Macro Factors in Stock Investing

Introduction

To pick up the right stock in the market, it is essential to estimate the intrinsic value (fundamental value) of a stock. Intrinsic value is primarily based on fundamental analysis of a company that includes both qualitative & quantitative macro factors. However, the fundamentals that need to be considered will depend on the analyst’s approach to valuation.

There are various methods to analyse stock investing decisions, fundamental analysis being one of them. Two most important methodologies that can be used by analysts while selecting stocks are:

- Top-Down Approach

- Bottom-Up Approach

The decision between the two approaches is largely a matter of personal interest. Let’s understand each of the two approaches in detail.

Top-Down Approach for Stock Investing

Firstly, let us start with the top-down approach for stock investing.

What is the Top-Down Approach?

A top-down approach is essentially the breaking down of a system to gain insight into its compositional subsystems.

In a top-down approach, an overview of the system is first formulated, specifying but not detailing any first-level subsystems. Each subsystem is then refined in greater detail, sometimes in many additional subsystems.

In a top-down approach, an analyst examines the economic environment, identifies sectors that are expected to prosper in that environment, and analyses securities of companies from previously identified attractive sectors.

Securities are valued with a forecast of the direction of the general economy projected against the outlook of the industry as a whole. Subsequently, we select our preferred picks from the industry that are suitably poised to make the most out of existing business tailwinds.

In this method, the investor starts the analysis by looking at the macro factors such as monetary policy, inflation, economic growth and broader events, before working on an individual stock.

The investor looks for the macro factors, events prevailing in the market and tries to understand the opportunity that could be derived from it.

For example, The Government of India’s push for a cleaner fuel has led to a surge in Ethanol demand from Oil Marketing Companies (OMCs). With the industry outlook bullish, we will now look for companies that can seize this opportunity to the fullest. Our next natural step would be to hunt for those sugar companies that have a sizable ethanol capacity at hand or those with mega expansion plans. We now build a position in these stocks.

What is the Rationale Behind the Top-Down Approach?

The core rationale behind the top-down approach of security analysis can be understood from the perspective of River rafting.

Let us suppose that a river is flowing at a rate of 8 km/hr. Then as you are sitting on the raft, even if you do not use your one bladed guide stick (paddle), you will still flow at the speed of 8 km/hr.

However, if you start using your paddle in the direction of the river flows, you can flow at 10, 12 or maybe even 14 km/hr just by giving more and more thrust.

In the same analogy, the economy acts like a river. If the economy grows at around 9% per annum, most of the industries will grow at this rate. As an analyst, our objective is to identify macro factors that indicate which industries can grow faster than the economy & therefore find companies that can outperform their respective industries.

In river rafting, the raft that exerts more pressure flows faster than the river and eventually wins the race. In the same manner, the industries that grow faster than the economy and companies which grow faster than the industry handsomely reward their shareholders. This approach is central to smart stock investing strategies.

Most top-down investors are macroeconomic investors, focused on capitalizing on large cyclical trends rather than individual equities. This means that their strategy is more about capitalizing on macro momentum and short-term gains than any kind of value-based approach to find undervalued companies.

Bottom-Up Approach for Stock Investing

The Bottom-Up approach is precisely the opposite of the top-down approach that we covered previously. So in this unit, we will discuss the bottom-up approach for stock investing.

What is the Bottom-Up Approach?

In a bottom-up approach, an analyst typically follows an industry or industries and forecasts fundamentals for the companies in those industries in order to determine relative valuation. In this method of stock investing, the investors:

- Start their analysis by looking at individual companies and then building a portfolio based on their specific attributes.

- The investors tend to focus on the micro-economic factors in this method of stock investing.

- They select their stocks on the basis of their stock selection criteria such as price to earnings multiples, debt to equity ratio, cash flows, management integrity, etc.

- Evaluate analyst reports and other research papers available on those stocks before taking a stock investing decision.

- They tend to buy-and-hold their investments being investors since they invest a lot of time researching individual stocks. This means that their investments may take a longer time to play out, but could be more effective at managing risk and ultimately increasing risk-adjusted returns being focussed more on fundamental parameters.

The above three types of analysis are essential for conducting both top down and bottom up approaches of fundamental analysis. We will discuss Economic analysis, Industry analysis and company analysis respectively in the next subsequent sections.

Economic Analysis

What is Economic Analysis?

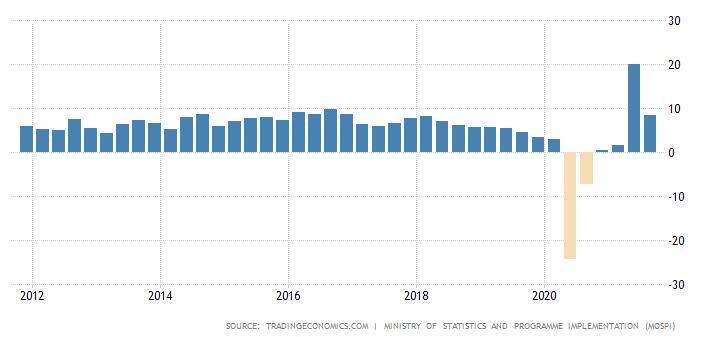

All the common stocks are susceptible to the change in the economic conditions. The deterioration or improvement of economic conditions can lead to fluctuations in the stock price. Hence, it is very important to perform economic analysis to understand the prevailing macro factors affecting stock prices.

What are the Macro Factors to Analyse the Economy?

Fiscal Policy

Fiscal policy is one of the key macro factors employed by governments that affects the demand & supply dynamics of the economy to maintain the economic growth, specifically by adjusting the levels and allocation of taxes, subsidies & government expenditures. For investors, understanding such macro factors is essential for making informed stock investing decisions.

If the tax rate increases, the demand in the economy decreases and if the tax rate decreases, the demand increases. Likewise, changes in the level of Government spending affects overall demand for goods & services.

The Fiscal policy can be contrasted with the other main type of macroeconomic policy i.e. monetary policy, which attempts to stabilize the economy by controlling interest rates and the supply of money. Both fiscal and monetary policies are critical macro factors that influence market behavior and stock investing outcomes.

The two main instruments of fiscal policy are government expenditure and taxation. Any changes in the level of taxation and government spending can have an impact on the following variables in the economy:

- Aggregate demand and the level of economic activity

- The pattern of resource allocation

- The distribution of income

Monetary Policy

In the same manner, Monetary Policy, among key macro factors, is used by the Central Bank to control the economic growth rate. If the Reserve Bank increases the repo rate, the demand for money decreases (since cost of borrowing funds has increased). This reduces the money supply in the economy, cools down prices and puts a downward pressure on demand. If interest rates fall, money supply increases which puts an upward pressure on prices, i.e. stokes inflation & increases the general demand for goods & services.

Monetary policy can either be expansionary (dovish) or contractionary (hawkish) in nature.

An expansionary monetary policy is in favour of lower interest rates with a view to increase money supply in the economy and vice-versa. An Expansionary policy is traditionally used to combat recession.

Similarly, contractionary policy reduces the supply of money in the economy using higher interest rates as a means. A contractionary policy is used to tame inflation.

Understanding how monetary policy influences economic conditions is crucial in stock investing, as these macro factors significantly impact market trends, corporate earnings, and investor sentiment.

Industry Analysis

What is Sector or Industry Analysis?

After economic analysis of key macro factors, we need to determine those industries or sectors which will prosper or suffer according to the economic outlook.

Sector or Industry analysis is carried out by investors who use a top-down or sector rotation approach to stock investing. It has been empirically observed that specific sectors outperform during certain phases of the market cycles. During different stages of the business cycle, certain sectors perform better in comparison to others.

The business cycle is comprised of expansions which are periods of economic growth, and contractions, which are periods of economic decline. During the expansion phase, investors normally focus their research on companies that benefit from low interest rates and increased Capex. During the periods of economic growth, performance of companies in the Financial and consumer discretionary sectors increase.

When the economy contracts and growth slows down, Investors focus shifts to defensive sectors, such as utilities and telecommunication services as these sectors often outperform during economic downturns.

To succeed in stock investing, we need to consider how macro factors influence industries that might be cyclical or counter-cyclical, analyzing how well or poorly individual firms in the industry will perform amid global shifts.

Example:

Let’s discuss 'Dabur Ltd' that belongs to the FMCG Sector.

Management & Discussion Analysis of Dabur Limited Annual Report 2020 states the following with respect to FMCG Sector Analysis

“The Fast-moving Consumer Goods (FMCG) sector is the 4th largest sector of the Indian economy. During FY 2019-20, the sector witnessed growth of 7.2% as per AC Nielsen, which is almost half of the 14% growth reported in FY2018-19”.

The sector saw a sharp slowdown during the year on account of various reasons:

- Moderation in economic activity

- Low farm incomes

- Weak rural wage growth

- Liquidity crunch in the system

- High unemployment levels

By March 2020, the sectoral growth dropped to 3.3% in value terms and 0.5% in volume terms.

The Coronavirus pandemic has further impacted the sector since March 2020 due to restrictions on the movement of goods, supply side bottlenecks and impact on consumption.

Consumers have been stocking up essential products such as packaged foods, staples, tea, coffee, milk, detergents, and other products of daily usage.

During this phase, demand has also surged for health and hygiene products as these aspects came into sharp focus. There was a surge in demand for hygiene products like sanitizers and disinfectants in addition to immunity building OTC (Over- the-Counter) and healthcare products.

However, “discretionary and nonessential items have seen weak demand as the focus during the lockdown has been on food and hygiene.”

Inference:

From the above excerpt taken from the annual report of Dabur ltd, we get an idea about the particular sector growth and the future outlook of the particular sector. It gives a fair idea of the economic and financial prospects of a sector and industry of the economy.

This analysis helps to identify the area where strategic changes will help to maximize profitability. It gives us knowledge of the untapped opportunities in the sector and economy.

We could conduct industry analysis using Michael Porter’s five force model. Porter is a Harvard Professor renowned for his work in developing a specialized industry analysis model. This is an appropriate way to assess the structure of an industry.

It is one of the ways to analyse whether the industry will prosper or suffer as the economy's outlook changes.

One of the simple but useful approaches would be to answer a set of questions-

1. Is this an appropriate industry for stock investing?

2. Are there any quality players even if the industry is average?

3. What are the challenges and growth drivers for the industry?

4. Who are the dominant players and why are they dominant?

5. What are the factors which will shape an industry’s future?

Porter believes that the combined strength of these five forces shapes industry’s potential for value creation.

Threat of new Entrants: It refers to the threat which new competitors would pose to the existing competitors in the industry. The lower the barriers to entry, higher are the chances of new entrants in the market. The threat from new entrants affects the level of competition for the existing peer firms and also influences the ability of existing firms to achieve profitability.

Higher levels of competition would lead to decrease in market share and profitability of existing firms.

The factors that may affect the threat of new entrants are-

- Government restriction

- Higher switching cost

- High fixed costs

- Existing loyalty to major brands.

Bargaining power of suppliers: This means how much pressure suppliers can put on a business. Suppliers of raw materials, components, labour, and services (such as expertise) to the firm can be a source of power over the firm, when there are few substitutes.

If one of the suppliers has a large impact on the margin and volume of the company, it means the supplier has substantial bargaining power. A strong supplier can make an industry more competitive and decrease profit potential for the buyer.

The factors leading to supplier power are as follows: -

- Presence of substitutes

- Higher Switching Costs

- Number of suppliers dealing in a product

- Product is a necessity to the consumers.

- Suppliers Switching Costs Relative to Firm Switching Costs

- Supplier Concentration to Firm Concentration Ratio

Bargaining Power of Buyers: This means how much pressure a buyer can place on a business. It is described as the market of outputs: the ability of customers to put the firm under pressure, which also affects the customer's sensitivity to price changes.

The more the buyer's concentration, the better is the impact they can create. Buyers increase the level of competition within an industry by bargaining for better services and reduced prices.

In order to assess the power of buyer, here are the conditions which you need to look into-

- Concentration of buyers

- Sensitivity of customers

- Volume of transactions

- Degree of Dependency upon Existing Channels of Distribution

- Bargaining Leverage, Particularly in Industries with High Fixed Costs

- Buyer Switching Costs Relative to Firm Switching Costs

- Buyer Information Availability

- Ability to Backward Integrate.

Threat of substitutes: Substitute goods are those goods that fulfill the same purpose and can be used in place of one another. For instance, tea & coffee, butter & jam, amongst others.

The threat from a substitute in an industry affects the competitive environment for the firms in that industry and influences the firm’s profitability.

The availability of a substitution threat affects the profitability of an industry because consumers can choose to purchase the substitute instead of the industry’s product.

The existence of products outside of the realm of the common product boundaries increase the propensity of customers to switch to alternatives.

The factors to be considered are:

- Buyer's Propensity to Substitute

- Relative Price Performance of Substitute

- Buyer Switching Costs

- Perceived Level of Product-Differentiation

- Number of Substitutes Available

- Ease of Substitution

- Standard Product

- Quality Depreciation

Competitive Rivalry among the Industry: It refers to the extent one firm exerts pressure on another firm within the industry and restricts each other’s profitability. If the level of competition is intense, competitors may try to eat away the profit and market share from one another.

Highly competitive industries generally earn a low return on capital. The factors which should be looked upon are:

- Changing Prices

- Improving Product Differentiation

- Using Channels of Distribution

- Exploiting Relationships with Suppliers

The intensity of rivalry is influenced by the following industry characteristics:

1. A larger number of firms increases rivalry because more firms must compete for the same customers and resources. The rivalry intensifies if the firms have similar market share, leading to a struggle for market leadership.

2. Slow market growth causes firms to fight for market share. In a growing market, firms are able to improve revenues simply because of the expanding market.

3. High fixed costs result in an economy of scale effect that increases rivalry. When total costs are mostly fixed costs, the firm must produce near capacity to attain the lowest unit costs. Since the firm must sell this large quantity of product, high levels of production lead to a fight for market share and result in increased rivalry.

4. High storage costs or highly perishable products cause a producer to sell goods as soon as possible. If other producers are attempting to unload at the same time, competition for customers intensifies.

5. Low switching costs increase rivalry. When a customer can freely switch from one product to another, there is a greater struggle to capture customers.

6. Low levels of product differentiation are associated with higher levels of rivalry. Brand identification, on the other hand, tends to constrain rivalry.

7. Strategic stakes are high when a firm is losing its market position or has potential for great gains. This intensified rivalry.

8. High exit barriers place a high cost on abandoning the product. The firm must compete. High exit barriers cause a firm to remain in an industry, even when the venture is not profitable. Competitive Rivalry among the Industry is an external factor, and the rest of Porter's forces are internal factors.

Case Study – Non-Banking Financial Companies (NBFCs)

Now that we have learned- Porters' five force theory & how it can be helpful to make industry analysis. Let's do a case study on the NBFC sector applying the same theory.

NBFCs are financial companies that offer loans to individuals and corporations. NBFCs cannot take deposits, they are not a part of the payment and settlement system and they do not fall under the deposit insurance scheme. They fall mainly under three main categories that are Asset Finance Company (AFC), Investment Company (IC) and Loan Company (LC).

In addition, NBFCs provides –

- Asset Management: Fund management and portfolio management

- Insurance: Life insurance and General Insurance

- Broking: Securities FX and GTC contracts

- Finance: Mortgages, Personal Loans, Business loans and Vehicle Loans

- Others: Institutional Brokerage and Private Equity

Analysis of Porter's five forces:

Threat of New Entrants: The sector is dominated by few large companies and it requires high capital to operate at pan India level. Government regulations are also high and Brand equity is important for trust. So, we can say threat of new entrants is low but the influx of foreign companies is imminent as the regulation eases and it is easy for small players to enter the market place.

Bargaining power of customers: Bargaining power is high as switching from one supplier to another is relatively easy depending on product i.e., insurance, loan etc. A number of suppliers in the market place are offering a wide variety of products.

Bargaining power of suppliers: Bargaining power is high as the suppliers have many choices where to invest their money.

Threat of substitutes: There are certain products which cannot be replaced but there are various investment products such as gold, land, assets and cash. Increased consumption demand may lead to less savings and thus less investment.

Rivalry among competitors: The number of people aware of stock investing products offered by NBFC is very low, so there is a possibility of large expansion with development of new products. Some companies have significant customer loyalty due to branding. Many of the companies are following similar strategies for expansion and this is the reason a large number of similar products are available to customers.

PESTEL Analysis

PESTEL analysis is very similar to Porter's Five Force Theory.

Porter's Five Forces evaluates the competitive situation, whereas PESTEL identifies how several macro-environmental factors may affect an organization or a sector and its competitive standing. As we have already covered Porter's Five Force Theory earlier, let us begin with the PESTEL analysis.

PESTEL analysis stands for "Political, Economic, Social, Technological, Environmental and Legal analysis" and describes a framework of macro factors used in the environmental scanning component of strategic management.

- Political factors, as important macro factors in the economy, can be thought of as the extent of government intervention that can significantly impact stock investing. Specifically, political factors include areas such as tax policy, labour laws, environmental laws, trade restrictions, tariffs, and political stability. Political factors may also include goods and services whose production & consumption the government intends to boost/restrict.

- Economic factors include economic growth, interest rates, exchange rates and the inflation rate. These macro factors have major impacts on how businesses operate and make decisions and understanding them is crucial for successful stock investing.

- Social factors include the cultural aspects and health consciousness, population growth rate, age distribution, career attitudes and emphasis on safety. Trends in these macro factors affect the demand for a company's products and how the company operates.

- Technological factors include ecological and environmental aspects, such as R&D activity, Automation, Technology incentives and the Rate of technological change. These macro factors determine barriers to entry & exit as well as minimum efficient production level and thus influence outsourcing decisions.

- Environmental factors include weather and climate change, which may especially affect industries such as tourism, farming, and insurance to be considered for stock investing.

- Legal factors, as important macro factors in stock investing, include discrimination laws, consumer laws, antitrust laws, employment laws, and health and safety laws.

Company Analysis

Lastly, we need to perform the stock analysis i.e., comparing firms on the basis of financial ratios and cash flow analysis.

A bottom-up approach assumes that an individual company might perform well in an industry that is not performing very well. A Bottom-up approach is just the vice versa of the Top-down approach. Making sound decisions based on a bottom-up stock investing strategy entails a thorough review of the company in question. This includes becoming familiar with the company's products and services, its financial stability and its research reports.

Before discussing the steps of making a company analysis, let us discuss-

What is Company Analysis?

Company analysis is a process of evaluating a company's value by digging deep into its fundamentals to get a fair view of it.

What are the Factors Affecting Company Analysis?

- Qualitative factors take into consideration the business model, competitive advantage, management & corporate governance.

- Quantitative factors deal with the industry growth & the company's growth along with its peers.

Pros & Cons of Company Analysis:

- Company analysis helps in understanding & getting the details about a company which further guides our stock investing decision.

- But on the other hand, too much analysis leads to nowhere, but a lot of questions, doubts & fear which might affect our decision of stock investing.

How to Evaluate Company Fundamentals?

- Understanding the business model is the primary & essential part of the process of company analysis.

- Analyzing the profit & loss statement along with the balance sheet and the cash flow statement is the next important part of the company analysis process.

- Finally, peer comparison should be made with the available data to get a comparative view of the company.

Let us discuss the steps in the company analysis process: -

1. Identify Company and Industry’s Economic Characteristic:

We need to start off by knowing about the company and the industry it operates in. This step will help us in getting an idea as to which part of the value chain does the company fits in as well as its closest peers.

Source – StockEdge

2. Identify and Know About the Products and/or Services:

After getting to know the overview of the company, we need to know the specific products & services offered by the company.

We have to also look at the nature of the product being offered by the firm, uniqueness of the product, demand and supply dynamics, market share, brand awareness in the geographical area it is present in.

For example: IRCTC is the only company which offers the platform to book online railway tickets for travellers. There is no competitor for this type of service in India which is a big positive for the company.

3. Understanding the Risks and Concerns About the Company:

Every business and industry has its own set of specific risks and concerns which might impact the performance and profitability of the company.

So, as an investor it is very important to get an idea as to the risks the company is exposed to in case of any eventualities.

For example, crude oil is an important component in the manufacturing of paints which constitutes around 55% of the raw materials, so the fluctuations in the crude prices will likely impact the EBITDA and the margins of the company manufacturing paints.

So, we need to check and analyse, to which extent will that particular risk affect the business and can the company overcome it.

For example: Currency volatility is an important risk for the IT industry as it generates the majority of the revenues from other countries. Here we need to check how and to what extent will currency appreciation or depreciation impact the company’s performance.

The Company’s Annual Report also contains the risks and concerns that the company is exposed to.

The 'Management Discussion and Analysis' section lists the risks which the company might face in its operations along with the steps it is taking to overcome those situations.

4. Analysing the Financial Statements:

This is one of the most important steps in the process to analyse a company.

The financial statement gives us the actual quantitative picture of any company which is an important part.

Income statement is the financial document that measures a company's financial performance over a specific accounting period. Financial performance is assessed by giving a summary of how the business earns and incurs its revenues and expenses through both operating and non-operating activities.

Source: StockEdge

From the Balance Sheet we get an idea as to how strong the company financially is. It offers a snapshot of the company's health. It tells us how much a company owns (assets) and how much it owes (liabilities) at a particular point in time. The difference between what it owns and what it owes is its equity, also commonly called "net assets" or "shareholders equity".

The balance sheet is named by the fact that it represents a business' financial structure balances in the following manner:

Assets = Liabilities + Shareholders' Equity

Cash Flow Statements gives us a detailed account of the company’s cash transactions from operating, investing and financing activities. It helps in understanding the firm’s liquidity position. Cash Flow statement is a document which provides aggregate data regarding all cash inflows of a company from both its ongoing operations and external investment sources and all cash outflows on account of business activities and investments during a given quarter or year.

Finally, it is also important to go through the ratios in a comparative manner, in relation to the past periods or relative to the other players in the industry.

Conclusion

As we have come to the end of this module, it is clear that analyzing the macro factors of the economy is vital before stock investing. This module has established a basic understanding of why macro factors of the economy are essential and how to apply them when conducting stock analysis for investments. Similarly, we have designed other modules on ELM School that help you get more knowledge on stock investing. So, be sure to check them out as well.