Corporate Governance

Introduction

Corporate Governance. Quite a fancy word. Isn't it?

A lot of trouble was brewing in the landscape when I started my tryst with the stock markets. Lehman had just declared bankruptcy and the global economy was in dire straits. I had no clue what was going on. Yes, housing prices ran up way too much, so what? What does Corporate Governance have to do with something like housing prices?

Turns out, it had quite a lot of muscle. I realized the vigor behind these two words only after going through a full-blown crisis period. The bankruptcy of a single firm sent nerves chilling in all parts of the world. And it was nowhere like the fall in early 2020. The Lehman Crisis was a byproduct of lax Corporate Governance standards. It was entirely man-made in nature and had much to do with more fancy terms like risk controls, subprime lending, over-leveraging, Collateralized Debt Obligations (CDO’s), Credit Default Swaps (CDS), Mortgage Backed Securities (MBS), and others.

“Corporate governance involves a set of relationships between a company’s management, its board, its shareholders, and other stakeholders. Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined.”

- G20/OECD Principles of corporate governance

Jaiprakash Associates, Suzlon Energy, Unitech, Satyam, Kingfisher Airlines, Jet Airways, Inox Wind, Punjab National Bank, Cafe Coffee Day, Vakrangee, Yes Bank, DHFL, Indiabulls Housing Finance, IL&FS, and so on. The failure list of Corporate Governance in India is extensive & endless.

Frankly speaking, Corporate Governance is a comprehensive term. It can be interpreted in several ways according to one's level of expertise. It is amorphous, i.e., it is not clearly defined. There are no fixed parameters for us to measure the quality and quantity of Corporate Governance. Neither is it possible for us to explain this term in a single phrase. One can informally think of Corporate Governance as a unifying force that allies the interests of the management with the shareholders. We will try to analyze a lot of aspects in this module to get a better understanding of how and why Good Corporate Governance is so vital to the success of any organization.

The Two Thin Lines

Now that we have a brief idea on Corporate governance. We will discuss the differences between a company's owner or shareholders from its management and how corporate governance has a major role in it.

The thematic discussion behind Corporate Governance rests on the point that ownership should be separated from control. This means that the owners of a company are those who own that company's stock & the management are merely their well-paid employees. It should be noted that the people running the company are elected representatives of the shareholders. It is neither plausible nor possible for the varied, numerous & dispersed shareholders to come together & manage the company's day-to-day affairs. Hence, full-time management is essential for the working of public companies & talented management is a valuable asset to an organization.

Corporations pool capital from a diverse investor base both in the domestic & international capital markets. In this context, investment is ultimately an act of faith in the ability of the company's management. When an investor puts his money in a corporation, he expects the board & the management to perform their fiduciary duties such as ensuring the safety of capital & also achieving a rate of return that is higher than the cost of capital. In this framework, investors expect management to act ethically & in their best interests at all times.

Companies can either be family-run or professionally managed. Let us discuss them in greater detail:

Q: What is meant by family control?

- Family control may constitute equity ownership, board representation, or senior management positions. It amounts to the degree to which the family exerts influence in the strategic direction & management of a company.

Q: What are the benefits of investing in family-controlled businesses?

- The background advantage - In maximum cases, the current & future employees of such businesses have been immersed in that environment since they were toddlers. This exposure gives them an intimate understanding & awareness of the firm's business model. Such expertise may be difficult to imitate by outsiders.

- Experience matters- Seasoned management have tackled several industry cycles in the past & know the appropriate plan of action to steer the company through difficult times. It is aptly said that a strong family background gives rise to world-class entrepreneurs.

- Low employee turnover is another calling card of family-controlled businesses. It beckons for higher productivity and a robust corporate culture. The shared long term vision & ethos adds further brownie points.

- Prudent decisions- Family-owned businesses are known for their conservative nature. They are less likely to be overleveraged or indulge in accounting gimmicks.

Governance 101

This is going to be a lengthy & excruciating read so brace yourselves. We understand that these theoretical lessons are like the History classes at school & it is nothing but natural to lose interest. We will try to keep the module as engaging as possible but do us a favor and grab a cuppa of coffee just in case.

Keep in mind, the devil lies in the details and you must be adept in spotting areas of trouble in the company.

The Need for Corporate Governance Standards:

- Accountability: Investor relations are a crucial part of good corporate governance. Investors directly/indirectly assign the management the responsibility to generate returns on their investment. The term accountability simply means that actions have consequences. When Corporate Governance incorporates the principle of accountability, shareholders know that performance will be measured. Good performance will be rewarded & poor performance might be penalized. More importantly, misconduct & manipulation will not be tolerated. The principle of accountability & transparency goes hand in hand.

- Enhanced Investor Trust: Investors love it when companies are transparent in their dealings. A survey by the consulting firm Mckinsey & Co. states that institutional investors are willing to pay up to 40% premium for companies that demonstrate superior corporate governance practices. For instance, FMCG Firms like Hindustan Unilever & Nestle India command much higher multiples than Emami or Bajaj Consumer. Another example can be that of Public Sector Enterprises. These stocks have consistently underperformed the broader markets and trade at a hefty discount to their book values.

- Corporate performance: Quality decision making enhances the long term prosperity of the company. This ought to be linked with improved corporate performance- either in terms of stock price or improved metrics.

- Combating corruption: It is natural for corruption to bloom where a lot of money is involved. Governance structures need to be crystal clear with proper whistleblower mechanisms in place. Management tone at the top influences the risk culture to a large extent. The recommendations of the Risk Management Unit must be taken seriously and dealt with an iron hand. An organization with proper disclosure practices, transparency in accounting & auditing processes would certainly fade out the menace of corruption. It would reduce the risk of crises & scandals.

- Easy finance from institutions: It is quite obvious that companies with excellent governance standards will have access to a large pool of cheap capital. The interest component is a huge expense for companies operating in capital intensive sectors. The cost of funds directly affects the viability of several projects. Also, In the case of banks, the cost of financing is important as it has a direct bearing on the Net Interest Margins (Interest on lending- Cost of borrowing). A bank with poor corporate governance standards will have a higher cost of capital. It might lose out to competition owing to high lending rates.

Principles of Corporate Governance

Earlier, we have discussed the basic aspects of Corporate Governance. However, there are rules, regulations, policies and practices adopted by different companies as part of their Corporate governance. So let us discuss some general principles of corporate governance.

The Organization for Economic Co-operation & Development (OECD), Principles of Corporate Governance was originally adopted by the 30 member countries of the OECD in 1999. These have gained worldwide recognition as an international benchmark for sound Corporate Governance. The OECD principles are proactively used by governments, regulators, investors, corporations, and stakeholders across the globe. The article was revised in 2004 to take into account the experience of developing & emerging economies as well. The main areas of the OECD principles are as follows:

I. Ensuring the basis for an effective Corporate Governance framework: The Corporate Governance framework should promote transparent and efficient markets, be consistent with the rule of law, and clearly articulate the division of 8 responsibilities among different supervisory, regulatory, and enforcement authorities.

II. The rights of shareholders and key ownership functions: The Corporate Governance framework should protect and facilitate the exercise of shareholders’ rights.

III. The equitable treatment of shareholders: The Corporate Governance framework should ensure the equitable treatment of all shareholders, including minority and foreign shareholders. All shareholders should have the opportunity to obtain effective redress for violation of their rights.

IV. The role of stakeholders in Corporate Governance: The Corporate Governance framework should recognize the rights of stakeholders established by law or through mutual agreements and encourage active cooperation between corporations and stakeholders in creating wealth, jobs, and the sustainability of financially sound enterprises.

V. Disclosure and transparency: The Corporate Governance framework should ensure that timely and accurate disclosure is made on all material matters regarding the corporation, including the financial situations, performance, ownership, and governance of the company.

VI. The responsibilities of the board: The Corporate Governance framework should ensure the strategic guidance of the company, the effective monitoring of management by the board, and the board’s accountability to the company and the shareholders.

The principles of Corporate Governance in India are in conformity with the principles of the OECD.

The Landscape of Corporate Governance in India

Till now, we have been discussing Corporate Governance at a broader level. Here in this section, we will discuss Corporate Governance in the Indian context.

The organizational framework for Corporate Governance initiatives in the country is undertaken by the Ministry of Corporate Affairs (MCA) alongside The Securities Exchange Board of India (SEBI). The SEBI monitors Corporate Governance standards in the case of listed entities through Clause 49. The SEBI is equivalent to the Securities Exchange Commission (SEC) in the United States. On the other hand, The MCA is more like a father figure & performs regulatory & policy functions. The objective of both these organizations is the same & they work in sync with each other. Other government bodies responsible for the enforcement of Corporate Governance standards include:

1) The National Company Law Tribunal

2) Registrar of Companies

3) The Regional Director

4) The Competition Commission of India

Besides these, sector-specific regulatory bodies such as TRAI (Telecom Regulatory Authority of India) & IRDA (Insurance Regulatory & Development Authority) also exist.

The concept of Corporate Governance gained prominence in India after the advent of the Companies Act, 2013 which together with other laws put in place strict provisions on governance. It also introduced penal consequences for non-compliance with these provisions.

The Companies Act, 2013 along with the SEBI guidelines are the principal sources of the Indian Corporate Governance regime. The provisions of the Company Act have been updated from time to time & must be read in conjunction with the rules, notifications, orders, circulars, and forms issued. Unlisted & systemically important companies are also required to comply with the Corporate Governance norms in the Companies Act.

The SEBI LODR (Listing Obligations & Disclosure Requirements) Regulations of 2015 specifies the guidelines to be adopted by listed entities. It includes all those companies that have their securities such as equity shares, bonds, mutual fund units, preference shares, debt instruments, etc listed on the exchange. The act lays down certain requirements such as the inclusion of Independent Directors, Disclosures on Related Party transactions, Accounting treatments, Formation of sub-committees of the board, Frequency of board meetings, Regulation of remuneration, and others. There is also a written code of conduct that must be adopted by all the board members as well as the senior management.

Additionally, the following laws also deal with Corporate Governance initiatives:

(i) The Securities Contracts (Regulation) Act, 1956 (‘SCRA’) and the rules made thereunder,

(ii) The Depositories Act, 1996 and the Regulations and Bye Laws framed thereunder to the extent of Regulation 76 of SEBI (Depositories and Participants) Regulations, 2018,

(iii) Foreign Exchange Management Act, 1999 and the rules and regulations made thereunder to the extent of Foreign Direct Investment, Overseas Direct Investment, and External Commercial Borrowings,

(iv) The following Regulations and Guidelines prescribed under the Securities and Exchange Board of India Act, 1992 (‘SEBI Act’):

- The Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011,

- The Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015,

- The Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018,

- The Securities and Exchange Board of India (Share Based employee Benefits) Regulations, 2014,

- The Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008,

- The Securities and Exchange Board of India (Registrars to an Issue and Share Transfer Agents) Regulations, 1993 regarding the Act and dealing with client to the extent of securities issued,

- The Securities and Exchange Board of India (Delisting of Equity Shares) Regulations, 2009, and

- The Securities and Exchange Board of India (Buyback of Securities) Regulations, 2018.

The domain of Corporate Governance extends beyond laws & regulations. The fundamental objective behind corporate governance is not just mere formalities & documentation but ensuring the commitment of the board in managing the affairs of the company in a transparent manner ethically for maximization of shareholder value.

A plethora of laws already exist to take note of investor grievances. However, poor implementation & lack of penal provisions leave a lot more room for improvement. The responsibility for good governance rests more on proactive initiatives taken by the company instead of external agencies.

FAQs on Corporate Governance & Law

Now that we have a complete understanding of Corporate Governance. In this section, we will discuss some common FAQs on the practices of Corporate Laws & Corporate Governance in India. The questions will range from the very basic to little complex ones so that you get a bird's eye view of the legal framework in which companies operate.

What Do You Mean by Board of Directors?

The board of directors is a group of elected representatives that represent the shareholders of the company. The board is responsible for protecting investor's interests & ensuring profitability & financial stability.

The board hires executives such as the CEO & the CFO. These Key Managerial People (KMP) are generally members of the board.

Who is the Chairman of the Company?

The chairman of the company is the head of its board of directors. The chairman wields substantial influence in setting the board's agenda & determining the voting outcome. In some cases, the managing director or the whole-time director presides over the board meetings as chairman of the board. A non-executive director may also be the chairman of the board. Managing Directors who act as chairman of the board are known as Chairman cum Managing Directors (CMD).

Who is the CEO of the Company?

The CEO is the highest-ranking executive in the organization. He is the public face of the business. The CEO reports directly to the Board of Directors.

In a nutshell- Shareholders own. Executives possess. The board governs.

Is It a Red Flag If the Chairman & the CEO of the Board are One & the Same Person?

This is a controversial topic and remains widely debated. Some argue that splitting the two roles is a key component of board independence because of the fundamental differences & potential conflicts between them. Another argument in favor of the two-tier system is that the independent chairman can serve as a valuable sounding board, mentor, and advocate to the CEO. On the flipside, setting up two power-centres may impair the decision making ability of the board.

The Uday Kotak committee for Corporate Governance reforms has recommended the separation of the posts of Chairperson & CEO/MD for Top 500 listed entities by market capitalization with more than 40% public shareholding. The market regulator has set April 2022 as the deadline for companies to conform to this notification. It quoted the Cadbury Committee of United Kingdom:

“Given the importance and the particular nature of the chairman’s role, it should in principle be separate from that of the chief executive. If the two roles are combined in one person, it represents a considerable concentration of power”

What Do You Mean by Executive & Non-Executive Directors?

Executive directors are those directors who are involved in managing the day-to-day activities of the company. They are usually full-time employees of the firm & are responsible for making critical business decisions.

Non-executive directors are also known as independent directors. These directors do not have any material relations with the company that might affect their independence of judgment. Additionally, he/she must not be a promoter of any of the entity's associates, subsidiaries, or holding companies.

What is the Composition of the Board?

As per SEBI regulations, The board of directors shall have an optimum combination of executive and non-executive directors with at least one woman as an independent director. Not less than fifty percent of the board shall comprise non-executive directors.

Is there a ceiling to the number of listed entities in which a person can hold directorship?

No person can hold office as a director in more than seven listed entities.

How Can Retail Shareholders Adjudge the Skills of the Appointed Directors?

A brief resume of the director is provided in media fillings at the time of appointment. The background & previous work experience provides insight into the director's capabilities.

What Powers Do the Shareholders Have in Matters of Appointment & Removal of Directors?

Directors are appointed by the Board and hold office until the next AGM, at which their approval is subject to voting by the company's shareholders. Also, directors can be appointed at a general meeting of the shareholders.

In the case of Indian public companies, 2/3rd of the directors are liable to retire from their position via rotation within a maximum period of three years from their appointed date. The reappointment of such directors is subject to fresh shareholder approval. This provision is not applicable to independent directors.

The shareholders have the right to remove both executive & non-executive directors by a simple majority vote.

How Many Times Does the Board Meet in Any Given Year?

The board of directors shall meet at least five times a year. There must not be a gap of more than 120 days between any two meetings.

When are AGMs Held? Can Retail Shareholders Attend Them?

All Indian listed companies shall hold their Annual General Meeting within a period of six months from the closure of the previous financial year i.e. by the 30th of September. As per the recommendations of The Uday Kotak committee on Corporate Governance, this timeline has been reduced to five months for the Top 100 companies by market capitalization as of 31st March for the year under consideration.

The Top 100 companies are also required to webcast their AGMs so that retail shareholders can also participate. Lately, a lot of other listed companies have started broadcasting their AGM's. This is indeed a great development & is beneficial for those who cannot physically attend the meeting.

What are the Primary Legal Responsibilities of the Board?

The central objectives of the board include managing the company's affairs & assets and ensuring compliance with all applicable laws. Directors of the company are expected to show utmost care, diligence & skill in the exercise of their powers. In fact, incompetencies & irregularities are treated as a deliberate act.

Do Controlling Shareholders Owe Duties to the Company or to Minority Shareholders? Is There Any Legal Recourse Available for Breach of These Duties?

It is the fiduciary duty of controlling shareholders to act in the best interests of the minority shareholders. Minority actions are allowed in case the majority shareholders benefit themselves at the expense of the minority.

The Companies Act, 2013 formally brought into force an effective redressal mechanism much popular in the USA.

Under this provision, the shareholders of the company may collectively file a class-action lawsuit to claim damages owing to the fraudulent actions of the company or any of its representatives such as directors, employees, auditors, consultants, and so on.

What are Related Party Transactions?

Related parties transactions are business dealings with related entities. Following are the examples of related parties for a company:

1) A Key Managerial Person or their relatives or a director of the company.

2) A private company or a firm in which the partner, manager/director or his relative is a partner

3) A public or a private company in which a manager or director is a director and holds along with his relatives more than 2% of its paid-up share capital.

Related party transactions include:

a) purchase, sale or supply of any goods or materials,

b) selling or otherwise buying, or disposing of, buying, property of any kind,

c) leasing of any kind of property,

d) rendering or availing of any services,

e) appointment of any agent for sale or purchase of goods, materials, services or property,

f) such related party's appointment to any office or place of profit in the company, its associate company, or, its subsidiary company,

g) underwriting the subscription of any securities or derivatives thereof, of the company.

If related party transactions are conducted & carried out in a fair manner without any biases, then the transaction is said to be at an arm's length. These transactions are disclosed in the annual report of the company.

Investors must cross-check these transactions to see if there are vested interests at play. For example, the company may sell a parcel of land at a throwaway price to the promoter entities. This results in a value transfer from the company to the promoter. It has been seen time & again that a lot of fraudulent activities are guided as RPT's and shielded from innocent retail investors.

What Do You Mean by Corporate Social Responsibility?

Corporate Social Responsibility (CSR) is a company's commitment to ensure that there are positive social & environmental effects associated with the operations of the company. It seeks to strike a balance between economic, environmental & social imperatives.

India was the first country in the world to legally enforce CSR in 2014. The law is based on the premise that profit-making companies should contribute to society. It mandates companies to set aside two percent of their average net profit in the last three years for CSR purposes such as education, healthcare, etc.

The image below is an example of CSR spend of Avanti Feeds Ltd:

Are Board Committees Mandatory by Law? What are the Mandatory Requirements for Committee Composition?

It is compulsory for listed companies to have sub-committees such as The Audit Committee and The Remuneration & Nomination Committee. Additionally, the law mandates the formation of a Stakeholders Relationship Committee to resolve the grievances of security holders for any company that consists of more than 1,000 security holders. Also, Companies with a net worth of more than ₹500 crores or turnover exceeding ₹1,000 crores or net profit exceeding ₹50 crores must constitute a CSR committee.

The Board of Directors may recommend forming other committees to assist them in the discharge of their duties.

As stated in The Companies Act, The Audit Committee must consist of at least three directors with Independent Directors forming a majority.

The Nomination & Remuneration Committee shall consist of three or more non-executive directors, at least half must be independent directors. The chairman of the company cannot head this committee.

What Can the Management Do in case of a Hostile Takeover?

The Takeover Code has certain provisions that make hostile takeovers relatively difficult by favoring existing shareholders & management. Listing norms make it mandatory to disclose the beneficiary in case his ownership in the company exceeds the 1% threshold.

The controlling shareholders can employ some commonly employed tactics such as Poison pills, Shark repellents, Pac-Man defense, Whitenight and Greenmail.

In India, takeovers are also subject to approvals from the Competition Commission.

As per the provisions of the SEBI's SAST Act, An entity buying more than 25% stake or in a listed company must mandatorily tender an open offer to buy an additional 26% in the company. Hence, an acquiring company will have a minimum of 51% in the target company post successful completion of the open offer.

Furthermore, controlling shareholders cannot buy more than 10% of the outstanding shares from the open market in a given year through the creeping acquisition method.

India's largest engineering & construction conglomerate Larsen & Toubro's acquisition of Mid-sized IT company Mindtree was supposedly the first successful hostile takeover in India. Larsen has two other listed entities in the same segment- L&T Infotech and L&T Technology Services. This move was described by the management as an attempt to de-risk the cyclical infrastructure business & consolidate the group's position in the services industry. Larsen currently owns about 60% of Mindtree.

How is the Remuneration of Directors Determined?

Private companies have no restrictions as regards determining the director's remuneration & the process to be followed.

However, Public companies must adhere to the norms of the Companies Act. As per the terms of the act, the total remuneration payable by a public company to its directors in a particular financial year must not exceed 11% of the net profits of the company for that financial year.

Furthermore, the cap stands at 5% of the net profits for any Director without obtaining the shareholders' approval. Also, non-executive directors cannot draw more than 1% of the net profit in case the company has a Managing Director, Full-time director, or Manager & 3% of the net profits in other cases.

Listed companies must disclose the remuneration details of every director in the annual report. As per the Listing Regulations, they must also report the ratio of remuneration of each director to the median employee's remuneration.

How is the Remuneration of the Most Senior Management Determined?

The senior management team comprises the highest level of managers in an organization, immediately below the board of directors. It includes KMPs such as CEOs, CFOs, Company Secretaries as well as all the functional heads.

In contrast to directors, the remuneration & appointment of senior management is governed by their respective agreements. No formal guidelines have been issued in this context.

What Role Do Employees Play in Corporate Governance?

The tone at the top determines the organizational culture. Public companies, Companies accepting public deposits, & Companies with borrowings exceeding ₹50 crores are mandated to establish a vigil mechanism for directors & employees to report genuine concerns from a Corporate Governance perspective.

The whistle-blower concept allows employees to alert senior management about any unethical practice against the company's code of conduct anonymously. The individual may also approach external authorities for redressal. Such information, if leaked publicly, might tarnish the reputation of the firm.

What Information Must Companies Publicly Disclose?

Listed companies must comply with a lot of disclosure formalities. They must periodically file the company's audited accounts, Board's report, Auditor's Report as well as the Annual Report with the Registrar of Companies as well as the Stock Exchanges.

Certain resolutions such as changes in directorship, changes in authorized share capital, conversion of warrants, advertisements issued by the company, court orders, amendments to the charter document must also be filled with the authorities.

Public companies must also adhere to The Listing Regulations, The Takeover Code as well as The Insider Trading Code.

Note: We have learned quite a lot of things related to Corporate Governance and its importance from this module. Every other company focuses on building a strong Corporate Governance in India for a good structure in the organization. Despite these facts, there are several instances of failures in Corporate Governance in India. So, let us go through some case studies in our subsequent units to better develop our understanding.

Landmark Failures of Corporate Governance in India: Yes Bank

Let's discuss a case study on Yes Bank:

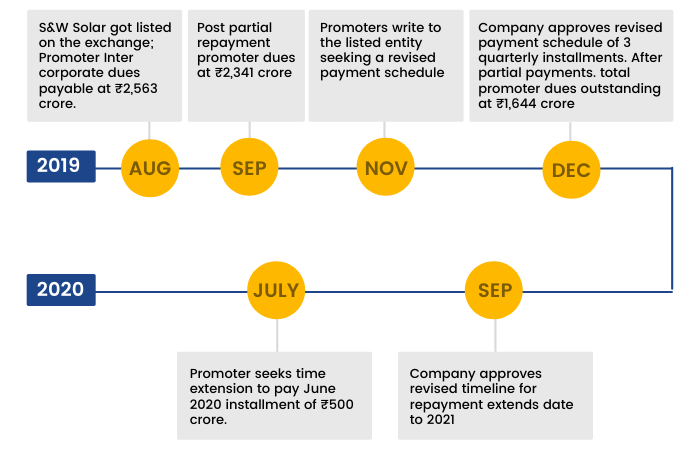

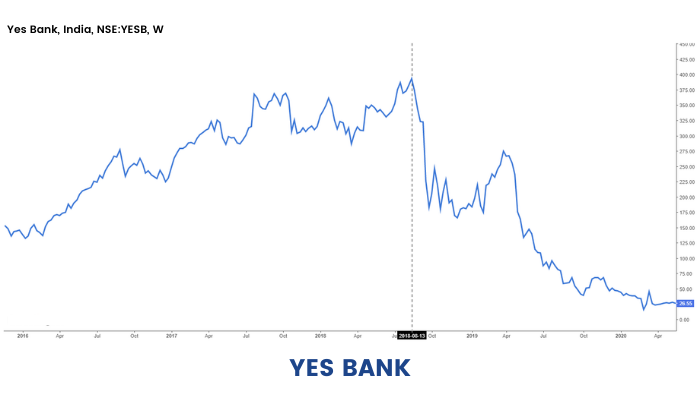

1) Yes Bank- The heightened drama ensuing Yes Bank made it appear like it was straight out of a Wes Anderson feature film. Yes Bank was a market darling at one point in time and found a lot of flavor with Foreign Institutional Investors. The stock traded at a Price to Book in excess of 5 & was touted with the likes of HDFC Bank & Kotak Mahindra Bank. At its peak, Yes Bank had a market capitalization just shy of ₹1 lakh crore.

Creeks started appearing in this dream run when a number of agencies took a deeper plunge into the bank's books. The bank had been on a lending spree & had the highest proportion of loans to stressed companies such as The Essel Group & Anil Ambani Group of companies. It was highly unlikely that a stressed account had not taken a cheque from Yes Bank. The last one I promise, Rana Kapoor was the YES man to every troubled borrower.

The banking regulator got a whiff of the toxicity when there were huge divergences in NPA levels reported by the bank & those ascertained in the Asset Quality Review(AQR) program. Yes Bank reported a divergence of more than 300%. Yes, you have read it right!

In FY 2016-17 the bank reported Gross NPAs to the tune of ₹2,019 crores. The number zoomed to ₹8,373 crores as per RBI assessments. Simply put, the bank's NPAs were under-reported to the tune of 5 percentage points.

Instead of plugging the loopholes, the bank made every attempt to downplay the situation. It further went on to highlight that most of these accounts had already paid back, some were sold to Asset Reconstruction Companies, or, ARC's & others were upgraded on account of satisfactory account conduct. The impact on financials was lowered to ₹485 crore from the ₹6,355 crore divergence reported earlier.

An old saying comes to my mind when I think of this debacle -There is no smoke without fire.

The Sheriff at Mint Street had been cracking the whip on 'Zamindar' CEO's like Chandna Kochhar at ICICI & Shikha Sharma at Axis. Rana Kapoor met the same fate when he was denied a three-year extension in August 2018. Kapoor was due to retire on 31st January, 2019.

The stock tanked heavily the day this news broke.

It was later clarified that the Corporate Governance issues in the bank persisted for a prolonged time. NPA's started swelling and doubled to 3.22% in Q4 FY 2018-19. The bank reported losses of ₹1,500 crores in the same quarter, its first since going public in 2004. The NPA number further swelled to 18.89% in Q3 FY 2019-20 as more and more irregularities in advances were unearthed. Poor lending standards had been ailing Indian Banks since time immemorial & Yes Bank had just joined the party. And of course, Depositors started fleeing in large numbers & the company was in urgent need of a capital infusion.

After struggling under the regime of Ravneet Gill- the new CEO, the bank was subsequently placed under moratorium in March 2020. A consortium of banks led by The State Bank of India bailed out Yes Bank. India's largest lender put in ₹7,250 crores & picked up a 49% stake in the ailing bank. The board was reconstructed & Prashant Kumar (Ex- CFO, SBI) took charge of the affairs. Since then, the bank is gradually attempting to rebuild its image.

Mr. Rana Kapoor is currently fighting several cases linked to money laundering using a number of shell companies. It is alleged that Mr. Kapoor took ₹600 crores in bribe for a quid pro quo investment of ₹3,700 crores in DHFL by Yes Bank. It is almost certain that many more skeletons will tumble out of Rana Kapoor's banking circle and more importantly he will be behind bars for a long long time.

A few pertinent questions however remain:

- Why do retail shareholders have to bear the brunt of the actions of a wicked promoter?

- Was it fair to bail out a private bank from taxpayers' money?

- Trust me, we do not have answers either.

Corporate Governance Failures in Satyam Computers

Let's discuss a case study on Satyam Computers:

Satyam Computers- The old-timers would remember this one vividly. The charm surrounding Mr. Ramalinga Raju cannot be simply written off like other perpetrators.

It is ironic that the word 'Satyam' means truth in the Sanskrit language, Satyam Computers was amongst the top four IT companies in the country. At its pinnacle, it had about 50,000 employees spread across 67 nations. The organization was synonymous with India's development & IT sector boom of the early 2000s.

Satyam had a market capitalization of 13,500 crores when the scam broke out in January 2009. The company was a part of both the mainstream Indian indices & was also listed on the New York Stock Exchange.

Satyam is also known as India's Enron. The fraud was a mastermind of Mr. Ramalinga Raju & his brother B. Rama Raju (former Managing Director). Others charged with serious offenses include Satyam's former Chief Financial Officer Vadlamani Srinivas, Three former employees of Satyam, Its chief internal auditor V.S Prabhakar Gupta along with two PricewaterhouseCoopers auditors.

The case against Mr.Raju was that he misled investors over the years by artificially inflating sales & profits to the tune of several thousand crores over the years. Good performance was rewarded & The Satyam brothers minted a profit of more than ₹2,500 crores by selling their stake in the firm at sky-high prices.

Markets got apprehensive about the Corporate Governance standards at Satyam when the board decided to acquire a 100% stake in Maytas Infra & 51% stake in Maytas Properties for a total consideration of $1.6 billion. Markets saw this move as an attempt by the board to swindle the cash resources of Satyam as both these companies were owned by the promoter group. The stock reacted negatively to these developments & ultimately the deal was called off.

This incident caused severe damage to Satyam's reputation as a well-managed company. The very same month, five independent directors resigned from the board of the company citing various reasons.

Finally, on 7th January, 2009, Mr.Raju admitted budgetary extortion of over ₹7,800 crores & resigned from the board. In his confession, Mr.Raju addressed the Maytas deal as his last attempt to "fill the fictitious assets with real ones".

The incident put a big question mark on the role of external auditors. PwC failed terribly in its job to spot the irregularities in the financial statements. There was no verification of invoices & bank statements. Nearly 7,560 fake invoices were created & PwC didn't bat an eye.

The government superseded the board of the company and appointed its own lieutenants. Later, Tech Mahindra stepped up & acquired a majority stake in Satyam Computers for ₹2,900 crores in a government-sponsored auction.

The scandal sent shockwaves across the corporate circles & led to a series of policy changes in India. The SEBI reacted proactively & announced pathbreaking reforms. These included:

a) Disclosure of pledged shares- It became compulsory for promoters to disclose their pledged holdings in listed entities on a periodic as well as event basis.

b) Electronic casting of votes- Listed companies were asked to enable the e-voting facility so that the retail shareholders could participate in the company's decision-making process. Further, the companies were instructed to announce the voting results/patterns on their websites & stock exchanges within 48 hours of concluding the shareholders' meeting.

c) Compulsory dematerialization of promoter holdings- This decision was made with a view to enhance transparency in dealing with shares that are pledged or used as collateral. The company's shares will be permitted to trade in the normal segment only if 100% of the promoter's stake has been dematerialized. Otherwise, the stock will be shifted to the Trade to Trade segment.

d) Peer-reviewed auditor- It was decided that Statutory audit reports for listed entities could be submitted only by those auditors who were subject to the peer-review process of the ICAI & held valid certificates issued by the Peer Review Board.

e) Maintenance of website- With an objective to enhance public dissemination of all information about the listed entity, it was mandated to maintain a functional website containing basic information about the company duly updated with the exchange fillings.

A musing anecdote amidst all the gloom- In April 2015, Mr.Ramalinga Raju & his brother were sentenced to seven years in jail by a special court in Hyderabad. His term was cut short to five years & he is currently acquitted of all charges. Mr.Raju also had to pay a hefty fine of ₹5.5 crores for embezzling $1.5 billion. Justice served.

Corporate Governance Failures in IL&FS

Let's discuss a case study on (IL&FS):

Infrastructure Leasing & Financing Services (IL&FS): Infrastructure financing is as murky as it gets. All infrastructure projects come loaded with a basket of risks that most lenders choose to steer clear of, long & protracted implementation, natural calamities, regulatory delays, cost escalations, additional debt servicing, & the most fatal, the risk of a market cycle turning sour.

Il&FS was set up in 1987 with an objective to finance large scale infrastructure projects for ensuring sustained economic growth. The group was once hailed as the pioneer of Public Private partnership (PPP) in India. IL&FS is a core investment company registered under the RBI and one of the Systemically Important Financial Institutions (SIFIs) in the country.

The IL&FS group was being run like a virtual ponzi scheme. The board believed in the magic powers of the chairman to call for additional credit lines in times of distress & boom problems solved. This myth burst in September, 2018 when a lot of red flags started surfacing. The Group began reeling under its massive debt burden when two of its subsidiaries were facing trouble in repaying Loans & Inter-corporate deposits in July. The chairman, Ravi Parthasarathy quit the firm in the same month citing medical reasons after staying at the helm for 30 years. The outgoing leader gifted himself a 144% salary hike as a parting memory.

Markets were in a state of panic & punished Banking & NBFC stocks black & blue. Leading the stash was Dewan Housing Finance Limited aka DHFL which defaulted soon after the crisis broke out. Indiabulls Housing Finance was also in a tough spot & painstakingly managed to stay solvent. The year of 2019 was the worst in nearly a decade for NBFCs as their primary sources of funding had nearly dried up. Banks & Mutual funds were unwilling to lend & there was an acute liquidity crisis.

IL&FS Financial Services informed the BSE on 27th September 2018 that it defaulted on ₹152 crores of short-term deposits & term deposits. The government took control of the beleaguered firm on the first of October & appointed Uday Kotak as the Chairman of the board.

At the heart of Il&FS's problems lies its tangled corporate structure. The Il&FS group houses 256 group companies including its subsidiaries, JV's and other associate entities. Only three of IL&FS group entities were listed on the stock exchanges & the intermeshing nature of the financials make it quite obscure for any meaningful scrutiny.

The holding company managed to pull off the dead weight of unfinished infrastructure projects & burgeoning liabilities for quite some time. In the three year period from FY 2014-15 to FY 2017-18, the consolidated debt at the group level rose 44% to $13 billion. The Debt to Net Worth ratio of the entity stood at 13:1. Credit Rating Agencies had simply turned a blind eye to all of these negative developments surrounding the company & consistently rated it as AAA. It essentially means that the default probability of IL&FS was close to zero.

According to a report by Grant Thornton on the IL&FS fiasco,

“Various strategies deployed by the then key officials of IL&FS group and certain favours/gifts provided to rating agency officials suggest the possible reasons for consistent good ratings provided to IL&FS group,”

These gifts ranged anywhere from Fitbit smart watches to Real Madrid match tickets.

Once again, the usual drama ensued. The market regulator slapped token fines worth ₹1 crore each on CARE Ratings, ICRA & India Ratings in September 2020. The Ex-CEO Hari Sankaran is behind bars & now the legal proceedings shall stretch a few more dozen years.

The IL&FS scandal was a systemic failure. A massive fraud engineered by the chairman Ravi Parthasarathy who colluded with his crony managers to route hard-earned taxpayers' money through various financial institutions & a web of shell companies. It is shocking that a board with the brightest business minds such as RC Bhargava &Jaithrith Rao were inept to report the rotten practices in the company.

Shareholding pattern as of March 2018:

Corporate Governance Failures in Jet Airways

Let's discuss a case study on Jet Airways:

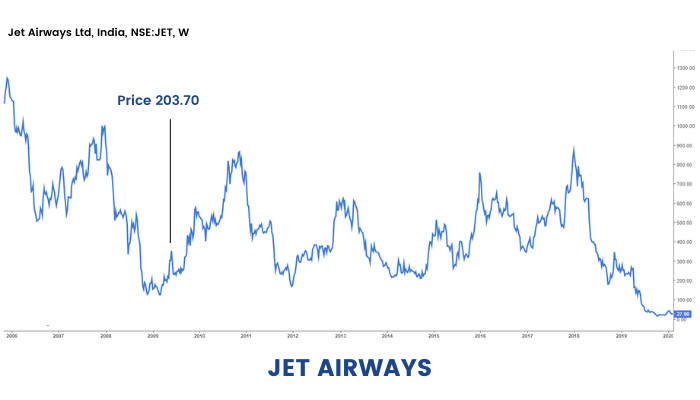

Jet Airways- Leadership is one of the most important factors influencing the success of any company. Poor leadership can adversely affect employee morale and even cause the company’s bottom line to plunge significantly. The Jet Airways case has all the elements explaining the perils of family-controlled businesses.

Aviation has always been a tough nut to crack despite more & more people taking to the skies. Jet Airways was once upon a time India's largest commercial passenger airline with a passenger market share of 22.6%. After soaring high for more than 25 years, Jet was finally grounded in 2018. It had close to 20,000 employees at that point in time. The airline flew to 63 destinations spanning the length & breadth of the Indian borders & even beyond. It had 97 aircrafts, the majority of which were supplied by Boeing.

The first blow to Jet was the acquisition of Air Sahara in 2007. It was a costly acquisition & many aviation experts advised the company against it.

However, Naresh Goyal (read the whimsical promoter) decided to go ahead with his decision and paid around ₹1450 crores for a loss-making airline. Air Sahara was renamed Jet Life & carried operations as a separate entity. This was another controversial decision as merging the operations would have resulted in cost control, economies of scale & other synergy benefits. Jet Life was merged with Jet's low-frills brand Jet Konnect in 2012. In May 2018, the aviation ministry rejected Goyal's plan of merging Jet Konnect & Jet Airways.

Then came the era of low-cost carriers (LCC) such as Indigo & Spicejet. While Jet was struggling to deal with its own problems, its competitors were aggressively expanding their foothold in the price-sensitive Indian market. These airlines leashed a period of cut-throat competition & airfares came down drastically. The operational metrics of full-service carriers like Jet began taking a hit as people resorted to cheaper alternatives.

Cash crunches & liquidity issues were a frequent problem in the company & delayed salaries had become more or less a norm. Salary cuts didn't help the company either. Oil prices were relatively calm for two years in 2015 & 2016 but had started spiking from Mid 2017 onwards. Banks simply refused to lend more until there was a clear revival plan.

Drying Coffers

Jet Airways Cash Dwindles against its High Debt

In what can be seen as a last-ditch effort, The Tatas were keen to buy a stake in the debt-ridden airline. As per various reports, Tatas wanted a controlling stake in the company. However, Naresh Goyal with a 51% stake in the company was unwilling to step down & hence the deal was called off. This one settlement had the power to undo all the bad decisions made by Goyal. He could have an honorable exit & save his company. The decision to let go of the Tatas was imprudent beyond reckoning. It looks as if the call was taken keeping solely the interests of the promoter group in mind. Man's greed for more is insatiable. Isn't it?

This is a classic case of Corporate Governance failure. The duty of independent directors is to protect the interests of minority shareholders. In the case of promoter-driven boards, the director has to fall in line with the wishes of the chairman else he may be kicked out. A fun fact- two independent directors on the board Vikram Mehta Singh and Ranjan Mathai tendered their resignation in November 2018, the very same month the group was in talks with the Tatas. We wonder if they had really put in their papers due to "time constraints". The company is presently admitted to the NCLT for bankruptcy resolution. It has a debt of over $1.2 billion & its total liabilities run in excess of $4 billion.

How to analyze the management of a Company?

This writeup will discuss the key steps/tools that investors can use to find companies with good management & avoid bad management. One must read this carefully & inoculate them in his/her stock analysis process so as to avoid falling into the trap of unethical management that benefits at the expense of minority shareholders.

"In evaluating a common stock, the management is 90%, the industry 9%, and all other factors are 1%. "

- Phil Fisher, Path to wealth through common stocks

Investors would acknowledge that it is the management alone that acts as the 100x catalyst

Simple steps to do Management Analysis:

- Promoters’ background check

- Promoters’ salary

- Related party transactions

- Warrants

- Management's focus on stock price

- Dividend payments

- Accounting juggernauts

- Competence

We will elaborately discuss each step in the subsequent sections.

Step 1: Check Promoter Background

Firstly, start with checking the promoter’s background.

A basic background check of the promoters' is the first step in conducting a management analysis of any company. A background check might be interpreted differently by different investors. For some, educational qualifications may be a vantage point whereas others may stress on family background. However, the focus must be made on past decisions of the management.

Educational qualifications are not a suitable barometer for analyzing the shareholder friendliness of the promoters. Investors must assess if the past decisions of the promoters were taken keeping the interests of minority shareholders' in mind.

Analysis of UPL Ltd:

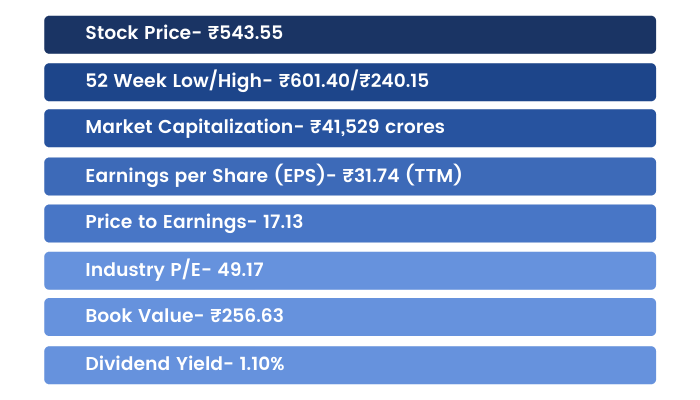

Quick Snapshot: (Data as of Closing Prices on 11th February, 2021)

UPL Ltd. or erstwhile United Phosphorus Limited, established in 1969 is a large-cap company with a market capitalization of about ₹40,000 crores. The company is principally engaged in the agro-business of production and sale of agrochemicals, field crops, vegetable seeds, and non-agro-business of production and sale of industrial chemicals, chemical intermediates, specialty chemicals.

I chanced upon the company a little while ago while looking for value picks in a market hitting fresh all-time highs every other day.

Profit & Loss (Consolidated Figures in ₹ Crores)

UPL Ltd. financials presented a picture-perfect scenario of any good business:

- Sales were growing at 24% CAGR

- Profits were growing at 20% CAGR

- Operating Margins were stable between 18-20%

- Interest costs went up significantly but it was not much of a concern given the strong liquidity position & a high growth rate. The company boasted cash & cash equivalents of ₹7,873 crores as of September 2020 compared to the Interest outgo of ₹1,826 crores in the last 4 quarters.

Finding a company with such stellar performance at throw-away valuations enticed me. However, upon doing a background check of promoters', I understood the reason behind this discount. It is very simple to conduct a basic background check.

"Just Google It"

Check for the name of the company with certain keywords such as " Fraud, Dispute, Court, Issues, SEBI, Resignations, etc". A simple attempt to know the promoter and give a lot of information that might be present in the public domain.

The Valuepickr Forum is an excellent platform for stock market discussions & investors must check it out for obtaining interesting insights about the company.

The check of Promoters' background for UPL Ltd. reflected that there were serious allegations against the promoters by a whistleblower who was also a member of the board. The whistleblower claimed that:

“UPL entered into rent deals with the shell company owned by its employees and paid crores of rupees in rent for properties held by the latter, which was earlier owned by UPL chief Jaidev Shroff himself.”

The stock shed 19% on 9th December 2020 and closed at ₹417.7 against its previous close of ₹492.6.

"Mr. Jaidev Shroff rubbished these claims in a TV interview & said that the complaint was put to rest way back in 2017. Shroff added that these complaints were made by his estranged wife and is about the house that he lives in. Further, these transactions were fully disclosed to the Audit Committee at that time & the company went ahead with it only after receiving a green signal from them."

Another google search with a different keyword revealed some more crucial information,

In a letter dated 14th October 2020, The company announced that KPMG Mauritius had resigned as the statutory auditor of its subsidiary UPL Corporation.

The stock tumbled 9% after this announcement and the management rushed to assuage investor concerns as usual:

"In order to re-organize the Audit Process to improve Productivity, at the request of the Company, KPMG Mauritius has resigned as Statutory Auditors of UPL Corporation Limited, Mauritius. M/s. BSR & Co. LLP, Chartered Accountants, continues to carry out the audit of Group Consolidated Financials of UPL Ltd, India which includes UPL Corporation Ltd, Mauritius, and its subsidiaries,"

In a further development, KPMG Mauritius refused to share specifics about its resignation. It simply cited that it had done so on the advice of UPL's risk management team.

These recurring instances of Corporate Governance lapses must not be taken at face value. All these developments point to the failure of internal controls in the organization.

Independent Directors- Such checks must be conducted for independent directors as well. It is often seen that non-executive directors constitute ex-bureaucrats, industry professionals, etc. It is well known that ex-bureaucrats bring a lot of administrative & management experience to the table. On the other hand, such arrangements might be indicative of crony capitalism as the position might have been offered as a reward for favors done to the company. An investor must make his/her own call on such matters.

In case of upcoming IPOs or newly listed companies, make sure to go through the Draft Red Herring Prospectus (DRHP) to seek information about any pending litigation or other risk factors associated with the company.

One should move ahead with further analysis after being convinced that no fingers can be raised when it comes to the character & integrity of the management.

That brings us to our lesson. It is always prudent to thoroughly read each & every line of the disclosures filed by the company. The Annual Report is a very important toolkit for investors. We understand that it is tedious to flip through two hundred pages of corporate trivia with absolute attention but one must do so to safeguard their own interests.

This case study has attracted a lot of media coverage but this is true only for a handful of companies in the listed universe. It becomes more important to spot these inconsistencies in the case of smallcap & midcap companies that stay away from the public eye.

Always remember, Investment in a great business with sound fundamentals might be futile if the management is not shareholder-friendly.

Step 2: Promoter's Salary

After checking the promoter’s background, it is important to evaluate the salary drawn by them.

The salary drawn by the promoter/management of the company is one of the key parameters to be looked upon while analyzing the company. Digging into the fine print will yield critical revelations about the working of the management.

The remuneration details of promoters & management are laid out in the Company's Annual Report. It is anyway an essential prerequisite for investors to go through the company's Annual Reports before putting their money.

An analysis of various companies across sectors reveals that the standard salary range for the management group is about 2-4% of Net Profit after Tax (PAT). The salary component can be broken down into a fixed monthly payment along with a commission on PAT & other perquisites.

It becomes vital to identify the companies where promoters are giving themselves sky-high salaries. Promoters are but the employees of the company. They are the people who are in direct control of the company & its key decisions. This includes the power to set their own salaries. In maximum cases, the promoters have their way & are able to get their desired remunerations recommended by the board of directors. Investors would acknowledge that the promoters are usually the largest shareholders in the company. Hence, it is not a hard task to get their remuneration approved by the shareholders in the Annual General Meeting/Extraordinary General Meeting.

Investors must remember that promoter salaries are an expense from the company's point of view. Expenses are debited in the company's Profit & Loss account. Basically, astronomical salaries eat into the net profits of the company. It directly reduces the profit margins. Many investors use the price to earnings ratio as a metric for valuing companies. Hence, not only would the available earnings per share reduce but the PE multiple would also be slashed.

What Do You Mean by a High Remuneration? How is the Remuneration Determined?

Private companies have no restrictions as regards determining the director's remuneration & the process to be followed.

However, Public companies must adhere to the norms of the Companies Act. As per the terms of the act, the total remuneration payable by a public company to its directors in a particular financial year must not exceed 11% of the net profits of the company for that financial year.

Furthermore, the cap stands at 5% of the net profits for any Director without obtaining the shareholders' approval. Also, non-executive directors cannot draw more than 1% of the net profit in case the company has a Managing Director, Full-time director, or Manager & 3% of the net profits in other cases.

Listed companies must disclose the remuneration details of every director in the annual report. As per the Listing Regulations, they must also report the ratio of remuneration of each director to the median employee's remuneration.

The senior management team comprises the highest level of managers in an organization, immediately below the board of directors. It includes KMPs such as CEOs, CFOs, Company Secretaries as well as all the functional heads.

In contrast to directors, the remuneration & appointment of senior management is governed by their respective agreements. No formal guidelines have been issued in this context.

Case study 1- Apollo Tyres

Quick Snapshot: (Data as of Closing Prices on 15th February 2021)

The management of Apollo tyres, India's second-largest tyre maker was on the receiving end of shareholder backlash for paying unreasonably high salaries to its promoter directors Onkar Singh Kanwar & Neeraj Singh Kanwar. The father-son duo took home ₹44.98 crores & ₹42.75 crores respectively for the Financial year ending 31st March, 2018. The minority shareholders rejected the re-appointment of Neeraj Kanwar, MD & Vice-Chairman of the company in its AGM in November.

Profit & Loss (Consolidated Figures in ₹ Crores)

The case against Kanwar was that he took a 44% pay hike in a year when the company reported its lowest net profit figures in the past five years. The consolidated profits fell from ₹1,099 crores in FY17 to ₹724 crores in FY18, implying a fall of around 34% YoY. The total compensation of both the promoters adds up to a whopping ₹87.74 crores. The Combined salary-to net-profit ratio for Onkar Kanwar & Neeraj Kanwar stood at 12.1% for that year. Keep in mind, Revenues for the year were the highest ever till that date at 14,843 crores.

Note: It might appear prima facie that the salary to net profit ratio at 12.1% exceeds the statutory limit of 11%. However, it is not so. The net profit under consideration is subject to certain provisions under Section 198 of the Companies Act.

After facing SEBI's whip for paying such exorbitant salaries, the management was forced to take a voluntary pay cut of around 30% for FY19. It introduced other "substantive" steps such as capping the total remuneration of the father-son duo at 7.5% of the profit before tax. Going forward, annual increments for the fixed portion of the promoter compensation will be in line with that of senior professionals of the company. It also added that the performance-linked pay of the promoters will be capped at 70% of the total pay.

Investors would acknowledge promoters are the employees of the company, and just like other employees they too want to be rewarded with higher remunerations year-on-year. However, it must be noted that a rise in promoters' remunerations is justified only if the profitability of the company has improved.

If an investor notices that a promoter is taking higher salaries year after year when the business profits are shrinking, it might indicate that the promoter is prioritizing his own interests rather than driving the business performance to new heights. It might also indicate that the promoter is treating the company as an avenue to extract the maximum possible amount of money. There must be strict provisions for performance-linked payments. Investors should be cautious in case of such companies where management remuneration is going up despite poor performance by the company & conduct thorough due diligence before risking their capital.

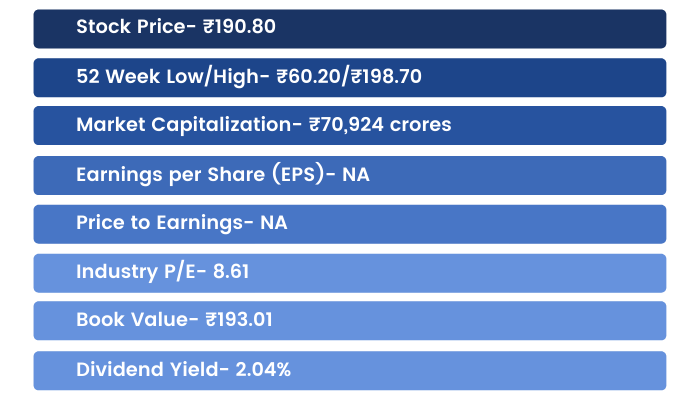

Case Study 2- Hindustan Construction Company (HCC)

Quick Snapshot: (Data as of Closing Prices on 15th February, 2021)

Mr. Ajit Gulabchand, Chairman & Managing Director of HCC was the man behind the vision of Lavasa, India's premier hill destination built along the lines of Portofino, Italy.

Those were the days when Jaypee Infratech, Sahara & Unitech used to rule the Infrastructure sector. Every other developer was announcing a larger than life project taking crores in bank debt. As a matter of fact, all three of them suffered the same fate.

Present-day, Lavasa is a ghost city with vacant houses, empty streets, dusty foundation stones & unfinished projects. Lavasa turned out to be a textbook example of a huge infrastructure project gone bad. Our point of discussion is not the future outlook of the company, but how a billionaire's folly became a nightmare for lenders & minority shareholders.

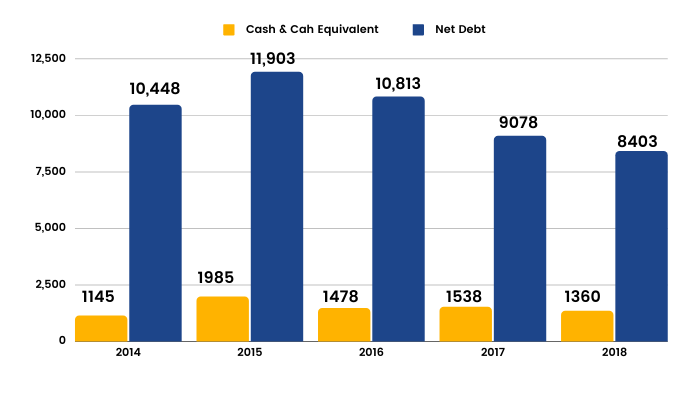

Let us have a look at how the debt exploded after March 2009,

Notice how things turned around for the company from 2012 onwards,

Profit & Loss (Consolidated Figures in ₹ Crores)

The company has consistently reported losses in its last 10 years of operations barring one stray occasion. An ever-burgeoning balance sheet has reduced off late due to asset sales. More than 90% of the promoter holding is pledged. The company is still reeling from severe stress & has been referred to National Company Law Tribunal for insolvency proceedings

The Corporate Governance lapses in the company are innumerable. The Ministry of Corporate Affairs had approved a payout of ₹ 1.92 crores & ₹1.21 crores to Mr. Ajit Gulabchand for 2014 & 2015 respectively. Schedule V of the Companies Act caps the total remuneration of directors at 11% of the net profits of the firm. This law is applicable even for loss-making firms with inadequate profits. & the number is arrived at using a complex calculation procedure. The company must obtain the permission of the Central Government to pay anything in excess of the stipulated amount.

Nonetheless, the esteemed board of directors requested the ministry to approve payment of ₹10.66 crores as compensation to Mr.Gulabchand for each of the two years.

Page 72, Annual Report, FY 2017-18

"Note 26.1 and 26.3 to the standalone financial statements regarding the remuneration of 10.66 crores paid for each of the financial years ended 31 March 2014 and 31 March 2016 to the Chairman and Managing Director (CMD), which is in excess of the limits prescribed under the provisions of the erstwhile Companies Act, 1956/ Companies Act, 2013, respectively and for which the Company has filed an application for review / an application, respectively with the Central Government; however approval in this regard is pending till date. Our opinion is not qualified in respect of this matter "

The company's financial position was not very encouraging either. Auditors were questioning Lavasa's ability to continue as a going concern. For FY14, the company reported consolidated losses of ₹227 crores, it shrank to ₹159 crores for FY15 but again expanded to ₹450 crores in FY16. At this point in time it is irrelevant if the ministry approved a higher payout or rejected the application. This incident clearly points out that the promoter prioritizes his personal interest above that of the minority shareholders.

An investor must be quick to exit his position as & when such red flags show up. It was still possible for an investor to save a substantial portion of his wealth by making a timely exit. Always remember, The first step of wealth creation is wealth protection.

Step 4: Warrants

Next check on Warrants issued to promoters or higher management.

Q: What are Warrants?

Stock warrants are just like call options on the common stock of the company. It gives the holder of the warrant the right to buy new shares issued by the company at a fixed price by paying 25% of the exercise price upfront. The remaining 75% must be paid on the date of exercise, not exceeding 18 months from the date on which the warrants were issued. The average share price in the last six months is taken into account while determining the exercise price of warrants. The price payable at the time of exercise is predetermined irrespective of the current market price of the share. If the promoter fails to pay the balance amount within the stipulated time period, the warrant expires.

The issue of Stock warrants to promoters can be interpreted in many different ways. In the case of companies that are undergoing severe liquidity issues, capital infusion by the promoters is generally taken as a positive sign. Lenders are happy with whatever amount the promoters bring as fresh equity to the company. The additional infusion gives them security as they would be able to recover a larger amount in case the company defaults.

Many times, warrants are issued to promoters at a steep discount to the current market price putting minority shareholders at a disadvantage. It might also happen that the promoter has some insider information that can significantly influence the stock price. The promoter can make huge paper gains by subscribing to the warrants before such information is made public. He might also exercise his warrants after the announcement of such news & sell his shares in the open market.

An investor would acknowledge that the shares issued via warrant allocation are subject to a lock-in-period of three years. Nonetheless, the promoters own a large chunk of the already existing shares of the company. Hence, it becomes possible for the promoter group to safely pocket the notional gains on shares received via warrant allotment by selling the existing shares of the company.

Promoters prefer to increase their stake via warrants as compared to open market transactions. The reason behind this is that promoters buying from the open market garners a lot of attention & pushes up the stock price of the company. However, in the case of warrants, the exercise price is fixed irrespective of the market price of the stock.

In our opinion, any warrants are a speculative tool possessed by insiders. If the company is facing a liquidity crunch & lenders are unwilling to provide loans, then the board can even raise funds through a rights issue. This method will provide the company with funds in a much shorter span of time. Also, it will give other shareholders a level playing field to protect their stake from dilution. It has been observed time & again that the promoters are unwilling to subscribe to the warrants if the share price of the company falls considerably below the exercise price. Many opportunistic managements took advantage of the recent market crash to issue warrants at prices much below the fair market value.

Analysis of Sagar Cements:

Quick Snapshot: (Data as of Closing Prices on 17th February, 2021)

We have spent a good amount of time in our lessons learning to spot the red flags. Let us now shift our attention to one of the best-in-class promoters who have oftentimes proved their mettle.

Consistency thy name:

Profit & Loss (Consolidated Figures ₹ Crores)

The revenue & profitability momentum of the company is a rare-feat for a small-cap company operating in a cyclical sector with excess capacity. The data speaks volumes about how committed the promoter is in scaling up the business.

What caught our eye:

"Pursuant to the approval accorded by you at the Extraordinary General Meeting held on 8th January 2019, your board had allotted 31,00,000 warrants at an issue price of 730/- per warrant. Each of these warrants was convertible at the option of the warrant holders concerned into 1 equity share of 10%-each at a premium of 720 per share within a period of 18 months from the date of allotment of the said warrants. Your company has raised a sum of 226.30 Crores through the above allotment and the same is being utilized, inter-alia, for investment in the subsidiary companies to part fund the setting up of a fully integrated green field cement plant of 1 MTPA capacity in Madhya Pradesh and a grinding station of 1.5 MTPA capacity in Odisha"

Page 65, Annual Report, FY 2019-20

The warrants were priced at ₹730 apiece, an over 14% premium over the stock's closing price of ₹639.95 on 16th January 2019. When share warrants are issued at a premium, it gives confidence to minority shareholders that the management would put in extra efforts towards creating value for all.

As discussed earlier, the warrants issued to the promoter group are valid for a period of eighteen months from the date of allotment. The promoter had already subscribed to 15,50,000 shares on 24th July 2019.

In an intimation to the stock exchanges on 27th March 2020, the company informed:

'"We wish to inform you that the Securities Allotment Committee of our Board has today allotted 3,25,000 shares of Rs.10/- each at an issue price of Rs.730/- per share (including a premium of Rs.720/- per share) to M/s. R.V.Consulting Services Pvt. Ltd., an entity belonging to our promoter group, against conversion of similar number of warrants, earlier allotted to it pursuant to the approval accorded by our shareholders at their Extra-ordinary General Meeting held on 8th January, 2019 "

Further on 24th July 2020, the company informed:

"We wish to inform you that the Securities Allotment Committee of our Board at their meeting held on today has allotted 12,25,000 equity shares of Rs.10/- at an issue price of Rs.730/- per share to the entities belonging to promoter group and others, against conversion of similar number of warrants, earlier allotted to them, pursuant to the approval accorded by our shareholders at their Extra-ordinary General Meeting held on 8 th January, 2019. In this connection, we further wish to inform you that with this present conversion, the process of conversion of the entire 31,00,000 warrants earlier allotted on 24th January 2019"

Let us check the stock price of the company on both these dates:

27th March 2020- ₹300

24th July 2020- ₹448.70

As a matter of fact, the stock hit its 52 week low of ₹236.30 on 23rd March 2020.

Some alternate courses of action:

a) The promoter could have issued the warrants at a steep discount to the market price on 16th January 2019 i.e. ₹639.95

b) The promoter could have simply forfeited the balance 15,50,000 warrants it had not yet subscribed. It had paid ₹182.5 per share i.e. 25% of the issue price for it. Next, the board could have come up with another issue of stock warrants at a much lower price. It would have resulted in substantial savings nonetheless as ₹300+182.5 amounts to ₹482.5 vs the issue price of ₹730.

c) If the actual intent of the promoter was only to raise his stake at the cost of minority shareholders, he could have also resorted to buying from the open market & choose not to subscribe to the remaining 15,50,000 warrants.

This is precisely why it is said that management integrity is tested in tough times like these. Liquidity was a real issue back in the day & everyone believed the market could fall further. Yet, the promoter showed faith in his company & invested more to fund these acquisitions at a time when the entire industry was apprehensive of the demand cycle returning to normalcy. Remember, The money in question here was the promoter's personal funds & he was under no obligation to subscribe to the remainder warrants.

Step 6: Dividend Payments

The next sensible step after evaluating the focus on share price is dividend payments.

Investors must think of dividend payments as the coupon payments on a bond. Practically speaking, a stock is a bond with a coupon rate equal to its dividend yield.

Dividend-paying companies tend to attract investors who are looking for a regular source of income. High-dividend paying stocks such as Coal India, ONGC, Oil India, etc are revered by Conservative investors who have a low-risk appetite & prefer safety of capital over its growth. Generally speaking, Public Sector Enterprises (PSEs) have the highest dividend yields owing to the fact that the Government of India is the major stakeholder in all these companies. Dividend receipts are a huge source of funds for welfare programs run by the Central Government. As per a CAG Report, the Government received ₹36,709 crores as dividends from more than 100 PSUs. in FY 2018-19.

It is often seen that growth companies tend to forego dividends & use the retained profits for additional investment. On the other hand, matured companies with a long track record of navigating market cycles are known for paying healthy dividends.

A lot of investors tend to think that high-dividend paying companies are an indication of shareholder-friendly management. However, this may not always be the case. It is essential to check a few things before firming up a belief about the management. High dividend payments might be a signal that the demand for the company's products has saturated. Due to the lack of demand, the company does not want to invest further in the business & concludes that dividends are a prudent way of allocating the excess cash on the company's books. Companies with more or less flattish revenues & fluctuating profits do not command high valuations. This is why so many legacy companies are constantly on the fray to remain relevant by diversifying their revenue streams.

The management must make some tough calls on dividend payout if the company is struggling as the earnings might not be enough to distribute. Such news is perceived very negatively by the markets & leads to huge sell-offs as sticky investors tend to look for other sources of passive income. For instance, Royal Dutch Shell, a global energy giant with a market cap in excess of $100 billion slashed its dividend payments in 2020 for the first time since World War II with a view to conserve cash on account of the pandemic-induced slowdown in Oil demand. The stock slumped 8.2% on this newsbreak.

As battered as the earnings profile may look, some companies lack the courage to cut dividends due to the pressure of the promoter group. Public reputation is also at stake for high-dividend paying companies as markets might suggest a signal that all's not well within the company. In order to avoid these situations, the management might engage in financial shenanigans & continue with regular dividend payments to conceal the actual state of affairs. It is crucial for investors to assess that a company is paying dividends from its free cash flow(FCF).

The FCF can be computed by subtracting the Capital Expenditure(CAPEX) done by the company from its Cash Flow from Operations (CFO):

FCF= CFO-Capex

If a company does not have sufficient Free Cash Flow available after accounting for CAPEX requirements from its operating cash flows, then it is highly probable that the company is paying out dividends to its shareholders by raising debt from lenders.

Investors would acknowledge that if a company consistently goes on paying dividend by raising debt, then inevitably the debt would reach giantesque levels & the company would find it too difficult to provide for interest payments.Hence, this practice is unsustainable on a long-term basis.

There is no hypothetical limit to the amount of dividend a company can pay to its shareholders, be it ₹1 or ₹100 per share. The only pain-point for the management is to find a lender who can furnish these loans. The operating efficiency of such companies simply does not come into question for such management to pay dividends to its shareholders.

Investors must not draw any cheer from regular dividend payments by a company that uses debt for its payout. Often, debt-funded dividend payments are to benefit the promoter group at the cost of the company & consequently at the cost of minority shareholders. A paltry dividend yield of 1% might be an insignificant amount for a small shareholder but the same might amount to crores for the promoter entity/ majority shareholder.

Let us look at a company that is paying dividends from debt proceeds:

Analysis of Vedanta Ltd.

Quick Snapshot:

(Data as of Closing Prices on 20th February, 2021)

The Cash Flow from operations (CFO) of Vedanta for 9 years (FY 2012-20) stood at ₹1,32,284 crores whereas it did Capital expenditure (CAPEX) of about ₹1,43,430 crores over the same period. The financials from FY14 onwards includes numbers of Cairn India as well. The move to acquire Cairn India was seen as an attempt by Vedanta to consolidate its position as one of the world's largest diversified natural resources conglomerates by diversifying into the Oil & Gas sector.

The net result was that over the 9 years (FY 2012-20), Vedanta Ltd had a negative free cash flow (FCF) of ₹11,147 crores. However, it kept on paying dividends year after year & shelled out about ₹49,128 crores cumulatively in 9 years.

It is clearly visible that the company did not have the cash resources to pay dividends to its shareholders. As anticipated, the dividend payments were made via raising debt which in turn ballooned the debt from ₹3,741 crores in FY2012 to ₹59,187 crores in FY20.