The Intelligent Investor

Introduction

About the book

"The Intelligent Investor" by Benjamin Graham (author) presents you with a logical framework that helps to keep emotions in your control while investing in the stock market. It teaches an investment strategy that has been one of the most successful during the last few decades.

The book also teaches how to pick quality stocks and helps you to understand the difference between "investment" and "speculation" in the market.

About the Author

Benjamin Graham was a renowned economist, professor and influential investor widely known as the "father of value investing". His book The Intelligent Investor is still regarded as one of the most important books written on value investing. Graham's research laid the groundwork for in-depth fundamental valuation used in the stock analysis even today by several market participants all over the world.

Buy the book

This book takes a deep dive into the world of value investing. We highly recommend you to read the entire book. (affiliate link)

Investment Versus Speculation

What is an Investment?

According to the author,"An investment operation is one in which, upon thorough analysis, promises safety of principal and an adequate return".

Throughout the 1900s and even before that, stocks were only considered for speculative purposes. Only bonds were considered for investments.

During this time common stocks were considered to be “too risky”, and over 90% of the people were opposed to buying them. Also, the majority of the losses for an exchange came from common stocks.

Let us look into the basic differences between Investment and Speculation:

One of the important things the author talks about is to keep investment and speculation totally separate. If we research about a company, read its financials, then that particular trade decision should be considered an investment activity. Speculation should be avoided 99% of the time, but a 1% speculation is necessary which can benefit an investor. We should limit speculative activities to a maximum of 10% of investment funds.

Intelligent speculation can be achieved if we avoid three things:

- We must thoroughly analyse a company’s business model and its financials before buying its stock.

- Speculate only if you have necessary skills and expertise for it.

- Never speculate by taking loans.

Graham also points out that buying “fresh issues” or IPOs also doesn’t really help an investor in achieving high returns by generating quick profits.

The author points out an example in which he tries to explain how hard it is to speculate:

Between Dec 1960 and Dec 1970, Dow Jones Industrial Average (DJIA) went from 619 to 839, or 36%. But in the same paying period, the S & P 500 index went from 58.11 to 92.15, or 58%. S & P proved to be a better buy, but it was difficult to predict that a stock index consisting of 500 stocks would do better than a Dow Jones Index.

A successful speculator should always stay with the market’s latest trends, the trends work sometimes and start disappearing as they become popular.

The author then briefly discusses the outcome of a defensive and an aggressive investor, which they should expect.

Jason Zweig, mentions that Intelligent investing involves:

- Analysis of the fundamentals like balance sheet, Profit and Loss account, Company ratios etc.

- A calculated plan to prevent a severe loss

- A pursuit of a realistic return in the future

The Investor And Inflation

Inflation and the fight against it is something that has been going on forever it seems and the fear that it can shrink the purchasing power of a currency has greatly influenced an investor's behaviour.

For example, between 1965 and 1970, the average annual inflation rise was 4.5% and because common stocks have proven to generate more returns than bonds, they are better investments for protection of inflation.

This is not true all the time, because common stocks bring uncertainty with them and their past performance does not guarantee a good future performance.

Many investors overlook the inflation factor when considering investments. The simple reason is that between 1997 and 2002, inflation in The United States averaged 2.2% and in recent years it has hovered around 1-2% which is not a huge number.

Another reason is the “money illusion”. For example, if we get a pay rise of 5% while inflation rises 7%, we feel better, compared to if we took a pay rise of 2% and the inflation is 1%. The first situation leaves us in a -2% cut-off from our original wages, i.e., our wages have increased in monetary terms, but our purchasing power has decreased because a good’s price has increased more than the increase in our wages, but as long as the nominal change is positive, an investor feels better.

The below figure illustrates the two situations:

To fight inflation, Graham suggested two inflation fighters to investors:

1) REITs or Real Estate Investment Trusts- These are companies that invest and collect rent from commercial and real estate properties. This can be a low cost-effective method of combating inflation in the long-run, while this method is not likely to be a full-proof inflation-fighter.

2) TIPS or Treasury Inflation-Protected Securities- TIPS are U.S government bonds. They go up in value as soon as inflation rises. They provide 100% protection against inflation and are also backed by the full faith and credit of the government of the United States. So, in one easy purchase, we can ensure protection from inflation. TIPS can be volatile in the short run and are best suited for long-term investors.

The point here the author tries to explain is that our Investment returns should be at least equal to the expected inflation rate otherwise we can lose the purchasing power of a good consumed by us. This can be better understood from the following example:

If today the price of a bag is $100, we have the capacity to earn one bag from $100. One year later, if the price of the bag rises to $107 and we generate a 3% return from $100, we have the capacity to purchase 0.96 units of a bag, which is less than what we were able to purchase a year ago.

A Century Of Stock Market History

Graham here tries to look 2 years ahead and foresees the bear market of 1973-74, in which U.S stocks actually lost 37% of their value. He argues that an investor must never forecast the future by just looking into the past itself.

Forecasters had started arguing that stocks had given an annual return more than the expected after inflation from 1802 and therefore they concluded that investors should expect the same outcome in future also.

But In the 1990s, the market crashed, investors lost huge amounts of money, and everyone who had come to this belief finally understood that stocks do not provide guarantees, while bonds provide a 100% guarantee against inflation.

The author says the value of an investment is simply the price we pay for it but that doesn’t mean that we should pay any price for a stock. As companies can earn limited returns, an investor should also pay a limited price for a stock.

Graham's advice on this chapter is simple. Every investor should buy when the price is low and sell when the price is high but investors generally do the opposite. Investors who can stay invested in the market in the long run, the more certain they can be about their investments.

If an investor is unable to decide how he or she goes about buying a stock, the following course of actions is to be avoided.

- Don’t take loans to buy or hold securities.

- Do not increase the proportion of funds held in common stocks and bonds. Reduce the total proportion if it is necessary to bring the portfolio to a 50-50 level, i.e., 50 % common stocks, 50 % bonds.

General Portfolio Policy: The Defensive Investor

The general perception is that an investor should earn a return according to the level of risk they take. But for the author, an investor should be earning returns on the amount of intelligent effort they are willing and are able to bear for this task.

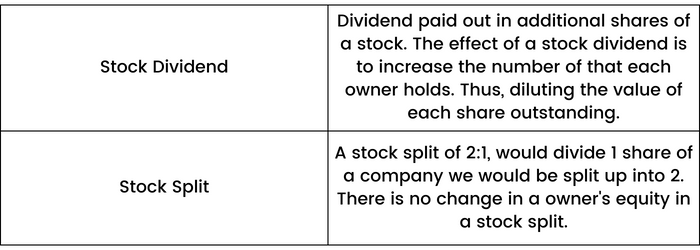

There are two types of investors:

Active investor: One who continuously keeps buying and selling at regular intervals. An enterprising investor is the one who uses maximum intelligence and skill for this purpose. Graham says an enterprising investor is someone who can devote a fair amount of his attention and efforts towards achieving better than average returns.

Passive/defensive investor: One who buys and holds a stock for a long period. The minimum return will go to passive investors, because they tend to use a simple buy and hold strategy.

In some cases, an investor might end up buying cheap which can offer a chance of making larger profits.

In general, people are better suited as a defensive investor because the time and dedication needed are very limited from their side.

Passive investment also requires fewer taxes, less commission, and a possibility of better returns. The author mainly talks about 2 investment products, i.e., stocks and bonds (mainly high-grade bonds).

The investor should allocate 50% of his value in stocks and 50% of it in bonds. A defensive investor should be satisfied with average returns because of the little research, time, and effort they are willing to give while doing their due diligence. Also, portfolio rebalancing is required when the stock falls out of the 50-50 target.

For example- if the stock rises 10%, then the total weight of stock becomes 55%, the investor should sell 5% of his stock value or buy more bonds to make it equal again. Also, if the investor has less expertise in stocks, they might allocate 75% in bonds and gradually decrease stocks to 25%.

Yale University had followed a similar method after 1937, but it had around 35% allocated to common stocks and in around 1961, 61% was allocated in equities. Market advancement was the reason for this rise of 26% and that is why the author suggests that we should frequently keep rebalancing our portfolio.

The Bond component:

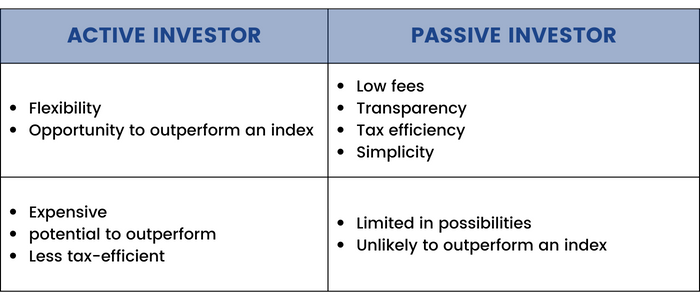

There are two factors concerning bonds:

1) Taxable or tax-free bond- The tax decision should be a question, whether an investor’s income is actually above or below the tax bracket.

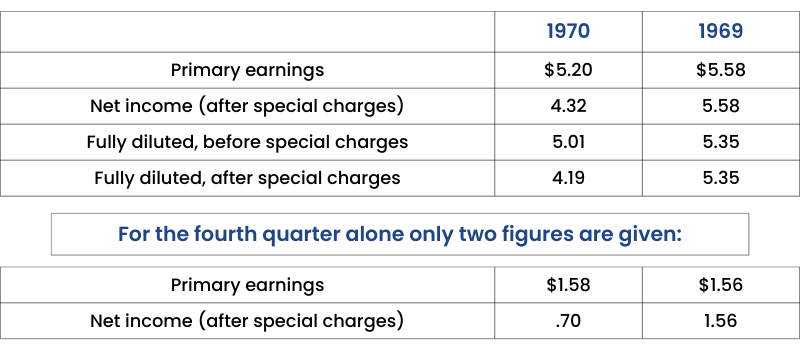

For example, consider 2 investments:

a) A 7.5%, 20 year “Aa” rated corporate bond.

b) A 5.5% tax-free bond.

For a general investor, the first option seems better. But consider an investor who is in a maximum tax bracket of 30%. If he selects option "a", his after-tax returns would be 5.3%. Whereas if he would have selected option "b" he would have generated a higher return of 5.5%. So, we should always consider post-tax returns when investing in bonds.

Tax Rate = 30%

2) Maturity- The author advises investors to sacrifice a small % of yield to purchase a non-callable bond of 20-25 years. Graham also states that there is an advantage in buying a low coupon bond at a discount than a high coupon bond at par.

The Defensive Investor And Common Stocks

“The best defense is a good offense”

The author mentions that common stocks are more advantageous than bonds because they provide protection against inflation and provide a better return than bonds in the long-run. But these advantages remain only if the investor doesn’t overpay for the stock.

How defensive we should be in the stock market doesn't depend on our risk tolerance levels but instead depends on the time and energy we are ready to give for our investments.

It also shouldn't matter what age bracket you are from and if you have lost money previously in the market. Just like we do a thorough research when we buy an electronic item, say a phone, we should also invest the same amount of time and energy when picking up stocks.

Graham suggests some rules:

- Diversification in the stocks you're investing in. The minimum stocks should be 10 and a maximum of 30 stocks.

- The dividend should have been paid to shareholders at least for the last 20 years.

- Stick to only the large companies that are conservatively financed.

- The price shouldn’t be more than 20 times of earnings of the past year and 25 times of the last 7 years.

Growth Stocks and Defensive Investor:

The term “Growth stock” means a stock whose earnings per share have increased in the past and are expected to rise in the future also and price shouldn’t be very high.In general, growth stocks are considered to be very risky because their P/E ratios are generally very high.

The author explains that starting our investments early can be advantageous because then, an investor can stay invested for more than 2-3 decades without worrying too much about losses. Even if a young investor makes a mistake in the market, they can always learn something while they are young and re-enter.

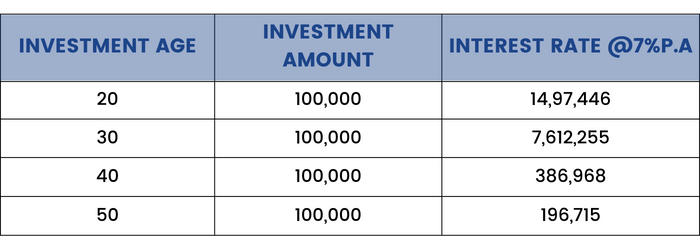

Power of Compounding:

Assuming an investor retires at age 60, and their investment amount stays constant over the period. From the above table, it is clear that the earlier we start, the better.

Portfolio policy For The Enterprising Investor – To Avoid

The main difference between a defensive and an enterprising investor is that an enterprising investor is willing to put in more time, research, and effort to invest more aggressively. Both the aggressive and the defensive investor should start from the same place, i.e., a division of their stocks between high-grade common stocks and bonds.

Graham discusses a list of things an investor shouldn’t do:

- Graham advises investors to avoid lower-rated bonds and preferred stock unless there is very high upside potential in the price of the securities. Lower rated securities have a tendency to fall in adverse markets as we saw in the 2007-08 crisis. The author discusses secondary-grade bonds and says that for the return they offer, they are not worth it. And even if they are available at a cheap/discounted price, secondary grade bonds are generally very illiquid and are not easily sellable.

- The small additional annual income we receive from lower-rated securities is just not worth the risk unless there is a possibility of huge capital gains. In other words, we should not buy lower-rated issues at a price close to Par of 100. A bond selling at 100 has no capital gains, compared to a bond purchased at 66 has the potential of 50% capital gains.

- The author also thought it was unwise to buy new issues, however, there are exceptions to this rule. Generally, new issues are brought to market by a company when it’s favourable for them, with great hype and sales promotion; and therefore, it is unlikely for an investor to have a bargain price.

- Graham also didn’t seem very fond of foreign government bonds, i.e., bonds that are sold by a government other than the country you live in. He believed that if an adverse situation occurs in the country we purchased our bonds from, we don't have a chance to claim the money back, whereas in a local bond, the government has the power to print the money and give it back which makes it safer.

- New issues should also be carefully examined before making a purchase.

There are two reasons with new issues:

- The first reason is that new issues generally have a sales team who sells the shares in exchange for a commission, the higher price they can get for an issue, the more their commission.

- The second reason is that the company generally sells new issues when the market conditions are in their favour and not vice-versa.

Portfolio Policy For The Enterprising Investor: To Do’s

The goal of an enterprising investor should be to achieve a higher-than-average rate of return. Graham laid out 4 activities from which an enterprising investor can do to earn more than a defensive investor. These are:

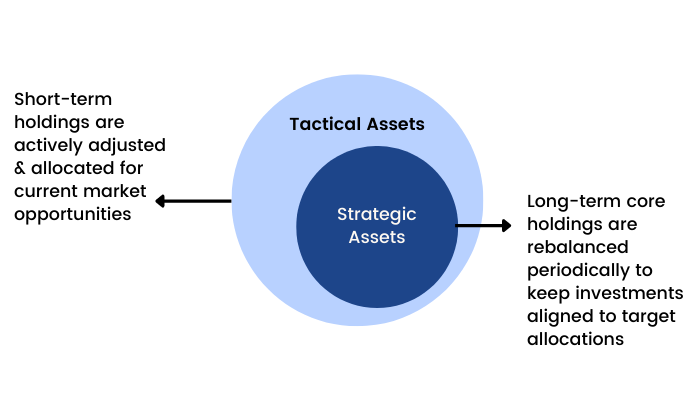

1) Buying when the markets are low\falling and selling when markets are high\rising, i.e.,tactical asset allocation, buying growth stocks, buying discount issues, etc.

2) A defensive investor should stick close to a 50% bond, 50% stock, or plain cash allocation, an enterprising investor has more flexibility in his\her allocations. Rebalancing a portfolio should be based on the attractiveness of an asset’s valuation. Set an equity allocation of min. 25% and a max. of 75%, based on the attractiveness of valuation.

3) When an enterprising investor buys a growth stock, they have to find a large company that is currently unpopular. The price of a growth stock usually reflects the expected growth, which is generally overestimated by the market participants, which means an investor must be extra careful when picking up growth stocks. The best bargain would be a well-established company whose price should be well below its average P/E ratio and its average historical price.

4) The last task for an investor would be searching for a “special situation”. This can involve situations where a small company can be a good fit for a large company to acquire. Graham notes that only a small percentage of enterprise investors engage in this task. So, this provides another area from which profits can be made.

The investor And Market Fluctuations

The author here states three important points:

- Fluctuations in high-grade bonds of relatively shorter maturity (7 years or less) are less affected by changes in market prices.

- The longer-term bonds have price fluctuations in general, and,

- The common stocks in an investor’s portfolio are bound to price fluctuations.

There are two ways by which an investor can profit from a common stock.

A) By way of timing,

B) By way of pricing.

By timing, the author suggests buying a stock when it is quoted below its fair value and vice-versa.

The problem with this method is that we are bound to become speculators and we will lose money, rather than earning. The author also mentions that we often buy or sell as shown on stock market forecasts because we might believe that a stock market broker or firm is more dependable than us but this is not always true.A stock owner should not be merely dependent on price quotations but also think from the viewpoint of a business owner.

The better a common stocks’ quality is, the more speculative its nature will be than the lower grade stocks.

The A&P example:

The author talks about a company named Great Atlanta and Pacific Tea Co. The A&P's shares were introduced in 1929, at a price of 494. By 1932, they were trading at 101 and by 1938, they fell to 36. The company’s valuations showed that the stock was significantly undervalued. At this moment any investor would be thinking of selling the stock. But, if they would have held the stock for one more year, i.e., 1939, its price saw a 117% rise. Any investor confident about their valuations about the stock should have refrained from selling the stock, if not buy more, and saw a rise in its coming years.

Temporary fluctuations always happen in the market and we should not panic by looking at the prices every day.

Graham used an imaginary investor named (Mr. Market) and illustrated how an intelligent investor should take advantage of market fluctuations. This is a parable about greed and fear, price and value, and how an investor will react.

A bonds’ safety of its principal and interest are not questioned, however, a long-term bond market price can fluctuate widely in response to changes in its interest rates. When a bonds’ yield is low, its prices are high and vice versa.

If it’s difficult to predict stock prices, it’s impossible to predict bond prices. Hence the investor might select a bond according to his or her preferences.

The price fluctuations of convertible bonds and preferred stocks are dependent on three factors:

- Variations in price of the related common stock

- Variations in the credit standing of the company

- Variations in general interest rates.

Investing In Investment Funds

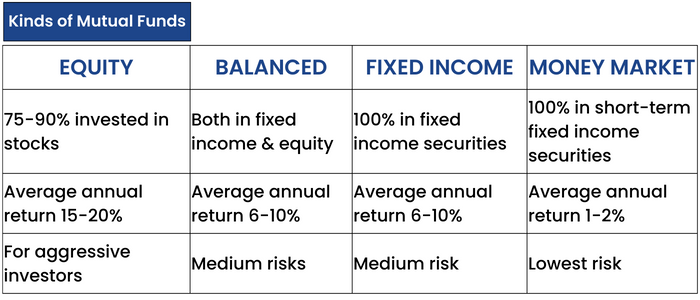

A defensive investor can also invest in investment funds. These are vehicles that provide a way for saving and investment, and possibly preventing individuals from making costly mistakes. These are commonly known as mutual funds or open-end funds and can be sold in the market for their NAV. At the end of 1970, there were 383 registered funds with the SEC, having a total of $54.6 billion dollars in assets.

This is a large industry. There are different ways of classifying these funds:

a) Balanced funds

b) Stock-bonds

c) Bond funds

d) Hedge funds

e) Letter-stock funds, etc.

Investment funds have promoted good habits of saving and investment, they are highly regulated, and individual costly mistakes can be avoided here.

Mutual funds have historically proven to be no better than the stock market, because mutual funds have substantial management costs and the after costs returns are not higher than the stock market returns for that year.

However, an investor should expect average earnings from mutual funds. We can check the performance for the last five years to get an idea about the fund performance.

An investor should be skeptical of any significant performances in the stock market. Outperformance in rising markets may indicate speculative behavior from portfolio managers. Usually, these funds end up with high losses.

The benefit of an investment fund is that it is a cost-effective method to diversify your portfolio with little to no effort.

Closed-end funds selling at a discount can be much more profitable than open-end funds (even with sale charges included). Buying at a cheap price changes the return-on-investment (ROI) calculations.

The Investor And His Advisers

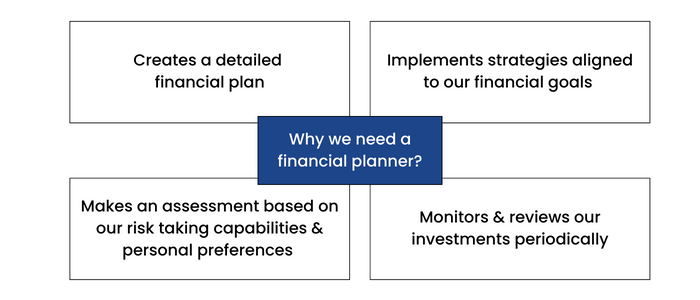

Investors before investing always receive some kind of advice from one or the other person. Most of the investors who are amateurs rely on this kind of advice.

Advice to investors may be based on different sources:

1) A relative or a friend.

2) A local banker.

3) A brokerage or an investment banking firm.

4) A financial service provider

5) An investment counsellor.

Among the above-mentioned sources, the author suggests that investors who are ready to pay a fee for the management of their funds can select some well-established investment but the results are nothing exceptional.

The advice of investment advisors is still better than the advice that our relatives or friends provide us with.

Investors that are new in the market are prone to make mistakes. Lack of proper diversification, high drawdowns of capital, etc. are examples of mistakes that generate returns that are below average.

Graham says,” Much bad advice is given free" and therefore we as investors should select advisors with the utmost character, who are proficient in the investment field.

An investor has to pay a fee for this service. In total not more than 1% should be paid as advisory fees. An advisor will prevent us from panic selling and make us buy when the markets are pessimistic.

Security Analysis For The Lay Investor: General Approach

The author talks about how the term “security analysis” is now becoming the term “financial analysis” and the latter term is more suited to this profession as it defines a wider concept.

Security Analysis begins with the interpretations of a company’s financial report.

When choosing our investments, it is best to make judgments on the basis of past performance because predictions about the future contain assumptions that enhance the chances of possibility of an error, i.e., we become more prone to selecting bad stocks than good stocks when making predictions about the future.

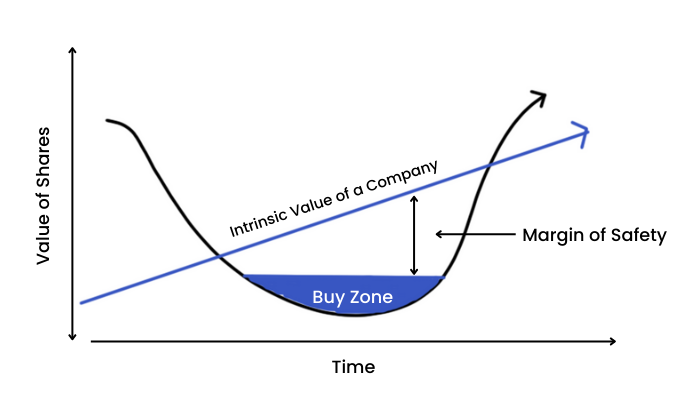

In the common stock analysis, the company’s valuation is compared to the current price of the stock to determine whether it is inviting a purchase and of course, an investor should also seek a margin of safety, i.e., purchasing a stock for less than its real value in the market.

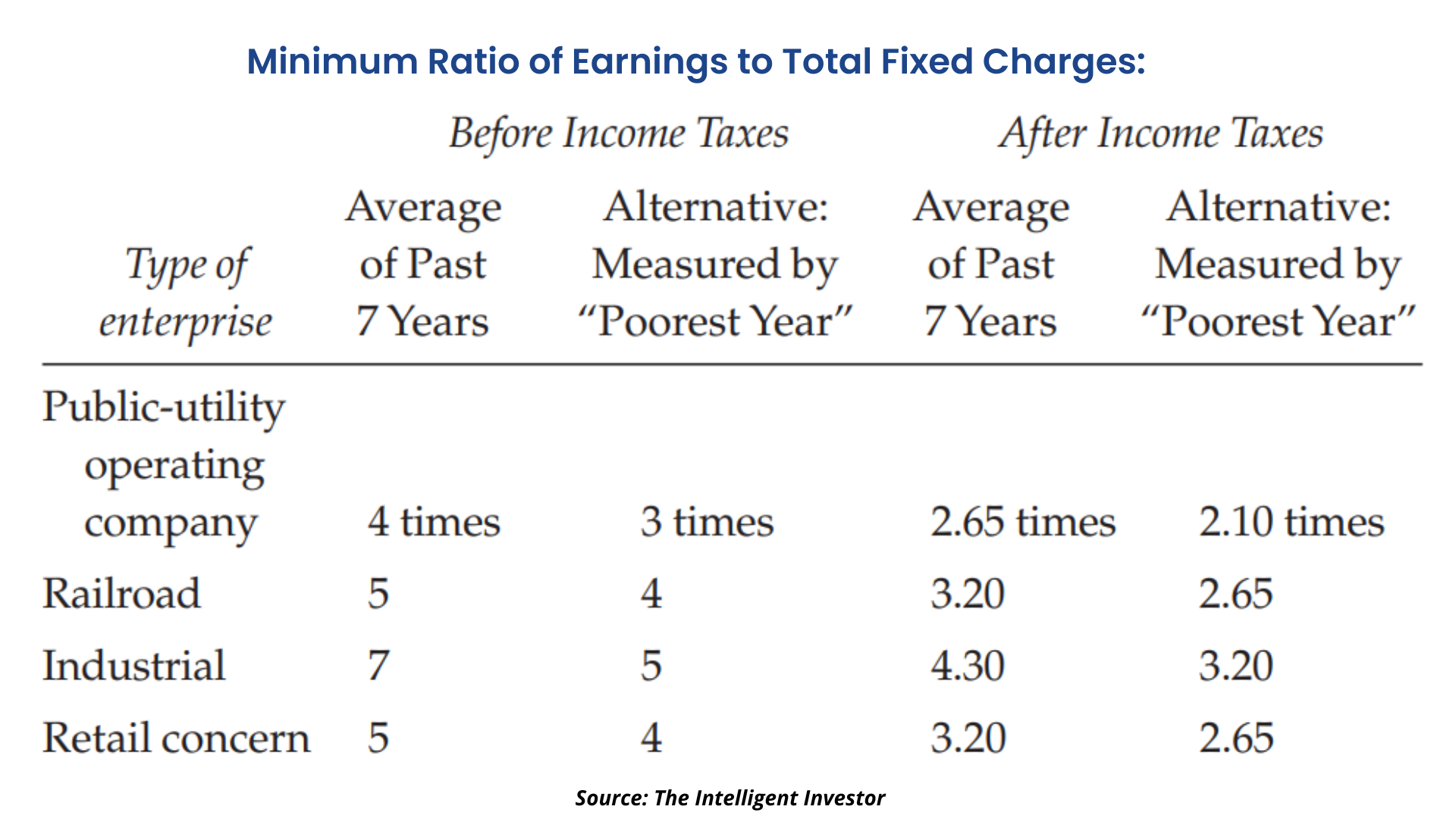

For the bond analysis, Mr. Graham provides a chart and advises us to follow that chart for better analysis:

The capitalization rate (required rate of return) may also differ, depending on the quality of the investment.

Every company has a different capitalization rate due to certain factors.

a) General long-term prospects: High price/earnings ratio and long-term vision.

b) Management: Companies with inner management issues and bad corporate governance policies shouldn’t be touched.

c) Financial strength and capital structure: The company should have an adequate amount of cash balance to make it run for a considerable future. Too much credit or "leverage" shouldn’t be in a company’s balance sheet.

d) Dividend Record: Dividend should be paid to the shareholders consistently for at least the last 20 years.

e) Current dividend rate: Dividend rate varies from company to company but most of the companies pay a significant part of their earnings (50% or more) in the form of a dividend.

f) Earnings Per Share should have grown by 6 to 7% at least for the last 10 years.

Since a company is a part of an industry, the economic position of an industry is an important factor to measure. Industry cyclicality, future industry prospects, etc. are needed to be considered when purchasing a stock.

Graham also recommends a two-part appraisal process:

A) Establish a “past-performance value”.

B) Contemplate how much of an adjustment is needed for a valuation based on future assumptions.

Also, a company having "a moat" or a competitive advantage in its market is an additional advantage.

Stock Selection For The Defensive Investor

The author provides some criteria which an investor might want to follow when selecting a stock:

- Adequate size of the enterprise- At least $100 million in annual sales (needs to be adjusted with inflation for today’s values).

- Strong financial condition- A current ratio of at least 2:1 and not a significant amount of debt in the balance sheet.

- Earnings Stability- Similar earnings in the past 10 years.

- Dividend Record- Uninterrupted dividend payments in the last 20 years

- Earnings Growth- a minimum increase of at least 1/3rd in per-share earnings in the past 10 years).

- Moderate Price/earnings ratio- (shouldn't be more than 15 times than the average earnings of the last 3 years)

- The moderate ratio of price to assets- not to be more than 1.5 times

One’s view of whether a stock is better from others also comes down to an investor’s taste and preference as well as their personal expectations from a stock.

A stock is not valued entirely on its today’s earnings, it is also based on the future earning capacity of the company.

If the stock's price has a sustainable margin above the stock's present value, it helps an investor not lose too much money in case the company develops any unfavourable situations in the future.

Diversification of stocks and industries is an important factor in a portfolio. It is totally not advisable to put all our money on 1 stock or industry. If any adverse situation occurs within that sector, we will lose all our money, but by diversifying, our risks are mitigated.

Stock Selection For The Enterprising Investor

To generate an average result equivalent to the performance of the DJIA, Graham says no one requires a special ability of any kind. All that is needed is 30 prominent securities, identical or similar to that of the DJIA. Surely then, it is possible to generate substantially better results with a detailed level of study, or experience than the DJIA. The above statement is very difficult to prove right even for the author because even the top funds have not been able to prove themselves as “superior” to others.

A typical investor would select stocks that have high growth industries and have high future expectations. This method, however, would omit all the lower-level stocks at lower prices.

The next method would include secondary companies that are making a good showing, have good past records but hold no charm for the public in general. The author then mentions some clues which can help us identify these stocks:

a) Price low in relation to earnings.

b) Current Assets at least 1.5 times that of current liabilities and debt not more than 110% of net current assets.

c) No earnings deficit in the last 5 years.

d) Should have a current dividend.

e) Price should be less than 120% of net tangible assets.

In addition, we might add high rating stocks from rating agencies and all the criteria that were applied for the defensive investor.

The author also did a little "experiment" by selecting some random stocks from the market and found out that companies of major size who have a large goodwill component do pretty well over a 2.5 year holding period. There is a momentum effect attached to these companies, i.e., companies that are doing well keep doing well and vice-versa.

An investor can also look for special situations or “workouts”.

Consider an example, Universal Marion Co., after ceasing its business operations, asked their shareholders to give formal consent for its dissolution. The treasurer had indicated that the common stock of this company had a value of $28.5 per share, most of which was liquid form. The stock closed at $21.5 in 1970, if the book value was realized in the liquidation process, a gross profit of more than 30% was realized.

These kinds of special situations always prove to be profitable for an investor but are not easy to predict or find.

The only way to be successful for an enterprising investor is to keep practicing and learning from the stock market.

Convertible Issues And Warrants

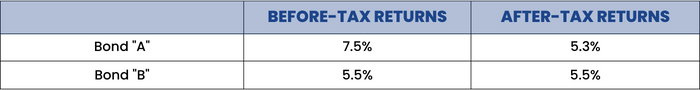

Convertible bonds and preferred stocks have taken importance in the financial markets in recent years. And stock-option warrants, which give the right to buy common shares at predetermined prices, have become more and more common. More than half the preferred issues quoted by S&P in 1970 have conversion privileges.

Convertible issues have proven to be advantageous to both the issuer and the investor. The investor receives protection from preferred stock or bonds and a chance to participate in an uprise of common stock. However, the issues on which these privileges are available of poor quality or yield or both.

During bull markets, these issues are bound to produce unsatisfactory results as a whole. It goes without saying that a convertible is less risky than the common stock of the same company.

The author suggests never to convert a convertible bond. Just because then we will lose the strategic combination of this issue and the chance to convert it at an attractive price.

People get carried away by their enthusiasm for converting an issue without doing proper due diligence and then suffer huge losses.

Generally, we can find convertible issues suitable for us in the older issues rather than the newer issues. But these instances are not easy to find.

The author considers warrants to be a mere fraud and a potential disaster. Warrants have the potential to mislead investors and speculators.

Graham also says that common stocks become less valuable with warrants attached to them. With attached warrants, common stocks become pricier and simply mislead investors who have less knowledge about the financial market.

Four Extremely Instructive Case Histories

The Penn Central Case:

This company went bankrupt in 1970 and the whole financial world was shocked.

Here are some conclusions:

a) The company had paid no income taxes for a long period of time, which raises questions about its earnings quality.

b) There were some strange transactions from this company which are very complicated in nature.

c) The management of the company might have been misleading.

Ling-Temo-Vought Inc:

This company tried to do some enormous expansion and took some enormous debt, ending up in some terrific losses.

A) The company's expansion period was without an interruption. This amounts to a company taking a large amount of debt and becoming riskier. By 1969, the company had a combined debt of $1869 million, this is one of the largest combined debts ever by any company.

B) The author asks how did the commercial banks give away so much debt to this company when it is clear that it was a mistake.

The NVF Takeover of Sharon Steel:

At the time of acquiring, Sharon Steel was 7 times larger than NVF. NVF had a huge debt obligation in their books because of Sharon Steel. The company had to make accounting misstatements which proved to be costly for the firm. A lot of unusual items were present in their accounts. A large dilution factor was also present, making it bad to worse.

AAA Enterprises:

This company sold mobile homes or “trailers”. Mr. Williams, when went public for this company, sold 300,000 shares to himself. The company also acquired some other businesses, and things seemed pretty well at the start. But the company ran out of capital and began cooking up its books. The author is shocked that how a worthless company like this can get this much speculation from the buyers. Due diligence before buying is very important.

“Margin Of Safety” As The Central Concept Of Investment

Equity value strategy looks to exploit equity market inefficiencies that exist in the short to mid term due to investors over-reaction in the near-term events.

The goal of an investor is to keep as high a margin of safety as possible. The higher the margin, the more an investor has the freedom in case a negative situation takes place in a company/economy before selling has to take place.

If we overestimate our abilities and investment, we are bound to buy a mispriced stock. Ultimately, the financial risk does not depend on what kind of investments we have, but what kind of investors we are. One more factor that an investor should think about is how they are going to react when their investments don’t turn out to be exactly as they planned.

If we are buying, then that means someone else is selling. How do we know that the other person is not right?

We should calculate how the share’s price needs to go up including the costs of trading and taxes before we break-even.

Investment is now most intelligent when a shareholder thinks like a businessman. The author suggests some principles for doing so:

1) Know your business.

2) Do not let anyone else run the business.

3) Do not enter manufacturing or a trading item, unless a reliable circulation shows it has a chance to yield profits.

4) Have the courage of your experience and knowledge.

To achieve satisfactory results is easy for an investor, to achieve superior results is very difficult and harder than it looks.

Conclusion:

Successful investing is not about avoiding risk, it’s about managing it.

Investing is an adventure and the financial future is always unpredictable. The Intelligent Investor is a very old book but still in today's world its implications remain. Software’s like Bloomberg and the introduction of paperless trading have changed the market significantly to what it was 100 years ago but the basics remain the same and anyone can still apply and achieve by applying and following the guidance of this book.