Value Investing And Behavioral Finance

Introduction

About the book

The book contains pearls of wisdom, great insights, and compelling concepts. The best part is that the book focuses on the Indian stock market, and each chapter is explained using Indian stocks. It is an antidote to investor anxiety and a guide to sane and safe investment decisions. It also shows how collective behavioural biases affect investment decisions and returns in the market.

A great piece of advice from the book: "When others are greedy, be fearful, and when others are fearful, be greedy."

About the Author

Mr Parag Parikh was a highly regarded and respected stock market veteran. He began his career as a stockbroker in the late 1970s and founded Parag Parikh Financial Advisory Services Private Limited in 1992, sponsored by the PPFAS Mutual Fund. He is particularly well-known for being a pioneer in applying globally accepted tenets of Behavioral Finance while investing in Indian companies. In a world where making politically correct, anodyne statements are the norm, he charted a different course with his candid, sometimes acerbic observations on the Indian financial sector in general and stock markets / mutual funds in particular. However, no one could deny that each statement had a ring of truth to it. As a prolific writer and blogger, his contributions to various reputable publications aided in conveying his forthright opinions to eager readers.

His two books, "Stocks to Riches" and "Value Investing and Behavioral Finance," cemented his reputation as a thought leader and prompted readers to examine their investing habits.

Buy the book

The book teaches you how to spot investment opportunities and pitfalls in the stock market. We highly recommend you to read the entire book. (affiliate link)

Success And failure

Parag Parikh explains why people fail at investing in the first few chapters. Then, he describes it by referring to human characteristics such as laziness, greed, self-interest, ignorance, etc. One of the main reasons for people's failure, as he explained, is their "unwillingness to delay gratification." Because of instant gratification, most people trade short-term gain for long-term pain.

Heuristics refers to the shortcuts that the brain employs when processing information. As a result, our brain does not process all of the information presented to it. This results in cognitive bias. Price to earnings heuristics, price to book value heuristics, and price to sales are some common valuation heuristics.

Key Takeaways

Certain universal principles do not change regardless of the circumstances, technological changes, geographical boundaries, demographic changes, and so on. The "Law of the Farm" is one such universal principle. You can't plant a seed today and harvest it tomorrow. The seed takes time to grow into a tree. It must go through various seasons. We will not be able to grow a tree in an instant. Nature does not provide us with immediate gratification.

If our lives are in tune with nature, we only naturally follow nature's laws. Success in life is determined by our ability to recognise that there are no shortcuts. If one takes such shortcuts, they are bound to fail.

The same is true for investments. Of course, you can't expect to make a quick buck by investing. However, most people today are attempting to invest in the hope of making a fortune.

Take a look around at the successful investors. They were successful because they could postpone gratification and understood the farm's law. Successful investors such as Warren Buffett, Charlie Munger, and Peter Lynch, to name a few, owe their success to their ability to avoid the "E" Factor.

The "E" Factor or "Expediency Factor," assumes that human nature is to solve problems with the least amount of extra-ordinary effort. This means that most people will choose the most convenient and easy path rather than the one that leads to success. Individuals who succumb to the Expediency Factor avoid obstacles and have the least impact on others. Every minute of every day, we fight a subconscious battle between doing what we know is right, difficult, and necessary and doing what is easy and of little value. The Expediency Factor isn't easily defeated, but there are examples all around you.

This understanding of human nature serves as the foundation for the various aspects of this book and will assist the investor in comprehending simplicity.

In terms of investing, it is simple, but the industry has made it complicated. It has woven a web of deception in its pursuit of instant gratification, complexity to perplex the investor; the same person on whom the industry is reliant on the government for survival. We, humans, are more concerned with concentrating, improving our intellect and, as a result, concentrating on developing the Intelligence Quotient (IQ). The most important balancing act, however, is the Emotional Quotient is a mechanism within us (EQ). We are all humans. We have both a mind and a heart. The mind controls our intellect. Our emotions are controlled by the heart.

A proper understanding and balance of the two lead to a successful life and a more fruitful and happy existence.

In his book "Emotional Intelligence," Daniel Goleman makes a strong case for the concept of Emotional Quotient (EQ). For example, parents want their children to attend the best schools possible. The motivation for such action is the belief that the environment, classmates, and teachers will help their children realise their true potential, allowing them to achieve great success when they grow up. The potential is frequently measured by high test scores and intelligent quotients (IQs). However, we often fail to understand whether IQ alone guarantees success or requires something else.

Take a look around you, and you'll notice that many people aren't exceptionally bright but are doing very well in terms of financial well-being and, more importantly, happiness. Yet, on the other hand, there are many people who, despite having a high IQ, perform poorly in life, end up stuck at the top of the corporate ladder, and fail to achieve a consistent dose of happiness and contentment. Understanding what scientists refer to as 'EQ' helps explain this anomaly.

What exactly is the Emotional Quotient?

Just as IQ is used to define a person's competence in terms of cognitive abilities, EQ is used to describe a person's mental composure. A person who can think clearly through life's challenges and accept failures without allowing them to demotivate him from moving forward is well-positioned to achieve success. Unfortunately, schools fail to develop this skill in children. It can, however, be cultivated by reflecting on our behaviour and the behaviour of those around us and observing how understanding and controlling emotions alone can help us realise our true potential.

This book is designed to shed light on various methods of developing one's EQ as a person and investor.

Understanding Behavioural Traits

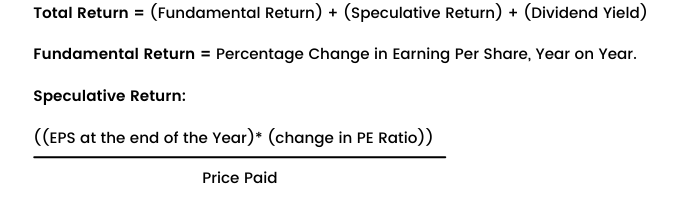

The second chapter, titled 'Understanding Behavioral Trends,' examines the two components of equity returns, fundamental returns and speculative returns. Fundamentals are concerned with the returns from increased earnings and dividends. The speculative component is caused by the expansion or contraction of the PE. The speculative components are influenced by investor sentiment and can fluctuate dramatically.

The author advises retail investors to avoid getting carried away by market 'noise' and instead buy fundamentally sound companies at a low to a reasonable price.

Returns from the Sensex (1991-2007)

Lessons From The Chapter Understanding Behavioural Traits

What Makes Investing Risky?

According to the previous study, corporate earnings have steadily increased over the 16 years under consideration, resulting in a compounded rate of return of around 16 per cent, as reflected in earnings per share. Earnings fell only during the three years from 1998 to 2000, which is explained by the fact that many good profitable companies comprised the Sensex were replaced by low profit-making information technology companies simply because the IT sector happened to be a "fancy" sector. Investors were willing to pay exorbitant multiples for such stocks in the hope of making large profits in the future.

Even this drop in earnings can be viewed as an outlier. As a result, earnings, in general, have been consistent, reliable, and sound over the last 16 years. This is reflected in Sensex's compounded return of 18 per cent over the same period.

Sensex's yearly return, on the other hand, was far from consistent due to irrational investor behaviour. This highlights an essential aspect of equity investing. The returns are determined by the companies' earnings that comprise the Sensex and changes in the PE ratios.

Acquisition Price Determines Stock Returns

The change of PE ratios over time reflects changes in investor sentiment. These changes could be caused by various factors, including:

- Changes in the business environment

- Changes in a company's fortunes,

- Changes in sectoral performance

- Macroeconomic factors

- Government deregulation

- Overall optimism or pessimism.

These factors can provide excellent opportunities for investors who are on the lookout for such behavioural mispricing. This is abundantly clear when we consider the stellar performance of companies from 1995 to 1997 and the returns on the Sensex—these three years presented enormous opportunities despite a tremendous amount of pessimism in the markets. The negative speculative element almost threw up great deals.

During this time, corporate earnings increased from ₹113.8 at the end of 1994 to ₹270.8 at the end of 1997, representing a 33.6 per cent CAGR in earnings. The Sensex, on the other hand, fell from 3,927 at the end of 1994 to 3,659 at the end of 1997, for a negative –6.8 per cent return. When we add the 4.1 per cent dividends received during this period, we get a negative 0–2.7 return from the Sensex. What accounts for the anomaly of a 33.6 per cent CAGR in earnings resulting in a –2.7 per cent return for shareholders? Excessive optimism prevailed in 1994, and investors were willing to pay high valuations, as reflected in the high PE of 34.5.

However, due to the high PE, the fundamental performance could not be translated into commensurate returns for the shareholders.

During the years 1995/6/7, investors profited greatly because the prices they paid were significantly lower than the fundamental values due to excessive pessimism.

Stock returns are determined by the purchase price.

Mr. Market Oscillates between Greed and Fear

The anomaly mentioned above was not a one-time occurrence. It happens again and again as the markets swing between optimism and pessimism.

Markets are made up of emotional people who make decisions based on the current mood of the environment. At times, they exhibit greed, but this greed is displaced by fear at other times. Stock prices become volatile due to bouts of greed and fear, trapping investors and causing them to lose fortunes.

Corporate earnings increased at an 8.8 per cent CAGR (Compound Annual Growth Rate) from ₹195.6 at the end of 2000 to ₹231.1 at the end of 2002, but the Sensex delivered a negative –14.9 per cent return to investors. The figure fell from 3,972 at the end of 2000 to 3,377 in 2002. When we add the 3.9 per cent dividends received during this period, we get a negative –11 per cent return from Sensex.

Corporate and shareholder performance can be opposed. Equity investing appears to be a risky proposition due to the investor's behavioural traits and the market's crowd behaviour in general.

A wise investor can identify bargains by being aware of and controlling one's emotions, as well as understanding the behavioural anomalies of others. Your Self-Control

Returns are determined by fundamental performance and the price paid for that set of fundamentals. Paying 25 times recent earnings for a company and then expecting it to grow at a rate of 25% over the next few years can lead to disappointment on two fronts. First, if and when earnings fall short of expectations, say by 25%, and second, losing on the speculative return front, i.e., a change in the PEs.

It is critical to be disciplined in your investment approach.

Opportunities do not come along every day, and one must be prepared and ready with money when they do. Unfortunately, investors tend to chase stocks when they receive tips, and they become such engrossed inexpensive stocks that they lack the funds when the markets tank and opportunities arise.

Proper discipline and courage are demonstrated when you buy when you do not feel emotionally inclined to buy and sell when your heart says no, but your mind and logic say yes.

Key Takeaways

One may be a winner or a loser in any given year due to changes in speculative interest driving the markets. Still, the long run distinguishes a true investor from a speculator. Just as an investor would try to be subdued during periods of optimism because his fixation is not only on the recent twelve months' profit and next year's expectation but on the long-term trend of the enterprises' earnings and profitability, a speculator will be fixated on the recent earnings and growth projections and be willing to pay a high premium for the current set of earnings, leaving him in a position where he may not be able to reap the profits of a bull market.

On the other hand, a true investor would wait for the period of optimism to pass before selecting opportunities in which the future is not favourably discounted into the price, allowing the stock price to catch up with the business fundamentals through PE expansion. All the while, he would look for companies where the fundamentals could continue to thrive, giving him a double whammy. For one, an increase in earnings will contribute to fundamental returns. For two, positive speculative interest in the stock or sectors will result in earnings expanding from low PE to moderate or high PE ratios and superior returns over time.

Equity as an asset class has provided attractive returns while investors have fared poorly, demonstrating erratic behaviour. We must recognise that we are human beings with hearts and minds. We must make decisions with our minds. We can use our minds to determine whether a stock is expensive or not, whether we are paying for its fundamental value or not, the amount of speculative interest and its reflection in the price, the value you are receiving concerning the price you are paying, and the general market sentiment, whether bullish or bearish.

However, when you use your heart, you tend to follow the herd and do what they are doing. If everyone else is buying, you'll start buying, and you'll end up spending a lot of money. Similarly, if everyone else is selling, you will sell and thus sell cheaply. As you become a part of the crowd, you are moved by market emotions and do foolish things that harm your financial interests.

You chase stocks because you get greedy when others get greedy, and you end up buying stocks at high prices. But, in reality, you must be greedy when others fear buying stocks at reasonable prices.

Because we are emotional beings, we tend to make decisions based on our emotions, which may not be in our best financial interests.

This emotional behaviour is evident in the stock market, where we oscillate between our basic emotions of greed and fear. Our emotions become eruptive because stock markets are volatile, and the results are all about making or losing money. Greed and fear are fueled by money. The challenge for a successful investor is to control one's emotions and not be swayed by emotional outbursts. Being calm in the face of market turbulence will aid one's ability to be a successful investor.

Behavioural Obstacles To Value Investing

This chapter examines both the Value and Growth investing styles and examines why people prefer one over the other.

Value is classified into two types:

- Value in use

- Value in exchange

Water has a high utility value, whereas gold has a high exchange value. Value Investors should understand the distinctions between the above concepts of value and only invest in companies that offer good value in exchange for a higher return over time.

Recency effect - giving more importance to recent information at the expense of older but relevant information - is one of the behavioural barriers to value investing. Prospect theory states that people place a higher value on loss aversion than profits and tend to sell off profitable investments quickly while keeping (and adding to) loss-making investments in their portfolios. Instant gratification - Lack of patience to stay invested for an extended period. People use PE, PB, and Price / Sales Heuristics to identify value because the process is complex.

The author makes two observations about Growth Investing. For starters, growth is not the same as return. You will not make money if you buy a growth stock at a high price. Two, there is a distinction between good companies and good stocks. It is not always necessary for good companies to be good stocks. There will be a time when the company's performance and potential to provide good investment returns diverge. Another critical point is that investors are hesitant to change their strategies and are sometimes content with sub-optimal returns.

What is Behavioral Finance?

Behavioural finance is a new field that combines behavioural and cognitive psychology with financial decision-making processes. As we know it, traditional economic theory talks about efficient markets and rational decisions to maximize profits. However, this new emerging school of behavioural economists contends that markets are inefficient, particularly in the short run, and that people do not make rational decisions to maximize profits. Humans are prone to various behavioural anomalies that become counter-productive to the wealth-maximization principle, resulting in irrational behaviour.

Key Takeaways

Why do most individual and professional investors refuse to adopt value-investing strategies despite such compelling evidence?

It is abundantly clear that growth investing is risky, even though most people do it.

The author spoke with a fund manager from a large mutual fund about the types of services we could provide. During the decision, the fund manager stated unequivocally that, while he believed in the author's value strategies, he wanted the author to give him ideas on stocks that would rise in the short run.

When the author expressed his inability to do so because it contradicted his investing beliefs and principles, he curtly informed the author that keeping his high-profile and high-paying job was more important to him. Thus he had to rely on momentum strategies rather than being a contrarian and underperforming in the short run. His company will not tolerate poor performance. He lacked the courage to stand up, despite knowing he was doing the wrong thing.

According to Lakonishak, Schleifer, and Vishny, being a contrarian may be too risky for the average person or professional.

If you are wrong along with everyone else, the professional and self-esteem consequences are far less severe than if you are wrong and alone in your choice of action. It's safer to be with the herd because it provides the security of numbers.

Another reason is that people are less likely to change their paths if they are content. Individuals are content with subpar performance as long as it is not painful. Furthermore, people who are unhappy and prone to making changes frequently do so for the wrong reasons and end up being just as disappointed in their new circumstances. Fear of failure and resistance to change may be too powerful to overcome.

Greed and envy appear to be the most common sins for investors caught in the growth trap.

The desire to make a quick buck saps them of all rationality and common sense. Instead, people try to emulate others' success without knowing the risks they took, believing that they, too, will be as successful as them.

No rationality operates in the stock markets because they are inefficient, particularly short.

What works in the stock market is recognising one's emotional and psychological flaws.

This is the initial step. The second step is to comprehend other people's irrational behaviour and profit from their mistakes. The third step is to muster the courage and conviction to deviate from the crowd. That is why value investing is effective. Unfortunately, it's a risky strategy that few people follow. The herd is frequently caught in the growth trap.

Value investing entails knowledge, whereas growth investing entails mystery.

Contrarian Investing

A Contrarian investor is one who goes against the conventional wisdom when picking investment opportunities. The book discusses personal and organizational heuristics that could become an impediment to contrarian investing.

Personal heuristics include:

- Group Thinking - where you sacrifice your views to become a part of a group,

- False Consensus Effect - tendency to overestimate the percentage of people we think would agree with us,

- Buyer's remorse - tendency to regret our decisions if they go against us in the short-term,

- Ambiguity Effect - Depending on external inputs to reduce uncertainty of stock purchase and reduce ambiguity (looking for validation in message boards, for example),

- Herding, Recency effect - giving undue importance to recent negative stock and Confirmation

- Trap - Tendency to seek confirmation of your decision through actions of others (You may not want to buy when all others around you are selling) etc. When selecting investment opportunities, a contrarian investor goes against conventional wisdom.

The book discusses personal and organisational heuristics that can stymie contrarian investing. For example, group Thinking is a personal heuristic in which you sacrifice your opinions to become a member of a group. The False Consensus Effect tends to overestimate the percentage of people we believe will agree with us. Buyer's remorse is the tendency to second-guess our decisions if they go against us in the short term. Ambiguity Effect - Relying on external inputs to reduce stock purchase uncertainty and ambiguity (looking for validation in message boards, for example), Herding, Recency effect - exaggerating the significance of recent negative stock and Confirmation Trap - The tendency to seek confirmation of your decision through the actions of others (for example, you may not want to buy when everyone else is selling), etc.

The author discusses a study conducted by his firm that found that over ten years, contrarian investing (buying the ten lowest PE stocks in the index and holding them for one year) outperformed conventional investing (buying the ten highest PE stocks in the index and holding them for one year) by a wide margin.

Growth Trap

Growth Trap is discussed in Chapter 5. When an investor pays a high price for growth, this happens. Even though the stock is a growth stock, the investor receives no return because he paid a high price.

Investors chasing growth stocks use heuristics to guide their behaviour. Heuristics for Availability: Everyone is talking about this stock, and investors make decisions based on readily available information. Sheepherding, Overconfidence bias: Because one is confident in their assessment, they underreact to negative information about the stock. Bystander effect: Even when one believes contrary to market expectations, one is hesitant to act on that belief. Information Cascade: imitating the actions of experts without conducting the necessary analysis and research The Halo Effect refers to making decisions based on only one prominent piece of information. The author uses multiple examples from Indian markets to demonstrate the growth trap.

For instance, Century Textiles was a growing company in 1979, while ACC was a neglected stock. If you had invested ₹100,000 in each of these stocks in 1979, ACC would have provided a 6% higher return (equivalent to approximately ₹4,000,000 over 25 years) than Century Textiles. This is due to the investor overpaying for Century Textiles, a growth stock.

Lessons:

The key takeaway from the preceding examples is to look for businesses that have the fundamentals to outperform the expectations built into the prices. The more significant the difference between the intrinsic value based on quantitative analysis and the expected value built into the price, the better the results for an investor.

At any given time, very few of the companies traded on the stock exchange would pass the above expectations game test. However, if one can train oneself to recognise the behavioural anomalies that result in mispricing, one can expect to find some bargains. Some of the common behavioural anomalies among all fads and fancies that lead investors into the "growth trap" are discussed further below.

Novelty Over Familiarity

The fascination with something new in the stock market is as old as establishing stock exchanges. From the Tulip mania, when a flower became so important to investors for no practical reason, to the South Sea bubble, when the company promised to amass gold that exceeded the estimated amount of gold on the planet, to the more recent Tech bubble of 2000, when people paid exorbitant prices for technology stocks and earnings seemed to matter little—people believed that there is more to a business than the assets it owns or the profits it can potentially earn for Such excesses are on the horizon in the infrastructure and real estate sectors.

Time has repeatedly demonstrated that an enterprise is worth the amount of money it can generate for its owners in the form of distributable earnings over its estimated lifetime. Of course, it deviates to excessive levels during boom and bust, but this fundamental law remains constant.

During such times, people, in their quest for a piece of something new, overlook the inherent strength of time-tested familiar businesses, which will almost certainly continue to do business as they have in the past. Investing in something that has stood the test of time and has earnings to show for the price paid provides an opportunity for a contrarian investor to prosper at such times.

Growth or Financial Cancer

Expected growth is not a reliable indicator of a company's ability to create value. To understand the true impact of growth on a company's ability to create shareholder wealth, one must estimate how much cash is required to produce a unit of earnings growth.

Growth can only be considered value-accretive if it is greater than the cost of capital. Otherwise, it is deemed value-destructive, and growth is a negative factor in the value equation. So, whenever you see growth projections, remember to ask yourself, "How much capital does the business require to grow?"

Occasionally, the stock market participates in a fancy parade in which all that matters to participants is that particular industry will achieve a high growth rate in the future. They forget to ask about capital requirements, competition and the potential for a downward shift in the average ROCE earned by the industry, current expectations built into the stock price versus the growth expectations implied by the business, and so on. Failure to ask these questions will inevitably result in losses. When processing information, avoid mental shortcuts. Process all information and avoid being swayed by hearsay.

Recency Effect

Psychologists define the recency effect as a heuristic in which people tend to favour recent events because they are easier to recall.

At the top and bottom of stock market cycles, investors exhibit extreme forms of this bias. For example, just before a market crash, liquidity and optimism are at their peak among the investor community as a whole. During bear markets, on the other hand, the amount of capital invested in equities as a percentage of total household savings is at its lowest, indicating that people's propensity to defer their investments in equity markets outweighs the market's short-term underperformance.

The best time to buy a business for a rational investor who thinks about the company behind the stocks is when it is available at a deep discount to its value. That is not to say that predicting the bottom of a bear market is possible. Nevertheless, the long-term investing principle is put to the test, and one must be willing to wait patiently from the point of purchase until interest is renewed.

Key Takeaways

Investment opportunities do not come along every day. However, the market noise occasionally offers mispriced securities. All company information is always readily available. This can never give you an advantage when it comes to investing. Many people, however, believe it to be true. However, many investors are swayed by market noise, and their crowd behaviour provides opportunities to a rational investor. Being in control of one's impulses and urges will help one spot mispriced opportunities and avoid the growth trap. A growth stock has skyrocketed in value. It is always in retrospect. Nevertheless, the long-term investing principle is put to the test, and one must be willing to wait patiently from the point of purchase until interest is renewed.

Commodity Investing

The chapter investigates the differences in investor behaviour regarding commodity investing. When the commodity cycle turns around, it has been observed that historically underperforming companies with carried forward losses and a high level of debt provide the highest returns. This is because high-interest rates cause failures, and when the cycle turns, revenues increase while interest costs remain the same or decrease. Furthermore, carried forward losses serve as an asset that can be deducted from period taxes. Both of the factors above raise the EPS and, as a result, the share price.

Commodity Cycles

Commodity stocks follow commodity cycles, and investors invest in commodity stocks based on commodity price trends. Commodity companies are prone to significant swings in profitability, posing difficulties for investors attempting to value such companies. Companies in these cyclical industries, such as steel, paper, chemicals, sugar, and cement, put fundamental valuation principles to the test. The use of the discounted cash flow technique creates obstacles due to cyclical fluctuations and price uncertainty in commodities.

Key Takeaways

When it comes to investing, shareholders are always looking for the best returns. If an investor had made investment decisions based on traditional valuation parameters, he would have purchased shares of low-cost producers with a lower debt component. His returns, however, would have suffered because these valuation parameters do not apply to commodity companies, where production efficiencies and capital structures differ.

Value investors always avoid commodity stocks because they do not fit their valuation parameters.

Commodity stocks would be ideal for traders and speculators. These stocks provide them with the rush of momentum investing. Unfortunately, most investors, classified as financial addicts, are enthralled by the markets' short-term nature and excessive reliance on quarter-to-quarter bottom-line earnings. This majority forms the crowd, and the standard set by the crowd becomes the popular following. That is precisely why commodity stocks cannot be valued using traditional valuation models.

Public Sector Units

The book's seventh chapter examines PSUs (Public Sector Units or government-owned companies) and discusses the reasons for the perception of underperformance in those stocks. As some of the reasons for this, the author discusses the absence of Availability Heuristics (not much information is available about those companies, unlike private sector companies, which are tracked by every analyst and his mother in law) and Herding - All PSUs are grouped. The critical point being made is that some PSU units, such as SBI and oil companies, are trading at extremely low valuations and offer significant long-term returns.

Key Takeaways

In the long run, markets are efficient, but in the short run, they are inefficient. Moreover, the nature of markets has changed due to the introduction of technology and the Internet and the disappearance of financial borders.

Returns are determined by purchasing a valuable asset at the right price. However, it is not as simple as it appears. When such an opportunity presents itself, we dislike it because our emotions and the environment influence our decisions.

It's not that most long-term investors were unaware of the PSU investment opportunity. Instead, it was the willingness to consider the long term that was lacking and returns are always a function of time.

In terms of the environment, investors were concerned about the government's lack of political will to implement reforms. Price controls killed the fertilizer industry. This anchor was too strong in investors' minds, and the woes of the oil marketing companies proved such cautious investors correct.

What has generated the returns in specific industries such as banking, mining, container shipping, and defence?

The first was that these sectors were opened up to reforms more quickly. Second, they were in monopolistic industries. Third, and most importantly, they successfully attracted investor interest over time. This was accomplished through consistent growth in profitability and size.

Most of these successful PSUs owe their success to their size and scale. The market capitalization game is still active in the market today.

Because there are investors from all over the world looking for investments in various countries, they look for a specific size. Even a great 'blue chip' will not be on such investors' investing list if it does not have a sizable market capitalization. This is where PSUs have an advantage in terms of market visibility. In addition, they have assets, infrastructure, knowledge, a client base, and a network to back up their claims. This also facilitates their access to capital markets. These significant issues will pique the interest of large foreign institutional investors.

Foreign institutional investors as a group are permitted to hold shares up to a specific limit, which has already been reached in the case of SBI.

This scale and size, once again, aid a company's entry into the index. Index traders and those seeking country exposure typically invest solely in index stocks. As analysts cover such highly capitalized index stocks, PSUs will gain a strong investor following. The stock market is all about the herd. A fancy stock has a herd following it because it is a large-cap stock in the index. And because fancy stocks have high built-in expectations, their stocks appreciate. When you buy early, you get a good return on your investment.

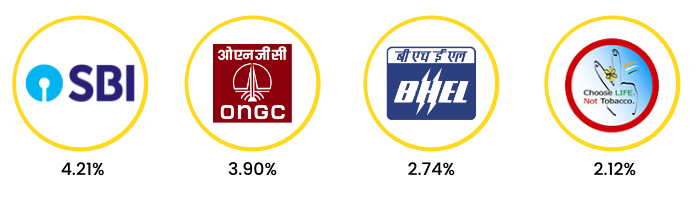

As of April 23, 2008, the BSE Sensex comprised four major PSUs, with SBI leading the pack with a weightage of 4.21 per cent, followed by ONGC with 3.90 per cent, BHEL with 2.74, and NTPC with 2.12 per cent.

Together, they have a weightage of more than 12%, which is relatively low given the scale and size of PSUs in India. The NSE Nifty is represented by nine PSUs, with a weightage of more than 22%. More PSUs will be listed in the future, providing investors with excellent investment opportunities.

A wise long-term investor cannot, without a doubt, overlook PSU stocks.

Sector Investing

Different sectors lead each phase of a bull market. Sector Investing is covered in Chapter 8. When a sector becomes popular, investors begin hearing a lot about its prospects (availability heuristic), all stocks in the sector appreciate regardless of fundamentals (Representative Heuristic), everyone begins investing in the sector (herding), everyone becomes optimistic (overconfidence), making bad decisions (Winner's curse, as when TISCO purchased CORUS), and so on. A sector bubble occurs when many new companies enter a sector, and their stock prices rise without regard for fundamentals. When investing in sectors, investors should exercise extreme caution. It is critical to leave at the appropriate time. When the tide turns, a sector bubble can burst very quickly.

Lessons:

Investors get trapped in the Growth Trap when they invest in hot and fancy sectors in the markets.

1. Investors end up paying crazy valuations for stocks when they chase stocks in the current hot sectors. This affects their long-term returns. This could also lead to capital depreciation.

2. When a sector is hot, new companies taking advantage of the market conditions enter the market with initial public offerings to cash in on the investor fancy. This leads to investors paying fancy prices for mediocre companies. Beware of IPOs.

3. Investment bankers try to cash in on the fancy sector by selling sub-par paper to the investors.

4. Be careful of the information fed to you by the media. Be wary of your favourite stock market TV shows. Carefully scan various buy recommendations from intermediaries.

5. Rapid growth in a sector does not mean good investment returns for the investors. The inverse is true. Investor returns are dependent on the right acquisition price.

6. A sector changes slowly, but companies’ fortunes can change rapidly. Misguided portfolio allocations based on sector growth can lead to the acquisition of mispriced securities.

7. Sector bubbles are a warning to investors to reduce their allocation to the sector. For example, we saw the IT sector bubble in 1999–2000. A similar bubble is evident in the real estate sector. Such sectors are not for the long-term investor.

8. A deflated sector, like FMCG or healthcare, offers good investment opportunities for long-term returns. The companies in these sectors are also available at reasonable PE multiples.

9. Do not buy what others are also buying. Long-term returns are a function of buying what others are not buying. It is here that you get the price advantage.

Key Takeaways

Sector investing is also a type of stock investing. You do not have to buy what is popular. You don't have to buy what everyone else is buying because it's already too expensive. According to representative thinking, you don't need to invest in a hot sector because the stocks in that sector are all overpriced. Furthermore, when a sector is performing well, an investor is more likely to fall into the growth trap because the company chosen in the sector may be incorrect.

Alternatively, when a sector performs well, unscrupulous managements enter the sector with flawed business models, causing investors to pay exorbitant valuations based on the sector. Companies would frequently change their names to reflect the current hot sector in order to attract investor attention. Based on our previous discussions, it makes sense to look at a sector with sustainable economic characteristics performing poorly due to a lack of investor interest. The challenge would be to find the right company in the sector.

Companies in out-of-favour industries can produce healthy investor returns. In and of itself, forging is a very dull industry. It lacks the charisma of technological innovation or the desire for growth. It was a neglected sector in the early 1980s, and few companies wanted to be in it. Only a few companies remained in the sector following the departure of companies due to uneconomic scales. Bharat Forge was one such company. Its management focused on what it did best and increased efficiency. When the sector did not pique the interest of investors, there was little competition. This provided it with the impetus to construct an impressive moat around it. It ran a mediocre business efficiently and profitably for its shareholders. From 1979 to the present, it has returned an average of more than 31 per cent compounded returns to its investors.

Dividends are reinvested when calculating returns. At the time, both the forging sector and the company had obscure names. Similarly, FMCG is currently a neglected sector. Despite the poor economic conditions, the underlying business is viable.

Companies with a strong brand and an extensive distribution network provide good investment opportunities. So it is with a neglected sector such as technology. Oracle purchased IFlex Solutions for ₹2,100 per share. At ₹980, this stock is available for half the price. Is it possible to go wrong? The industry as a whole, as well as this fantastic company, is underserved.

Initial Public Offerings

Those who have lost money in IPOs, such as yourself, will undoubtedly identify with the points made in this Chapter. Investors use 'Singular Information,' which is recent information, rather than 'Base Information,' which is historical information relevant to the current investment decision. Because IPOs typically appear during a bull market, singular information generally is very positive and exciting. Investors make decisions based on a single piece of information (extrapolation bias) that they later regret. Another point raised in the 'winner's curse' occurs when uninformed investors receive full allocation of bad IPOs (I remember receiving a full allocation of the Orient Green IPO and losing a lot of money).

It listed at a lower price than the IPO price and has avoided the IPO price ever since) because informed investors avoid these IPOs.

According to the Chapter, since 1990, investors have lost money on more IPOs than they have made. Despite this well-known fact, the author finds it perplexing that those who did not receive an allotment in the IPO tend to buy it on the listing, usually at a higher price, as if the stock is some hot target or something. (An example was the craze of Snowman IPOs.)

The Chapter examines the behaviour of various stakeholders in the IPO market and concludes that the notion that IPOs are typically underpriced is incorrect. The company's motivation for coming to IPOs is to get as much money from the market as possible, so they have an incentive to price the IPO aggressively. The bonuses for bankers' issues are determined by how much money the IPO can raise from the market. As a result, they have an incentive to overprice the IPO.

Key Takeaways

It is safe to conclude that IPOs, which appear to be a good investment vehicle, are not. An IPO is a product that works against the interests of investors because it is typically offered to investors when they are willing to pay a higher and outrageous valuation during boom times. Therefore, it is logical for the company and the investment banker to dump these stocks on the investors.

IPOs only enter the market when the management believes they will receive a fair price for their stock.

Evidence suggests that only a tiny percentage of the many IPOs that hit the market reward shareholders. Therefore, it makes sense for wise investors to wait for bear markets to take advantage of such investment opportunities. Of course, avoid chasing these stocks when they first list or during the hot IPO period. There are far too many people who would do so, and when the losses arrive, and their patience wears thin, these same people will offer you these stocks at enticing valuations. Do not be swayed by the newest of the new, as you may end up paying exorbitant prices only to see a drop in your returns.

Index Investing

To understand this, one must first understand the distinction between the philosophies that drive a corporation and those that drive an index. Corporations place a premium on continuity. They may perish if they do not receive fresh blood at regular intervals. Indexes, on the other hand, concentrate on discontinuity. They constantly scan the markets, injecting new potential stock and removing the weaker ones. The index never rests on its laurels in this manner and is always focused on future potential.

This is the fundamental principle underlying Index Investing. The issue arises during execution. Market capitalization is the minimum requirement for a stock to be included in the index. Weak companies can sometimes enter the index by playing the market capitalization game. This is why different index funds perform so differently. Because of this index manipulation, especially in emerging markets, an actively managed active investing strategy can pay out large dividends.

The author cites a study conducted by his team. Beginning in the 1990s, whenever a stock was replaced in the index by a new one, he invested the same amount of money in both on the day the transition occurred. In this manner, he accumulated two portfolios, one of the rejects and the other of entrants. Surprisingly, the team discovered that the portfolio of rejects outperformed the portfolio of new entrants by a statistically significant margin.

Lessons:

Avoid the Bait

Index funds are created by fund houses and asset management companies to entice lower fees. The author wishes life were so simple that you could buy a basket of stocks and then sit back and wait for the market to reward you. The goal of fund houses is to raise the most money possible. It all comes down to massive assets under management and the fees charged on them. Furthermore, they have no standard against which to measure their performance. The index reflects the market, and if the market falls, so will the index. There is power without accountability. We live in a competitive world, and this type of passive investing is clearly out of date.

However, its marketability is very strong because it is a good and effective way to exploit investors' loss-aversion behavioural bias. Lower fees should not entice people to invest in index funds. Do we pick our doctor based on the prices he charges? Certainly not.

His fees are less important than our health. Similarly, our wealth and growth are more important than the nominal fees we try to save.

Availability Bias

All of the information available on index investing is so positive that investors assume it is correct. However, we don't know whether index investing worked because there isn't a benchmark. Furthermore, the stock markets have been volatile, with speculators making and losing fortunes. They lost not because equity is a lousy investment class but because of greed and irrational behaviour. This information is so vivid in investors' minds because it can be found in every bull and bear market. Investing and earning returns is all about the cost of the value received.

Be Courageous

It only takes little guts to go against the grain and act unconventionally. As one's self-esteem and confidence grow, it becomes a habit. Evidence suggests that going against popular opinion pays off in the long run. Have the courage to put this strategy into action.

There are many irrational people around who are eager to provide you with good market opportunities. However, you will be successful if you take your time.

Do Your Own De-indexing

Investing is all about purchasing a stock with the least investor expectations.

Such stocks are discovered when they are removed from the index. We've shown you evidence that such stocks outperform in terms of long-term investor returns. Do some research and select such good stocks that are leaving the index. If you don't want to do that, buy the stocks removed from the index and build your portfolio. We have demonstrated how the laggards performed. You have evidence on your side. To go against the grain, you must have the guts to do so. That is the litmus test for investment success.

Your conviction must fuel your bravery.

Key Takeaways

By the end of the week, knowledge has changed. Trends reveal a great deal to us. Trends are significant because they help us know where we're going and provide evidence. This is what we did in the prior studies.

Index investing is not superior to active investing. On the contrary, based on the difference in returns between the laggards and the replaced stock portfolios, it is safe to conclude that the contrarian approach to indexing works better.

If you want, you can call it "De-Indexing."

Finally, investor returns are determined by the price paid for a stock with the fewest pre-existing investor expectations. To become a successful investor, you must be able to control your emotions and resist the pull of the crowd. Are you capable of defying popular opinion? Go ahead. It's similar to taking the road less travelled. It is only after years of perseverance that you will realise how much of a difference it made.

Bubble Trap

When markets experience bubbles, investors typically suffer significant losses. Investors are looking for answers to four questions.

- How do bubbles form?

- What kinds of bubbles are there?

- How can one tell if a bubble is forming

- How should an investor deal with bubbles?

These questions are addressed in Chapter 11 of Bubble Trap. Bubbles begin to develop as a result of real-world data. For example, the rise in real GDP growth from 6% to 9% signalled the start of the 2008 bubble. As initial investors begin to profit, word spreads, and others waiting in the wings enter, causing prices to rise. There is a general sense of overconfidence and optimism, which leads to bubbles. Market bubbles, sector bubbles, and stock bubbles are examples of bubbles.

Bubbles have two distinct characteristics. One is rapid PE expansion to abnormal levels, and two is the IPO entry of new and small companies into the market. When investing in the market, investors should keep valuations in mind at all times. They should sell and exit as soon as they see PE expanding beyond reasonable limits. Do not wait until the stock reaches the final 5% before leaving.

How can one identify if bubbles are forming / formed?

Lessons From The Chapter Bubble Trap

Valuations do Matter the Most

You cannot pay any price for growth or a new idea or a concept. Ultimately, it is the profits from an enterprise that matter. And for that stream of earnings, there is a price to be paid. That is the value you attach to a stock. Paying a high price for an expected future stream of earnings is a sure way to lose. This is conventional wisdom. No new economy or the advent of any technology can change that. Remember the IT boom. The new adage was “eyeballs”. How many hits a site generated made the company owning that site very valuable. People gave crazy valuations to such companies. Profits did not matter, as in the so-called new internet economy, what mattered was eyeballs.

Investing is all about earning a reasonable rate of return on one’s investment, and that cannot happen if the company does not make profits. Such fads lasted for some time until wisdom dawned and the prices of such internet stocks came crashing down. Most of the real estate, infrastructure and power stocks are highly expensive, but the India growth story is so hyped up that investors believe in paying higher prices for the growth they see in these sectors.

It is challenging to value the land bank of a real estate company. Moreover, in real estate deals, a lot of unaccounted money changes hands in the form of cash. Hence, there is a question of corporate governance. As a result, there is a lack of transparency in dealings; it becomes difficult to value the company. But, in the hope of a boom in real estate prices and the India growth story, investors are willing to buy these stocks at ridiculous valuations.

Take the case of power companies. These companies should deserve the valuations of a commodity company. Moreover, power pricing is also subject to specific government controls. There is no way that, in a developing country like India, which has a power deficit, the power companies will make significant profits to justify high valuations. But power was a hot sector, and power stocks are fancy and media-hyped.

Many capital goods companies and construction companies that will be direct beneficiaries of infrastructure growth are commanding steep valuations even on the infrastructure front. So investors ignoring the valuations are sure to get hit.

Avoid Triple Digit PEs

Another sure way to lose is chasing triple-digit PE stocks. In a bubble situation, the hype and the investor euphoria are so severe that investors pay any price to acquire certain hyped-up stocks. Undoubtedly, sometimes a company comes out with excellent performance due to a breakthrough technology or change in fortunes. However, the investors extrapolate this too far into the future. They are so excited about the salient event that they overreact. They assume that this will be repeated and will thus justify the high price they are paying.

There is no way that such performance can be sustainable. During the technology boom, we saw how even a company like Infosys was commanding a PE of over 100. It was an excellent company with an excellent track record and management. However, such a high PE was unwarranted. There were too much of investor expectations implicit in the price. Any investor who bought this great company in 2000 would lose their investment. Not that the choice of the company was wrong, but the price paid was exorbitant. Even a long-term holding period of eight years could not undo the mistake of paying triple-digit PEs. Reliance is a strong brand in the Indian capital markets. However, some stocks like Reliance Natural Resources Ltd are quoting at a PE of over 700. Reliance Infrastructure is at a PE of over 190.

Such valuations cannot be sustained in the long run, and investors are bound to get hurt. Similarly, another real estate company India Bull Real Estate Co, was at a PE of over 800 in January 2008. With the meltdown in the market in March 2008, it declined to trade at a PE of over 600. A dangerous PE at which to buy a stock. However, The Economic Times reported on 20th March that George Soros, the billionaire investor (speculator), had picked up a 2.5% stake in the company at Rs.455.80.

If one is investing, it is a dangerous thing to do. No wise investor would do this. This is speculation. Investors take the cue from such news and make investment decisions. It is on the assumption that George Soros knows all. However, he is human and prone to make mistakes as much as you are. His speculation does not make the investment instrument any better. It remains a triple-digit PE stock, and investors need to avoid it. In times of madness, anything can happen. Even a public sector company, MMTC of India, commanded a PE multiple of over 800. This soon crashed, to the dismay of greedy investors who paid such a lofty valuation.

Mid-Cap and Small-Cap Stocks

Once the highly capitalized stocks start getting expensive, the market is looking at identifying new opportunities. Thus, the focus shifts to the mid-cap and the small-cap stocks. The growth stories of the hot sectors are woven around these stocks. There is nothing wrong with mid-cap or small-cap stocks, but the problem is representative thinking in a market bubble. When the leaders become expensive, it is effortless to rig the mid-and small-cap stocks. Due to their lack of liquidity, their rise becomes fast, becoming operator favourites.

Unscrupulous management, operators and brokers take advantage of a bubble phase in specific stocks and sectors by rigging the mid-cap and the small-cap in these representative sectors. Since IT stocks were doing very well during the IT boom, we found that many small and less-known companies attracted investor attention due to representative bias. When the tide turned, these stocks became worthless paper. Examples of smaller companies affixing the words ‘dot com’ to their names became sought-after companies, and investors paid a heavy price for chasing them.

Moreover, the mid-cap and small-cap stocks become highly illiquid when the bull market ends. In such a situation, they lose their value very fast without any buyers. After the Harshad Mehta boom in the early-1990s, when the financial sector liberalization started, we had a boom in the financial services industry. Any company having a financial services business was sought after.

When the party ended in 1995, investors were left with worthless paper and the entrants in the industry without jobs. Revisiting the real estate sector, we had new entrants in the mid-cap category entering the markets to take advantage of the boom. Akruti City was one such stock, commanding a lofty multiple of over 90. Similarly, Mahindra Life Space Developer became an investor craze with over 160.

Avoid Large Little-known Companies

In a bubble phase, little-known companies tend to become large due to the market capitalization going up because of the price increase. Such companies attract media and investor attention.

Analysts always want new ideas and thus are born such growth ideas around little-known companies. These companies being in the limelight, become famous and their recall value in the minds of the investor increases. Visual Soft during the IT boom is a fine example of a little-known.

The Hyderabad-based company became large because its stock price went up to ₹Rs.10,000 for an ₹Rs.10 face value. It was the talk of the town, recommended heavily by reputed investment bankers, brokers and analysts. Unfortunately, investors lost a fortune when the tide turned. Financial Technology is another little-known company that came into the limelight due to its fast-growing financial sector and its knowledge base of stock exchanges. It promoted the Multi Commodity Exchange of India. It is an excellent company, with able promoters and a good business model. However, the triple-digit valuation of over 120 PE in the mid-cap category makes it an unattractive investment idea. There are many such examples in the hot sectors like real estate and infrastructure.

Information Asymmetry

Beware of information asymmetry. Information travels in a channel, right from the people surrounding or involved to the ultimate recipients, the investor. The medium encapsulates various mediums and forms. From management updates to stock exchanges to business news channels to sources close to the company to your next-door neighbour who knows somebody in the company.

When you are bombarded with information from various directions, always consider what part of the news reflects the ground reality and what part is somebody else's interpretation of that event. Be critical in your reaction to such news items; otherwise, one might have to face seemingly reliable news turning out to be a hoax, resulting in losses and distress. Moreover, one has to be aware of what step of the information ladder one is.

If one is not at the second or third step of the information ladder, one is likely to be a loser. Availability heuristics create such information ladders. These are made through websites, blogs, newspapers, business magazines and rumours. They also have geographical variants. For example, information in Mumbai city could be old and tenth on the information ladder. Still, in Ahmedabad, the same could be brand new information and first or second on the ladder. The initial investors become salesmen and spread the information more widely. It is only when such inside information becomes public news, and many investors chase it that the stock price goes up and the initial investor's exit. To avoid being an investor who would help the initial investors to exit.

Always check how fast the stock has appreciated in the near past.

This Time it is Different

Every bubble phase has a new theme; however, the excesses are the same. The institutional memory of investors, though decisive regarding the past mistakes in bubbles, fails to help them as they believe that “this time it is different”.

Every bubble signifies excesses and irrational crowd behaviour. This leads investors to buy expensive stocks, buy what others are buying, buy what is fancy in the markets and buy dreams.

However, every new bubble has a unique story, justifying how this is very different from the past bubble. These are just new ideas and fads to act upon the new mania.

During the technology boom, did we not hear “this is the new economy emerging”, “the old rules do not apply”, and “bricks and mortar is dead”? The Indian growth story is leading to excesses in sectors like infrastructure, real estate, and power in the recent past. Stocks in these sectors have been investor favourites and available at expensive multiples. But over a more extended period, the excesses will be corrected. Certain universal principles do not change, irrespective of other changes: A company has to make a profit to reward its To earn returns, one has to buy at the right price; valuations matter the most, there are no short-cuts, and you cannot sow today and reap tomorrow. Irrespective of different times and circumstances prevailing, the universal principles do not change. The euphoria of markets makes one forget the conventional wisdom.

Never Get Married to your Stocks

One common mistake investors make falling in love with their stocks so much that they are not willing to part with them. Yes, one could be lucky to make a fortune in a particular stock, as one was lucky enough to buy it at the right price. But, what must one do when the stock has risen and becomes expensive? There are chances of one getting into a decision paralysis mode.

One must undertake this small exercise:

1. Ascertain the profit you are making on the stock.

How many times have you been lucky enough to make much money? Do these opportunities come often? What can you do with this money? This will set the clarity for your decision-making process.

2. Thereafter, assume that you have money and need to invest.

Ask yourself if you would buy the stock at this rate? If the answer is yes, don’t sell. If the answer is no, sell your stocks and keep the cash handy to buy when the markets offer good buying opportunities. Remember, bull and bear markets follow each other. Cash is the king. Opportunities always come, but you need to have the cash when they arrive. This cash can come when you follow the basic tenets of investing: buy low and sell high. There are many foolish people around who will give you such opportunities. So never get married to your stocks.

Never Short-Sell

After understanding the signs of a bubble, one may become confident and think of short selling, the act of borrowing shares and selling them to repurchase them when the price drops. This temptation needs to be avoided, as a bubble can last longer than one imagines. A stock at a triple-digit PE of 100 may be overvalued, but the market's euphoria can take it up to even 600. No one can judge how long the madness will last. There is another danger in short-selling. If one buys a stock at a price, one knows the maximum loss one can make. However, one does not know how much the stock will go up when one short sells.

If one buys a stock at ₹50, the maximum damage is ₹50 if the stock goes down to zero. However, if one sells a stock at ₹50, the loss is unlimited. The stock can go up to ₹100, 500, 1,000. Or even ₹10,000. When buying a stock, one can borrow money from various sources to pay for the stock. However, when one short-sells the stock, one needs to go to the stock owners to borrow. And these owners can demand any price. One's universe of borrowing is very small. The stock market contract is thus heavily biased towards the buyer.

Moreover, every government would like the markets to be moving up, as that signifies a healthy economy and sound economic policies of the government. The world over, stock markets are the barometer of the financial health of a country. Whenever there is a crisis in the stock markets, the government comes to the rescue. Large government institutions step in to buy to support stock prices, the Finance Minister soothes the sentiment by announcing stimuli, the Reserve Bank brings down interest rates, etc. In such a situation, a short-seller is never respected and is seen as unpatriotic. He cannot have any government sympathy, although he only defies the market stupidity. So it is best to watch the "fun" end and then buy your stocks at reasonable valuations.

Key Takeaways

Investors would do better in investing and in all walks of life if they kept in mind the behavioural biases that affect clarity in thinking. Money is good as long it is in the pocket. It becomes dangerous when it goes in the head. That is when we become irrational and start making blunders. ‘House money effect’ is used to denote the tendency common amongst gamblers playing in casinos, where they are ready to take more risk with money earned quickly or unexpectedly, which is eventually what success in gambling means.

This tendency is not limited to gamblers in the casinos; it is prevalent in the stock market, particularly during bull runs. As the bull run moves from stage to stage, the money made during one phase is put at risk much more quickly as the thrill and ease associated with making money in the market increases. Thus, just as an investor avoids taking a risk before the onset of the bull run because he values his money more highly, he eventually becomes much more vulnerable to parting with his money, which has grown somewhat during the initial stages of the bull run. This, in part, explains what makes market valuation lose touch with economic reality. Human beings tend to credit their successes to themselves, whereas their failures are attributed to external variables. This bias is termed as ‘attribution bias’.

Money is made mainly backed by the overall increase in stock market levels because of increased demand for stocks. People start attributing their successes to themselves and become more and more confident about their abilities and methods. But any event is a confluence of internal and external factors, and the same is the case in investing. Thus, when an investor makes money, he should reason his success by appreciating any unforeseen event, which led him to make money out of a trade and, accordingly, weighs his strengths against his weaknesses, rather than blindly attributing all the success to himself. If he fails to do so, he will cease to see the linkage between cause and effect, and the result will not be favourable in the long run. Imagine the confidence you will have if you can spot a bubble. Waiting for it to burst can open up a host of opportunities to make a fortune. But it requires courage and patience—rare attributes amongst humans accustomed to quick fixes and instant gratification.

Investor Behavior-Based Finance

The book's final chapter discusses Investor behaviour-based Finance. Just as an investor will benefit from researching a company before investing, a company will benefit from understanding its investor profile before making any major corporate finance decisions. For example, some investors may be long-term, while others are medium-term, and still, others are short-term. Some investors may be focused on the organisation, while others may be focused on the management. In contrast, still, others may be focused on the company's strategic direction, while still others may be focused solely on the financials. With this knowledge, a company can predict the impact of its decisions on its share price and decide whether such movement is acceptable.

Key Takeaways

Why Investor Behavior-Based Finance?

Financial markets are growing all over the world. Every country needs to attract capital for its growth, and what better route can there be than the stock markets? Borders are opening up and, with the use of new technologies such as the internet, information is available to all. Thus, financial markets have become very fluid. With the click of a button, transactions take place. This has led to the growth of an investing class hungry for investment opportunities to make a fast buck. The chaos in the market, along with the emotions of greed and fear, have created

investors who are very short-sighted and unpredictable.

It is essential to understand the behaviour of these investors so that we can manage their perceptions and, thereby, control the volatility in the stock prices due to their actions. They are the corporation's stakeholders, and understanding their behaviour will help the corporation manage its stock volatility.

What are the Benefits?

• Identifying and mapping investor behavior leads to better understanding of the investor base

• Being proactive leads to informed decisions

• Increase faith and trust with investors

• Transparency leads to investor-friendly strategies

• Make stock price less volatile

• Manage investor perceptions

• Create better understanding of the company

• Manage irrational behavior of investors

• Completes the missing link with employees, customers and Suppliers

Conclusion

Investors' emotions and behaviour heavily influence the field of equity investing. Greed and fear are the two primary emotions that drive investors. Understanding these emotions is essential for becoming a successful investor. When making investment decisions, an investor employs a variety of heuristics. Some of them may be explicit, while others may be implicit. Some may be beneficial, while others may be harmful. They will become a better investor if they know the heuristics that they employ. This is where this book comes in handy.