Rich Dad Poor Dad

Rich Dad Poor Dad Book Summary

About the Book

Rich Dad Poor Dad is about Robert Kiyosaki (author) and his two dads. His real father (poor dad) and the father of his best friend (rich dad). The book explores the ways in which both men shaped their thoughts about money and investing. The book explodes the myth that you do not need to earn a high income to become rich.

It explains several methods of managing your personal finances effectively and teaches the difference between working for money and having your money work for you.

About the Authors

Robert Kiyosaki and Sharon Lechter, the authors of the best-selling book Rich Dad Poor Dad, are renowned for their work in financial education. Kiyosaki, an entrepreneur and investor, and Lechter, a certified public accountant and financial expert, have helped millions understand the importance of financial literacy, smart investing, and achieving financial independence. They believe everyone has the power to take control of their finances and build lasting wealth.

Rich Dad Poor Dad

According to the author, the traditional schooling system lacks proper education in the financial field. Normally, schools focus on building professional skills and not financial skills. This shows how smart students, who have become smart professionals in their respective fields, struggle when it comes to handling their finances.

The author, whom he referred to as 'Rich Dad', is his childhood friend, Mike's Dad. He taught him lessons about money and finances throughout his life. He noticed that both of his dads- his father and Mike's father - worked hard, but when it came to money matters, his dad never used his brain for financial advantages. Therefore, he is referred to as the 'Poor Dad' in his book Rich Dad Poor Dad.

- The poor dad preached that if the author studied hard in his school days, it would help him find a good company to work in and a stable job, whereas the Rich dad said that studying hard would help the author to find the right company to buy..

- The poor dad believed that the largest investment and the greatest asset is their house, whereas the rich dad believed it to be a liability.

- The poor dad had a habit of paying bills first and the Rich dad preferred to pay the bills as delayed as possible.

- The poor dad had taught the author to write great resumes which would help him finding and cracking good job interviews, on the other hand the rich dad taught him to journal great financial plans so that he could create jobs.

There was a time when the 'Rich Dad' was broke due to a major financial setback, but he continued to refer to himself as a rich man. He stated that there is a difference between being poor and being broke; he said, "Broke is temporary, poor is eternal".

The author was motivated by his rich dad to understand how ‘Money’ works and how to make it work for him.

The Rich Don’t Work For Money

The rich dad had a completely unique approach to teaching. He said that if a person works for him, it's his responsibility to educate and teach that person. He even claimed that a person learns faster if he/she work along with learning. Practical experience is the key. Just to sit and listen to lectures is a sheer waste of time, and that's what happens in school.

“The poor and middle-class work for money, the rich have money work for them.”

The author’s rich dad explained that the rich really did “make money.” They did not work for it. He believed that the best reason to get a job was to learn something, and not for the monthly salary.

The author started a business when he was only 9 years old. He had a library and rented comic books to the neighbourhood kids.

The author said that "The best part was that our business generated money for us, even when we weren't physically there. Our money worked for us."

The daily chorus, to get up, go to work, pay bills, and live, was a vicious cycle, according to the rich dad. Being offered more money as a job promotion over time results in an increase in expenditure and no real gain in the value for money; the life of the person wouldn’t change. He referred to it as a ‘Rat Race’, as we get to know from the book Rich Dad Poor Dad.

As people grow, their expenses increase, and so does their demand for expensive things. They have a constant thought to cope with society and their standard of living. The fear pushes them, but the desire beckons to them, enticing them towards unsafe territories, and that’s the trap.

In Rich Dad Poor Dad, the author explains that the poor and the middle-class work for money, fear, and greed because they were not taught to take risks, and rather to stay in their comfort zone and work for a stable salaried-job. He says that opportunities come and go in life, and the rich recognize them and grab them, but the poor ignore the opportunities, because they are too busy seeking money and security.

These lessons inspired the two boys (Robert & Mike) to find new ways to make money.

Why Learn Financial Literacy?

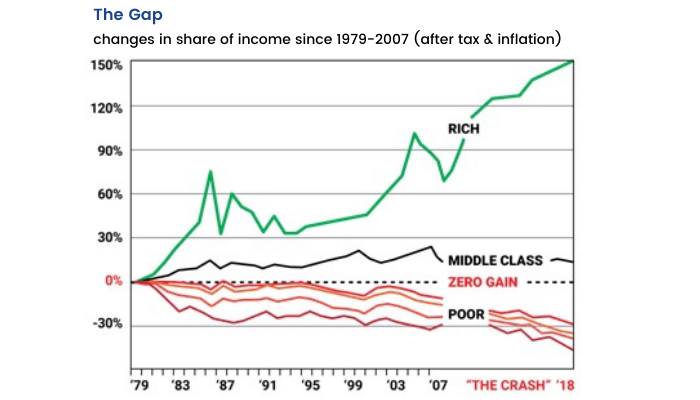

In Rich Dad Poor Dad, the author reveals the secrets of financial literacy when it comes to getting rich and emphasizes the fact that the rich really do get richer over time.

The author raises concern about the fact that people are concerned with getting as much money as they can, but fail to realize that their greatest wealth is their education.

He continues to emphasize the importance of financial literacy because without it, even if one is rich, one can end up broke. He cited some examples of professional athletes and celebrities who made poor financial decisions and were in financial distress.

Mantra to Become Rich: You must know the difference between an asset and a liability and always focus on buying assets.

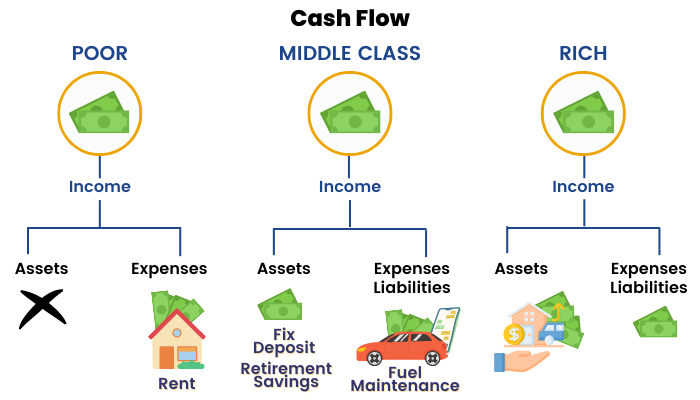

According to the book, Rich Dad Poor Dad, rich people acquire assets, whereas the poor and the middle-class people are busy acquiring liabilities that they think are assets.

The key feature about an asset that distinguishes it from a liability is that assets result in making money for us, helping us become rich.

Students leave school without acquiring financial skills and that’s the reason why they are concerned with professional success and not with financial stability.

They fail to understand that spending the money you have is not the way of life and this is caused by lack of financial literacy.

Explore Finance Careers: Know Opportunities in Finance Now!

Why do the rich keep getting richer?

The assets of the rich people generate income that is high enough to cover their expenses. The remaining balance income is further reinvested in buying more assets. This way, their assets continue to grow, and so does their income.

On the other hand, the poor and the middle-class people remain poor because they do the opposite and pile up their liabilities. One has to understand that it is not how much one can earn, but how much one can keep and save that truly makes one rich.

The real evil here is a lack of financial education. The reason the middle-class have to play it safe is because they couldn’t get their hands on financial literacy at a young age, and now they have a lot of liabilities hovering over their head. Their only source of income is their monthly salary checks. Their livelihood is completely dependent on their employer.

A simple observation;

- The rich buy assets

- The poor have expenses

- The middle class buys liabilities that they think are assets.

Mind Your Own Business

In Rich Dad Poor Dad, the author explains beautifully that most people confuse their profession with their business. They spend their entire lives working in somebody else’s business and making other people rich. Instead, they should mind their own business if they want to become financially free. They should figure out ways to become their own boss and build their own business.

Things to know about the poor and the middle class:

- These people work for everyone but themselves. Primarily, they work for the owners of the company, then for the government of the country by paying taxes, and lastly for the bank that has the mortgage on their homes.

- When the factor of downsizing came into play, millions of workers who considered their houses as their assets realized that this 'asset' became their biggest liability at that point. What they thought was an asset couldn't help them in times of financial crisis.

Things to know about the rich:

- The rich always focus on their asset column when everybody else focuses on their income statement.

- The rich have this habit of minding their own business. The author says to keep your day job, but start buying assets like real estate and stocks. Do not buy liabilities or personal expenditures that add no real value to your net worth.

- As assets increase, the income will also increase. This would result in an urge to buy luxuries. The rich buy assets last. Buying luxury on credit is the most fatal. The debt of the luxury product eventually becomes a financial burden. The aim should be to build income-generating assets that can buy luxuries.

The History Of Taxes And The Power of Corporations

Being an expert in arts and history, the rich dad explained to Mike and the author that originally, there were no taxes in England and America, as portrayed in the book Rich Dad Poor Dad. The original plan was to tax the people who could afford to lose a part of their income, but with time, the government needed money so badly that these taxes trickled down to the middle and lower classes, too.

The knowledge of the legal corporate structure is what really gives the rich a huge advantage over the poor. They use their knowledge to build corporations, which are essentially “a legal document that creates a legal body without a soul”.

Once again, the rich used this to protect their wealth, as the income tax rate for a corporation is lower than the income tax rate for an individual.

The rich cannot be bullied because they are the bullies.

Every time in history, when people tried to punish the rich by making them pay more taxes, they fought back. They have the power, money, motivation, and intent to do whatever it takes to reduce their tax burden. They take all sorts of actions, from hiring smart accountants to persuading or bribing politicians to pass laws that will benefit them.

The rich don’t just sit around and do whatever the government or the people are telling them to do; they use their wealth to bring about the change. The same cannot be said about the poor and the middle class.

Financial IQ involves 4 major points to be satisfied:

The main difference between a corporation and an employee is that the corporation has the ability to earn, spend everything it can and then be taxed on whatever is left, whereas an employee is taxed on whatever he earns and then tries to live off on whatever's left.

Business Owners with Corporations

- Earn

- Spend

- Pay Taxes

Employees Who Work for Corporations

- Earn

- Pay Taxes

- Spend

One of the biggest secrets that keeps the rich ahead is that they own their own corporation wrapped around their own assets.

The Rich Invent Money

According to Kiyosaki’s Rich Dad Poor Dad, everyone is born with talent, but that talent is suppressed because of self-doubt and fear. Kiyosaki explains that smart, bold, and adventurous people prosper. The people who struggle with their finances even when they have a lot of money are so because they fail to tap into opportunities and are afraid to take risks.

Most of these people just sit around and wait for the opportunity to come to them.

Kiyosaki stresses the point that people make luck; they don’t sit around and wait for it to happen. The same goes for money; it has to be created.

The author quotes that “Most people never win because they’re more afraid of losing. That is why I found school so silly. In school, we learn that mistakes are bad, and we are punished for making them. Yet if you look at the way humans are designed to learn, we learn by making mistakes. We learn to walk by falling down. If we never fell down, we would never walk.”

People’s fear of losing causes them not to be rich. “People who avoid failure also avoid success.”

The author emphasizes on education, he says, “A trained mind is a rich mind”.

He categorizes investors into two platforms in Rich Dad Poor Dad:

- There are investors who go for packaged investments.

- And, there are investors who customize their investment to suit their objectives.

Hiring people who are more intelligent than you is an important factor because they capitalize on the knowledge of others. An intelligent investor builds up their own knowledge base and hence dictates more power over those who don’t know. They enjoy the power of the foundation they created for themselves at a very young age.

Also Read: How Big People Make Big Money in Stock market.

Work To Learn, Don’t Work For Money

Rich Dad Poor Dad states the concept of not working for money is hard for many to grasp because money is such an important part of one’s life that, if not working for money, the question arises, “What are you working for?”

According to Kiyosaki, a good question for oneself is “Where is this daily activity taking you?”

In other words, it means what is your vision, and are you in line with your vision?

To illustrate the importance of a broad skill set rather than a single great skill, the author explains with McDonald’s as an example. He says that anyone can make a better burger than McDonald’s, but the way McDonald’s makes huge amounts of money from average burgers is because they know good business. Not many people know about the business systems outside of the line they work in. The solution to this problem can be summed up in this quote by Robert Kiyosaki:

“I recommend to young people to seek work for what they will learn, more than what they will earn. Look down the road at what skills they want to acquire before choosing a specific profession and before getting trapped in the Rat Race”.

Rich Dad Poor Dad says that the education system rewards people for knowing a lot about a few things. As the person progresses and earns more degrees, they feel that they have a lot of earning potential, and sometimes they do, but there is a risk if the education and degrees obtained are only for a particular industry, forcing employees to be dependent upon their employers.

According to Kiyosaki’s rich dad, one needs to know a little about a lot. We need just a sufficient number of things about a particular part of the business. It’s not feasible to have extensive knowledge about every aspect of it.

Many different skills are required to successfully run a business, like leadership, time management, etc., but the most important skill, according to Kiyosaki’s Rich Dad Poor Dad, is marketing and sales.

The ability to communicate with your customer in simple language to let them know about your product or service is how a business survives and earns money. Communication skills like writing, speaking, and negotiating are the success mantra.

Overcoming Obstacles

Rich Dad Poor Dad states that the primary difference between a rich man and a poor man is how they deal with fear. A rich man loses money, but he is bold about it. They take risks, make investments according to their own knowledge, but sometimes they may end up losing money. However, in all other times, their investments pay off and their earnings are substantial.

A poor man never loses money because they are afraid of taking risks; they are risk-averse people. They are afraid to make investments so they don’t lose, but they don’t gain either!

There are five core reasons why even the financially literate don’t become financially independent:

- Fear

- Cynicism

- Laziness

- Bad Habits

- Arrogance

The rich man is inspired by their failures, as it becomes a teaching lesson; they learn from it and do better. The poor or middle-class don’t succeed financially because for them, the pain and suffering of losing money is much greater than the joy of becoming rich. They choose to lead a life that is simple, safe, and small. They may purchase big houses and fancy cars, but they don’t focus on buying big investments. The main reason the majority of people struggle financially is that they play not to lose, they don’t play to win.

Focus is one of the keys that drives the desire of a man to be rich. Unlike poor and middle-class minds who refuse to take risks, the rich put most of the eggs in one basket, and they focus. Focus until they succeed.

A smart investor knows that the worst time (as it seems) is the best time to invest and make money. When everyone else is too afraid to act, the smart investor does not hesitate to pull the trigger and get rewarded.

Winners analyze and cynics criticize. The rich dad explained that criticism doesn’t lead to any solution, but meaningful analysis is an eye-opener and a path seeker. Analysis allowed the rich to open their eyes and look for opportunities that no one had ever known existed. Finding what everyone missed is the key to success.

Losers are defeated by loss. Winners are inspired by loss. One can still hate losing without being afraid of it. – explains the author.

In today’s times, being busy with actually accomplishing things that matter and just being busy can be confusing. In fact, according to Rich Dad Poor Dad, busy people are often the laziest.

The key to building wealth is paying yourself first. Once you pay yourself first, the weight of paying taxes and your creditors will give you the necessary drive to work harder than usual.

“I’ve worked extra jobs, started other companies, traded in the stock market, anything just to make sure those guys don’t start yelling at me. That pressure made me work harder, forced me to think, and all in all, made me smarter and more active when it comes to money. If I had paid myself last, I would have felt no pressure, but I’d be broke.” – as quoted by the author.

Read Also: Personal Finance Rules – 6 Simple Tips for Managing your Finances

Getting Started

The book Rich Dad Poor Dad tells us that “there is gold everywhere, most people are not trained to see it.” The author lists ten steps that should be followed to develop your financial genius and IQ and discover the gold that's already with you, just waiting to be found.

- Have a deep emotional reason or purpose for doing what you do, a combination of wants and don’t wants.

- Understand the power of choice and choose daily what to do, including choosing the right habits and educating yourself.

- Choose your friends carefully by leveraging the power of association, being careful not to listen to poor or frightened people.

- Master the power of learning quickly and develop a formula for making money.

- Pay yourself first by mastering the power of self-discipline to manage your cash flow, people, and personal time.

- Select great people for your team and compensate them generously for their advice, because the more money they make, the more money you will make.

- Ask “How fast do I get my money back?” by focusing on return on investment first, followed by return on investment.

- Use money generated by assets you own to buy luxuries by focusing on self-discipline to direct money to create more.

- Have a role model to follow and tap into the power of their genius to put to your use.

- Realize that if you want something, you need to give something first.

Still Want More? Here Are Some To Do’s

- Take a break to assess what is and isn’t working.

- Always look for new ideas and keep learning.

- Find someone who has experience in the field you are about to venture into.

- Take classes, read, and attend seminars.

- Make lots of offers, even if they are low; you never know who might say yes.

Conclusion

The Five Big Ideas

- The poor and the middle class work for money. The rich have money to work for them.

- It’s not how much money you make that matters. It’s how much money you keep.

- Rich people acquire assets. The poor and middle classes acquire liabilities that they think are assets.

- Financial aptitude is what you do with money once you make it, how you keep people from taking it from you, how to keep it longer, and how you make money work hard for you.

- The most powerful asset we all have is our mind.

One key takeaway from Rich Dad Poor Dad, that rich people are not always born rich. Your destiny relies on how you spend your money and your time. Your family’s future will be determined by your choices today.