a return of 15% over the same period, it is said to have generated positive alpha of 5% and the stock (Reliance) has outperformed the market (Sensex). Alpha can be negative if the stock underperforms the market.

Now, the focus of the chapter shifts to how Ray established his name in the hedge fund industry. One of his early clients, Alan Bond, was a famous entrepreneur, who bought an asset in Australia by taking a loan in the US in US Dollar currency. This was done because the US had a lower interest rate than Australia during that time. Ray advised them. In the case of Alan Bond, he carried the risk of US Dollar appreciating against Australian Dollar. Hence in order to hedge themselves, they needed to buy US Dollars. The strategy was explained to them by Ray, however, as hedging activity involves cost, Bond did not go for it and suffered huge losses.

Now, Ray was doing interest rate and currency trading and also consulting businesses in order to manage currency and interest rate risk. This was going well, but Ray did not stop at this. He was able to garner $5million from the World Bank’s pension fund and henceforth made a killing in managing that and growing to $180million in a matter of 10 years.

The trading strategies used by Ray proved to be successful even during the Black Monday on October 19, 1987, the day when the stock market declined 20%+. That same month, Ray’s fund was up by 22%. This got him a lot of coverage and they were being called, “Heroes of October” by the financial press.

However, this success did not let him forget the basics of investing. He was still cognizant of the fact that no matter how confident he was of a particular trade, it could still be wrong and hence proper diversification was a must. His study of diversification discovered that with fifteen to twenty good uncorrelated return streams, he could reduce the portfolio risk materially. He called it the “Holy Grail of Investing”. Look at the chart to see how increasing the number of uncorrelated assets to 20 provides the highest return to risk ratio and reduces the probability of losing money.

The Ultimate Boom

This chapter covers the success of Bridgewater from a boutique firm to an institution. The core of the company however remained the same – invest in technology to get insights that are not possible through manual research.

Ray was enthusiastic about financially engineering products in order to suit the client’s needs. One such discovery was investment in inflation indexed bonds (IIB). IIBs are bonds whose coupon rates are adjusted to inflation. For example, if inflation rises from 2% to 4%, the bond will compensate the investor for the increase in inflation by increasing the coupon rate on the bond.

Such bonds were unavailable during 1995, however, when a client Davind White (portfolio manager at Rockefeller Foundation) asked Ray for an investment in order to make 5% above US inflation rate, Ray suggested buying foreign inflation indexed bonds. However, as you might remember from earlier chapters, investment in foreign assets involves currency risk, hence Ray advised him to hedge it by buying US Dollars as well in order to manage currency risk. This was a very innovative product during that time.

When this gained popularity and caught the attention of the US Treasury Department, Ray and his team were called in as experts in order to introduce a similar IIB in the US as well.

The diversified portfolio approach that Ray uses focuses on earning optimal return while keeping the risk in check. Through his research mindset he was able to think of an appropriate asset allocation mix that could grow and preserve wealth for generations. And as he accepts, the journey to achieve this excellence involved various mistakes, however learning and adjusting the model appropriately was the key to success. As per Ray, it was growth (economic growth) and inflation that affected the returns of asset class. Hence, he builds portfolios around the following four scenarios:

- Rising growth and falling inflation

- Rising growth and rising inflation

- Falling growth and falling inflation

- Falling growth and rising inflation

With the help of his co-CEO at Bridgewater, Dan, he was able to build a portfolio, henceforth known as “All Weather Portfolio”. When this was commercially marketed it started with one single investor, Verizon, but soon gained popularity and within a year dozens of investors. They were managing a total of $80bn for this strategy.

Similar to the investment strategy, Ray had systematized the human resource management activities at Bridgewater as well. One of the methods he used was psychometric testing. This involved using Myers-Briggs Type Indicator (MBTI)

[read more here: https://www.myersbriggs.org/my-mbti-personality-type/mbti-basics/] for assessing the growth roadmap for an individual based on its present characteristics. The other instance was using baseball cards that mentioned the stats of an individual. This method allowed managers to understand the interests and potential of employees and allocate work accordingly.

By a combination of prudent investment style and systematized human resource management, Bridgewater was able to dodge the 2008 financial crisis. They were up 14% in 2008 when most of the other funds were down by double digits. It was in the year 2000 itself that they had developed a “depression gauge” that provided insights when the economy could be in recession. Due to his consistent performance, Ray was involved in various government advisory projects as well and has a high reputation in the financial services industry.

Returning The Boon

According to Dalio, there are three stages in one’s life:- First is we are dependent on others and we learn; Second is when others depend on us and we work and finally third is when others no longer depend on us and we no longer need to work. We can basically enjoy life.

By the year 2011, Dalio had reached the third stage in which he wanted to enjoy his life. He wanted to free the company from the “Key Man Risk”, which means the risk the company faces when it loses a very important person. This de-risking activity required Ray to find people who can replace him in his two important roles, Chief Executive Officer (CEO) and Chief Investment Officer (CIO) of the company. Bridgewater Associates was now going to change from a founder led organization to a professional led organization. So, in 2011, he stepped down as CEO and Greg Jensen and David McCormick were the new CEOs.

Now replacing Ray Dalio as the CIO was a very difficult task. He was also known as the Steve Jobs (Apple’s co-founder) of the investment industry due to the innovations he bought in the industry. Some of the similarities that were discovered between the two were- both were rebellious, independent thinkers and worked relentlessly for innovation and excellence. So, the person whom he was looking for as his replacement should have a lot in common. Like, independent thinking, strong mental maps in order to think clearly, resilient, wider vision, systematic and practical.

He also pointed out a very controversial term in this chapter, “Concern for others” as a personality test. According to him, the people who have low concern for others are the ones who succeed in life. This however was explained by him as, successful people are the ones who do not care to please others and hence work relentlessly towards their goal. It has nothing to do with empathy or donation.

The chapter towards the end shifts the focus towards how Ray helped in solving the European debt crisis. In 2010, Ray, due to his systematic investment procedure, had been able to figure out that Europe was about to face a debt crisis worse than 2008. In 2012, the European Central Bank (ECB) governor, Mario Draghi took a bold decision to buy bonds in order to improve liquidity in the economy. This could avert the debt crisis for a while, however, Ray was convinced that it could not have happened unless they printed money.

Printing of money was considered inflationary by the European government, however, Ray was able to convince them via a lot of calculations over several meetings that it wasn’t inflationary if it was done at the right timing. There was low demand in the European economy during this time. Hence if they printed more money, the demand gap would first be filled and thereafter demand would be over supply, increasing prices. Low demand could lead to deflation (reduction in prices of goods) that is also a very dangerous event for any economy. Hence Ray could convince the ECB to print more money in order to stimulate the economy faster. This as per his previous experience (abolition of gold reserve in 1970s) was good for the market. The same we could see in the times of COVID when all the central banks printed money in order to keep the economy stable, increased the stock prices. This is why Ray stresses that understanding history is important.

Ray through his experience of the economy has created a very informative video which every economic and market enthusiast must watch – “How the economic machinery works”

My Last Year And My Greatest Challenge

The transition wasn’t going as smoothly as they had imagined. Technology and recruiting were the pain areas for Ray and team. Hence, they needed to change the CEO. Greg and Murray who were Bridgewater CEO at that time (2016), were over burdened and hence a committee was formed in order to look out for alternatives. It was finally decided that Greg would step out as co-CEO and Ray would step in again along with Murray to co-manage the company. Ray states that it was a very difficult decision to let Greg step out of the day-to-day management of the company.

Though, Greg would still be the head of investments, however, removing him from such an important post was a big decision. It needed to be taken for the betterment of the entire company.

The chapter quotes Jim Collins (management expert), “to transition well, there are only two things that you need to do, Put capable CEOs in place and have a capable governance system to replace the CEO if they’re not capable”. This means that having a system in place can be substituted for talent as well. Something as qualitative as people management can be systematized by organizations in order to standardize the day to day management activities.

Finally post creation of a systematic process, Ray appointed David McCormick and Eileen Murray as co-CEOs and himself resigned from the organization in April 2017.

Life Principles

In this part, Ray discusses various principles in life that will help us succeed. Let’s begin to learn them one by one.

Embrace Realty and Deal with it

According to Ray Dalio, one should always be realistic. In this way he can visualize the things he wants to create and build them. As per him, one should not be afraid of mistakes but instead enjoy the pleasure that comes from learning from it. He calls this “mistake learner’s high”.

Be a hyperrealist

One should dream about achieving big stuffs, however just dreaming isn’t going to take you anywhere. You need to be grounded to reality, even harsh ones and think in a practical way as to what is possible to achieve given your expertise and circumstances.

Dreams + Reality + Determination = A Successful Life

It doesn’t matter whether you want to savor life or what to make an impact, working hard and working efficiently is required for each of them.

Truth—or, more precisely, an accurate understanding of reality—is the essential foundation for any good outcome.

Be open minded and transparent- Having a feedback loop is important in the process of learning. Being open minded enhances the efficiency of feedback loops and helps avoiding being deceived by yourself.

Don’t be afraid of what others think of you

Do things in a unique way and have an open mind to run the feedback loop.

Look to nature & learn how reality works

Don’t be biased on what is good for yourself

In this context, Ray defines how nature has created objects or events for the good of the whole rather than an individual. Think of a lion eating an innocent deer. One might think that this is a bad event or feel empathy for the deer. However, if you remember the food cycle, the process is important in order to maintain balance in the nature. Therefore, the author has advised us to do a second order or even third order thinking while analysing anything for good or bad.

Evolve or die

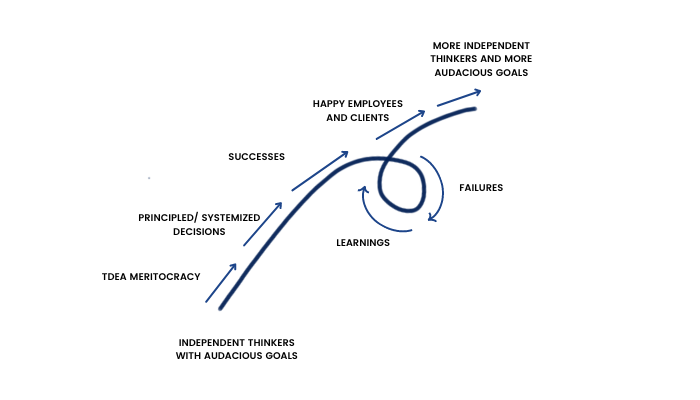

Evotion takes place in a non-linear trend. It is not always that better things come up with each passing evolutionary procedure, but with trial and error, things adapt. Similarly for companies, evolution is an important process, but nonlinear. There will always be times when a company evolves but it decreases the value instead of increasing it. However, if the management can learn from the mistakes and not repeat it, it would finally work out for the best. The key is to fail, learn and improve quickly.

Evolving is life’s greatest accomplishment and greatest reward

Individual’s incentives must be aligned to group’s goals.

Creation of an optimum incentive structure is a must. It should be such that the development or pleasure of an individual should be aligned to the interest of the group. This will create a health organization. Look for how the incentives of management/employees is aligned with the interest of the organization.

Adaptation through rapid trial and error is invaluable

There are three kings of learning the spur evolution:

- Memory based learning (storing the information in ones mind, so that it can be recalled later)

- Subconscious learning (the knowledge that is a take away from our experiences and affect our decision making)

- Learning that occurs without thinking

Pain + Reflection = Progress

Quite beautifully stated, if you don’t fail, you’re not pushing your limits, similarly if you’re not pushing your limits, you’re not maximizing your potential. If you can push through the painful process of evolution, the chances of success increases.

The chapter details a lot of other principles as well for achieving the goals, however the most important ones are listed below:

- Never confuse yourself with what is true and what you wish to be true. Hence be realistic.

- Don’t try to please others, instead concentrate on achieving your goal.

- First order thinking often is contrary to your goals. Therefore, focus on second and third-order ones, which basically means, think of the cause-and-effect relationship of each decision you take and what circumstances it can create in the future.

- Don’t let pain stand in the way of progress.

- Don’t play the blame game. Take responsibility for your own decisions.

Work Principles

As per Ray, for any organization to function well, it is necessary that the principles of its employees/ partners are aligned with the principles of the organization on the whole. This sole match can motivate the people around and make the organization prosper. This does not necessarily mean that every principal should be matched, it just means that the majority of those which are most important should match.

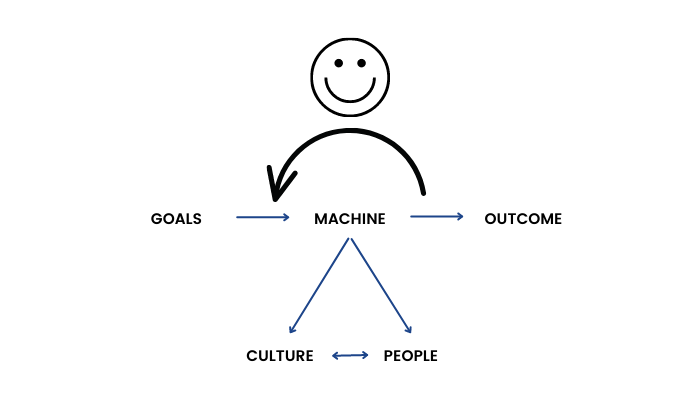

What is an organization? An organization is a machine with two main parts – Culture and People.

a. Great organizations have both great people and great culture. Tata Group, Bajaj Finance, Asian Paints and a host of other successful generation old companies are considered to have embedded a common culture across the organization. Some of the examples may be, trust among employees and managers, motivating employees to switch roles within the organization to suit their interests, etc. all motivate employees. Companies with great culture encourage employees to discuss their issues/mistakes and work together to improve on them.

b. Great people have both great character and great capabilities. Both the factors are important and hence should be looked in pair rather than individually. A person with great character and low on capabilities, will be a burden for the organization and vice-versa, a person with great capabilities and low on character, has a chance of deceiving the company.

c. Putting comfort ahead of success produces worse results. Hence organizations are advised to not force culture/ principles on employees, rather have it on a mutual consent basis.

Idea Meritocracy = Radical Truth + Radical Transparency + Believability Weighted Decision Making

Let’s understand each of the concepts one by one.

Idea meritocracy is a term coined by Ray Dalio. It defines a culture in the organization where each and every person is allowed to express their ideas very fluently and openly.

Radical Truth – It’s important to be truthful to the employees. No matter how important the position may be, managers should be able to communicate their views with utter honesty.

Radical Transparency – Every procedure in an organization should be done with utmost transparency. For example, annual appraisals should list out exactly what was expected from the employee and how it performs on each of the matrices. Having a proper quantitative rule for it, gives employees satisfaction.

Believability Weighted Decision Making – The appraisal system should be such that everyone is able to believe in it. Basically, the organization should use some quantitative computer-based software (algorithm) that will nullify any emotions in decision making.

This is a self-reinforcing spiral that leads to success of an organization over the long term.

Principles – Get Your Culture Right

1. Trust in radical truth and radical transparency

Following the principle of being radically truthful is essential for any organization over the long term. We need to create a culture that there is nothing to fear about from knowing or telling the truth.

- The culture of fearlessly telling the truth henceforth avoids many large-scale errors, especially in a financial services firm. Majority of the scams are a result of small mistakes that were kept hidden over a long term. Take an example of the Harshad Mehta scam. If the bank officials who knew that something fishy was cooking in their books, could report at the right time, the Indian stock market could be saved from a sharp crash post the burst of the scam.

- Being truthful also means that integrity. Don’t let loyalty come in the way of truth. Even if your very close friend is involved in a mistake it is better to blow the whistle and report the fraud in the betterment of the entire company.

- The culture in the company should be such that everyone has an equal chance to speak up and express their ideas. Ray suggests a rule of listening for 2 minutes. Here he states that every manager should at least give the employees 2 minutes of time, uninterrupted, before the manager can express his/her views about the employee’s suggestions.

- Being transparent doesn’t mean to speak out every secret of the company. However, things that are non-confidential or are important for the organization on the whole, should be spoken in a very transparent manner.

2. Cultivate meaningful work and relationships

- Maintaining good relations within the organization is easy when the organization is small, however for larger organizations it becomes challenging.

- Organisations must treat employees who are loyal to the company.

3. Create a culture where it is acceptable to make mistakes and learning from them

- Managers must realize that making mistakes is a part of work. However, if one is not learning from the mistake and keeps on making the same mistake again and again is an indication of close mindedness and should not be tolerated.

- Don’t play the blame game. You must have heard or experienced instances where the credit goes to the manager while the blame towards a work badly done is borne by the employee. This spoils the culture of an organization.

- Mistakes should be celebrated. This means that when an employee makes a mistake it should not be seen down upon. Instead, a team activity should be created around it in order to share the learnings and solutions. Pondering on one mistake and taking learnings from it is called “Reflection”.

- Remember, Pain + Reflection = Progress

4. Believability weighted decision-making process

- It is better to give more importance to the opinions of capable decision makers than less capable ones. Therefore, once the idea is pitched, it neither should be one person taking the execution decision, nor should be the team at large, rather, execution of the idea should be kept in the hands of few capable decision makers who will argue among themselves independently and reach to a conclusion.

- Feedback is extremely important in the decision-making process. The people who disagree with you are the best teachers and should not be shooed away.

- Sometimes inexperienced people can have far better ideas than inexperienced ones.

5. Hire right people

- Organization is a machine. When you plan to hire, create a mental image as to how the employee should be in order to suit the job. Don’t design jobs to fit the people, instead find the correct people for the job.

- 3 C’s: Character, Common Sense and Creativity

- Teams are just like sports where different skills are possessed by different people and it is very difficult to find one person with all the skill sets.

- Check the track record of the person you’re planning to hire.

- While planning the compensation, provide both stability and opportunity.

6. Train people you hire effectively

- Judge the candidate within a year of joining. The commensurate promotion should be given as per the capabilities judged.

- Be fair on the compensation. Stability of the employee should also be considered.

- Don’t hesitate to fire an employee if it is not well suited for the job.

To Build and Evolve a Machinery

1. Manager as someone operating a Machine to achieve a Goal

- No Matter how well you design the organization (machine) there are always going to be areas that require some fixing.

- Keep comparing the outcomes with your goals. For example, if your goal is to achieve 25% return per annum, review the performance at the end of every quarter to see if you’re able to achieve at least 6.25% or closer to it. If not, maybe your strategy requires a bit of tapering.

- A great manager is an organizational engineer. As you might remember from the beginning chapters, Ray used to take building of the organization as a science and used psychological techniques to keep the team motivated.

- Understand the difference between managing, micro managing and not managing at all. Micromanaging is a concept where managers track every detail of the employee and will not let it take any decisions on its own. A well-managed company will delegate almost everything except the most strategic decisions on which the future of the company lies.

- Recognize and deal with key man risk. Take the example of HDFC Bank. Aditya Puri, who was the founding CEO of the bank, was a very capable banker and had managed HDFC Bank very well. However, he has to leave some day. Hence a proper succession planning started almost a decade prior to his departure from the bank. This is required in every organization to ensure a smooth transfer of leadership.

- Hold regular meetings with the team in order to inform them about the performance of the company and their contribution in the same.

2. Perceive and don’t tolerate problems

- Watch out for the boiling frog syndrome. It is said that if you put a frog into boiling water, it will jump immediately. However, if you put it in water at room temperature and slowly start heating it, it will stay there till it dies. Similar is the case with managers. Small but unnoticed unacceptable things, can turn out into events that are disastrous.

- Beware, that if no one thinks something is wrong, it’s right. Basically, do not depend on others’ thinking. Have your own independent analysis of the case and come out with your own opinion.

- Don’t be afraid to fix difficult mistakes. Understand the problem and come up with a detailed solution.

3. Diagnose problems to get at their root cause

- A good diagnosis will get to the root cause of the problem to find out what actually went wrong with the people in charge that led to the issue.

- If someone isn’t suited for the job, the best decision is to let him/her go.

- To diagnose a problem, ask the following main questions:

- Is the outcome good or bad?

- Who is responsible for the outcome?

- If the outcome is bad, if the person in-charge is incapable or the organizational design was wrong.

4. Make necessary improvements

- Make the organization self-reliant that is able to sustain even in your permanent absence.

5. Don’t ignore governance: Ray has suggested the following organization structure which is necessary for ensuring smooth running of the organization.

- There will be 1-3 chairmen who are overlooking the board and the CEO. The board has the power to replace the CEO.

- The CEO will undertake the responsibility of managing a few cabinet members and a close team who may be the future group of leaders.

- The CEO should not be given the responsibility of handling the entire organization. The line managers should be responsible to do so.

- As you can see the “Rest of Organization” is outside the third and last circle under the CEO’s control.

Conclusion

The purpose of the book is dual:

1. Make the reader understand the concepts of investing in the financial markets. Some of the major concepts discussed were

- How to hedge risk

- Building a diversified portfolio

- Trading

- Investing for long term

2. The second part discusses the life and work principles

- Life principles are dedicated to employees who are in the early stage of their careers. Having well defined principles will help them stay on the right path and succeed.

- Work principles are for the managerial level. These help them build, maintain and improve the organization.

Going through Ray Dalio’s book, Principles, gives readers a comprehensive checklist that can help them in each and every stage of their life.